Can PPL's Diversified Fuel Mix Drive Growth & Decarbonization?

PPL Corporation PPL is strategically positioned to benefit from multi-fuel generation through its investments in a diverse energy portfolio. By diversifying its generation sources, PPL aims to enhance grid reliability, reduce carbon emissions and lower costs for customers. Additionally, PPL is investing in grid modernization to support the integration of more distributed energy resources and exploring low-carbon technologies like carbon capture. PPL expects a regulated capital investment plan of $20 billion during 2025-2028. Investments are focused on new technology, strengthening of grid and expansion of clean energy generation capacity.

The company’s carbon emission reduction target is presently following the objective to meet the below 2-degree Celsius scenario. PPL plans to achieve its carbon emissions target of 70% by 2035 and of 80% by 2040 (from 2010 levels). It aims to become carbon neutral by 2050. To ensure continued reliability, the company is evaluating a diverse mix of replacement generation, including non-emitting and cleaner sources like natural gas, renewables, carbon capture, hydrogen, and biofuels. This multi-pronged approach offers both flexibility and resilience in the evolving energy landscape.

PPL is pushing multi-fuel innovation with hydrogen projects in New England and Kentucky and carbon capture studies at its Cane Run plant. The early results even show net-negative emissions.

As of Dec. 31, 2024, PPL’s subsidiaries Louisville Gas and Electric Company and Kentucky Utilities Company (in unison) electricity generation capacity was nearly 79% from coal, 19.9% from gas, 1% from hydro and 0.1% from solar.

Diversified Fuel Mix Supporting Utility Growth

Some other utility companies that are also benefiting from multi-fuel generation capacity have been discussed below.

Duke Energy DUK utilizes a diverse energy portfolio that includes coal, natural gas, nuclear, and renewable energy sources. This ensures a reliable electricity supply and helps the company manage fuel-related risks.

Vistra Corp.’s VST long-term growth potential is greatly increased by its multi-fuel generation portfolio. Vistra is in a strong position to handle the changing energy landscape in the United States, thanks to a balanced mix of coal, nuclear, natural gas, and growing renewable energy and battery storage.

PPL’s Earnings Estimates

The Zacks Consensus Estimate for 2025 and 2026 EPS indicates an increase of 7.69% and 8.33%, respectively, year over year.

Image Source: Zacks Investment Research

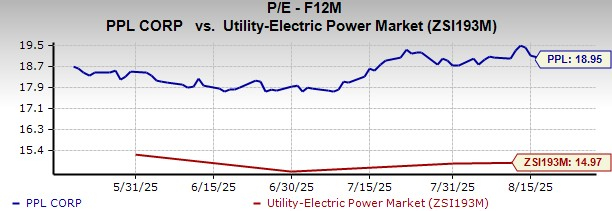

PPL Stock Trading at a Premium

PPL is trading at a premium relative to the industry, with a forward 12-month price-to-earnings of 18.95X compared with the industry average of 14.97X.

Image Source: Zacks Investment Research

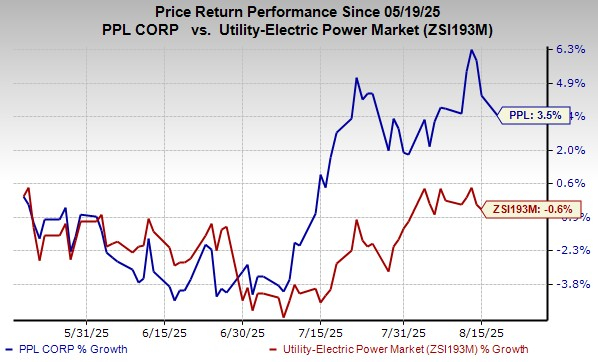

PPL Stock Price Performance

In the past three months, PPL’s shares have risen 3.5% against the industry’s 0.6% decline.

Image Source: Zacks Investment Research

PPL’s Zacks Rank

PPL currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

See our %%CTA_TEXT%% report – free today!

7 Best Stocks for the Next 30 DaysWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPL Corporation (PPL): Free Stock Analysis Report

Duke Energy Corporation (DUK): Free Stock Analysis Report

Vistra Corp. (VST): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com