Published on August 8th, 2022, by Felix Martinez

There is no exact definition for blue chip stocks. We define it as a stock with at least ten consecutive years of dividend increases. We believe an established track record of annual dividend increases going back at least a decade shows a company’s ability to generate steady growth and raise its dividend, even in a recession.

As a result, we feel that blue chip stocks are among the safest dividend stocks investors can buy.

With all this in mind, we created a list of 350+ blue-chip stocks, which you can download by clicking below:

In addition to the Excel spreadsheet above, we will individually review the top 50 blue chip stocks today as ranked using expected total returns from the Sure Analysis Research Database.

This article will analyze Leggett & Platt (LEG) as part of the 2022 Blue Chip Stocks In Focus series.

Business Overview

Leggett & Platt is a diversified manufacturing company. It was founded in 1883 when an inventor named J.P. Leggett created a bedspring that was superior to the existing products at that time. The company designs and produces engineered components and products found in most homes and automobiles.

It operates its business through three segments: Bedding Products, Specialized Products, Furniture, Flooring, and Textile Products. Serving a broad suite of customers worldwide, Leggett & Platt’s products include bedding components, automotive seat support and lumbar systems, specialty bedding foam, and private label finished mattresses, components for home furniture and work furniture, flooring underlayment, adjustable beds, and various other products.

Source: Investor Presentation

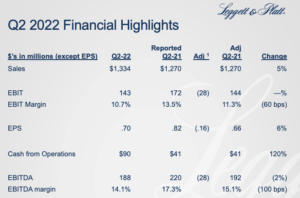

Leggett & Platt reported its second quarter and six months earnings results on August 1st. Quarterly revenue of $1.33 billion rose 5% year-over-year. Adjusted earnings-per-share of $0.70 fell 15% from the same quarter the previous year. Volume was down 6%, primarily from demand softness in residential end markets, partially offset by industrial end markets and automotive growth. Raw material-related selling price increases added 13% to sales.

Revenue is up 10% for the six months of the fiscal year, but net income is down 7% compared to the first six months of 2022. Overall, earnings per share are down 7% for the six months year-over-year, from $1.46 to $1.36 per share. Also, the company repurchased 1.0 million shares at an average price of $35.01

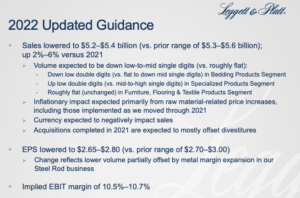

Management also provided guidance for the current fiscal year, forecasting revenues of $5.2 billion to $5.4 billion, which will be up 2% to 6% compared to 2021. Also, they expect EPS of $2.65 to $2.80. Based on the midpoint, this would represent a 2.1% decrease versus 2021.

Source: Investor Presentation

Growth Prospects

Growth at Leggett & Platt will rely on a multi-faceted approach, including average annual revenue growth (both organic and through acquisitions), new products and programs, expanding addressable markets, and ensuring that acquisitions are strategic. Further, share repurchases and cost controls could also boost the bottom line.

The most strategic acquisition was when the company spent $1.25 billion to purchase Elite Comfort Solutions. Elite Comfort Solutions’ foam bedding operations complement Leggett & Platt’s existing mattress capabilities and infrastructure. In 2021, LEG made three small acquisitions that expanded its capabilities in International Bedding, Aerospace, and Work Furniture.

Over the past ten years, the company’s earnings have been growing at a Compound Annual Growth Rate(CAGR) of 7.3%. Over the past five years, earnings have had a CAGR of 2.9%. So, earnings growth has been decreasing in recent years. However, overall, earnings are growing.

We expect the company to continue to grow earnings at a slightly higher rate compared to its five-year great rate of 5% over the next five years.

Source: Investor Presentation

Competitive Advantages & Recession Performance

Leggett & Platt has established a wide economic “moat,” meaning it has several operational advantages which keep competitors at bay. First, the company enjoys a leadership position in the industry, which allows for scale.

Leggett & Platt also benefit from operating in a fragmented industry, which makes it easier to establish a dominant position. There are few or no, large competitors in most of its product markets. And when a smaller competitor does achieve significant market share, Leggett & Platt can simply acquire them, as it did with Elite Comfort Solutions.

Leggett & Platt also has an extensive patent portfolio, which is critical in keeping competition at bay.

These competitive advantages help Leggett & Platt maintain healthy margins and consistent profitability. That said, the company did not perform well during the Great Recession.

You can see a rundown of Leggett & Platt’s earnings-per-share from 2007 to 2011 below:

- 2007 earnings-per-share of $1.20

- 2008 earnings-per-share of $0.88 (27% decrease)

- 2009 earnings-per-share of $0.86 (2% decrease)

- 2010 earnings-per-share of $1.16 (35% increase)

- 2011 earnings-per-share of $1.20 (3% increase)

The company has an acceptable balance sheet. The company sports a debt-to-equity ratio of 0.9 and a long-term debt-to-capital ratio of 42.8. Also, the interest coverage ratio is 5.0, which is a good ratio, meaning that the company covers the interest on its debt well. Overall, the company sports an S&P credit rating of BBB, an investment grade rating.

Valuation & Expected Returns

As previously mentioned, LEG stock has an impressive dividend history. The company has increased its dividend for half a century. Leggett & Platt has historically generated plenty of cash flow to distribute significant cash to investors and invest in growth initiatives.

It also has a solid current dividend yield of 4.2%. This is more than triple the ~1.3% average yield of the broader S&P 500 Index.

Leggett & Platt is expected to generate earnings-per-share of $2.70 for 2022. Based on a current stock price, shares are presently trading at a price-to-earnings ratio of 14.8x earnings.

While the company has been a steady grower over many years, with a long dividend history, we believe something closer to 15 times earnings is fair value for LEG stock. As such, this could indicate the potential for a meaningful valuation tailwind over the intermediate-term, to the tune of 1.5% per year if the current P/E expands to 15.

If you combine the 5% expected EPS growth rate, 4.2% starting dividend yield, and 1.5% potential valuation tailwind, you come to an expected annualized total return of 10.7% over the next five years.

Final Thoughts

Leggett & Platt is a company that has performed very well in the past, both in terms of generating earnings growth and its decades-long dividend growth track record. As we advance, we believe that Leggett & Platt’s earnings-per-share growth rate will be substantially lower, but the company’s earnings-per-share should continue to grow in the long run.

According to our present estimates, Leggett & Platt will offer compelling total returns over the coming years. We rate the stock a buy at current prices below our fair value estimate.

The Blue Chips list is not the only way to quickly screen for stocks that regularly pay rising dividends.

- The Dividend Aristocrats: S&P 500 stocks with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the Dividend Aristocrats with the highest current yields.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 44 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks: Monthly dividend stocks with the highest current yields.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Complete List of Russell 2000 Stocks: arguably the world’s best-known benchmark for small-cap U.S. stocks.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The 2022 High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The 2022 High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The 2022 Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta.