Updated on November 27th, 2019 by Eli Inkrot

The Dividend Aristocrats are a group of 57 companies in the S&P 500 Index, with 25+ consecutive years of dividend increases.

In addition to the full downloadable spreadsheet, you can see a preview of the Dividend Aristocrats list in the table below:

Note: Data table coming soon

We review each of the 57 Dividend Aristocrats once per year. Next up is W.W. Grainger (GWW), which has increased its dividend for 48 years in a row, including a 5.8% increase in April of 2019.

Grainger has struggled in the recent past, due to intensifying competition in its industry. This has led to price deflation, and lower profit margins. However, the company has a long history of growth. It has a leading position in its core markets, and is investing in new growth initiatives. It has deployed multiple initiatives to continue growing through the difficult pricing environment.

This article will discuss Grainger’s business, growth potential and valuation.

Business Overview

Grainger was founded in 1927. Today, it is a large supplier of maintenance, operating, and repair products, or “MRO” for short. These are products like safety gloves, power tools, ladders, test instruments, and motors. It also offers services such as inventory management.

Source: Fact Sheet

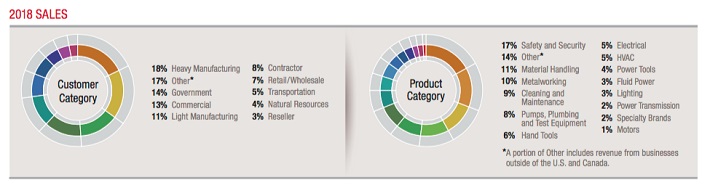

Sales span a wide range of both customers and categories, without a reliance on any one industry in particular.

Source: Fact Sheet

Last year Grainger sold $11.2 billion worth of products to more than 3.5 million active business and institutional customers worldwide. The majority of customers are large U.S. businesses, but while over half of revenue is derived from the U.S., Grainger also has operations in Japan, the U.K., Mexico, and Germany.

Grainger reported its third-quarter earnings results on October 23rd, 2019. The company generated revenue of $2.9 billion during the quarter, which represents growth of 4% compared to the prior year’s quarter. Management noted that global demand continued to be weak, but its U.S. and endless assortment businesses gained share as it made good progress on its key growth initiatives and was diligent in managing costs.

Operating margin was down 20 basis points to 11.5%. Adjusted gross profit and operating earnings both increased by 2% year over year, resulting in adjusted earnings-per-share also increasing by 2% to $4.25.

W.W. Grainger reiterated its guidance for 2019 including net sales growth of 2% to 5% and earnings-per-share in the range of $17.10 to $18.70. At the midpoint of the guidance range, $17.90, W.W. Grainger would grow its earnings-per-share by 7.2% compared to 2018.

Growth Prospects

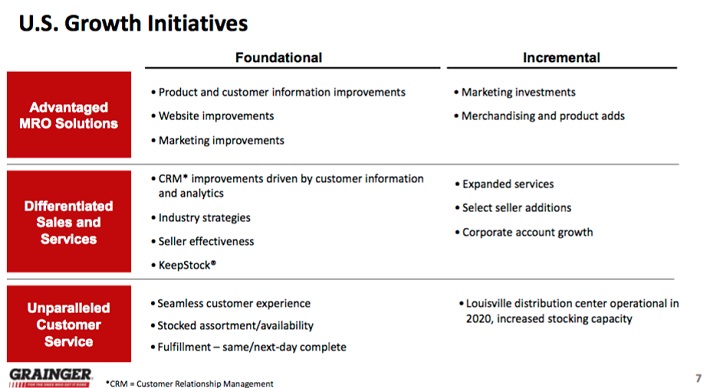

Grainger lays out a number of growth initiatives in the U.S.:

Source: Standard IR Presentation

These initiatives are parsed out between “foundational” and “incremental.” In other words, between what the company is already doing to keep market share and what it can do to make further gains. For example, within MRO Solutions, Grainger needs to keep making improvements in its website and customer information to keep pace with competitors, while investing in marketing to attract new customers.

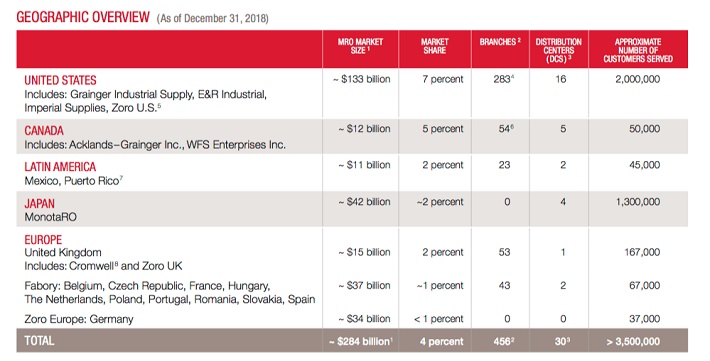

Despite being a fairly large business, Grainger’s overall market share is far from dominant:

Source: Fact Sheet

The company estimates that the MRO market reaches $284 billion and yet Grainger only accounts for 4% of that, with tremendous opportunities in foreign countries especially.

Another growth catalyst is e-commerce. It has various e-commerce platforms, including MonotaRO in Japan, and Zoro in the United States.

Source: Standard IR Presentation

Along with internal investments, Grainger has ramped up its digital platform heavily in recent years. All of these catalysts are likely to help Grainger return to earnings growth over the long-term.

Grainger grew its earnings-per-share by 13.7% annually between 2009 and 2018, but this included the impact of the recovery from the financial crisis. Between 2008 and 2018 the earnings-per-share growth rate averaged 10.6%. Backing out the positive one-time impact of a lower tax rate that led to outsized earnings-per-share growth during 2018, the average growth rate declines further.

With that being said, revenue is still growing, margins are improving over time and share repurchases will continue to buoy the bottom line. While it becomes harder to grow as the company gets larger, we are forecasting 7% earnings growth over the next five years.

Competitive Advantages & Recession Performance

Grainger’s competitive advantage is its vast distribution network. It has the ability to offer services such as next-day ground delivery, which help it retain its competitive position. In addition, the scale of the business allows it to competitively price its products.

Grainger is not active in a high-tech industry, but the services that the company provides are essential for other businesses. This makes Grainger’s business relatively resilient during recessions, providing it with the ability to continue raising its dividend each year.

These competitive advantages helped Grainger stay highly profitable during the Great Recession. Earnings-per-share during the economic downturn are as follows:

- 2007 earnings-per-share of $4.94

- 2008 earnings-per-share of $6.09 (23% increase)

- 2009 earnings-per-share of $5.25 (-14% decline)

- 2010 earnings-per-share of $6.81 (30% increase)

Grainger only had one year of earnings decline during the Great Recession, in-between two very strong years. Moreover, the company continued to grow after 2010. This indicates a high-quality business model that can withstand recessions relatively well.

Valuation & Expected Returns

Based on Grainger’s expected earnings-per-share of $17.90 for 2019, and a current share price of $320, the stock has a price-to-earnings ratio of 17.9.

While shares have traded hands with an average P/E ratio of 18.5 during the last decade, this was when the company was growing at a much faster pace. Taking a more conservative view, using 16 times earnings as a fair value baseline, implies the potential for a -2% to -3% annual valuation headwind.

Weighing this potential decline in value against a strong 7% earnings growth rate and 1.8% stating dividend yield, investors might anticipate a mid-to-high single-digit annualized total return expectation. While this is not spectacular, it could be understated if shares were to continue trading at 17+ times earnings or if growth formulates at a quicker pace than anticipated.

Final Thoughts

W.W. Grainger is a company managed for the long-term. It has encountered difficulties as of late, but the business continues to persevere, just as it has done for decades. Moreover, the company remains profitable in good times or bad and has an exceptional record of not only paying but also increasing its dividend for 48 straight years.

While the business strength and potential growth are enviable, the dividend yield and the valuation are not particularly compelling at this juncture. As such, we view Grainger as a solid business with an average total return potential over the intermediate-term, making the stock a hold and not a buy right now.