Updated on February 6th, 2022 by Prakash Kolli

Investors looking for high-quality dividend growth stocks should focus in part, on companies that maintain long histories of dividend increases. Steady dividend raises from year to year, regardless of the economic climate, is a sign of a company with durable competitive advantages and long-term growth potential.

With that in mind, every year we review each of the Dividend Aristocrats, a group of 66 companies in the S&P 500 Index, with 25+ consecutive years of dividend increases. You can download your copy of the Dividend Aristocrats list, including important metrics like dividend yields and price-to-earnings ratios, by clicking on the link below:

The next Dividend Aristocrat in the series, is healthcare giant Medtronic (MDT).

Medtronic has an impressive history of dividend growth. The company has increased its dividend for 44 years in a row. With an approximately 2.5% yield, Medtronic is not exactly a high-yield stock. However, the stock’s yield is still higher than the average yield of the S&P 500.

But Medtronic typically raises its dividend at a high rate each year, thanks to its strong earnings and leadership position within the medical devices industry. According to the company, Medtronic has increased its dividend by 16% compounded annually over its 44 years of annual increases. These qualities make Medtronic an attractive dividend growth stock for long-term investors.

Business Overview

Medtronic was founded in 1949 as a medical equipment repair shop by Earl Bakken and his brother-in-law, Palmer Hermundslie. Today, Medtronic is one of the largest healthcare companies in the world. Medtronic is a large-cap stock with a market capitalization of ~$138 billion.

Medtronic PLC is the largest manufacturer of biomedical devices and implantable technologies in the world. Medtronic currently has four operating segments: Cardiovascular, Neuroscience, ,medical Surgical, and Diabetes.

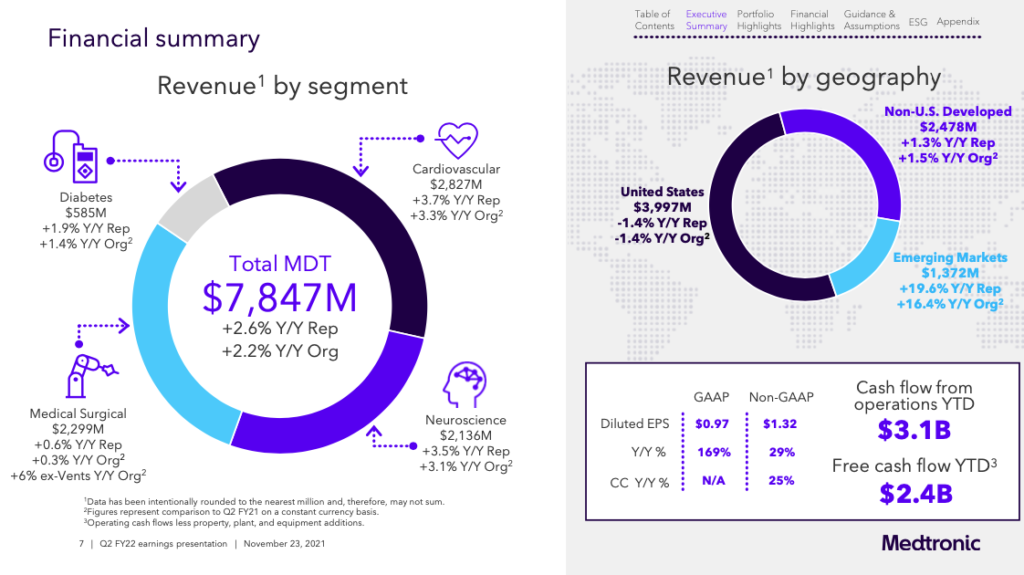

Source: Investor Presentation

On November 23rd, 2021 Medtronic reported Q2 fiscal year 2022 results for the period ending October 29th, 2021 (Medtronic’s fiscal year ends the Friday closest to April 30th). For the quarter, Medtronic reported sales of $7.847 billion, a 2.6% increase compared to the same quarter last year. Sales in the Cardiovascular, Neuroscience, Medical Surgical, and Diabetes segments were up 3.7%, up 3.5%, up 0.6%, and up 1.9%, respectively.

Adjusted net income equaled $1.792 billion or $1.32 per share, a 29.9% year-over-year increase. Medtronic guided for 7% – 8% revenue growth and earnings per share of $5.65 to $5.75.

The coronavirus pandemic has had a negative impact on the company’s results, and the recent Omicron surge has had a negative effect. However, we view headwinds as temporary, and the company is still guiding for growth. Due to a variety of factors including the favorable economics of the U.S. healthcare industry, Medtronic should enjoy many years of growth up ahead.

Growth Prospects

Medtronic is investing in growth, both organically via R&D and through acquisitions. The first catalyst for Medtronic is the aging population. There are ~70 million Baby Boomers in the U.S., those aged 51-69 years. Thousands of people are entering retirement every day. Combined with longer life expectancy and rising healthcare spending, the operating environment is very attractive for Medtronic.

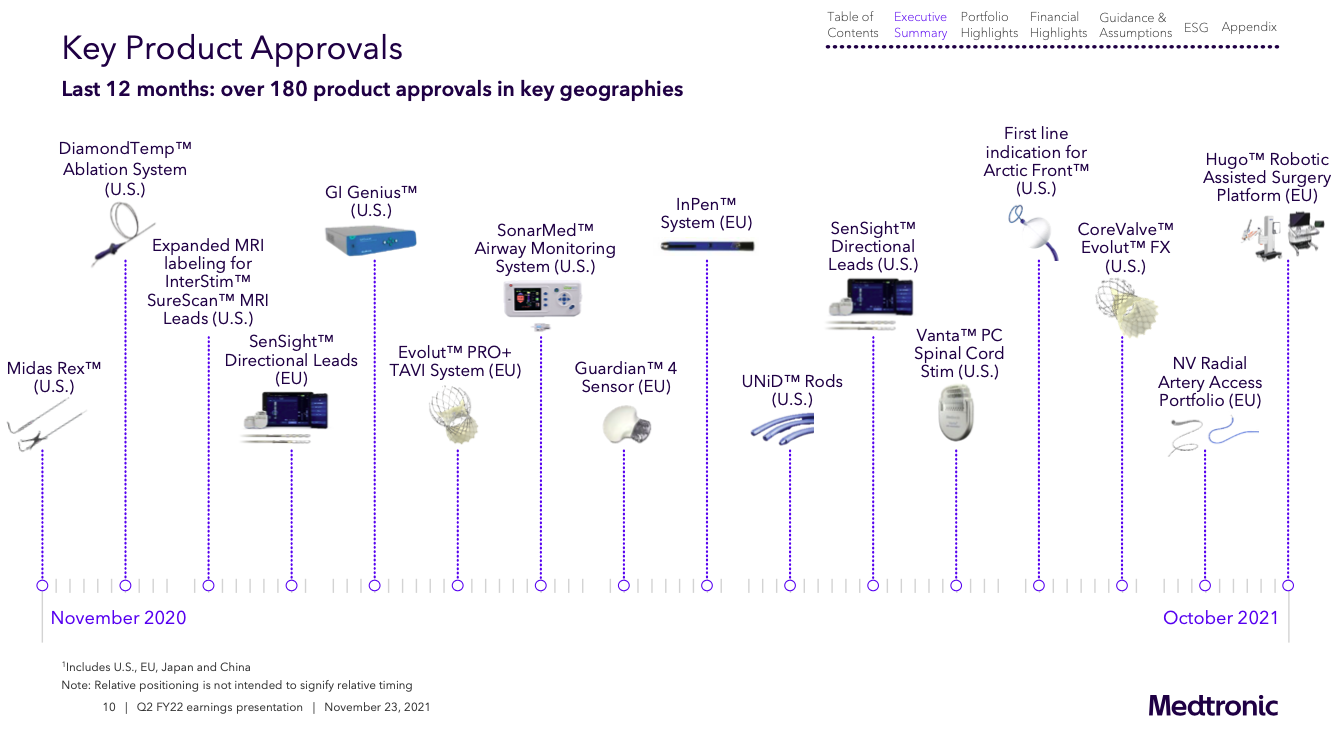

The company has had many regulatory product approvals since 2019. The new products should drive growth allowing the company too maintain or even gain market share.

Medtronic also has a major growth opportunity in new geographic markets. Specifically, Medtronic has a presence in several emerging markets, such as China, India, Africa, and more. These countries have large populations and high economic growth rates. Medtronic operate globally in more than 140 countries.

Medtronic’s emerging market revenue has consistently grown at a double-digit rate for many years. In the most recent quarters emerging market constant-currency revenue increased 16%, while the non-U.S. developed markets rose 2%, and the U.S. declined -1%. While the U.S. currently accounts for approximately half of Medtronic’s revenue, emerging markets are growing faster.

Another growth catalyst for Medtronic is acquisitions. The largest single acquisition for Medtronic was its $50 billion acquisition of Covidien in 2015. The acquisition presented significant growth potential for Medtronic.

Today, Medtronic is acquiring tuck-in acquisitions and has spent more than $2.3 billion on over seven acquisitions in 2021. These companies include Medicrea, RIST, Avenu Medical, Companion Medical, Sonarmed, intersect ENT, and AI Biomed. In addition, Medtronic has made 40+ minority investments for a total of $500 million. These investments will facilitate future tuck-in acquisitions.

Competitive Advantages & Recession Performance

The main competitive advantage for Medtronic is its research and development capabilities. The company spends heavily on R&D each year, which provides it with product innovation. Medtronic’s R&D investments over the past few years are as follows:

- FY 2016 R&D expense of $2.2 billion

- FY 2017 R&D expense of $2.2 billion

- FY 2018 R&D expense of $2.3 billion

- FY 2019 R&D expense of $2.3 billion

- FY 2020 R&D expense of $2.3 billion

- FY 2021 R&D expense of $2.5 billion

The result of all this spending is that the company has a huge intellectual property portfolio with over 45,000 awarded patents. This fact has allowed Medtronic to build a strong product pipeline across each of its business segments.

In addition, Medtronic benefits tremendously from global scale. The company operates in over 140 countries around the world. It has the operational flexibility to generate industry-leading profit margins, which helps fuel its growth.

Another competitive advantage for Medtronic is that it operates in a defensive industry. Consumers often cannot choose to forego medical treatments, even when the economy goes into recession.

Medtronic’s earnings-per-share during the Great Recession are as follows:

- 2007 earnings-per-share of $2.61

- 2008 earnings-per-share of $2.92 (12% increase)

- 2009 earnings-per-share of $3.22 (10% increase)

- 2010 earnings-per-share of $3.37 (5% increase)

Medtronic had the rare achievement of earnings growth each year during the recession. This demonstrates its recession-resistant business model. Medtronic should be able to continue growing its dividend each year, in both economic recessions and expansions.

Valuation & Expected Returns

Based on the recent share price of $103 and expected earnings-per-share of $5.70 in fiscal 2022, Medtronic stock trades for a price-to-earnings ratio of 20.1. The current valuation of the stock is below that of the broader S&P 500 Index, and Medtronic’s valuation is slightly above its long-term average.

From 2013 through 2020, it had been typical to see Medtronic stock trade hands in the 15 to 19 times earnings range, even bumping up to 20+ times earnings a couple of times; this despite the idea that the firm has been exceptionally consistent through that entire period. Our expectation assumes a fair multiple of 17 times earnings.

As a result, Medtronic shares appear to be slightly overvalued today. If the stock valuation retraces to our fair value estimate by 2027, the corresponding multiple contraction would reduce annual shareholder returns by approximately 1.2% per year over this period.

We expect 6% annual earnings growth for Medtronic through 2026, and the stock has a 2.5% dividend yield. There is plenty of room for continued dividend increases each year. With a dividend payout ratio below 50%, and a positive earnings growth outlook, Medtronic should continue its streak of annual dividend increases.

Total returns would consist of the following:

- 6.0% earnings growth rate

- -1.2% multiple reversion

- 2.5% dividend yield

Medtronic is expected to return just 7.3% annually over the next five years. Medtronic’s decline in stock price since September, 2021, has improved the potential annualized returns.

Final Thoughts

Medtronic has virtually all of the qualities dividend growth investors should look for. It possesses a highly profitable business, a leadership position in its core markets, and long-term growth potential. It also has multiple catalysts for future growth, and the ability to keep growing its dividend even during recessions.

Medtronic has increased its dividend for more than four decades, including a strong 8.6% increase in 2021, which is highly impressive given the continued headwinds from the COVID-19 pandemic.

The only negative aspect of investing in Medtronic stock today is the valuation. However, Medtronic’s stock price is near its 52-week low. Medtronic remains a high-quality holding for long-term dividend growth investors.