Updated on November 26th, 2019 by Josh Arnold

Each year, we review all of the Dividend Aristocrats, a group of just 57 companies in the S&P 500 Index with 25+ consecutive years of dividend increases.

In addition to the full downloadable spreadsheet, you can see a preview of the Dividend Aristocrats list in the table below:

| 3M Co. | 170.24 | 3.3 | 97,896 | 19.9 | 66.4 | 1.08 |

| A. O. Smith Corp. | 48.76 | 1.8 | 6,682 | 20.1 | 36.3 | 0.91 |

| Abbott Laboratories | 84.49 | 1.5 | 149,327 | 45.5 | 68.9 | 1.06 |

| AbbVie, Inc. | 87.76 | 4.9 | 129,781 | 40.3 | 196.3 | 0.88 |

| Aflac, Inc. | 54.30 | 2.0 | 39,857 | 13.3 | 26.3 | 0.71 |

| Air Products & Chemicals, Inc. | 234.74 | 2.0 | 51,726 | 29.4 | 57.4 | 0.80 |

| Archer-Daniels-Midland Co. | 43.08 | 3.2 | 23,982 | 20.4 | 65.5 | 0.81 |

| AT&T, Inc. | 37.26 | 5.5 | 272,184 | 16.6 | 91.0 | 0.61 |

| Automatic Data Processing, Inc. | 170.20 | 1.9 | 73,645 | 31.1 | 57.8 | 1.02 |

| Becton, Dickinson & Co. | 253.86 | 1.2 | 68,530 | 64.0 | 77.7 | 0.99 |

| Brown-Forman Corp. | 67.77 | 1.0 | 32,362 | 39.5 | 38.2 | 0.71 |

| Cardinal Health, Inc. | 56.35 | 3.4 | 16,481 | -4.0 | -13.6 | 0.92 |

| Caterpillar, Inc. | 146.42 | 2.5 | 80,920 | 13.8 | 34.0 | 1.38 |

| Chubb Ltd. | 149.97 | 2.0 | 67,966 | 18.9 | 37.2 | 0.62 |

| Chevron Corp. | 118.38 | 4.0 | 223,841 | 16.9 | 66.8 | 0.85 |

| Cincinnati Financial Corp. | 105.94 | 2.1 | 17,307 | 18.8 | 39.3 | 0.72 |

| Cintas Corp. | 250.87 | 1.0 | 25,965 | 28.8 | 29.3 | 1.01 |

| The Clorox Co. | 145.25 | 2.8 | 18,229 | 22.7 | 63.2 | 0.44 |

| The Coca-Cola Co. | 53.22 | 3.0 | 228,020 | 29.4 | 87.9 | 0.43 |

| Colgate-Palmolive Co. | 66.98 | 2.5 | 57,404 | 24.8 | 62.9 | 0.54 |

| Consolidated Edison, Inc. | 86.04 | 3.4 | 28,602 | 20.2 | 69.0 | 0.24 |

| Dover Corp. | 111.95 | 1.7 | 16,262 | 25.0 | 43.1 | 1.08 |

| Ecolab, Inc. | 182.06 | 1.0 | 52,477 | 34.4 | 34.8 | 0.80 |

| Emerson Electric Co. | 74.35 | 2.6 | 45,290 | 19.9 | 52.3 | 1.17 |

| Exxon Mobil Corp. | 68.91 | 4.9 | 291,565 | 20.1 | 98.5 | 0.92 |

| Federal Realty Investment Trust | 130.37 | 3.2 | 9,927 | 38.7 | 122.1 | 0.52 |

| Franklin Resources, Inc. | 27.98 | 3.7 | 13,935 | 11.9 | 44.1 | 1.11 |

| General Dynamics Corp. | 182.66 | 2.2 | 52,844 | 15.7 | 34.2 | 0.90 |

| Genuine Parts Co. | 103.98 | 2.9 | 15,107 | 19.0 | 55.0 | 0.78 |

| Hormel Foods Corp. | 42.76 | 1.9 | 22,832 | 23.2 | 44.3 | 0.48 |

| Illinois Tool Works, Inc. | 175.18 | 2.3 | 56,303 | 23.0 | 53.3 | 1.20 |

| Johnson & Johnson | 137.18 | 2.7 | 361,039 | 25.8 | 69.7 | 0.60 |

| Kimberly-Clark Corp. | 133.35 | 3.1 | 45,713 | 22.7 | 69.7 | 0.46 |

| Leggett & Platt, Inc. | 52.83 | 3.0 | 6,952 | 23.7 | 70.0 | 1.08 |

| Linde Plc | 205.94 | 1.7 | 110,626 | 21.1 | 35.3 | 0.78 |

| Lowe's Cos., Inc. | 117.00 | 1.8 | 89,856 | 30.9 | 54.4 | 1.04 |

| McCormick & Co., Inc. | 166.62 | 1.3 | 22,145 | 31.3 | 41.9 | 0.39 |

| McDonald's Corp. | 191.89 | 2.4 | 144,511 | 24.9 | 60.3 | 0.42 |

| Medtronic Plc | 111.78 | 1.9 | 149,827 | 32.1 | 59.7 | 0.67 |

| Nucor Corp. | 55.92 | 2.9 | 16,955 | 9.5 | 27.3 | 1.15 |

| People's United Financial, Inc. | 16.48 | 4.3 | 7,319 | 12.5 | 53.6 | 0.96 |

| Pentair Plc | 44.02 | 1.6 | 7,399 | 21.4 | 34.7 | 1.20 |

| PepsiCo, Inc. | 133.83 | 2.8 | 186,616 | 15.2 | 42.7 | 0.53 |

| PPG Industries, Inc. | 127.79 | 1.5 | 30,217 | 25.1 | 38.3 | 0.91 |

| Procter & Gamble Co. | 120.51 | 2.4 | 300,529 | 74.9 | 181.8 | 0.53 |

| Roper Technologies, Inc. | 359.69 | 0.5 | 37,428 | 32.3 | 16.6 | 1.04 |

| S&P Global, Inc. | 265.85 | 0.8 | 64,973 | 31.3 | 26.0 | 0.99 |

| The Sherwin-Williams Co. | 580.01 | 0.7 | 53,540 | 38.2 | 28.0 | 0.87 |

| Stanley Black & Decker, Inc. | 159.29 | 1.7 | 24,213 | 34.2 | 57.3 | 1.53 |

| Sysco Corp. | 79.82 | 2.0 | 40,726 | 24.2 | 47.2 | 0.51 |

| T. Rowe Price Group, Inc. | 122.58 | 2.4 | 28,644 | 15.4 | 37.3 | 1.23 |

| Target Corp. | 125.19 | 2.1 | 63,431 | 19.8 | 41.2 | 0.84 |

| United Technologies Corp. | 147.52 | 2.0 | 127,324 | 24.7 | 49.2 | 1.09 |

| VF Corp. | 86.55 | 2.3 | 34,565 | 26.6 | 60.3 | 1.14 |

| W.W. Grainger, Inc. | 320.49 | 1.7 | 17,263 | 18.6 | 32.5 | 1.07 |

| Walmart, Inc. | 118.92 | 1.8 | 338,241 | 23.6 | 41.9 | 0.61 |

| Walgreens Boots Alliance, Inc. | 60.67 | 2.9 | 54,150 | 14.1 | 41.2 | 1.03 |

| Name | Price | Dividend Yield | Market Cap ($M) | Forward P/E Ratio | Payout Ratio | Beta |

One of the newest members of the Dividend Aristocrats list is industrial heavy equipment supplier Caterpillar Inc. (CAT).

Caterpillar made the 2019 Dividend Aristocrats list by raising its dividend for the 25th year in a row. Even more impressive is the fact that Caterpillar operates in a highly cyclical industry, which normally forbids such consistent dividend growth.

However, Caterpillar’s management team has proven its commitment to returning cash to shareholders even through the inevitable ebbs and flows of the business over the years.

The yield is back up to 2.8% despite a strong rally in the shares in recent weeks, making Caterpillar not only a long-term dividend growth story, but one that offers strong current income as well.

Business Overview

Caterpillar was founded in 1925, and today competes in the manufacturing and selling of construction and mining equipment. The company also manufactures ancillary industrial products such as diesel engines and gas turbines. Caterpillar generates annual revenue of $54 billion and the stock has a market capitalization of $81 billion, making it one of the largest industrial stocks in the world.

Industrial stocks have struggled in the recent past as fears over slowing – or even declining – global economic growth have compressed valuation multiples in the industry. Caterpillar is particularly beholden to commodity prices of all sorts, from metals to crops, so this fear has hit the share price significantly in the past couple of years. However, we see shares as slightly undervalued at current prices even if some of these fears over growth and commodity prices come to fruition.

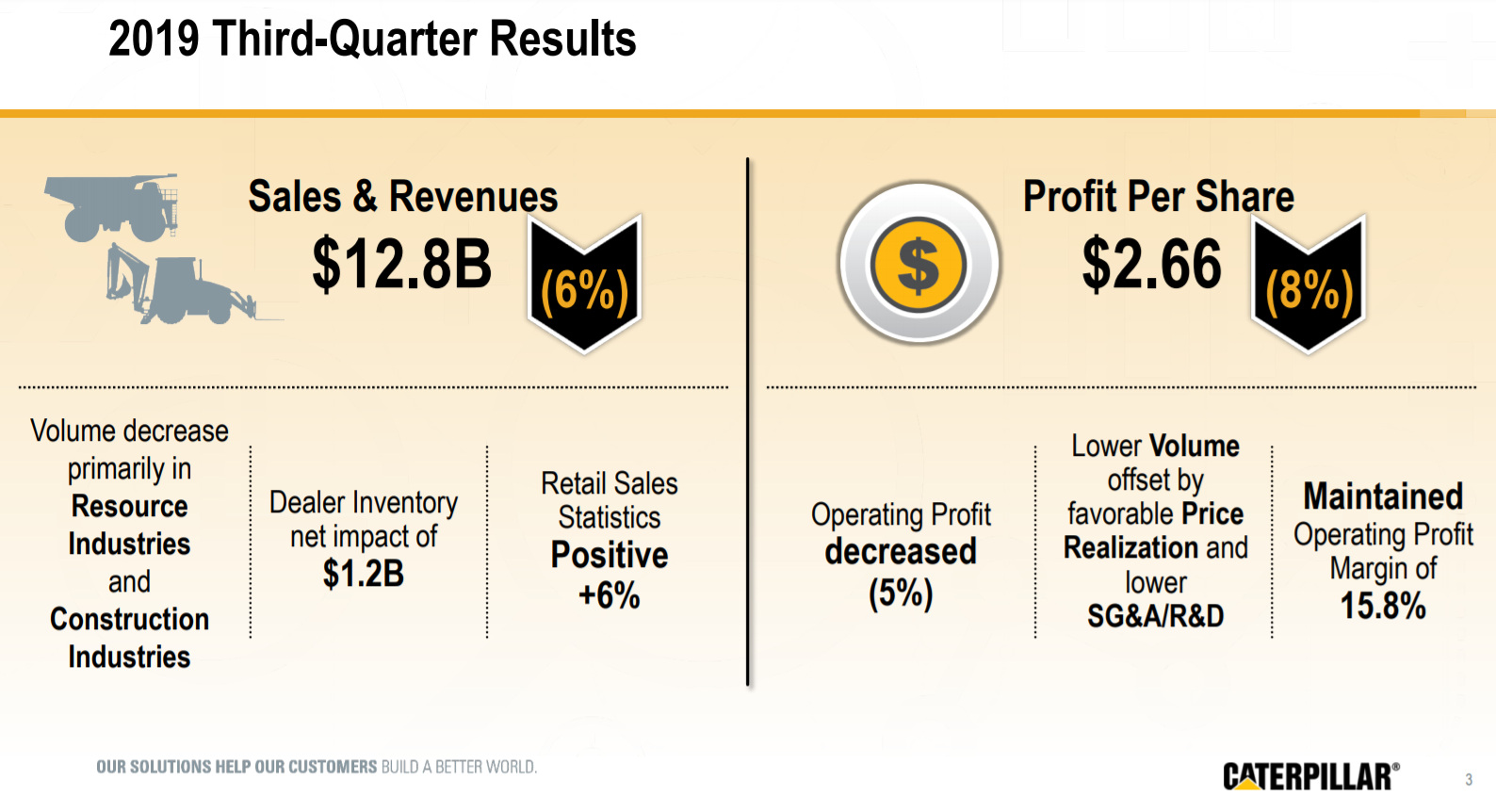

Caterpillar reported third quarter earnings on October 23rd and results were disappointing on the top and bottom lines, as well as with the company’s updated guidance range.

Source: Investor presentation, page 3

Caterpillar saw total revenue decline 6% against the year-ago period as the company faced tough comparables from a very strong 2018. Nevertheless, the company saw volumes decline and the impact of dealer network inventory reductions. Volume declined in all three reporting segments last quarter.

Energy & Transportation performed the best of the three core segments, with sales declining marginally, but operating margins rising during Q3. Total revenue was down from $5.6 billion to $5.5 billion year-over-year, but operating margin rose from 17.5% of revenue to 18.7%, leading operating profits higher from $973 million to $1.02 billion in the third quarter.

Resource Industries revenue declined from $2.6 billion to $2.3 billion year-over-year on weakness in the mining business. Volume declines led operating margins lower as they fell from 15.7% of revenue to 13.5%. Operating profit on a dollar basis plummeted from $414 million to $311 million year-over-year.

Finally, Construction Industries revenue fell from $5.7 billion to $5.3 billion year-over-year as lower demand in China and unfavorable currency translation took their toll. Operating margin declined from 18.6% to 17.8% of revenue year-over-year, and operating profit declined from $1.06 billion to $940 million.

Consolidated operating profit declined 5% in Q3 as sales volume declines more than offset small gains made elsewhere. In total, operating profit declined from $2.14 billion to $2.02 billion. Earnings-per-share declined from $2.88 to $2.66.

Caterpillar is not just an earnings growth story, however, as it returns billions of dollars of cash annually to shareholders via dividends and buybacks. The company repurchased $1.2 billion of stock in Q3, and returned $600 million through dividends.

The dividend was raised 20% for 2019, which is much more than what the company has been doing in recent years. It illustrates management’s confidence in the business and the outlook, which you can see in the image below:

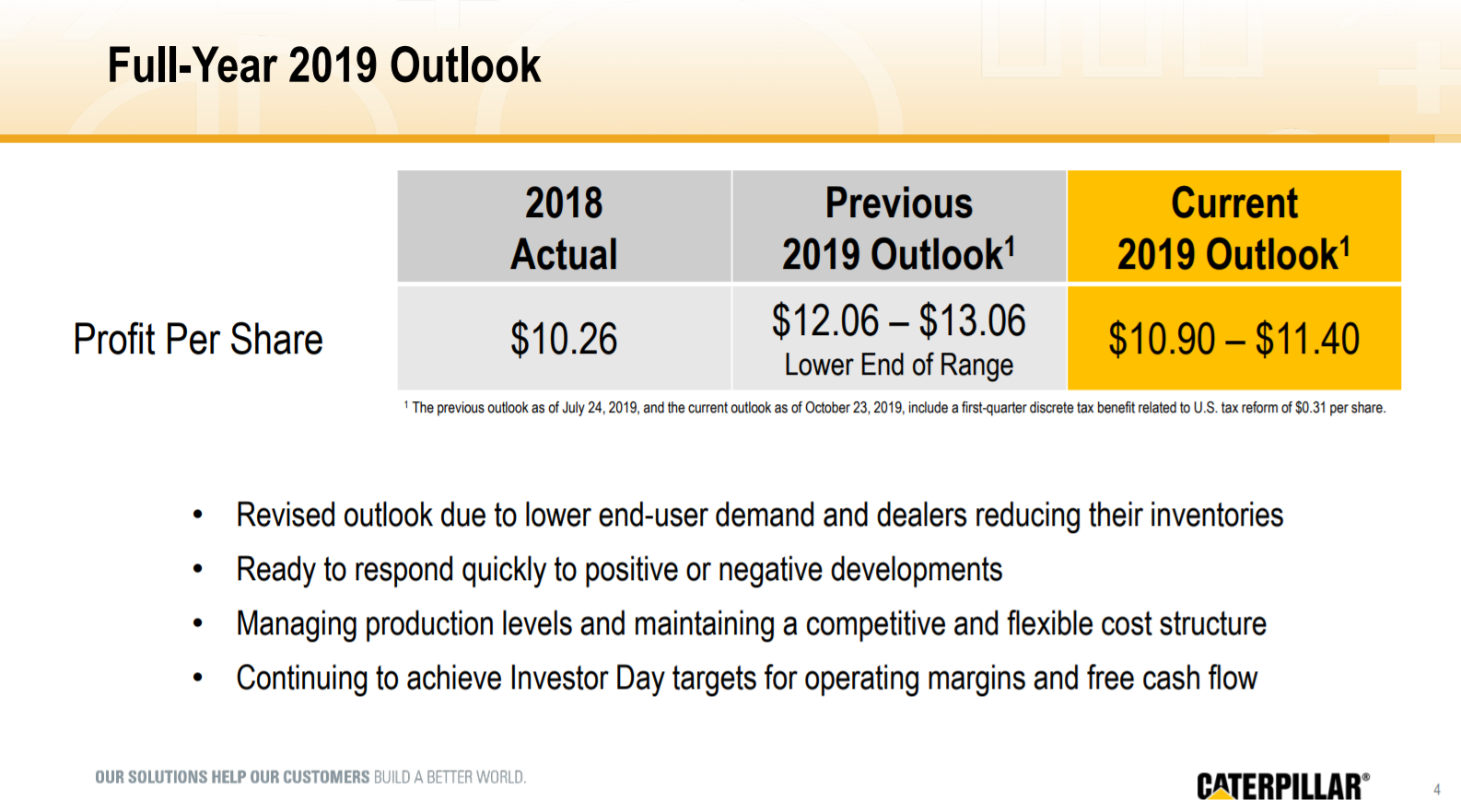

Source: Investor presentation, page 4

Management has guided for $10.90 to $11.40 in earnings-per-share for 2019 after reducing the range in the Q3 earnings release. This is roughly in line with what the company produced last year. Caterpillar is seeing lower end user demand and dealer inventory reductions, which is fairly normal given the cyclicality of the company’s business lines. Considering all of this, we expect 2019 earnings-per-share of $11.10, which is near the middle of the guidance range.

Growth Prospects

Caterpillar is closely tied to global economic growth, as well as commodity prices. Its customers extract resources from the earth as well as build and construct a wide variety of structures, so economic growth is key to fund that development. This leads to some fairly extreme cyclicality in Caterpillar’s results, which then sees the stock swing wildly between extremes of the sentiment scale.

Caterpillar is seeing volumes moderate from very strong levels last year and dealer inventory reductions, however, this is not necessarily a long-term impairment. Caterpillar sees these sorts of swings in inventory fairly regularly, but the outlook for 2019 is materially lower than it was before the Q3 report due to these headwinds.

Further, Caterpillar’s own cost-cutting measures have driven operating margins higher for years and while the bulk of the gains may have been realized, we see further potential for expense reductions to positively boost earnings. Sales volumes, however, derailed that story in Q3 as costs deleveraged due to a lower revenue total.

Below, we can see the company’s strategy for long-term growth.

Source: Investor presentation, page 5

Caterpillar sees key growth levers as expanding its digital services catalog, increasing its operational excellence to improve margins, and expanding offerings in its engine and mining technologies. We think these drivers will provided Caterpillar with 5% annual earnings-per-share growth as the inevitable ups and downs in the business are somewhat offset by constant share repurchases. We note that Caterpillar’s growth over time will not be linear. However, we think the long-term prospects of the company are intact.

Competitive Advantages & Recession Performance

Competitive advantages in industrial applications can be difficult given that for most applications, there are competitors that make largely similar products. However, Caterpillar has built itself into one of the largest players in lucrative end markets such as construction, energy, and mining over the years.

Its global presence affords it some diversification of revenue by segment and industry, but also geographically, which has served it well in recent years. Its scale also gives it the ability to leverage down variable costs per unit, which boosts margins.

However, Caterpillar is certainly not immune from recessions as slowdowns in the global economy are generally accompanied by lower commodity prices and slowing construction spending. These factors took a major toll on Caterpillar’s bottom line during the Great Recession, as earnings were devastated, if only briefly.

Caterpillar’s earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share of $5.32

- 2008 earnings-per-share of $5.71 (7% increase)

- 2009 earnings-per-share of $1.43 (75% decline)

- 2010 earnings-per-share of $4.15 (190% increase)

While Caterpillar certainly felt the pain from the Great Recession, its earnings rebounded fairly quickly and it reclaimed its pre-recession earnings-per-share number in 2011. The next recession likely won’t be as damaging for Caterpillar as the Great Recession, but it is almost certain to see a meaningful decline in earnings-per-share when it does strike.

Caterpillar’s 2.8% current yield and the potential for 10%+ annual dividend increases for many years to come make the stock attractive for long-term dividend growth investors. We note that the enormous increase in 2019 may mean slightly smaller increases in the coming years, but given the low payout ratio of ~37% of earnings for this year, we see a lot of safety and room for growth in the dividend.

Valuation & Expected Returns

Caterpillar’s current price-to-earnings ratio is just 13.2 today, which compares very favorably to our fair value estimate of 14. This makes Caterpillar somewhat undervalued in our view, and should provide shareholders with an annual tailwind to total returns of around 1%.

Periods of cyclicality are normal for Caterpillar when it comes to the valuation, and today, we are certainly seeing a swing higher in the price of the stock relative to earnings. The stock is up roughly 20% since the October bottom so shares are much more expensive than they have been for much of the year.

Based upon the factors discussed above, we see total earnings-per-share growth at 5% annually. This will accrue from a combination of revenue growth, margin expansion, and the sizable share repurchase program. While Caterpillar has some potential headwinds in front of it should we see a global economic slowdown, overall, its fundamentals are quite strong. Volume declines in the most recent quarter are somewhat concerning, but as mentioned, we don’t see the impairment as a long-term issue.

In addition to earnings growth and a boost from the valuation, the current yield of 2.8% will help drive shareholder returns. Combining the three factors, we see total annual returns of around 8.6% for the next five years. We are more cautious on Caterpillar given the sizable increase in the valuation, but continue to rate the shares a long-term buy.

Final Thoughts

Caterpillar offers investors a wide variety of reasons to want to own the stock today. It has a nearly-3% yield in addition to 26 consecutive years of dividend increases. Its payout ratio is around one-third of earnings, so its dividend has a very high safety rating and has lots of room to continue to expand in the coming years.

It also has favorable fundamental backdrops in its major segments, which means earnings growth should continue for the foreseeable future. Finally, the stock is attractively priced as it trades just under our fair value estimate. Putting these factors together paints a bullish picture of Caterpillar, and we believe it is a buy today even with the recent rally.