Cleveland-Cliffs Q3 Loss Narrower Than Expected, Revenues Miss

Cleveland-Cliffs Inc.’sCLF third-quarter 2025 adjusted loss was 45 cents per share. The figure was narrower than the Zacks Consensus Estimate of a loss of 48 cents per share. It reported an adjusted loss of 33 cents per share in the prior-year quarter.

Revenues went up 3.6% year over year to $4,734 million in the quarter. The top line missed the Zacks Consensus Estimate of $4,886.6 million.

CLF’s Operational Highlights

The company reported Steelmaking revenues of roughly $4.6 billion for the third quarter, up around 3% year over year.

The average net selling price per net ton of steel products was $1,032 in the quarter, down around 1.2% year over year. However, the metric beat our estimate of $996.

External sales volumes for steel products were roughly 4.03 million net tons, up around 5% year over year. The figure missed our estimate of 4.3 million net tons.

Financial Position of CLF

Cleveland-Cliffs ended the third quarter with cash and cash equivalents of $66 million, up around 8.2% from the prior quarter. Long-term debt increased 4% sequentially to $8,039 million.

As of Sept. 30, 2025, the company had $3.1 billion in total liquidity.

CLF’s Outlook

The company has revised its full-year 2025 guidance. Capital expenditures are now expected to be approximately $525 million, down from the previously anticipated $600 million. Selling, general and administrative (SG&A) expenses have also been lowered to around $550 million from the earlier estimate of $575 million.

CLF continues to target steel unit cost reductions of approximately $50 per net ton compared with 2024. Depreciation, depletion and amortization expenses have been maintained at approximately $1.2 billion. Meanwhile, cash pension and Other Post-Employment Benefits payments and contributions remain unchanged at approximately $150 million.

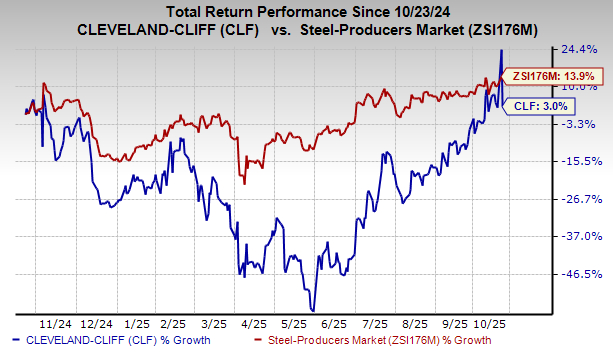

Price Performance of CLF

Shares of CLF have gained 3% over the past year compared with a 13.9% rise in its industry.

Image Source: Zacks Investment Research

CLF’s Zacks Rank & Key Picks

CLF currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks worth a look in the basic materials space are Avino Silver & Gold Mines Ltd. ASM, Royal Gold, Inc. RGLD and Fortuna Mining Corp. FSM.

Avino Silver is slated to report third-quarter results on Nov. 6. The Zacks Consensus Estimate for third-quarter earnings is pegged at 3 cents per share. ASM’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, with the average surprise being 141.67%. Avino Silver flaunts a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Royal Gold is scheduled to report third-quarter results on Nov. 5. The Zacks Consensus Estimate for RGLD’s third-quarter earnings is pegged at $2.18 per share. RGLD’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, with the average surprise being 8.95%. Royal Gold currently sports a Zacks Rank #1.

Fortuna Mining is expected to report third-quarter results on Nov. 5. FSM carries a Zacks Rank #2 (Buy) at present. Fortuna Mining’s earnings beat the consensus estimate in one of the last four quarters and missed thrice.

Beyond Nvidia: AI's Second Wave Is Here

The AI revolution has already minted millionaires. But the stocks everyone knows about aren't likely to keep delivering the biggest profits. Little-known AI firms tackling the world's biggest problems may be more lucrative in the coming months and years.

See "2nd Wave" AI stocks now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cleveland-Cliffs Inc. (CLF): Free Stock Analysis Report

Royal Gold, Inc. (RGLD): Free Stock Analysis Report

Fortuna Mining Corp. (FSM): Free Stock Analysis Report

Avino Silver (ASM): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com