Published on August 11th, 2022 by Josh Arnold

When investors think of sectors in the stock market that are prone to have dividend longevity, the technology sector generally isn’t one that comes to mind. The tech sector itself isn’t old enough to rival the longest standing dividend streaks found in other sectors, and many companies within IT have business models that are too volatile to generate sustainable dividends.

However, not all tech stocks are created equal.

Computer Services (CSVI) is an IT stock that has boosted its dividend for an extremely impressive 50 consecutive years. That makes it stand out not only among other IT stocks, but in fact, among just about any other stock in the market today.

It also lands Computer Services on the list of Blue Chip stocks, a group of more than 350 companies that have boosted their dividends for at least 10 consecutive years. These companies have stood the test of time and competitive threats to return ever-higher amounts of capital to shareholders.

With this in mind, we’ve created a list of 350+ Blue Chip stocks, which you can download by clicking below:

In addition to the Excel spreadsheet above, we are individually reviewing the top 50 blue chip stocks today as ranked using expected total returns from the Sure Analysis Research Database.

This article in the 2022 Blue Chip Stocks In Focus series will analyze Computer Services’ business model, growth prospects, and total returns.

Business Overview

Computer Services is an IT company that serves mostly financial companies in the US. It offers core processing, digital banking, managed services, payments processing, regulatory compliance, and other services to banks and other corporations. It has a long slate of services that help smaller financial institutions with tasks that would be cost-prohibitive to provide themselves, and the company has created a nice niche for itself over the decades.

Computer Services was founded in 1965, produces about $320 million in annual revenue, and has a market cap of $1 billion today, following sizable weakness in the stock in 2022.

The company reported first quarter earnings on July 11th, 2022, and results were strong, producing record revenue and earnings for the quarter.

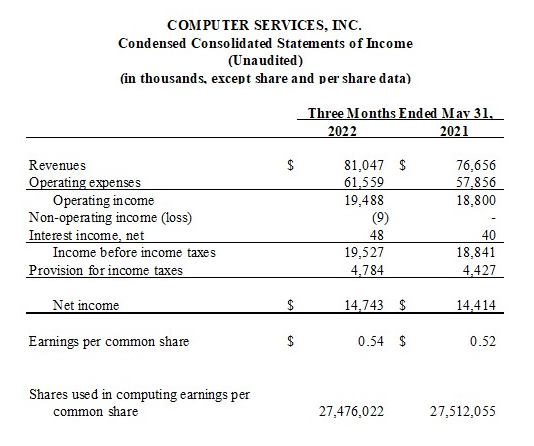

Source: Q1 earnings release

Revenue was up 5.7% to $81 million in Q1, with growth coming from higher sales in digital banking, payments processing, cybersecurity, and document delivery. Excluding contract termination fees, organic revenue was up 6.1% in Q1.

Operating expenses were up 6.4% to $61.6 million, which was due to higher marketing and travel expenses, higher cost of goods sold on better volumes in payments processing, digital banking, document delivery, and cybersecurity, as well as increased software and equipment expenses. These were partially offset by lower personnel costs due to lower profit-sharing plan contributions.

Operating income was up 3.7% to $19.5 million, slower than the rate of revenue growth due to expense growth. That meant operating margin was 24% of revenue, down from 24.5% a year ago.

Net income was up 2.3% to $14.7 million, or up 3.8% on a per-share basis at 54 cents for Q1.

Growth Prospects

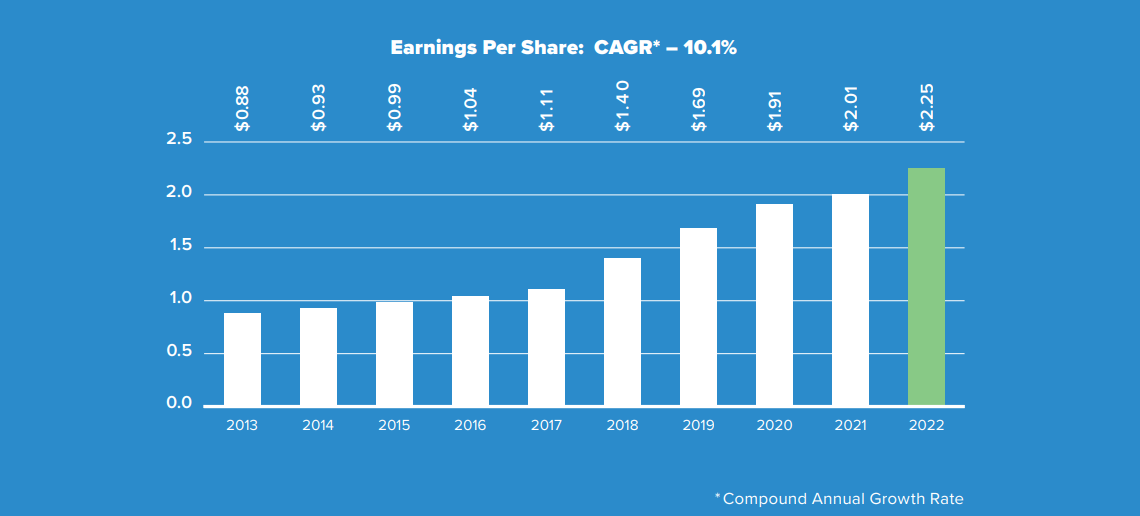

Computer Services has a very impressive history of growth, with the past decade seeing an average annual increase in earnings-per-share of more than 10%. In addition, the company has produced higher earnings every year in that period. That track record puts Computer Services in rare company, particularly among companies that serve financial institutions.

Source: Annual report

We don’t see that kind of growth as sustainable, but we do expect 7% annual earnings-per-share growth in the years to come. We believe the company can grow earnings via a combination of revenue growth, a small measure of margin expansion, and to a lesser extent, share repurchases. Computer Services prioritizes the dividend, then capital expenditures, then share repurchases when it comes to utilizing its cash flow.

The dividend has grown at more than 14% on average in the past decade, and again, we see that level as unsustainable. However, we do think 10% dividend growth is attainable as the company continues to grow earnings, and return much of its free cash flow to shareholders.

The company’s balance sheet is also in terrific shape, as it has no long-term debt, but has a $76 million cash position as of the end of the first quarter. Given this, even if earnings were to dip temporarily, we believe management would defend the dividend at all costs.

Competitive Advantages & Recession Performance

While Computer Services is certainly a small operator in what is a very large IT sector, it has created a niche with smaller financial institutions that has served it well over the decades. The company competes where it would be inefficient for bigger players given that the market isn’t that big. But Computer Services has carved out a terrific, profitable business and it has brand recognition as a result.

Recessions aren’t kind to banks, and given banks are the company’s customers, earnings could be crimped during a recession. However, Computer Services’ offerings are necessities for its customers, so they cannot simply stop payment processing, or other core services. We therefore believe recession resilience is quite good for Computer Services, and how it’s been able to boost its dividend for half a century.

The payout ratio is under 50% of earnings for this year, and in conjunction with the clean balance sheet and robust growth outlook, we have no worries about dividend safety going forward.

Valuation & Expected Returns

We assess fair value for the stock at 17.4 times earnings, but shares trade today at just 15 times earnings. That implies we could see a ~3% annual tailwind to total returns should the valuation reflate to normalized levels.

The dividend yield is also up to 2.9% today, following dividend raises and stock price weakness. That’s about double the S&P 500’s yield, so the stock is attractive on an income basis as well.

Coupled with our 7% growth estimate, we see total annual return potential of 13% in the years to come, putting the stock firmly into ‘buy’ territory.

Final Thoughts

Computer Services is certainly not one of the largest dividend stocks available today, but we see the niche the company has carved out as very attractive. It supports long-term earnings growth, the management team is very shareholder-friendly, and the stock offers attractive total return potential.

The dividend increase streak is also at 50 years, putting Computer Services in rarified company on that measure, and we see it as attractive for value investors, those seeking a high yield, and growth stock investors.

The Blue Chips list is not the only way to quickly screen for stocks that regularly pay rising dividends.

- The Dividend Aristocrats: S&P 500 stocks with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the Dividend Aristocrats with the highest current yields.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 45 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks: Monthly dividend stocks with the highest current yields.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Complete List of Russell 2000 Stocks: arguably the world’s best-known benchmark for small-cap U.S. stocks.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The 2022 High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The 2022 High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The 2022 Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta.