Published on July 29th, 2022 by Nathan Parsh

Investors are often best served by owning shares of high-quality companies that have been paying dividends for long periods of time.

To us, the best stocks to own are blue chip stocks, which we believe are those names that have been paying dividends for at least 10 consecutive years. This shows shareholders that management is committed to returning capital through dividends.

Those companies with longer dividend growth streaks, say 25 years or more, have proven successful at raising dividends through multiple recessionary environments, which speaks to the strength of the business model.

Blue chip stocks can help protect your portfolio against significant market disruptions as investors often flock to quality when the economy enters a downturn.

As a result, we feel that blue chip stocks are among the safest dividend stocks that investors can buy.

With all this in mind, we created a list of 350+ blue-chip stocks which you can download by clicking below:

In addition to the Excel spreadsheet above, we will individually review the top 50 blue chip stocks today as ranked using expected total returns from the Sure Analysis Research Database.

Blue chips don’t come in one-size fits all. While many blue chips are among the largest companies in the world, there are also names that have market capitalization below $1 billion.

This includes the next installment of the 2022 Blue Chip Stocks in Focus series, Enterprise Bancorp, Inc. (EBTC).

Business Overview

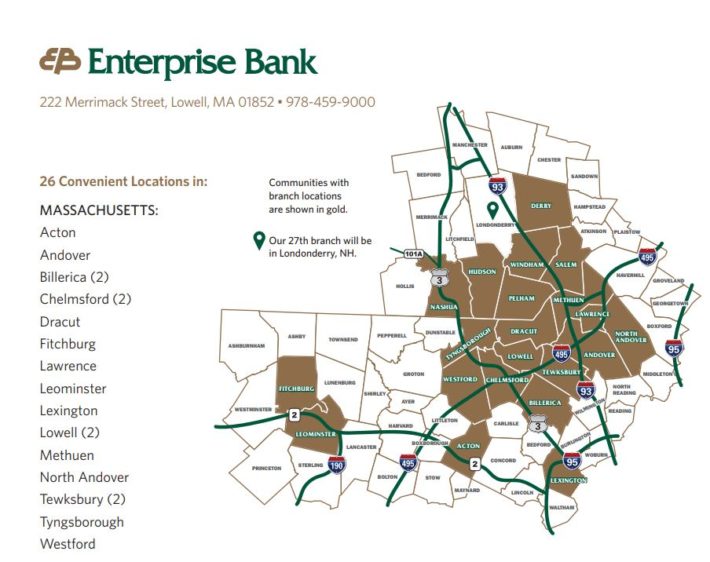

Formed in 1996, Enterprise Bancorp Inc. is the parent holding company of Enterprise Bank and Trust Company. The $385 billion company, commonly referred to as Enterprise Bank, has 27 full-service branches in the North Central area of Massachusetts and Southern New Hampshire.

Source: 2021 Annual Report

Enterprise Bank’s main service offerings include deposits, investing in commercial loans and investment securities, residential and consumer loans, cash management services, insurance services, and wealth management.

Enterprise Bank reported second quarter earnings results on July 21st, 2022. Revenue fell 6.3% to $37.5 million, while earnings-per-share fell to $0.67 from $0.92. Results in the prior year benefited a recovery of loan loss provisions as earnings-per-share was higher by 51%.

Total core loans improved 5% to $3.08 billion. Excluding Paycheck Protection Program loans, loans grew 5% on a sequential basis. Compared to the prior year, loans grew 16% for the second quarter. Non-performing loans declined to 0.21% from 0.86% quarter-over-quarter and 1.21% year-over-year. Provisions for credit losses was $2.4 million. Net interest income grew 2% to $35.8 million due to higher interest rates. Average total deposits were up 2% to $58.2 million.

Enterprise Bank is expected to earn $3.40 per share in 2022, down slightly from record levels last year.

Growth Prospects

Despite its small size and limited reach, Enterprise Bank has remained profitable for 131 consecutive quarters. This means that the company’s streak of profitability dates back to the late 1980s. Enterprise Bank’s business model has successfully navigated multiple recessions, including the Great Recession which impacted so much of the financial industry.

Because the company is on the smaller size, Enterprise Bank didn’t find itself involved in the riskier areas of the financial industry that negatively impacted so many of its larger peers. This conservative business model will likely help protect the company the next time there is a recession as Enterprise Bank focuses on individual customers.

One way that Enterprise Bank does have the ability to grow is through the opening of new branches. The company added a new branch in North Andover in early 2021. More recently, Enterprise Bank opened its 27th branch in Londonderry, New Hampshire in May of this year. New branches for most banks might not be noteworthy, but for Enterprise Bank this increased its branch count by 8% and helped the company gain an additional foothold in its service area.

Another tailwind for the company is that the successful rollout of Covid-19 vaccine has reduced the prevalence of the virus in the U.S. This has made returning to work much easier, allowing for customers to make loan payments and take out new loans. This should provide continued support to loan growth.

And with unemployment below 4%, Enterprise Bank should see its provisions for credit losses and its non-performing loans remain very low as customers are more likely to be able to meet their obligations.

Lastly, Enterprise Bank should benefit from interest rate hikes, including the 0.75% increase in the fed funds rate that was announced earlier this week. With the Federal Open Market Committee projected to make multiple hikes in 2022 and possibly 2023, Enterprise Bank should continue to see net interest income rise through at least the end of this year.

With these factors working in the company’s favor, we project that Enterprise Bank should be positioned to grow earnings-per-share at a rate of 5% annually through 2027.

Competitive Advantages & Recession Performance

As a small, regional bank, Enterprise Bank doesn’t have many of the competitive advantages that its larger peers do.

That said, the company has been ranked as one of the “Top Places to Work in Massachusetts” by the Boston Globe for the last decade. Maintaining a strong work place environment helps keep talent inhouse as well attracts new talent instead of losing them to larger banks.

These employees are then able to build relationships with the community that motivates customers to return to the bank for loans, deposits, and wealth management services because of these personal connections.

As stated above, Enterprise Bank has been profitable every quarter for more than three decades, which has led to excellent performances, especially in market downturns. Below are the company earnings-per-share totals before, during, and after the last recession.

- 2006 earnings-per-share: $1.21

- 2007 earnings-per-share: $1.27 (5% increase)

- 2008 earnings-per-share: $0.70 (45% decrease)

- 2009 earnings-per-share: $0.96 (37% increase)

- 2010 earnings-per-share: $1.15 (20% increase)

- 2011 earnings-per-share: $1.16 (0.9% increase)

- 2012 earnings-per-share: $1.29 (11.2% increase)

Enterprise Bank did see a steep decline in earnings-per-share from 2007 to 2008 as the company endured the worst of the financial crisis. The company began to see a recovery the very next year. Earnings-per-share fell 24% for the 2007 to 2009 period, a lower decline than most in the banking industry.

Enterprise Bank established a new high for earnings-per-share two years later in 2012 and growth has generally been higher ever since. Only twice in the last decade (2017 and 2020) has the company failed to establish a new high for earrings-per-share, a remarkable feat for a small bank.

The ability to withstand a recession and pivot to growth following an economic downturn has enabled Enterprise Bank to raise its dividend for 28 consecutive years, qualifying the company as a Dividend Champion. This includes a 10.8% increase for the March 1st, 2022 payment date. This is nearly twice the dividend’s compound annual growth rate of 5.9% since 2012.

The projected payout ratio for this year is just 24%, so shareholders of Enterprise Bank are likely to continue to see future dividend raises. Shares yield 2.6%, a full percentage point better than the average yield of the S&P 500 Index.

Valuation & Expected Returns

With the stock trading at $32 per share, Enterprise Bank has a price-to-earnings ratio of 9.4 based on expected earnings-per-share for the year.

We believe that Enterprise Bank has a fair value closer to 12 times earnings, which is slightly below the long-term average. Reaching our target valuation by 2027 would add 5% to annual returns over this period of time.

In total, Enterprise Bank is forecasted to have a total annual return potential of 12.3% per year for the next five years. This projection stems from an expected earnings growth rate of 5%, a starting yield of 2.6%, and a mid-single-digit contribution from multiple expansion.

Final Thoughts

It’s not just mega caps that can qualify as a blue chip stock. Enterprise Bank is an excellent example of a small cap stock that can be considered high-quality. The company has less than 30 bank branches, but has turned in a very strong track record for its business that dates back to the last century.

Enterprise Bank also has a long history of raising its dividend and offers a yield that tops that of the what the market is offering.

Shares could provide double-digit total returns over the next half-decade, earning Enterprise Bank a buy rating. For investors looking for a high-quality small cap bank, Enterprise Bank has many attractive characteristics.

The Blue Chips list is not the only way to quickly screen for stocks that regularly pay rising dividends.

- The Dividend Aristocrats: S&P 500 stocks with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the Dividend Aristocrats with the highest current yields.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 44 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks: Monthly dividend stocks with the highest current yields.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Complete List of Russell 2000 Stocks: arguably the world’s best-known benchmark for small-cap U.S. stocks.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The 2022 High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The 2022 High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The 2022 Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta.