Published on July 30th, 2022 by Nikolaos Sismanis

If one thinks of their favorite blue chip stocks, the first names that come to mind are usually giant companies that generate tens of billions of dollars in revenue per year. While it’s true that sometimes bigger companies enjoy a number of competitive advantages, including a great moat and scaling economics, amongst others, the size of a company is not necessarily a critical factor to its quality.

In this article, we are looking at Community Trust Bancorp, whose annual revenues are hardly over $225 million. For a stock to be classified as a blue chip one, our condition is that it numbers at least 10 years of consecutive annual dividend increases. We believe that such a track record exhibits a company’s ability to generate steady growth and raise its dividend, even in a recession.

With 41 years of consecutive annual dividend increases, Community Trust Bancorp has certainly proven its ability to grow its dividend through various periods of harsh economic conditions. Thus, we consider it a true blue chip stock despite its admittedly small market cap of just $775 million.

To browse hundreds of quality companies, we created a list of 350+ blue-chip stocks which you can download by clicking below:

In addition to the Excel spreadsheet above, we will individually review the top 50 blue chip stocks today as ranked using expected total returns from the Sure Analysis Research Database.

This installment of the 2022 Blue Chip Stocks In Focus series will analyze Community Trust Bancorp, Inc. (CTBI).

Business Overview

Community Trust Bancorp is a local bank, running 84 branch locations in 35 counties in Kentucky, Tennessee, and West Virginia. It is the second-largest bank holding company in Kentucky, with a market cap of just $775 million currently.

The company engages in a broad range of commercial and personal banking and trust and wealth management activities. These include accepting time and demand deposits, originating loans to corporations and individuals, providing cash management services, issuing letters of credit, renting safe deposit boxes, and providing funds transfer services, amongst others.

Community Trust Bancorp operates with a $5.4 billion balance sheet. As of June 30th, total shareholders’ equity stood at $653.3 million, and trust assets under management were $3.6 billion, including CTB’s investment portfolio totaling $1.5 billion.

Due to its small market cap, Community Trust Bancorp does not belong to the S&P 500 index, and hence, it is not considered a Dividend Aristocrat even though it has raised its dividend for 41 consecutive years.

Community Trust Bancorp’s latest results demonstrated the bank’s potential to post reslilent numbers even during a tough trading environment. Its Q2-2022 net interest income edged up 2.0%, thanks to loan growth. The bank’s non-interest income decreased -by 7% over the prior year’s quarter, but the decline was mostly due to changes in the valuation of mortgage servicing rights.

Moreover, the bank increased its provision for credit losses by $0.1 million, whereas it had recovered provisions of $4.3 million in the prior year’s quarter. Overall, just like in the previous quarter, the bank faced a tough comparison over its blowout results last year, and thus, its earnings-per-share dipped by 15%, from $1.34 to $1.14. Nevertheless, it exceeded the analysts’ consensus by $0.04. It’s important to note that most of the growth last year resulted from the reversion of provisions for loan losses, and hence investors should expect lower earnings in 2022. Accordingly, we expect EPS to land close to $4.40 in fiscal 2022, implying a year-over-year decline of 10.9%.

This doesn’t translate to a deterioration in the company’s performance, nonetheless.

Source: SEC filings, Author

Growth Prospects

Excluding the record year 2021, in which Community Trust Bancorp posted blowout earnings thanks to the reversal of loan loss provisions recorded in 2020, the bank has grown its earnings-per-share at a 4.3% average annual rate over the past decade and at a 4.7% average annual rate over the last five years.

The economy has recovered from the pandemic, and the Fed has started to raise interest rates aggressively this year. This should be proven a tailwind to Community Trust Bancorp. However, the non-recurring declines in the tax rate of the bank, which fueled a great portion of the bottom line growth in 2018 and 2019, will not be meaningful growth drivers anymore.

Consequently, we do not anticipate the company to accelerate its growth pattern in the upcoming years. By taking a prudent approach, we expect Community Trust Bancorp to grow its earnings per share at a 2.0% average annual rate over the next five years.

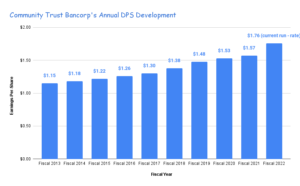

Regarding its dividend, Community Trust Bancorp has grown its dividend-per-share for 41 consecutive years as a result of prudent capital management and of consistent focus on shareholder returns. The 10-year dividend-per-share compound annual growth rate stands at 2.61%. This is not a satisfactory growth rate, and frankly, it barely counterbalances the long-term inflation average. However, investors can find comfort in the growing payouts and expect that the dividend can keep growing for decades to come if the bank retains its current prudent management.

Source: SEC filings, Author

It’s also worth noting that the lack of more aggressive dividend growth does not mean that shareholder value creation is not maximized. With the company retaining a substantial portion of earnings, it has been able to grow shareholders’ equity (book value) at a momentous rate over the years.

Source: Investor Presentation

Competitive Advantages & Recession Performance

Community Trust Bancorp proved that it was well managed in the Great Recession. In the worst financial crisis of the last 80 years, when most banks cut their dividends, this bank remained profitable and continued raising its dividend. The COVID-19 pandemic in 2020 caused an -8% decrease in the earnings-per-share of Community Trust Bancorp. Still, this business performance is superior to that of most other banks, thanks to the conservative loan portfolio. To provide a perspective, the bank has reported average net loan charge-offs of only 0.02% in the last four quarters, further demonstrating its overall qualities.

You can see a rundown of Community Trust Bancorp’s earnings-per-share from 2007 to 2011 below:

- 2007 earnings-per-share of $2.20

- 2008 earnings-per-share of $1.40

- 2009 earnings-per-share of $1.51

- 2010 earnings-per-share of $1.97

- 2011 earnings-per-share of $2.31

While earnings-per-share fell by 36.4% in 2008, the company quickly recovered. By 2011, earnings-per-share were well above the 2007 level.

Overall, we believe that Community Trust Bancorp’s dividend should remain safe even during a prolonged recession. During the past five years, the company’s dividend payout ratio has averaged close to 40%.

Based on our expected earnings-per-share for fiscal 2022 and the current dividend-per-share run-rate, the payout ratio stands at precisely 40% as well. Despite the ample room to grow the dividend at a much faster pace, we believe that the bank will maintain the payout ratio close to the current levels as part of its prudent strategy, nonetheless.

Valuation & Expected Returns

Community Trust Bancorp is presently trading at a price-to-earnings ratio of 9.5, which is lower than its 10-year average price-to-earnings ratio of 12.6. Despite its consistent profitability and overall qualities, the market likely expects minimal growth in the coming years, which explains the discount. Still, we believe that income-oriented investors are likely to appreciate the company’s 4.0%, especially during the current shaky macroeconomic environment. Along with the fact that rising rates should benefit the company, we believe that the stock could experience valuation tailwinds to a P/E of 12.

If the price-to-earnings multiple expands from 9.5 to 12, future returns would be boosted by4.7% per year over the next five years. Combined with our EPS & DPS growth rates, as well as the current dividend yield, we project annualized returns could amount to 9.8% through 2027.

Accordingly, we rate Community Trust Bancorp a buy.

Final Thoughts

Community Trust Bancorp is a well-managed bank. It accelerated its growth pattern in 2018 and 2019 thanks to higher interest rates and its reduced tax rate. It also posted record earnings last year thanks to the reversion of provisions for loan losses as the economy recovered from the pandemic. While net income will decelerate this year due to the absence of last year’s growth driver, fiscal 2022 should mark another year of excellent bottom line numbers.

The company also features a healthy payout ratio, which should sustain dividend payments and possibly dividend growth even if earnings were to be materially affected. Community Trust Bancorp thus qualifies as a blue chip stock to rely on for income-oriented investors, particularly given its exceptional dividend growth record.

The Blue Chips list is not the only way to quickly screen for stocks that regularly pay rising dividends.

- The Dividend Aristocrats: S&P 500 stocks with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the Dividend Aristocrats with the highest current yields.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 44 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks: Monthly dividend stocks with the highest current yields.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Complete List of Russell 2000 Stocks: arguably the world’s best-known benchmark for small-cap U.S. stocks.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The 2022 High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The 2022 High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The 2022 Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta.