Published on August 2nd, 2022 by Josh Arnold

The financial services sector tends to see a lot of companies that are keen to return cash to shareholders. In addition, earnings tend to be fairly reliable – barring a harmful recession – which means companies have the willingness and ability to send rising amounts of cash to shareholders each year.

It is no surprise, then, that so many financial services companies are counted among the Blue Chip stocks. This is a group of stocks that each have at least 10 years of dividend increases, and today, there are more than 350 of them. Incredibly, about a quarter of them are financial services companies.

With an extremely impressive streak of 36 years of consecutive dividend increases, Eagle Financial Services (EFSI) counts itself among the Blue Chips. Eagle has stood the test of time when it comes to dividend longevity, through recessions and competitive threats.

We find blue chip stocks that satisfy the 10-year payout growth streak criterion are among the safest dividend stocks that investors can buy today, simply because their track records on dividend longevity are already proven.

We’ve created a full list of 350+ Blue Chips, which is available for download by clicking below:

In addition to the Excel spreadsheet above, we’re individually reviewing the top 50 blue chip stocks today as ranked using expected total returns from the Sure Analysis Research Database.

This installment of the 2022 Blue Chip Stocks In Focus series will analyze Eagle Financial Services, including recent earnings, growth prospects, and expected returns.

Business Overview

Eagle Financial Services is a bank holding company for Bank of Clarke County, which is in Virginia. The company provides various traditional retail and commercial banking products and services in the Shenandoah Valley, and parts of Northern Virginia.

Deposit products include checking, money market, savings accounts, and time deposits. Its loan portfolio includes residential real estate, commercial real estate, construction and land development, personal loans, credit cards, automobile loans, and more. Eagle also offers investment services, and certain types of insurance.

Eagle has twelve full-service branches in operation, and traces its roots to 1881. Today, it generates about $42 million in annual revenue, and has a market cap of $125 million, making it one of the smallest Blue Chip stocks.

Eagle released second quarter earnings on July 28th, 2022, and the quarter was a record in terms of earnings for the company.

Net income came to $4.0 million, up 23% from Q1, and up 33% from last year’s Q2. The gain was driven primarily by increased net interest income, which was led by strong loan growth.

Net interest income was $11.9 million in Q2, which was up 7% from Q1, and up 19% from the comparable period a year ago.

Average loans for the quarter were $1.07 billion, up from $876 million a year ago. The tax-equivalent yield on average loans was 4.36%, a decline of 11 basis points year-over-year. The decline was attributed to lower prevailing market loan yields on new loans, relative to those being paid off.

The company’s average investments were $189 million, up from $176 million a year ago. The average yield on these investments was 2.04%, up 49 basis points from last year’s Q2.

Net interest margin was 3.70% for Q2, up from 3.56% in last year’s comparable period, and very high by any standard in today’s rate environment.

Noninterest income was $3.8 million in Q2, up from $2.7 million in last year’s Q2. The increase was due to distributions from small business investment companies.

Noninterest expense was up 6% year-over-year, which was due primarily to expansion of the wealth management business, as well as its marine lending business. We therefore would not expect similar increases going forward, which will help improve margins.

Following Q2 results, we expect to see about $4 in earnings-per-share for this year.

Growth Prospects

Should Eagle hit $4 in earnings-per-share for this year, that would put its average earnings growth rate for the past decade at more than 7%. That’s quite impressive for a community bank, and the company is continuing to outperform many of its peers.

We see 5.5% growth going forward, as some of that strong earnings growth in the past decade was due to the relatively low base coming out of the financial crisis. Still, mid-single digit long-term growth for a community bank is quite respectable.

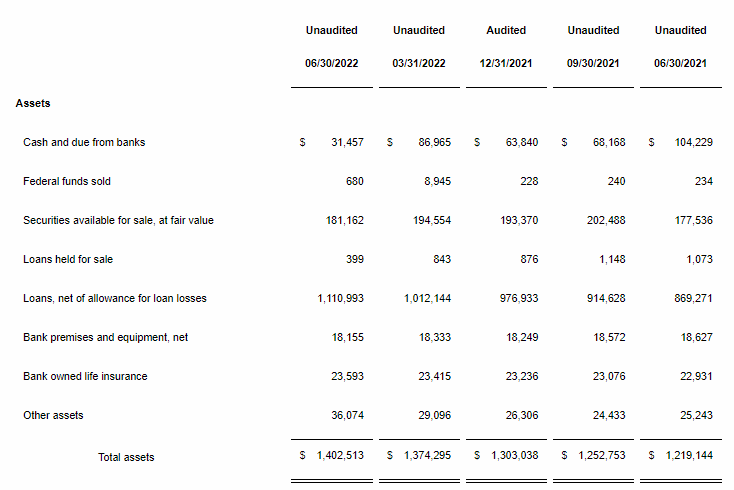

Source: Q2 earnings release

One way we see Eagle growing earnings is through continuously boosting its earning assets. We can see that in recent quarters, the company has managed to sustainably, and significantly, move its asset count higher. In addition, this asset growth has come from loan growth, which has soared from $869 million in Q2 of 2021 to $1.11 billion in just one year. The loans held for sale has declined as well, meaning Eagle is keeping more of its loans on its books to accrue interest income.

As yields are also now rising, we think Eagle is well positioned for earnings growth in the years to come.

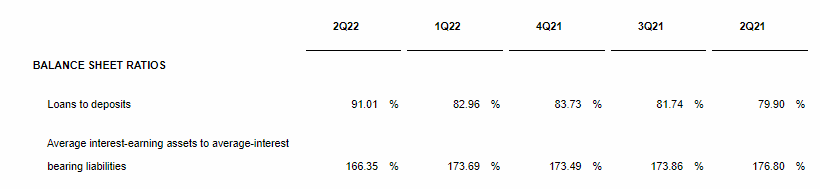

Source: Q2 earnings release

One thing that we see potentially offsetting that growth is the fact that Eagle has lent out deposits quite aggressively in recent quarters. Its loan-to-deposit ratio was 80% in Q2 of 2021 but ended the most recent quarter at 91%. That has afforded the company strong loan growth, but it also means there isn’t much left in terms of loan-to-deposit expansion.

Dividend growth has averaged just under 5% annually for the past decade, and we see similar growth going forward at 4.5%. With the company’s dividend increase streak approaching four decades, we think this rate of dividend growth is quite attractive, all things considered.

Competitive Advantages & Recession Performance

As a community bank, competitive advantages are difficult to come by. Banks all sell essentially the same products, so they operate a bit like commodity companies in that way. However, Eagle has grown its niche over the decades where money center banks aren’t willing to go, and the formula works.

Recessions are obviously unkind to banks as well, and Eagle is far from immune. However, it has held up well in recent recessions, owed to prudent underwriting practices that focus on risk up front.

We also wouldn’t expect the dividend to be in any sort of danger during a recession, given the bank’s outstanding track record, as well as the fact that the payout should be under 30% of earnings this year.

Valuation & Expected Returns

Eagle’s valuation has been pretty steady throughout the years, hovering generally in the low-double digits. We assess fair value at 11 times earnings, given multiples have come down in the banking sector in 2022. Still, shares trade for just 9 times this year’s earnings, meaning we see the stock as quite reasonably priced.

That could drive a ~4% tailwind to total returns should the stock reverts to fair value over time. In addition to our estimate of 5.5% growth and the 3.2% current yield, we believe Eagle could produce ~12% total annual returns in the coming years.

Final Thoughts

While Eagle is one of the smallest companies in our coverage universe – and indeed in the realm of Blue Chips – it has very attractive prospects for shareholders. We see a robust combination of growth, yield, and valuation expansion driving double-digit average annual returns for buyers of the stock today.

In addition, shareholders get a nearly four-decade streak of dividend increases, and high levels of dividend safety. Given all of this, we rate Eagle a buy.

There are other ways to screen for strong dividend stocks besides just the Blue Chips.

- The Dividend Aristocrats: S&P 500 stocks with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the Dividend Aristocrats with the highest current yields.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 44 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks: Monthly dividend stocks with the highest current yields.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Complete List of Russell 2000 Stocks: arguably the world’s best-known benchmark for small-cap U.S. stocks.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The 2022 High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The 2022 High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The 2022 Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta.