Published on August 8th, 2022 by Quinn Mohammed

There is no exact definition for blue chip stocks. We define it as a stock with at least 10 consecutive years of dividend increases. We believe an established track record of annual dividend increases going back at least a decade, shows a company’s ability to generate steady growth and raise its dividend, even in a recession.

As a result, we feel that blue chip stocks are among the safest dividend stocks that investors can buy.

With all this in mind, we created a list of 350+ blue-chip stocks which you can download by clicking below:

In addition to the Excel spreadsheet above, we will individually review the top 50 blue chip stocks today as ranked using expected total returns from the Sure Analysis Research Database.

This installment of the 2022 Blue Chip Stocks in Focus series will analyze the industrial machinery company Emerson Electric (EMR) in greater detail.

Business Overview

Emerson Electric was founded in Missouri in 1890 and was originally known as The Emerson Manufacturing Company. Since then, it has evolved from a regional manufacturer of electric motors and fans into a technology and engineering company which proves solutions to industrial, commercial, and individual customers.

It is a global leader with a presence in more than 150 countries and operates in two segments: Automation Solutions and Commercial & Residential Solutions.

Automation Solutions helps manufacturers minimize energy usage, waste, and other costs in their processes.

The Commercial & Residential Solutions segment makes products that protect food quality and safety, as well as boost efficiency in the production process.

On May 4th, 2022, Emerson reported second quarter earnings, and results were better than expected. Adjusted earnings-per-share came to $1.29, surpassing expectations by $0.11. Revenue was $4.8 billion, up 8% year-over-year.

Sales in Automation Solutions rose 5% to $2.93 billion, and sales in Commercial and Residential Solutions increased 13% to $1.85 billion.

Net profit was $674 million, up from $561 million year-over-year. Adjusted EBITA margin was up 20 basis points to 20.2% of revenue. Free cash flow for the second quarter fell by half year-over-year to $333 million, as a result of higher inventory due to supply chain constraints.

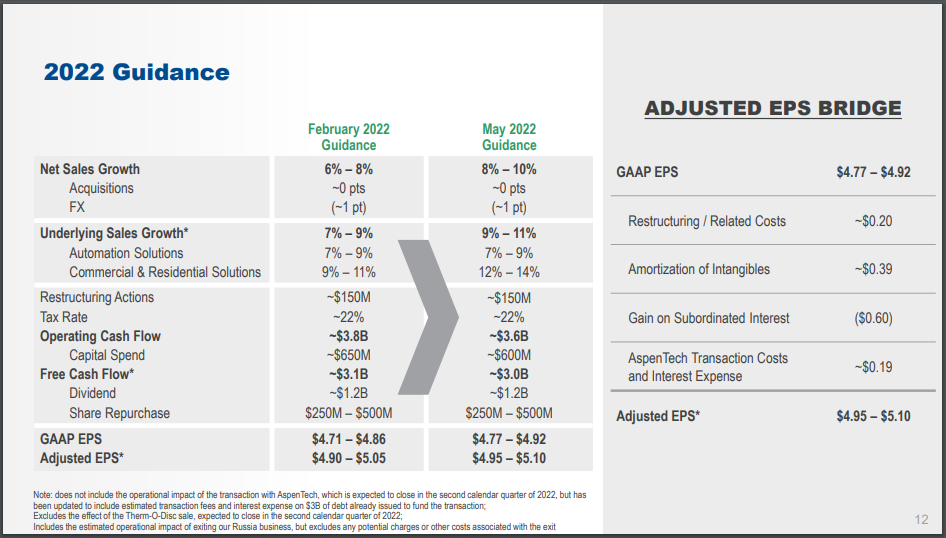

Source: Investor Presentation

The company raised guidance for this year to adjusted earnings-per-share of $4.95 to $5.10, up from previous guidance of $4.90 to $5.05. The mid-point of guidance equals $5.05 per share.

Growth Prospects

We see low single-digit revenue growth and some strength from share buybacks. The company is rebounding off its 2020 low-point of $3.46. Still, there is clear, long-term growth in the company’s history. This growth has enabled Emerson to raise its dividend for decades without fail.

As global oil prices have risen following the sanctions against Russian oil, Emerson Electric benefits from higher spend from its energy sector customers. This oil exposure is like a pendulum, improving and deteriorating Emerson’s results as oil prices fluctuate.

The company can also grow through acquisitions, as it has done in the past. Some recent acquisition examples are Micromine in July 2022, Fluxa in June 2022, and Mita-Teknik in December 2021.

We expect Emerson Electric will grow earnings-per-share at a rate of 5% annually in the intermediate term.

Competitive Advantages & Recession Performance

Emerson has two main competitive advantages which are its massive global scale, and its proprietary technology. Emerson generates high margins due to its tremendous global distribution network.

The company also has a solid reputation, and strong customer retention because the company is dedicated to solving complex engineering tasks for its customers and providing unique solutions.

Emerson frequently invests hundreds of millions of dollars in new technology which has afforded the company a leadership position across its two product segments. These competitive advantages enabled the company to handle recessions well for an industrial company.

For example, Emerson made it through the Great Recession with a one-year 27% decline in earnings-per-share. However, the company returned to earnings growth in the following year. By 2011, Emerson’s results surpassed those in 2008.

The oil price collapse of 2014 saw the company’s earnings-per-share decrease 24% and earnings didn’t surpass the $3.75 posted in 2014 until 2021, when Emerson earned $4.10 per share.

So, Emerson Electric is susceptible to recessions, but given its competitive advantages, and its conservative payout ratio, the company has been able to increase its dividend for 65 consecutive years.

Valuation & Expected Returns

Shares of Emerson Electric have traded for an average price-to-earnings multiple of around 19.0. Shares are now trading below this average, which indicates that shares could be undervalued at the current 17.9 times earnings.

Our fair value estimate for Emerson Electric stock is 19.0 times earnings. If this proves correct, the stock will benefit from a 1.2% annualized gain in its returns through 2027.

Shares of Emerson Electric currently yield 2.3%, which is below its average yield of 3.0%. On a dividend yield basis, EMR shares seem to be trading above fair value.

Putting it all together, the combination of valuation changes, EPS growth, and dividends produces total expected returns of 8.2% per year over the next five years. This makes Emerson Electric a hold.

The current dividend payout is adequately covered by earnings, with room to grow. Based on expected fiscal 2022 earnings, EMR has a payout ratio of 41%. We anticipate continued low single-digit dividend increases in the years to come.

Final Thoughts

Emerson Electric is a Dividend King in the industrials sector. The company has increased its dividend for 65 consecutive years, through economic downturns and oil price collapses.

The dividend yield of 2.3% today is not particularly impressive, and total returns are decent but not exciting. At the current price, Emerson Electric earns a hold rating.

The Blue Chips list is not the only way to quickly screen for stocks that regularly pay rising dividends.

- The Dividend Aristocrats: S&P 500 stocks with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the Dividend Aristocrats with the highest current yields.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 44 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks: Monthly dividend stocks with the highest current yields.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Complete List of Russell 2000 Stocks: arguably the world’s best-known benchmark for small-cap U.S. stocks.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The 2022 High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The 2022 High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The 2022 Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta.