Updated on April 6th, 2021 by Nikolaos Sismanis

CAZ Investments is an investment management company located in Houston, Texas that focuses on giving high net worth individuals access to exclusive investment opportunities.

CAZ Investments was founded in 2001 by Christopher Zook. It has grown to manage ~$1.45 billion in assets and was the 16th largest Houston asset manager at the end of 2020.

Investors following the company’s 13F filings over the last 3 years (from mid-February 2018 through mid-February, 2021) would have generated annual total returns of 12.20%. For comparison, the S&P 500 ETF (SPY) generated annualized total returns of 12.50% over the same time period.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

You can download an Excel spreadsheet with metrics that matter of CAZ Investments current 13F equity holdings below:

Keep reading this article to learn more about CAZ Investments.

Table Of Contents

- Introduction & 13F Spreadsheet Download

- CAZ’s Investing Strategy

- CAZ’s Portfolio & Top 10 Holdings

- Final Thoughts

CAZ’s Investing Strategy

The general idea behind CAZ Investments is to provide investors with access to investment opportunities they otherwise would not have. This typically means private equity, hedge fund, and venture capital deals.

CAZ Investments creates private funds that have a specific investment theme and invest in opportunities that match the specific investment theme. Recent investment themes CAZ Investments has identified are shown in the image below.

A brief description of a sampling of CAZ Investments funds is below. The company currently has 29 different funds based on its most recent ADV brochure:

- CAZ AI Fund, L.P., which invests in various securities (stock, convertible notes, warrants, etc.) of Lucid Holdings.

- CAZ Co-Investment Opportunities Fund, L.P. – Didi Portfolio, which invests as a limited partner in Paulson Investment Company LP, which in turn invests in shares of Xiaoju Kuaizhi, doing business as Didi Chuxing, a Chinese transportation network with significant mobile taxi and private car services market share in China.

- CAZ Co-Investment Opportunities Fund, L.P. – Lyft Portfolio, which invested as a limited partner in Paulson Investment Company II LP, which in turn invested in Lyft before it went public. This fund is now in liquidation mode because Lyft is publicly traded.

- CAZ Co-Investment Opportunities Fund, L.P. – VEP Portfolio, which invests with Vista Equity Partners. Vista Equity Partners is an investment firm focused exclusively on enterprise software.

- CAZ Distressed Secondary Fund, L.P., which invests in Dorchester Capital Secondaries III, L.P. Dorchester Capital is a Houston-based hedge fund.

- CAZ Energy Infrastructure Fund, L.P., which invests in the EnCap Energy Infrastructure Fund, L.P. EnCap Investments L.P., which manages the EnCap Energy Infrastructure funSUMOd, is a venture capital firm for independent energy companies.

CAZ Investments has invested directly or indirectly in the notable companies and funds shown in the image below, among others.

CAZ’s Portfolio & Top 10 Holdings

During the period covering CAZ’s latest 13F filing, the fund initiated and ditched the following entries:

New Buys:

- Sprott Inc (SII)

- Sixth Street Specialty Lending Inc (TSLX)

- Owl Rock Capital Corp (ORCC)

- Ares Capital Corp (ARCC)

New Sells:

- Aberdeen Standard Platinum ETF (PPLT)

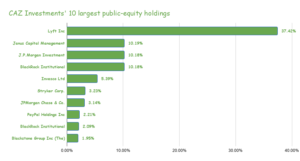

CAZ’s portfolio is quite concentrated, comprising only 30 individual stocks, the top 10 of which account for nearly 86% of its total weight. The fund’s largest single holding is Lyft, which accounts for around 37.4% of the total portfolio.

Source: f13 filings, Author

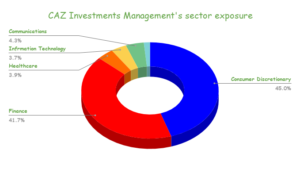

In terms of sector exposure, due to the limited number of stocks held, financials and consumer discretiony (which includes the Lyft stake) collectively account for 86% of the total portfolio.

Source: 13F filings, Author

CAZ’s 10 most significant holdings are the following:

Lyft (LYFT):

The fund’s largest investment, by far, is its $25.2 million equity stake in Lyft, which currently accounts for 37.4% of CAZ’s total public-equity holdings. It’s also worth noting that CAZ holds no interest in Uber, which would have been a sensible choice in terms of diversification. CAZ’s position has remained relatively steady since the company’s IPO, placing a strong conviction towards the transportation giant.

CAZ’s bet is rather risky, as the company is still struggling financially, with no clear path on how to reach a positive bottom line. During Q4, the company recorded revenues of $569M, a -44% decline year-over-year, as the ongoing pandemic has reduced consumers’ demand for transportation. In that regard, the company is under extreme pressure, as its growth has been utterly wiped out. Revenue per active rider increased by 14% compared to Q3.

However, the company still recorded -51% few rides compared to last year, suggesting that it’s still a long way from reaching its pre-pandemic ride volume levels, let alone delivering a positive bottom line. For this reason, investors should not expect a Lyft dividend any time soon.

On the other hand, the company’s future may not be completely dark. Rideshare recovery continues, despite being far from the pre-pandemic levels. Furthermore, Lyft’s contribution margins (per-ride profit metric) stood at nearly 55.5%, which means that the company has great prospects to become profitable if it reaches a sufficient scale of monthly rides.

The company ended the year with $2.25 billion in cash and equivalents ($2.45 billion in Q3) in terms of liquidity, which should help sustain some additional short-term losses before the company is in need of further raises. Still, this should only last for a couple of years, at which point investors should expect further dilution.

Overall, Lyft remains a risky investment. Along with its peer Uber (UBER), the company faces increased scrutiny in terms of driver/rider rights, as well as increased pressure by the local authorities. The duo recently won a reprieve in California, amid media reports that the order on classifying its drivers as employees rather than contractors has been delayed. Still, regulation remains very fluid and could easily turn either in favor or hostile for rider-sharing companies.

CAZ’s bold bet could end up booking massive losses, or potentially massive gains, in the future. While positive catalysts remain, the stock is in quite a speculative position as well. As of CAZ’s latest 13F filing, Lyft’s position was held steady.

Short-Term ETFs

As of its latest 13F filing, CAZ was holding three different ETF positions in short-term funds, switching its capital allocation from its tech holdings towards highly liquid assets, possibly expecting for correction to occur soon.

These include:

- Janus Henderson Short Duration Income ETF (VNLA)

- JPMorgan Ultra-Short Income ETF (JPST)

- Blackrock’s iShares Ultra Short-Term Bond ETF (ICSH)

The 3 ETFs collectively occupy nearly 30% of the fund’s portfolio.

Invesco (IVZ), JPMorgan Chase & Co (JPM), & The Blackstone Group (BX)

Invesco, JPMorgan Chase & Co, and The Blackstone Group occupy around 5.4%, 3.1%, and 2.0% of CAZ’s portfolio, respectively. Invesco’s position was trimmed by just 1% while the two other holdings were left intact. Still, they rose to CAZ’s largest positions due to the fund trimming its previously higher holdings. A shift to higher exposure in financials seems like a prudent move by CAZ since the sector currently remains quite undervalued compared to its historical valuation multiples.

The three companies delivered robust results during Q4, with hefty bottom lines. Should these profits eventually translate to higher stock prices, CAZ should significantly benefit.

Stryker Corp (SYK):

Holding a just over $2 million position, Stryker Corp is CAZ’s sixth-largest holding, and the only notable holding in the healthcare sector, making up around 3.2% of its portfolio. CAZ held its position steady from the previous quarter. In the meantime, Stryker reported an excellent FY2020, reporting $1.6 billion in profits, as its essential medical devices are of prime importance during the current environment. Amid a great year, shares are currently trading near all-time highs, around $243/share.

PayPal (PYPL)

PayPal is CAZ’s eighth-largest position and its largest fintech holding, accounting for around 2.2% of the total portfolio. The pandemic increased the need for online payments, boosting Paypal’s network of users and the total number of transactions to new all-time highs. Hence, revenues for the year achieved a new record of $21.45 billion.

PayPal is a mega-cap stock with a market cap above $200 billion.

Net income was also the highest in the company’s history, at $4.20 billion, retaining robust margins. Paypal’s consistent and growing performance makes it a very attractive pick in the tech sector. However, investors should be wary of the stock’s current valuation, which is way above its historical levels, at 53.3 times its forward net income.

CAZ held the position steady during the quarter.

iShares MSCI Emerging Markets ETF (EEM)

Around 2.1% of CAZ’s portfolio is invested in iShares’ Emerging Market ETF. The position was trimmed by 39% during the quarter. With the U.S. markets arguably overvalued, it makes sense that CAZ would look for more attractively priced securities, possibly overseas. The fund also makes for a great diversification vehicle holding some international blue-chips such as Alibaba (BABA), Tencent (TCEHY), and Taiwan Semiconductor Manufacturing (TSM).

The ETF is currently trading around 0.85% higher than its net asset value (NAV), so investors should be wary not to overpay for its assets.

Final Thoughts

CAZ Investments value proposition is to give investors access to opportunities they otherwise would not have. As a result, the firm seeks to partner with top-tier private equity, venture capital, and hedge funds to provide the best opportunities to its clients.

The firm’s February 2021 13F filing shows that it has only ~$67 million invested in individual equities not including ETFs. This is under 5.0% of the firms’ assets.

You can download an Excel spreadsheet with metrics that matter of CAZ Investments current 13F equity holdings below:

Additional Resources:

Lone Pine Capital’s 37 Stock Portfolio: Top 10 Holdings Analyzed

Slate Path Capital’s 20 Stock Portfolio: Top 10 Holdings Analyzed

Athanor Capital’s 534 Stock Portfolio: Top 10 Holdings Analyzed

Viking Global’s 75 Stock Portfolio: Top 10 Holdings Analyzed