Can NIKE's Digital Expansion Strategy Reignite Consumer Engagement?

NIKE, Inc.’s NKE digital ecosystem remains a powerful engagement engine and has long been positioned as a core pillar of its growth strategy. However, the company has been experiencing a sustained digital slowdown. Revenues at NIKE Digital dropped 12% and NIKE Direct fell 4% in first-quarter fiscal 2026. Organic traffic declined in double digits, reflecting the company’s deliberate pullback from heavy promotions and overreliance on sneaker launches.

While this shift aims to restore brand health and profitability, it exposes gaps in consumer engagement and content strategy. Efforts to rebalance the mix toward full-price sales have yet to fully offset traffic declines. On its last earnings call, management highlighted that it does not expect NIKE Direct to revert to growth in fiscal 2026, with traffic remaining under pressure and limiting revenue acceleration.

Personalization is a core strength of NKE’s digital strategy. However, as competition from digitally native brands and retailers’ own e-commerce platforms intensifies, NIKE needs to re-establish digital stickiness by strengthening personalization, fostering community engagement and delivering a more seamless omnichannel experience. NIKE’s renewed emphasis on sport-led product storytelling and franchise resets is also essential for converting digital engagement into tangible demand. Hence, NKE is focused on growing the entire marketplace, including NIKE Direct digital commerce.

The company can reignite consumer engagement despite weak demand, intensifying competition and shifting consumer expectations by reinvigorating its digital value proposition through personalization, rewards and more seamless end-to-end experiences. In addition, disciplined integration of digital platforms with broader brand campaigns and omnichannel distribution can amplify reach, reinforce relevance and strengthen consumer connection across touchpoints. Digital strength, paired with NKE’s broad portfolio of brands, sports categories and expansion into global markets, can help deepen consumer engagement and drive sustainable growth.

NKE’s Competition in the Digital Arena

adidas AG ADDYY and lululemon athletica inc. LULU are the key companies competing with NIKE in the digital ecosystem.

adidas continues to view digital as a vital pillar of its growth agenda, with a focus on strengthening direct-to-consumer (DTC) capabilities, enhancing personalization and deepening consumer engagement across its platforms. The company has invested in upgrading its e-commerce infrastructure, mobile apps and data analytics to deliver more localized, relevant and seamless consumer experiences. ADDYY is seeing robust growth across the global markets, thanks to solid growth in its wholesale and DTC businesses.

lululemon continues to position e-commerce as a core growth driver, ramping up investments in digital infrastructure to capture rising online demand. Key priorities include ongoing site enhancements, improved omnichannel functionality and expanded fulfillment capabilities. Importantly, the digital channel continues to be a powerful driver of guest acquisition and retention, with lululemon leveraging data and personalization to deepen customer relationships. With digital penetration nearing 40%, lululemon views e-commerce as a critical growth engine, enabling scalable expansion and strengthening global brand reach.

NKE’S Price Performance, Valuation and Estimates

Shares of NIKE have gained 12.3% in the past six months compared with the industry’s rise of 9.4%.

Image Source: Zacks Investment Research

From a valuation standpoint, NKE trades at a forward price-to-earnings ratio of 30.40X compared with the industry’s average of 27.47X.

Image Source: Zacks Investment Research

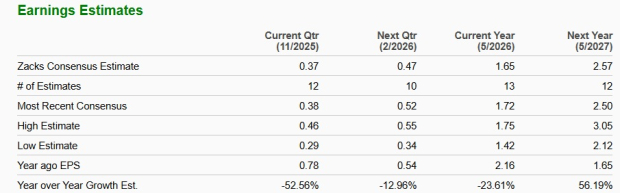

The Zacks Consensus Estimate for NKE’s fiscal 2026 earnings implies a year-over-year plunge of 23.6% while that of fiscal 2027 shows growth of 56.2%, respectively. The company’s EPS estimate for fiscal 2026 and fiscal 2027 has moved northward in the past 30 days.

Image Source: Zacks Investment Research

NIKE stock currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NIKE, Inc. (NKE): Free Stock Analysis Report

lululemon athletica inc. (LULU): Free Stock Analysis Report

Adidas AG (ADDYY): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com