Bull of the Day: Roku (ROKU)

Roku ROKU helped pioneer streaming. Its TVs, Roku TV models, Roku streaming players, and TV-related audio devices are available worldwide through direct retail sales and/or licensing arrangements with TV OEM brands.

The stock sports the highly coveted Zacks Rank #1 (Strong Buy), with EPS expectations moving bullishly across the board.

Image Source: Zacks Investment Research

Let’s take a closer look at what’s been driving the positivity.

Roku Shares Outperform

Roku posted a double-beat concerning our headline expectations in its latest quarterly release, with adjusted EPS tripling alongside a 14% sales increase. Importantly, the company posted positive operating income for the first time since 2021.

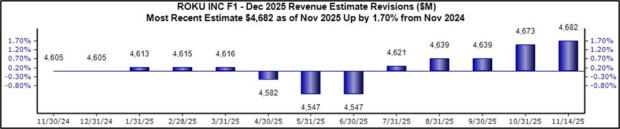

Advertising efforts and subscription growth led to the strong quarter, with the company raising its fiscal year guidance following the print. The current year sales outlook has remained positive following the guide higher, as we can see below.

Image Source: Zacks Investment Research

The positive release helped move shares higher post-earnings, up 30% on a YTD basis and outperforming relative to the S&P 500 by a fair margin. Big growth is expected, with current year consensus expectations alluding to 140% adjusted EPS growth on 14% higher sales.

Image Source: Zacks Investment Research

Bottom Line

Investors can implement a stellar strategy to find expected winners by taking advantage of the Zacks Rank – one of the most powerful market tools that provides a massive edge.

The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

Roku ROKU would be an excellent stock for investors to consider, as displayed by its Zack Rank #1 (Strong Buy).

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roku, Inc. (ROKU): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com