Can Intel's Investment-Driven Strategy Regain Its Competitive Edge?

Intel Corporation (INTC) has completed a previously announced $5 billion investment from NVIDIA Corporation (NVDA), under which the latter purchased around 214.7 million shares of the former at $23.28 per share. Earlier in December, this transaction received U.S. antitrust approval from the Federal Trade Commission. This purchase gives NVIDIA roughly a 4% equity stake in Intel through a private placement of shares.

The partnership aims to tightly combine Intel’s custom-designed x86 CPUs with NVIDIA’s AI GPUs and NVLink interconnect technology to create faster, more efficient AI systems and next-generation PCs with stronger AI and graphics performance. This could help Intel remain competitive in the AI era.

Intel had also secured $8.9 billion in funds from the U.S. government to support semiconductor manufacturing and packaging projects in Arizona, New Mexico, Ohio and Oregon in order to boost the domestic chip industry. SoftBank has also invested $2 billion, providing funds to support Intel’s restructuring and AI projects.

Intel is constantly making efforts to bring huge investments to strengthen its balance sheet, supporting heavy spending on new factories and R&D, boosting market confidence and enabling deeper technology collaboration with firms like NVIDIA.

How Are Rivals Performing?

Intel faces competition from Qualcomm Incorporated (QCOM) and Advanced Micro Devices (AMD). Qualcomm recently completed its $2.4 billion acquisition of British semiconductor company Alphawave Semi to strengthen its AI, data center and high-speed connectivity technologies, boosting its competitiveness beyond smartphones. By strengthening its PC chip offerings through programs like Snapdragon X, Qualcomm can expand into new markets such as AI infrastructure, edge computing and personal computers. Qualcomm entered the AI infrastructure space by developing AI accelerators like AI200 & AI250.

AMD is set to launch high-performance AI GPUs, EPYC server CPUs and full AI systems like Helios to compete with NVIDIA and provide faster, more efficient solutions for data centers and enterprises. AMD is partnering with companies like OpenAI and Oracle to expand across gaming, PCs and servers to increase revenues and stay competitive. The company continues to improve its ROCm open software stack and open hardware standards.

INTC’s Price Performance, Valuation & Estimates

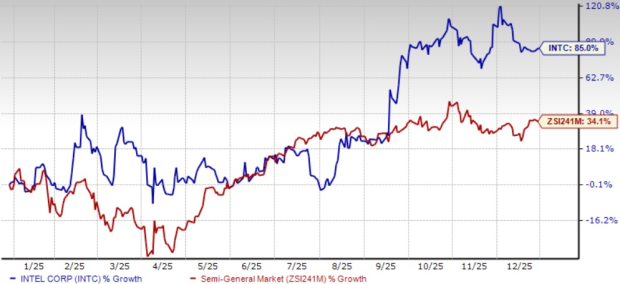

Shares of Intel have surged 85% over the past year compared with the industry’s growth of 34.1%.

Image Source: Zacks Investment Research

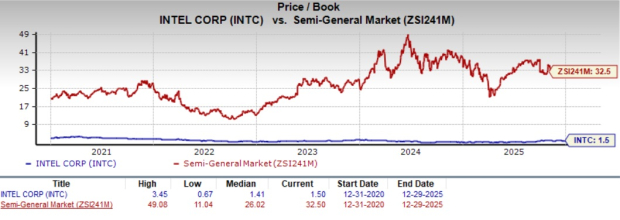

Going by the price/book ratio, the company's shares currently trade at 1.5 book value, lower than 32.5 of the industry average.

Image Source: Zacks Investment Research

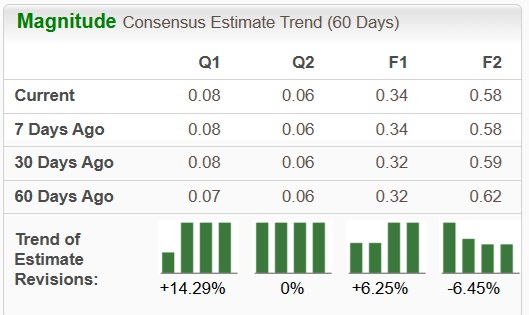

INTC’s earnings estimates for 2025 have increased 6.3% to 34 cents per share, while those for 2026 have declined 6.5% to 58 cents over the past 60 days.

Image Source: Zacks Investment Research

Intel stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC): Free Stock Analysis Report

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com