Cushman & Wakefield Releases Study Assessing Pandemic’s Impact on the Residential Sector

Cushman & Wakefield (NYSE: CWK), a leading global real estate services firm, released a new study on the impacts of the COVID-19 pandemic on the global rental housing market, including rental market rebound rankings and investment recommendations.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210616005556/en/

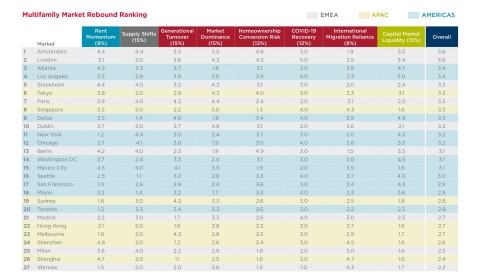

Multifamily Market Rebound Ranking (Graphic: Business Wire)

The report identifies five factors that will determine the speed of recovery in rental housing market demand compared to their pre-pandemic path over the next several years by analyzing global gateway markets across each of these factors and then combining them into a single composite model.

The factors include generational turnover, market dominance vs. competitive markets, risk of homeownership conversion, severity of COVID-19 impact and response and the market’s reliance on international migration for growth.

“The nature of the pandemic negated the traditional advantages of global urban centers and has some questioning whether residential demand will ever bounce back to pre-pandemic levels. For this study, we examined 27 global gateway markets to assess how these factors impacted the multifamily housing market,” said David Bitner, Head of Capital Markets Insights at Cushman & Wakefield. “Then we combined these factors together into a ‘rebound ranking’ score for each city.”

A higher rating indicates that conditions are more favorable for a rebound in rental market fundamentals and investment compared to the pre-pandemic trend over the next three to five years (see table).

European markets were most represented among the top 10, followed by U.S. markets. For Asia Pacific, Tokyo and Singapore both ranked within the top 10 for rebound potential.

Download Cushman & Wakefield’s Global Residential Impact Study for more insights.

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 50,000 employees in over 400 offices and 60 countries. In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210616005556/en/

Cushman & Wakefield PLC Stock

With 6 Buy predictions and not the single Sell prediction the community is currently very high on Cushman & Wakefield PLC.

However, we have a potential of -9.09% for Cushman & Wakefield PLC as the target price of 11 € is below the current price of 12.1 €.