Published on August 7th, 2022, by Felix Martinez

There is no exact definition for blue chip stocks. We define it as a stock with at least ten consecutive years of dividend increases. We believe an established track record of annual dividend increases going back at least a decade shows a company’s ability to generate steady growth and raise its dividend, even in a recession.

As a result, we feel that blue chip stocks are among the safest dividend stocks investors can buy.

With all this in mind, we created a list of 350+ blue-chip stocks, which you can download by clicking below:

In addition to the Excel spreadsheet above, we will individually review the top 50 blue chip stocks today as ranked using expected total returns from the Sure Analysis Research Database.

This article will analyze Travelers Companies (TRV) as part of the 2022 Blue Chip Stocks In Focus series.

Business Overview

The Travelers Companies was founded in 1864 in Hartford, CT, by two local businessmen. The company began with life and accident insurance but has expanded into other types of coverage in the 150+ years since then. Today, it generates just over $33 billion in annual revenue and has a $37.72 billion market capitalization. The company offers a broad and deep variety of protection products for auto, home, and business customers. It is also a Dow Jones Industrial Average member, making it the only property casualty insurance provider in the prestigious index.

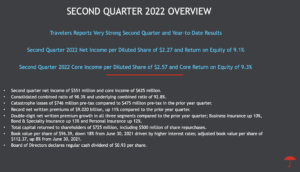

On July 21, 2022, the company reported the second quarter and six months results for Fiscal Year (FY)2022. Revenue for the quarter is up 5% compared to the second quarter of 2021. Revenue was $8,687 million in 2Q2021, and now revenue for 2Q2022 is $9,136 million. Net written premiums saw an increase of 11% year-over-year.

The company has double-digit net written premium growth in all three segments compared to the prior year’s quarter; Business Insurance up 10%, Bond & Specialty Insurance up 13%, and Personal Insurance up 12%.

Net income of $551 million decreased by $383 million due to lower core income and net realized investment losses compared to net realized investment gains in the prior year’s quarter. Core income of $625 million decreased by $254 million, primarily due to higher catastrophe losses, lower net investment income, and a lower underlying underwriting gain, partially offset by higher net favorable prior year reserve development.

For the six months of the fiscal year, total revenue was up 6%, while net written premiums have increased 11% compared to the first six months of FY2021. However, net income is down 6% for 2022 first six months compared to 2021 first six months. However, per diluted share, it is up 10%, from $6.18 per share in the first six months of 2021 to $6.81 per share in the first six months of 2022.

Source: Investor Presentation

Growth Prospects

After solid growth from the Great Recession, Travelers failed to regain its 2015 high of $10.87 in earnings-per-share until 2021. Conditions were favorable in 2021 because prior reserve developments were unwound, investment conditions were excellent, and losses were lower than average. This year should result in more normalized conditions, but as a result, we are expecting higher.

Over the past ten years, the company has been growing earnings at a Compound Annual Growth Rate (CAGR) of 13.2%. However, there were some down years where earnings decreased compared to the prior year. For example, in 2016 and 2017, earnings fell by 7% and 32%, respectively.

However, earnings have increased over the past five years with a CAGR of 13.2%. We expect that this will slow down in the coming years. Thus we expect the company to grow earnings over the next five years at a 6% rate annually.

Travelers could achieve this growth primarily from higher underwritten premiums and the buyback program, although margins should also play a part as long as there aren’t any large catastrophes.

The dividend has been raised in the mid-single-digit range annually, and we expect it to continue for the foreseeable future. Travelers is not a pure income stock, but its 2.3% yield is still decent by its historical standards and almost 100bps better than the S&P 500.

Source: Investor Presentation

Competitive Advantages & Recession Performance

Travelers’ primary competitive advantage is in its immense scale and recognizable brand. Its size allows it to underwrite policies that others would not be able to, and its brand is well-known from its long history. The company is more susceptible to catastrophes than recessions, as we saw in 2017 and again in 2018. This makes Travelers a defensive play should the economy weaken materially, but we reiterate that insurance companies are susceptible to significant and unforeseen shocks, as Travelers has demonstrated in recent years.

You can see a rundown of Travelers’ earnings-per-share from 2007 to 2011 below:

- 2007 earnings-per-share of $6.71

- 2008 earnings-per-share of $5.27 (21% decrease)

- 2009 earnings-per-share of $6.29 (19% increase)

- 2010 earnings-per-share of $6.26 (0.5% decrease)

- 2011 earnings-per-share of $3.28 (48% decrease)

The company did see a significant decrease in earnings in 2008. However, saw a nice comeback in 2009 with a 19% increase in earnings. But, in the following two years, earnings decreased.

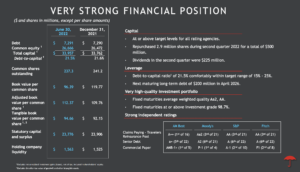

The company has an outstanding balance sheet. The company sports a debt-to-equity ratio of 0.3 and a long-term debt-to-capital ratio of 23.8. Also, the interest coverage ratio is 13.2, which is a high ratio, meaning that the company covers the interest on its debt very well.

Source: Investor Presentation

Valuation & Expected Returns

Over the past ten years, the company has averaged a PE ratio of 12.7x earnings. However, we think a PE ratio of 12x earnings is appropriate for this company. At the current price, this company has a PE ratio of 11.7x earnings based on 2022 expected earnings of $13.40 per share.

At the current price, the valuation multiple expansion is about a 0.5% tailwind over the next five years. Adding the valuation multiple expansion of 0.5%, a dividend yield of 2.3%, and expected earnings growth of 6% gives us an expected five-year annual rate of return of about 8.8%. This is a modest rate of return at the current price.

Final Thoughts

Travelers look like safe financial services providers with a decent growth outlook. We forecast a total annual return potential of 8.8% in the coming years, consisting of a 2.3% yield, 6% earnings-per-share growth, and a slight tailwind from the valuation. Thus, we think that Travelers should have a hold rating as the stock is only slightly undervalued in our view.

The Blue Chips list is not the only way to quickly screen for stocks that regularly pay rising dividends.

- The Dividend Aristocrats: S&P 500 stocks with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the Dividend Aristocrats with the highest current yields.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 44 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks: Monthly dividend stocks with the highest current yields.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Complete List of Russell 2000 Stocks: arguably the world’s best-known benchmark for small-cap U.S. stocks.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The 2022 High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The 2022 High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The 2022 Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta.