Bull of the Day: Credo Technology Group (CRDO)

Credo Technology CRDO, a Zacks Rank #1 (Strong Buy) provides innovative, secure, high-speed connectivity solutions that deliver improved power efficiency as data rates and corresponding bandwidth requirements increase exponentially throughout the data infrastructure market.

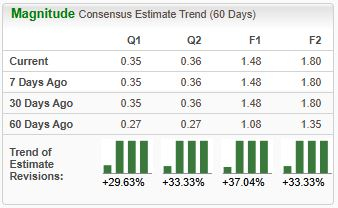

The company’s EPS outlook remains bullish across the board, with the stock sporting the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Let’s take a closer look at how the company presently stacks up.

CRDO Benefits from AI

Credo’s latest set of strong quarterly results was fueled by continued strong demand for its services, with the company a big beneficiary of the AI frenzy. The increased AI spend is undoubtedly set to continue for years, positioning the company nicely to continue reaping the benefits and reflecting a somewhat ‘under-the-radar’ play on the broader AI movement.

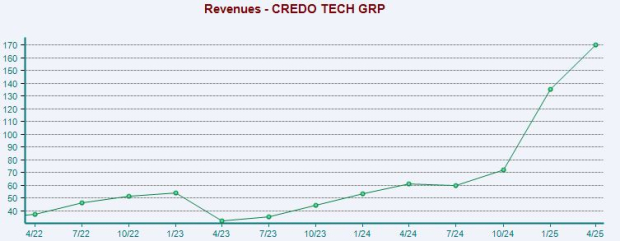

CRDO crushed our consensus expectations in the above-mentioned release, with sales up a rock-solid 180% year-over-year. Below is a chart illustrating the company’s sales on a quarterly basis, with the acceleration visibly seen over the past few periods.

Image Source: Zacks Investment Research

The favorable print rounded out its rock-solid FY25, with CEO Bill Brennan delivering a notably positive statement following the release –

“I’m proud of Credo’s achievements in fiscal 2025. For the year, the Company delivered record-breaking financial results, with revenue up 126% year over year to $436.8 million. The Company’s results were fueled by surging demand for our innovative, reliable, and energy-efficient high-performance connectivity solutions. We continue to see growing demand for our solutions across hyperscaler customers to power advanced AI services, a trend we believe will persist for the foreseeable future.”

The stock remains a prime pick for those seeking high-growth, with current Zacks Consensus estimates for its current fiscal year (FY26) suggesting 110% EPS growth on 85% higher sales. Growth is currently expected to spill over nicely into FY27, with EPS and revenue forecasted to be up 22% and 21%, respectively.

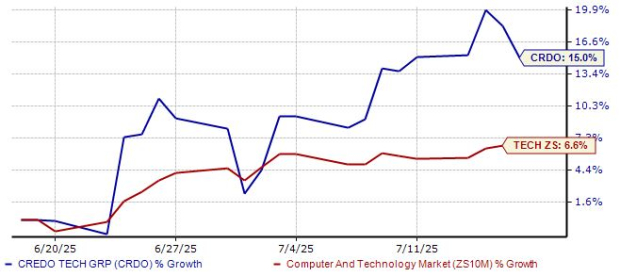

The stock sports a Style Score of ‘A’ for Growth. Shares continue to deliver rock-solid gains, up 15% just over the last month and outperforming the Zacks Technology sector by a big margin.

Image Source: Zacks Investment Research

Bottom Line

Investors can implement a stellar strategy to find expected winners by taking advantage of the Zacks Rank – one of the most powerful market tools that provides a massive edge.

The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market in the near-term more than any other rank.

Credo Technology CRDO is currently a Zack Rank #1 (Strong Buy).

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Credo Technology Group Holding Ltd. (CRDO): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com