Published on August 6th, 2022, by Felix Martinez

There is no exact definition for blue chip stocks. We define it as a stock with at least ten consecutive years of dividend increases. We believe an established track record of annual dividend increases going back at least a decade shows a company’s ability to generate steady growth and raise its dividend, even in a recession.

As a result, we feel that blue chip stocks are among the safest dividend stocks investors can buy.

With all this in mind, we created a list of 350+ blue-chip stocks, which you can download by clicking below:

In addition to the Excel spreadsheet above, we will individually review the top 50 blue chip stocks today as ranked using expected total returns from the Sure Analysis Research Database.

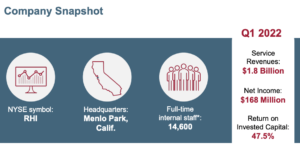

This article will analyze Robert Half International (RHI) as part of the 2022 Blue Chip Stocks In Focus series.

Business Overview

Robert Half International provides staffing and risks consulting services for companies worldwide. The business’s three segments are Contract Talent Solutions, Protiviti, and Permanent Placement. These segments accounted for 64%, 26%, and 10% of sales. Contract Talent Solutions makes up most sales and includes contributions from different sub-segments, including Accountemps, which offers accounting help for companies, Office Team, which provides office workers for companies; Robert Half Technology, which helps companies find IT professionals; and Robert Half Management Resources, which helps businesses find senior-level professionals.

Source: Investor Presentation

On July 21 st, 2022, Robert Half International reported second quarter 2022 results for the period ending June 30th, 2022. The business reported earnings-per-share of $1.60, up 20.3% from the year-ago period. Revenue increased 17.7% year-over-year to $1.86 billion, but revenue missed expectations by $40 million.

Growth was led by the Total Contract Talent Solutions segment, which grew 19.2% year-over-year to $1.17 billion. In the Total Contract Talent Solutions business, the Finance and Accounting services led the segment in revenue growth, gaining 22.1% year-over-year to reach over $810 million in revenue for the quarter. Additionally, Protiviti, one of Robert Half’s subsidiaries, generated $497.0 million in revenue for the quarter, up 8.4% year-over-year.

Net income for the quarter was $176 million versus net income for the prior year’s second quarter of $149 million. Net income increase was driven by higher revenue and a slight service cost increase compared to the second quarter of 2021.

For the six months of the fiscal year, revenue is up 23.5% compared to the six months of 2021. Also, net income is up 32.4% in the same period. Thus, the company’s earnings are up 34.5% over the six months of the fiscal year, from $2.32 per share to $3.12 per share in the first six months of 2022.

Growth Prospects

Earnings have been growing immensely since the end of the Great Recession. For instance, earnings since 2010 have an Annual Compound Growth (CAGR) Rate of 21.8%. Over the past five years, earnings growth has slowed to 15.1%. However, the COVID-19 pandemic lowered earnings in 2020.

We expect that the company will continue to grow its earnings. However, we do not think that the company will grow earnings at the rate it has in the past. We expect the company to grow earnings at a modest 2% over the next five years.

This results from how fast the company grew earnings in 2021 and expected earnings growth for 2022. For example, earnings grew 99% in 2021, and we expect earnings to grow another 17% in 2022.

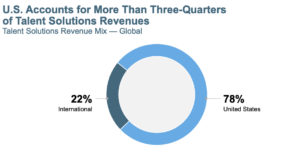

If the company wants to continue higher growth, it should look at the international market as it only makes up 22% of its current revenue source. Expending more into the global market should get the company earnings back to double-digit growth.

Source: Investor Presentation

Competitive Advantages & Recession Performance

The company’s competitive advantage is in its intangible assets and network effects, even within a highly fragmented global staffing industry. Its brand strength, reputation, and centralized database benefit employers looking for qualified candidates willing to accept hard-to-fill positions and job candidates seeking positions in highly skilled professions.

Source: Investor Presentation

The company did not do well during the Great recession. As you see below, earnings did fall significantly in 2009. However, it bounces vigorously in the following years. Also, during the COVID-19 pandemic, the company’s earnings fell substantially by 31% year-over-year (YoY).

You can see a rundown of Williams Sonoma Inc.’s earnings-per-share from 2007 to 2011 below:

- 2007 earnings-per-share of $1.81

- 2008 earnings-per-share of $1.63 (Decrease 10% YoY)

- 2009 earnings-per-share of $0.24 (Decrease 85% YoY)

- 2010 earnings-per-share of $0.44 (Increase 83% YoY)

- 2011 earnings-per-share of $1.04(Increase 136% YoY)

While earnings-per-share fell significantly in 2009, the company quickly recovered. However, by 2011, earnings-per-share were still below the 2007 level.

In addition, RHI has a solid balance sheet with ample cash, sufficient liquidity, and zero debt levels. For example, the company has a debt-to-equity ratio of 0.1, virtually none.

Source: Investor Presentation

Valuation & Expected Returns

Over the past ten years, the company has tended to have a Price to earning ratio (PE) of 20.8x earnings. At the current price, the company now has a PE of 13.3x earnings. This indicates that the company is undervalued based on this metric.

Overall, we think that the company should have a PE of 20x earnings. At the current PE ratio, this will provide an investor with a valuation multiple expansion of 9.7% over the next five years.

Suppose we add up the expected growth of 2% and the current dividend yield of 2.2% with the valuation multiple expansion of 9.7%. In that case, this will provide an investor with an expected five-year return of 13.9% annually.

Final Thoughts

Robert Half International offers investors an opportunity to invest in a business that has seen historical solid growth and stands to benefit from the new changes in employment that have been brought by COVID-19 and the work-from-home economy.

At today’s price, we rate the stock as a buy because total return prospects come in at 13.9% annually over the next five years. Investors might be interested in this stock because well-managed staffing companies can earn high returns on capital, and this business benefits from the current employment environment.

The Blue Chips list is not the only way to quickly screen for stocks that regularly pay rising dividends.

- The Dividend Aristocrats: S&P 500 stocks with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the Dividend Aristocrats with the highest current yields.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 44 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks: Monthly dividend stocks with the highest current yields.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Complete List of Russell 2000 Stocks: arguably the world’s best-known benchmark for small-cap U.S. stocks.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The 2022 High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The 2022 High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The 2022 Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta.