Published on August 10th, 2022 by Josh Arnold

Healthcare tends to be a sector with a lot of great dividend stocks, because companies in the industry tend to have fairly defensive earnings profiles. It is no wonder then that dividend stock lists tend to have a fair number of healthcare companies as components.

This is true of the list of Blue Chip stocks as well, which is a list of more than 350 companies with at least a decade of consecutive dividend increases.

With a staggering 60 years of consecutive dividend increases, healthcare giant Johnson & Johnson (JNJ) is one such company. The company has one of the longest dividend increase streaks in the world, and has proven its ability to raise its dividend through all kinds of economic environments. We see the list of Blue Chips as a great place to start in order to find great dividend stocks, like Johnson & Johnson.

We see Blue Chip stocks that satisfy the 10-year payout growth streak criterion as among the safest dividend stocks that investors can buy.

Accordingly, we created a list of all 350+ Blue Chip stocks which you can download by clicking below:

In addition to the Excel spreadsheet above, we are individually reviewing the top 50 blue chip stocks today as ranked using expected total returns from the Sure Analysis Research Database.

This installment of the 2022 Blue Chip Stocks In Focus series will analyze Johnson & Johnson in detail.

Business Overview

Johnson & Johnson’s outstanding dividend streak comes in part from its highly diversified business model. It has a pharmaceutical business, a consumer health business, and a medical device business all under one roof. Through these segments the company engages in a wide variety of markets, including consumer-facing consumable products like baby care, feminine care, skin care, over-the-counter medications, mouthwash, and the list goes on.

In addition, it has a pharmaceutical business that offers products for rheumatoid arthritis, psoriasis, HIV/AIDS, certain cancers, and COVID-19. The medical device business produces a huge slate of products that treat cardiovascular disease, neurovascular care products for hemorrhagic an ischemic stroke, orthopedics, disposable contact lenses, and more.

Johnson & Johnson traces its roots to 1886, generates about $96 billion in annual revenue, and trades today with a market cap of $447 billion.

The company’s most recent earnings report was delivered on July 19th 2022, for the second quarter. Results were better than expected on both revenue and profits, but the company lowered guidance for the full year, which it attributed to a much stronger US dollar.

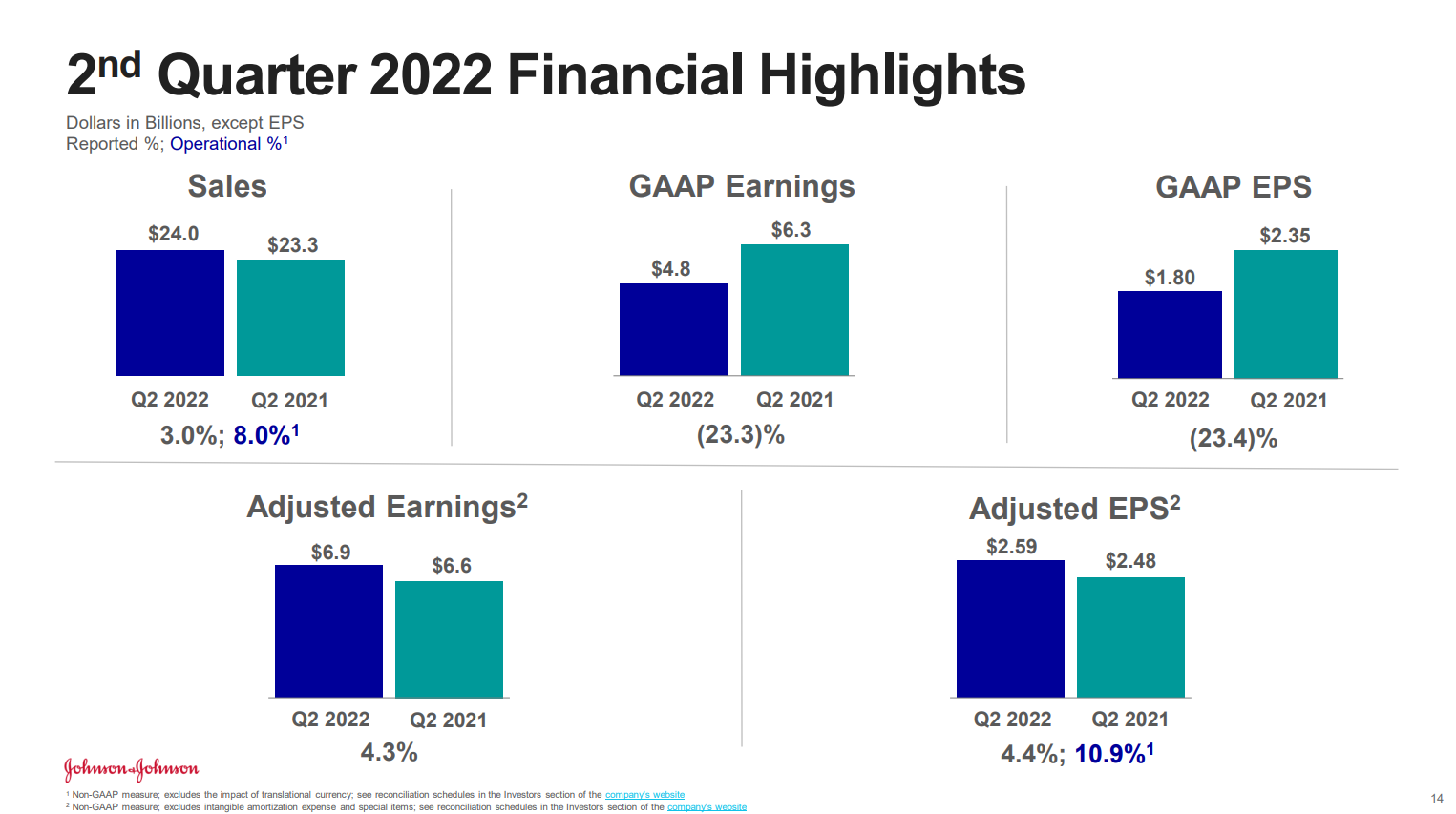

Source: Investor presentation, page 14

For the second quarter, adjusted earnings-per-share came to $2.59, which was four cents ahead of expectations. Revenue was $24 billion, up 3% year-over-year and $180 million ahead of estimates.

Operational growth, which adjusts for certain non-recurring items such as COVID-19 vaccine sales, rose 8% during the quarter, painting a somewhat rosier picture of the company’s top line performance.

The pharma segment saw $13.3 billion in sales, which was up 7% year-over-year thanks in part to 14% growth in Stelara. Somewhat offsetting that was a 13% decline in Imbruvica, which dropped below a billion dollars in quarterly sales in Q2. Darzalex, which is a treatment for multiple myeloma, saw 39% growth year-over-year to $2.0 billion.

The consumer business – which Johnson & Johnson intends to spinoff – posted revenue of $3.8 billion, a fractional decline year-over-year.

The medical device business saw a 1% decline in revenue to $6.9 billion, or up 3% on an adjusted basis.

Management reiterated sales and earnings guidance on a constant currency basis for this year, but due to the very strong US dollar, cut both sales and earnings guidance on an reported basis to ~$93.8 billion and $10.05 per share, respectively. Both of these were below consensus but we note if and when the US dollar weakens, the company should reap the benefit of higher sales and earnings on a reported basis.

Our estimate of earnings-per-share stands at $10.05 following Q2 results.

Growth Prospects

Johnson & Johnson has averaged 7% growth in earnings-per-share for the past decade, which is impressive given its massive size. The company has been able to move the needle steadily through a combination of higher sales, better profit margins, and a slight reduction in the float through buybacks.

We see similar 6% growth going forward, which we believe will be driven by the same factors. We note the spinoff of the consumer business – should it come to fruition – would likely see us revising that growth estimate higher, but we’ll wait to reassess at that time.

The dividend has grown at a rate of 6.5% in the past decade, almost exactly the same as earnings. We continue to see this kind of rate going forward, and given the payout ratio is still just 45% of earnings for this year, we believe the dividend is extremely safe. In fact, we see what is likely to be decades of further dividend increases ahead for shareholders.

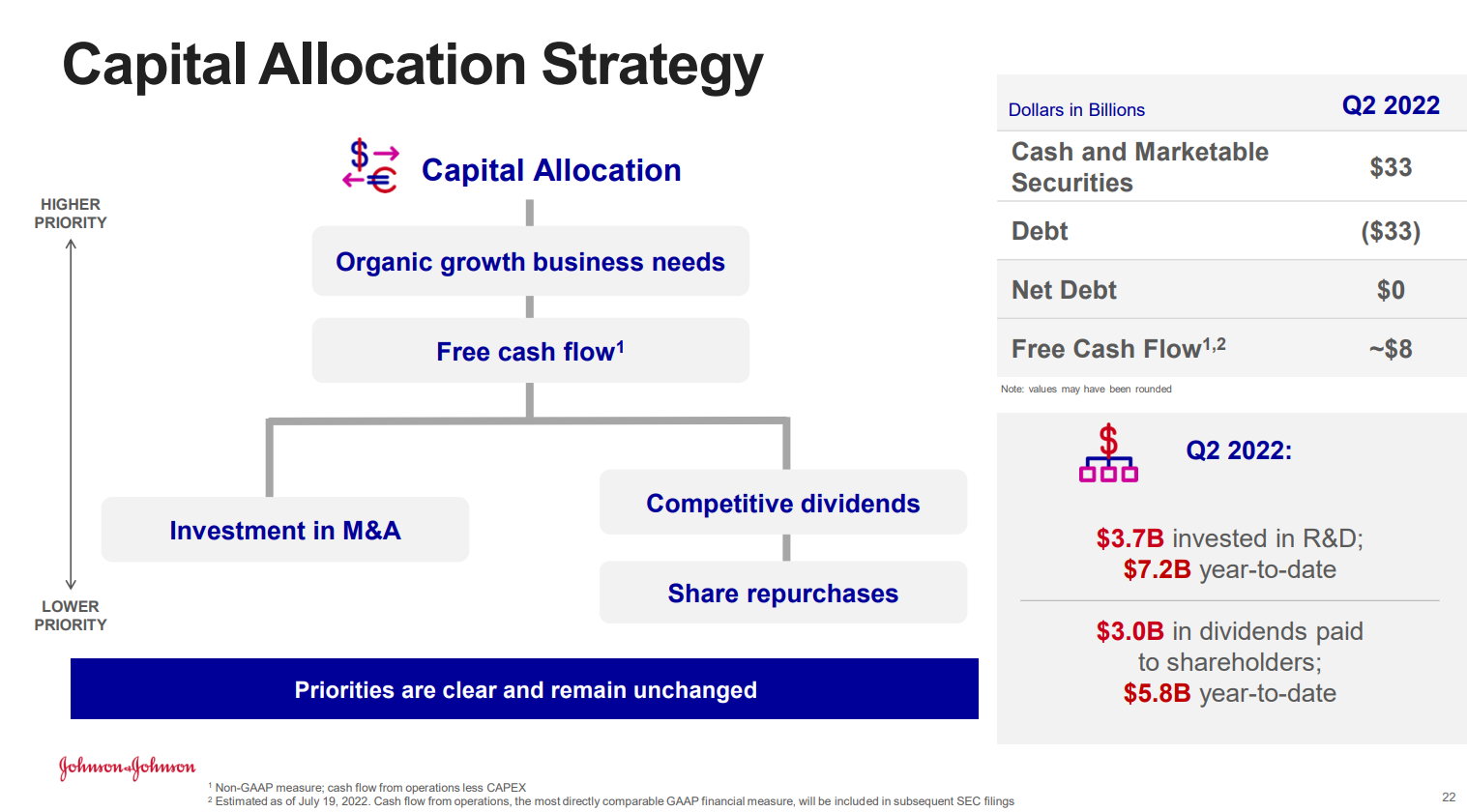

Source: Investor presentation, page 22

The company has made it clear that dividends are a priority with its capital allocation strategy, and it continues to maintain a very strong balance sheet. Further the company’s cash flow generation is outstanding, and affords it the ability to continue to boost capital returns while investing in the future growth of the business.

Competitive Advantages & Recession Performance

Johnson & Johnson’s competitive advantage is certainly in its size and scale. The company offers an array of consumer, pharmaceutical, and medical device products that is unmatched. This, paired with the company’s century-plus operating history and commensurate brand recognition makes it a compelling long-term hold.

Recessions are unkind to medical device makers, typically, as some of these are discretionary. However, the company’s pharmaceutical business is highly resilient to recessions, as is the consumer business, so long as it remains part of Johnson & Johnson. We have no doubt the dividend can continue to be raised for many years to come, whether recessions strike or not.

Valuation & Expected Returns

Johnson & Johnson trades today almost exactly at our estimate of fair value of 17 times earnings. We therefore do not see any impact to total returns on the valuation.

We noted 6% expected growth above, and the dividend yield is currently 2.7%, which is almost double that of the S&P 500. All told, we expect to see total annual returns of 8.5% in the years to come. That’s not quite good enough for a buy rating, but given this and the company’s exemplary dividend longevity, it’s certainly a strong hold.

Final Thoughts

Johnson & Johnson isn’t among the highest total return stocks in our coverage universe, but it is certainly one of the best in terms of dividend longevity. Even among the Blue Chips, the company stands above the crowd in terms of dividend excellence, and we see it as producing strong total returns in the years to come, with a yield that is almost double that of the broader market.

The Blue Chips list is not the only way to quickly screen for stocks that regularly pay rising dividends.

- The Dividend Aristocrats: S&P 500 stocks with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the Dividend Aristocrats with the highest current yields.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 45 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks: Monthly dividend stocks with the highest current yields.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Complete List of Russell 2000 Stocks: arguably the world’s best-known benchmark for small-cap U.S. stocks.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The 2022 High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The 2022 High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The 2022 Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta.