Updated on May 28th, 2020 by Bob Ciura

Bill Gates is the second-richest person in the world, behind only Jeff Bezos, Founder & CEO of Amazon (AMZN). While Bill Gates has fallen to #2, his net worth of nearly $100 billion is a massive amount of money. Not surprisingly, the Bill & Melinda Gates Foundation has a huge investment portfolio above $17 billion according to a recent 13F filing.

That kind of wealth is something the vast majority of us can only dream of. However, there is one similarity between the everyday investor and the wealthiest person on the planet: We’re all looking for good stocks to buy and hold for the long-term.

That is why it is useful to review the stock holdings of the Bill & Melinda Gates Foundation. You can download our full list of Gates Foundation stocks (along with important metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Free Excel Download: Get a free Excel Spreadsheet of all 19 of Bill Gates’ stocks, complete with metrics that matter – including P/E ratio and dividend yield. Click here to download the Gates Foundation’s holdings now.

The Bill & Melinda Gates Foundation owns several highly profitable companies, with sustainable competitive advantages. Many of the stocks also pay dividends to shareholders, and grow their dividend payouts over time.

This article will discuss the 23 stocks held by the Bill & Melinda Gates Foundation.

Table of Contents

You can skip to the analysis for each of the Gates Foundation’s 23 stock holdings, with the table of contents below. Stocks are listed in order of the portfolio’s largest positions to smallest positions.

- Berkshire Hathaway (BRK.B)

- Waste Management (WM)

- Canadian National Railway (CNI)

- Walmart (WMT)

- Caterpillar (CAT)

- Crown Castle International (CCI)

- Ecolab (ECL)

- United Parcel Service (UPS)

- FedEx (FDX)

- Schrodinger, Inc. (SDGR)

- Coca-Cola FEMSA SAB (KOF)

- Apple, Inc. (AAPL)

- Amazon.com Inc. (AMZN)

- Alibaba (BABA)

- Grupo Televisa SAB (TV)

- Liberty Global plc (LBTYK)

- Alphabet (GOOGL)

- Alphabet (GOOG)

- Liberty Global plc (LBTYA)

- Arcos Dorados Holdings (ARCO)

- Twitter, Inc. (TWTR)

- Liberty Latin America Ltd. (LILAK)

- Liberty Latin America Ltd. (LILA)

#1—Berkshire Hathaway

Dividend Yield: N/A (Berkshire Hathaway does not currently pay a dividend)

Percentage of Bill Gates’ Portfolio: 47%

Berkshire Hathaway stock is the largest individual holding of the Gates Foundation’s investment portfolio, and it is easy to see why. It’s safe to say the money is in good hands. Berkshire, under the stewardship of Warren Buffett, grew from a struggling textile manufacturer, into one of the largest conglomerates in the world.

Today, Berkshire is a global giant. It owns and operates dozens of businesses, with a hand in nearly every major industry including insurance, railroads, energy, finance, manufacturing, and retailing.

Berkshire can be thought of in five parts: wholly owned insurance subsidiaries like GEICO, General Re and Berkshire Reinsurance; wholly-owned non-insurance subsidiaries like Dairy Queen, BNSF Railway, Duracell, Fruit of the Loom, NetJets, Precision Cast Parts and See’s Candies; shared control businesses like Kraft Heinz (KHC) and Pilot Flying J; marketable publicly-traded securities including significant stakes in companies like American Express (AXP), Apple, Bank of America (BAC), Coca-Cola (KO) and Wells Fargo (WFC); and finally the company’s cash position which sat at $137 billion at the end of the 2020 first quarter.

In Berkshire’s annual letters to shareholders, Buffett typically evaluates the company’s performance in terms of book value. Book value is an accounting metric that measures a company’s assets minus its liabilities. The resulting difference is a company’s book value. This is a proxy for the intrinsic value of a firm, which Buffett believes to be the most important financial metric.

On May 2nd, 2020 Berkshire released Q1 2020 results for the period ending March 31st, 2020. For the quarter net

earnings totaled -$49.7 billion compared to $21.7 billion in Q1 2019. However, beginning in 2018 mark-to-market gains and losses, even if not yet realized, must be run through the income statement whereas previously the unrealized portion was only reflected in shareholder equity – a significant change given Berkshire’s very large portfolio of publicly-traded securities.

On an operating basis Berkshire posted $5.87 billion ($2.41 per share) in earnings against $5.56 billion ($2.26) in the year ago quarter. Moderate declines in Investment Underwriting, Railroad, Utilities and Energy and Other businesses, were offset by an improvement in Insurance Investment Income and Other.

Berkshire doesn’t pay a dividend to shareholders. Buffett and his partner Charlie Munger have always contended that they can create wealth at a higher rate than the dividend would provide to shareholders.

There are very few managers who can say that and get away with it, but Buffett and Munger might be the only two who can.

While Berkshire stock may not be attractive for investors who want dividend income, there are few companies that have a track record nearly as successful as Berkshire.

#2—Waste Management

Dividend Yield: 2.2%

Percentage of Bill Gates’ Portfolio: 9.9%

Waste Management is the embodiment of a company with a wide economic “moat”, a term popularized by Warren Buffett to describe an impenetrable competitive advantage. Waste Management operates in waste removal and recycling services. This is a highly-concentrated industry, with only a few companies controlling the majority of the market.

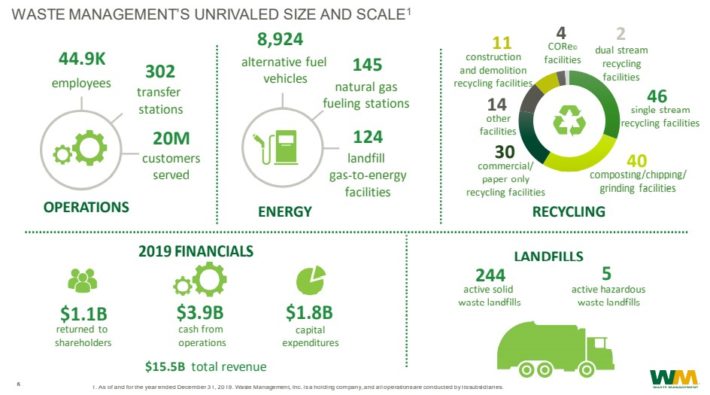

Source: Investor Presentation

The company is performing well right now. In the 2020 first quarter, On May 6th, 2020 Waste Management released Q1 2020 results for the period ending March 31st, 2020. For the quarter the company reported $3.73 billion in revenue, a 0.9% increase compared to Q1 2019, driven by yield and volume growth. Net income equaled $361 million or $0.85 per share compared to $347 million or $0.81 per share prior. Adjusted net income equaled $395 million or $0.93 per share, compared to $402 million or $0.94 in the year ago period.

Previously, Waste Management provided a 2020 outlook anticipating $4.56 billion to $4.66 billion in adjusted EBITDA and 1.5% internal revenue growth from volume. However, as a result of the uncertainty related to the COVID-19 pandemic, the company has suspended its guidance along with share repurchases.

Waste Management operates in a stable and necessary industry. In addition, waste removal is extremely capital-intensive, and is subject to significant regulatory oversight.

These competitive advantages allow Waste Management to generate steady profits, even when the U.S. economy enters recession. Waste Management’s high margins and consistent cash flow put the company in strong financial position.

Waste Management uses part of its cash flow to invest in the business, and for shareholder cash returns. For its part, Waste Management has increased its dividend for 17 consecutive years. The stock currently has a 2.2% dividend yield.

#3—Canadian National Railway

Dividend Yield: 2.0%

Percentage of Bill Gates’ Portfolio: 7.7%

Canadian National Railway is the only transcontinental railway in North America. It has a massive network, which includes more than 19,000 miles that spans Canada and the U.S.

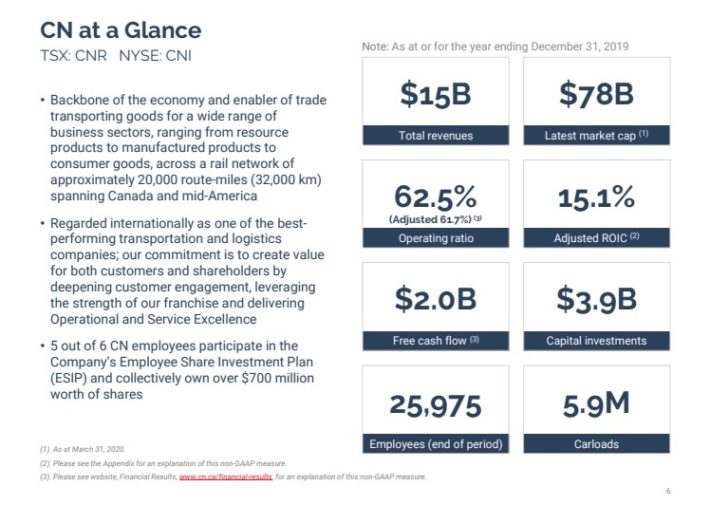

Source: Investor Presentation

The company offers a full range of services including rail, intermodal, trucking, warehousing, and distribution. The company has generated steady growth for many years. First, it placed focus on improving productivity. This has allowed the company to boost volumes and revenue. Furthermore, Canadian National produces industry-leading margins, thanks to its lean cost structure.

Canadian National Railway reported first quarter on 4/27/2020. Earnings-per-share of $0.87 were flat year-over-year, but topped estimates by $0.09. Revenue declined 4.2% to $2.5 billion, though this was nearly $80 million above estimates. The company’s operating ratio improved 380 bps to 65.7%.

One factor negatively impacting the company right now is that it is exposed to commodities, specifically coal and mining. That being said, the company’s diverse customer base and operational excellence more than offset the declines in its commodity-based segments.

With its hefty margins, Canadian National generates significant cash flow. And, its shareholder-friendly management actively deploys this cash flow to investors.

The company currently pays a quarterly dividend of $0.575 per share in Canadian dollars. In U.S. currency, the dividend payout of $0.42 per share quarterly ($1.68 annualized) represents a dividend yield of 2.0%. The company is one of the best dividend growth stocks in Canada.

Canadian National certainly isn’t a flashy business. Railroads may be overlooked by many investors for being boring, but Canadian National’s shareholder returns prove that boring can be beautiful.

#4—Walmart Inc.

Dividend Yield: 1.7%

Percentage of Bill Gates’ Portfolio: 7.6%

Walmart is another great example of a company with durable competitive advantages. It is the largest retailer in the U.S., with annual revenue above $500 billion. The company came to dominate the retail industry by keeping a laser-like focus on reducing costs everywhere, particularly in supply chain and distribution.

This allowed Walmart to offer consistently lower prices than its competitors ever could. In turn, it steadily devoured market share until it became the giant it is today.

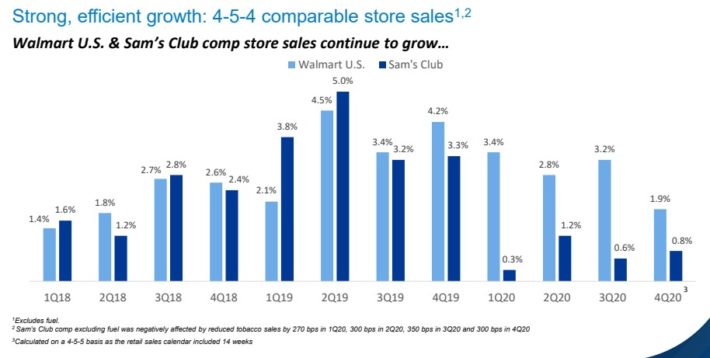

Walmart has generated steady growth for the past several quarters.

Source: Investor Presentation

Despite its large size, there are still growth catalysts for the company to look forward to, specifically in e-commerce and smaller format retail stores.

Walmart reported first quarter earnings on May 19th with results beating expectations on the top and bottom lines.

Comparable sales soared 10% in the US and up nearly 10% for the entire company, as the International and Sam’s Club businesses, respectively, grew much more slowly than the core US business.

Comparable sales in the US were driven by food and consumables, primarily, with average ticket prices soaring 16.5%, while traffic declined -5.6%. International sales were up 3.4% while Sam’s Club was up 9.6%, as that business saw its digital sales nearly double during Q1.

Consumers tend to scale down to discount retail when times are tight, which is why Walmart continued to grow, even during the Great Recession. As a result, Walmart is arguably the most recession-resistant stock in the Gates Foundation’s portfolio.

This allows Walmart the ability to raise its dividend each year like clockwork, even during recessions. Walmart has raised its dividend for 47 years in a row.

Its long history of dividend growth qualifies Walmart as a Dividend Aristocrat, a group of companies in the S&P 500 that have raised dividends for at least 25 consecutive years.

You can see the entire list of all 66 Dividend Aristocrats here.

#5—Caterpillar

Dividend Yield: 3.5%

Percentage of Bill Gates’ Portfolio: 7.5%

Caterpillar is the global leader in heavy machinery. It has a strong brand with a dominant industry position. Caterpillar manufactures heavy machinery, mostly to the construction and mining sectors.

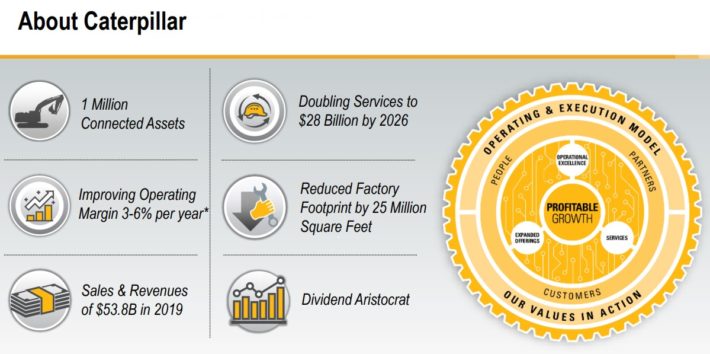

Source: Investor Presentation

In the 2020 first quarter, the company reported revenue of $10.6 billion, representing a -21% decline compared to Q1 2019. This result was due to lower sales volume driven by lower end-user demand and the impact from changes in dealer inventories.

Earnings-per-share equaled $1.98 compared to $3.25 in the prior year quarter, as the COVID-19 crisis began to influence results. Caterpillar ended the first quarter with $7.1 billion of cash and $10.5 billion of available global credit facilities.

Earnings-per-share equaled $1.98 compared to $3.25 in the prior year quarter, as the COVID-19 crisis began to influence results. Caterpillar ended the first quarter with $7.1 billion of cash and $10.5 billion of available global credit facilities. On May 13th, Caterpillar announced that its rolling three-month retail machine sales declined 22%.

Caterpillar’s competitive advantage is its global presence, which affords it economic scale. For example, Caterpillar has the ability to leverage down variable costs per unit, which boosts profit margins.

The steady global economic growth over the past several years has fueled positive growth for Caterpillar. Mining companies are expanding operations as commodity prices remain favorable, and construction continues to expand in the U.S., China, and other key markets around the globe.

Services will be also be a major long-term growth catalyst. Caterpillar expects to double Machinery, Energy & Transportation (ME&T) services sales to $28 billion by 2026 and deliver higher adjusted operating margins, which should lead to positive long-term earnings growth.

Caterpillar is a Dividend Aristocrat, with an attractive 3.5% dividend yield.

#6—Crown Castle International

Dividend Yield: 3.0%

Percentage of Bill Gates’ Portfolio: 4.4%

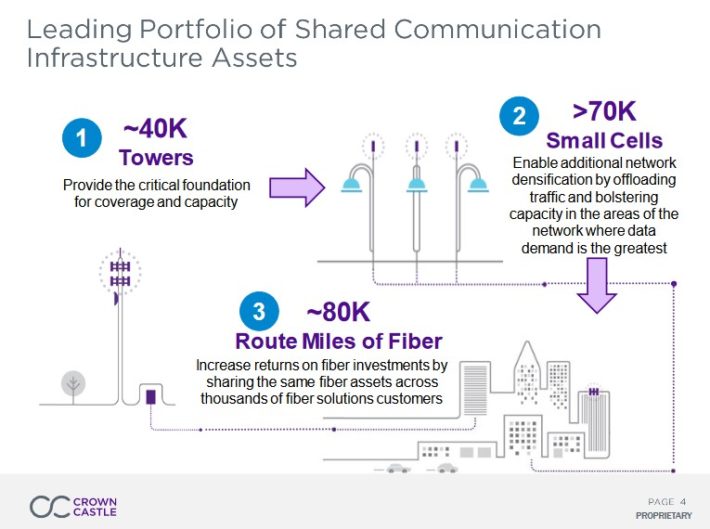

Crown Castle International is structured as a real estate investment trust, or REIT, and operates cell phone towers with small cells where larger towers are not feasible, and fiber connections for data transmission. The trust owns, operates and leases more than 40,000 cell towers and 75,000 route miles of fiber across every major US market, helping it to support data infrastructure across the country.

Source: Investor Presentation

Crown Castle reported first quarter earnings on April 29th with results beating expectations on the top and bottom lines. Site rental revenues were up 5% year-over-year to $1.31 billion as Crown Castle continues to post impressive organic growth figures. Organic growth contributed $71 million in Q1 as new leasing activity and contracted tenant escalations far outweighed non-renewals.

The trust expects new leasing activity this year to produce $395 million to $425 million in new revenue, in addition to $90 million to $100 million in rent escalators. This will be partially offset by $175 million to$195 million in non-renewals, for total organic growth of $250 million to $295 million in adjusted revenue. The trust maintained its guidance for ~$6.12 in FFO-per-share for 2020.

Crown Castle should be quite resilient to recessions given its place in what amounts to a utility in the burgeoning telecommunications industry. The trust performed very well during the Great Recession and we see no reason for investors to be alarmed during this recession. Its competitive advantage is somewhat weak given it provides a service with a relatively low barrier to entry, but Crown Castle’s scale is something its competitors do not have.

#7—Ecolab

Dividend Yield: 0.9%

Percentage of Bill Gates’ Portfolio: 3.9%

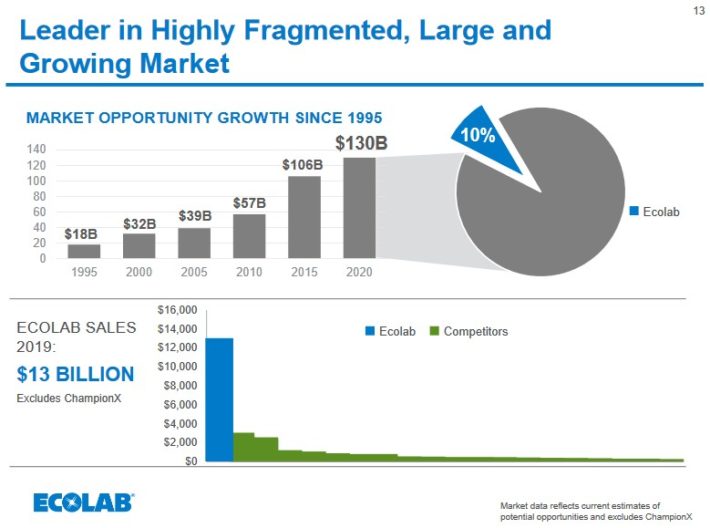

Ecolab was created in 1923, when its founder Merritt J. Osborn invented a new cleaning product called “Absorbit”. This product cleaned carpets without the need for businesses to shut down operations to conduct carpet cleaning. Osborn created a company revolving around the product, called Economics Laboratory, or Ecolab.

Today, Ecolab is the industry leader and generates annual sales of roughly $15 billion. Ecolab operates three major business segments: Global Industrial, Global Institutional, and Global Energy, each of roughly equal size. The business is diversified in terms of operating segments, and also geography.

Source: Investor Presentation

One of the best aspects of Ecolab’s business is its consistency. Providing cleaning products and services is a very steady business. Customers need Ecolab’s services, regardless of the condition of the U.S. economy.

This means Ecolab is a recession-resistant business. In fact, the company grew earnings-per-share each year from 2007-2010. Not only did the company generate positive earnings growth in each year of the recession, but in three of those years, it achieved double-digit earnings growth.

This growth came during arguably the worst economic downturn in the U.S. since the Great Depression. Ecolab’s recession performance makes abundantly clear that the company holds sustainable competitive advantages.

Ecolab serves more than 1 million customer locations, spread across more than 170 countries. The company is not afraid to spend significant resources on research and development of new products and services. Management refers to R&D spending as its “innovation pipeline”. Ecolab often spends more than a $1 billion on the innovation pipeline. Due in large part to this R&D spend, the company’s number of patents in nearing 8,000.

Ecolab qualifies as a Dividend Aristocrat. The stock has a dividend yield of just 0.9%, which is on the low side. However, it increases its dividend each year, and typically at a high rate. Investors may want to wait for a better buying opportunity. But Ecolab is a high-quality company. It is the largest operator in its industry, which provides competitive advantages.

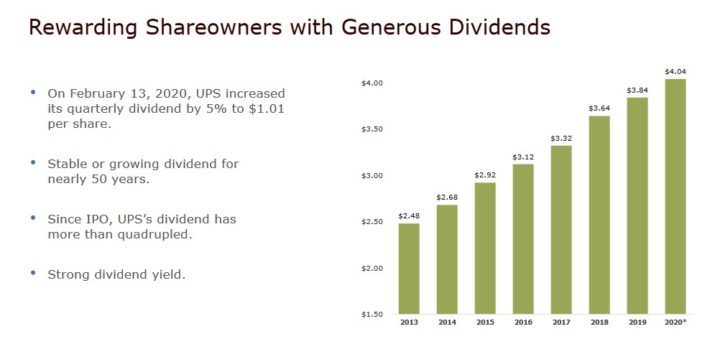

#8—United Parcel Service

Dividend Yield: 4.1%

Percentage of Bill Gates’ Portfolio: 2.4%

United Parcel Service is a logistics and package delivery company that offers services including transportation, distribution, ground freight, ocean freight, insurance and financing. Its operations are split into three segments: U.S. Domestic Package, International Package, and Supply Chain & Freight.

The company’s continued growth in the face of potential global economic headwinds, is due largely to its competitive advantages. UPS is the largest logistics/package delivery company in the U.S. It operates in a near duopoly, as its only major competitor to date is FedEx (FDX). To be sure, Amazon (AMZN) is expanding its own logistics business, but it still remains a customer of UPS as well.

UPS has the ability to generate steady growth through economic cycles. During the last financial crisis, UPS’ profitability declined substantially—earnings-per-share dropped from $4.11 in 2007 to $2.31 in 2009. Since then, profits have risen relatively consistently, thanks to the growth of the global economy. This has allowed the company to raise its dividend steadily for years.

Source: Investor Presentation

From 2007-2019, earnings-per-share grew by 5.2% annually. While UPS would likely be negatively impacted by a recession, it possesses the ability to snap back fairly quickly, thanks to its efficient business model and global competitive advantages.

Lastly, UPS is an attractive dividend stock as it has a high yield above 4%. UPS also has a long record of consistent dividends. According to the company, it has paid flat or rising dividends for nearly 50 years.

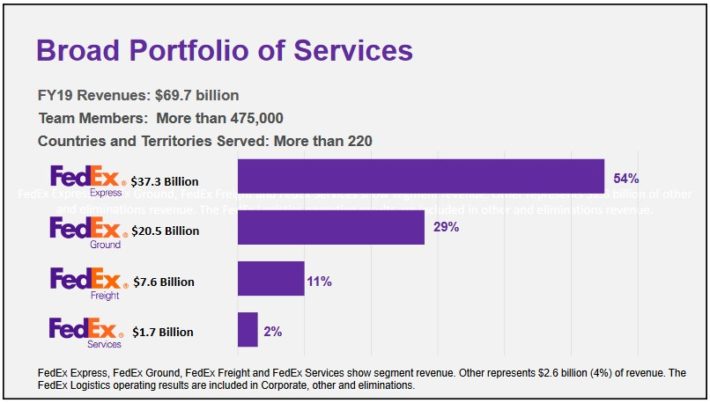

#9—FedEx

Dividend Yield: 2.1%

Percentage of Bill Gates’ Portfolio: 2.1%

FedEx Corp. is a transportation and shipping company. The company offers a variety of services including transportation, e-commerce, and business services. It operates four core segments: FedEx Express, FedEx Ground, FedEx Freight, and FedEx Services.

Source: Investor Presentation

FedEx provides domestic and international shipping for package delivery and freight. It also provides sales, marketing, information technology, communications, customer service, technical support, billing,and collection services.

On 03/17/20, FedEx reported financial results for the fiscal Q3. For the quarter, revenue increased 3% to $17.5 billion against the comparable quarter a year ago. The adjusted operating margin of 2.8% saw a great compression of 3%. This led to net income falling 57% to $315 million and adjusted earnings-per-share falling 53% to $1.41.

We expect long-term growth for FedEx, as it is yet another example of a company with a strong economic moat. It operates in global logistics, which is essentially a duopoly. It would be extremely difficult financially, for a company to build out a fleet large enough to compete on the scale of FedEx.

FedEx generates more than $50 billion in annual revenue. It has more than 400,000 employees and services more than 220 nations and territories around the world.

However, FedEx is not a recession-resistant business. While the company should remain profitable in a downturn, its revenue and earnings are likely to decline in a recession. That said, the dividend is unlikely to be cut even in a severe recession thanks to its low payout ratio.

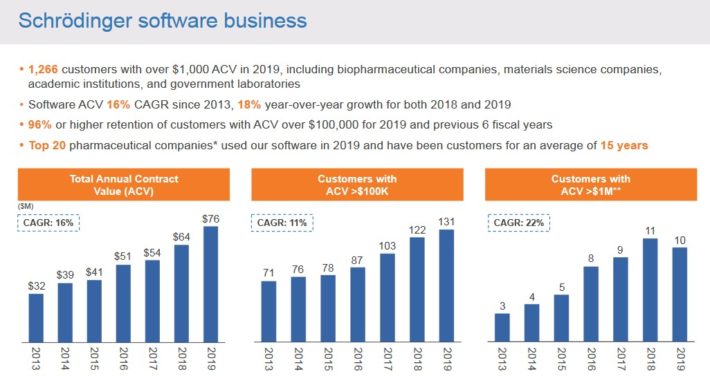

#10—Schrodinger Inc.

Dividend Yield: N/A

Percentage of Bill Gates’ Portfolio: 1.7%

Schrodinger, Inc. is a health care technology company. It operates a computational platform that aims to accelerate drug delivery, both for external clients and the company’s own internal drug programs. Schrodinger conducted its initial public offering in February 2020. The stock currently has a market capitalization of $3.3 billion.

Schrodinger has generated strong growth over the past several years, due to the growing popularity of its software.

Source: Investor Presentation

In the most recent quarter, the company reported total revenue of $26.2 million, up 26% year-over-year. This included record software revenue of $23.8 million, up 28% year-over-year. Schrodinger reported a net loss, after adjusting for non-controlling interests, of $13.8 million, compared to $5.8 million in the same period last year.

The company ended the first quarter with cash, cash equivalents, restricted cash and marketable securities of $288.8 million. This represents sufficient liquidity to get through the coronavirus crisis.

Schrodinger has exciting growth potential, due to the success of its drug delivery platform and its large and diversified customer base. The company has approximately 1,300 customers. From 2017 to 2019, the company’s total revenue grew at a 24% compound annual rate.

Schrodinger has a long runway of growth, because of the high degree of value that its products and services provide to customers. Designing drugs is extremely difficult work which is complex, lengthy, capital-intensive, and prone to high failure rates. This means many customers will continue to outsource this work to Schrodinger.

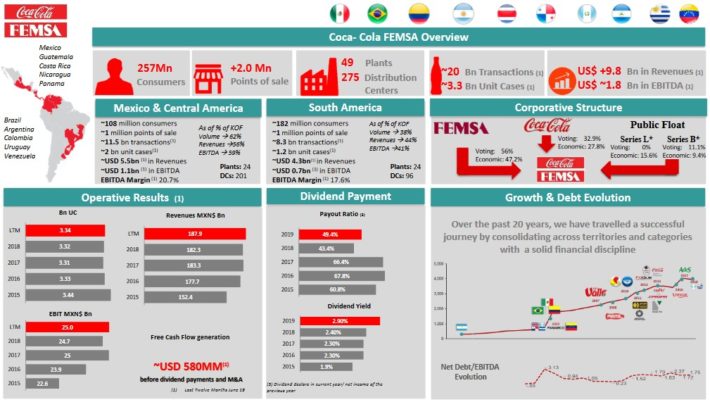

#11—Coca-Cola FEMSA SAB

Dividend Yield: 4.6%

Percentage of Bill Gates’ Portfolio: 1.4%

Coca-Cola FEMSA produces, markets, and distributes Coca-Cola (KO) beverages. It offers the full line of sparkling and still beverages. It sells its products through distribution centers and retailers in Mexico, Guatemala, Nicaragua, Costa Rica, Panama, Colombia, Venezuela, Brazil, Argentina, and the Philippines.

Coca-Cola FEMSA is the largest franchise bottler in the world. The stock is an excellent way to gain exposure to two very attractive emerging markets: Latin America and South Asia.

Source: Investor Presentation

Coca-Cola FEMSA is in strong financial position, with low levels of debt and positive free cash flow. In addition, carrying the Coca-Cola brand allows it to generate high margins and enjoy pricing power. This allows the company to consistently raise its dividend each year.

One risk factor investors should keep an eye on going forward is a potential change in consumer preferences. Coca-Cola FEMSA sells and distributes water and non-carbonated beverages, but ~75% of the company’s annual sales come from carbonated soft drinks.

The emerging markets are high-growth economies with expanding middle classes. Citizens are enjoying rising standards of living. But once these markets become more mature, there could be a risk of consumers changing their dietary habits. Soda sales have declined in the U.S. for more than a decade.

#12—Apple, Inc.

Dividend Yield: 1.0%

Percentage of Bill Gates’ Portfolio: 0.7%

Apple is a technology company that designs, manufactures and sells products such as smartphones, personal computers and portable digital music players. Apple also has a thriving services business that sells music, apps, and subscriptions. The stock has a market capitalization of $1.2 trillion.

On April 30th, 2020 Apple reported Q2 fiscal year 2020 results for the period ending March 28th, 2020. (Apple’s fiscal year ends the last Saturday in September.) For the quarter Apple generated revenue of $58.3 billion (below previous guidance of $63 billion to $67 billion), representing 0.5% growth compared to Q2 2019. Product sales were down -3.4%, with iPhones down -6.7%. However, a 16.6% improvement in Services, a much smaller portion of the business, and an increase in Wearables helped offset this.

Net income equaled $11.25 billion, a -2.7% decrease, while earnings-per-share totaled $2.55 compared to $2.46 previously, a 3.7% gain due to a substantially lower share count. Apple also declared an $0.82 quarterly dividend, payable May 14th, representing a 6.5% year-over-year increase, to go along with a $50 billion increase to the company’s share repurchase program.

Going forward Apple’s earnings growth will be driven by several factors. One of these is the ongoing cycle of iPhone releases, despite the significant decline in 2019. In the long run Apple should be able to grow its iPhone sales, albeit in an irregular fashion. Moreover, in emerging countries where consumers have rising disposable incomes, Apple should be able to increase the number of smartphones it is selling over the coming years. Increasing the selling prices of its phones could be a tailwind for revenue as well.

Another avenue for growth is Apple’s Services segment. This business unit, which consists of iTunes, Apple Music, the App Store, iCloud, Apple Pay, etc., has recorded a significant revenue growth rate during the last couple of quarters. Services revenues grow substantially faster than other segments and produce high-margin recurring revenues.

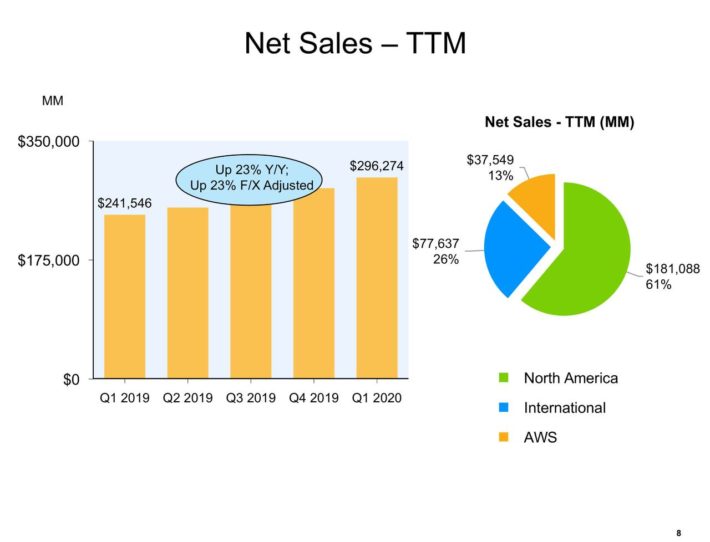

#13—Amazon.com, Inc.

Dividend Yield: N/A

Percentage of Bill Gates’ Portfolio: 0.7%

Amazon is an online retailer that operates a massive e-commerce platform where consumers can buy virtually anything with their computers or smartphones. It operates through the following segments:

- North America

- International

- Amazon Web Services

The North America and International segments include the global retail platform of consumer products through the company’s websites. The Amazon Web Services segment sells subscriptions for cloud computing and storage services to consumers, start-ups, enterprises, government agencies, and academic institutions.

Amazon’s e-commerce operations fueled its massive revenue growth over the past decade. Consider that in 2008, Amazon generated revenue of $14.84 billion. Sales reached $280 billion in 2019, an amazing level of growth over the past decade.

The company has continued to perform well in 2020, as the coronavirus crisis generated even higher demand for Amazon. In the most recent quarter, trailing 12-month sales increased 23% from the same period the previous year.

Source: Earnings Presentation

Amazon is making major investments to continue building its online retail platform. Amazon continues to grow its retail business. It also acquired natural and organic grocer Whole Foods for nearly $14 billion. This gave Amazon the brick-and-mortar footprint it desired to further expand its reach in groceries.

Amazon isn’t stopping there. In addition to the retail industry, it aims to spread its tentacles into other industries as well, including media and healthcare. Amazon has built a sizable media platform in which it distributes content to its Amazon Prime members.

Making original content is another highly capital-intensive endeavor, which will require huge sums in order for Amazon to compete with the likes of streaming giants Netflix (NFLX) and Hulu, as well as other television and movie studios.

Now that Amazon dominates retail and media content, it is readying a potential move into the healthcare industry. In 2018, Amazon acquired online pharmacy PillPack for $753 million, likely a precursor to a bigger move into healthcare distribution. These investments will fuel Amazon’s revenue growth, which is what the company’s investors are primarily concerned with.

Despite Amazon’s strong revenue growth, the stock does not pay a dividend to shareholders. With such a high level of growth investment, investors should not expect a dividend payout from Amazon for at least the next several years.

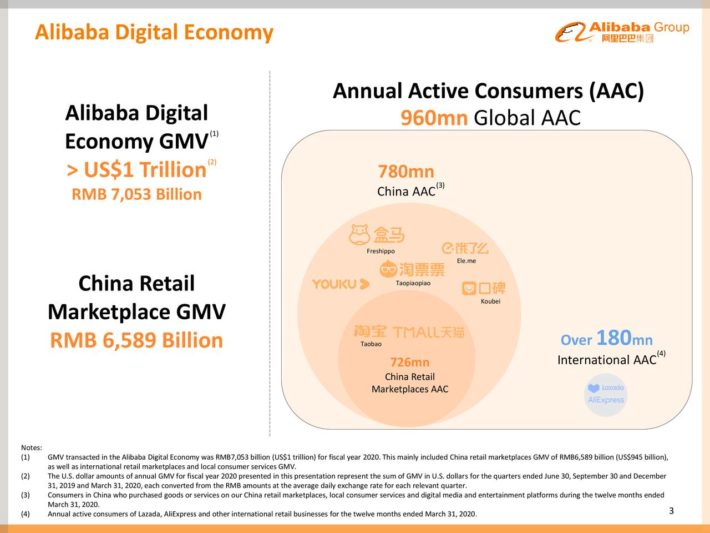

#14—Alibaba Group Holdings Ltd.

Dividend Yield: N/A

Percentage of Bill Gates’ Portfolio: 0.6%

Alibaba aims to be the Amazon of China. Started in 1999 by Jack Ma and 17 friends and students, Alibaba has become the Chinese market place’s largest retail commerce business. Alibaba provides technology infrastructure and marketing for small and medium sized retail businesses both inside and outside the country of China.

Due to its industry leadership position within a massive market, Alibaba’s growth potential is huge.

Source: Investor Presentation

It also provides business to wholesalers, cloud computing services, Digital Media and entertainment. It provides these services through its many subsidiaries such as Taobao.com, AliExpress and Youku. Taobao is a close competitor to eBay and fought a hard battle against eBay’s Chinese initiative, eventually forcing eBay to close its Chinese business. Youku is like YouTube but built with an intuitive interface for users in China. Alibaba’s market capitalization is $542 billion.

China’s middle class is expected to double in size within the next 10 years, with most of the growth driven by the less developed cities. Apart from the major metropolitan areas of China, such as Shanghai, Beijing and Shenzhen, China has more than 150 cities with a population of more than 1 million people.

All these cities have more than 500 million people in aggregate and a consumption economy of $2.3 trillion. The economies of these cities grow much faster than the economies of the major metropolitan areas. As a result, consumption from this category of Chinese cities is expected to approximately triple in a decade, from $2.3 trillion this year to about $7.0 trillion in 2029–for a 12% average annual growth rate. This secular trend will provide a strong tailwind to Alibaba, which relies to a great extent on domestic consumption.

Moreover, Alibaba greatly benefits from the fast pace of digitization of the Chinese economy. During the last decade, digitization has been driven primarily by smartphones, which have made it possible for consumers to remain connected to the internet for most of the day. Digitization of the Chinese economy will accelerate even further in the upcoming years thanks to the advent of 5G technology and the fast propagation of IoT (Internet of Things) devices. Alibaba is ideally positioned to benefit from the increasing penetration of Internet in the lives of consumers

Like Amazon, Alibaba does not pay a dividend, and is not likely to do so in the foreseeable future, as the company needs to invest heavily to stay ahead of the competition.

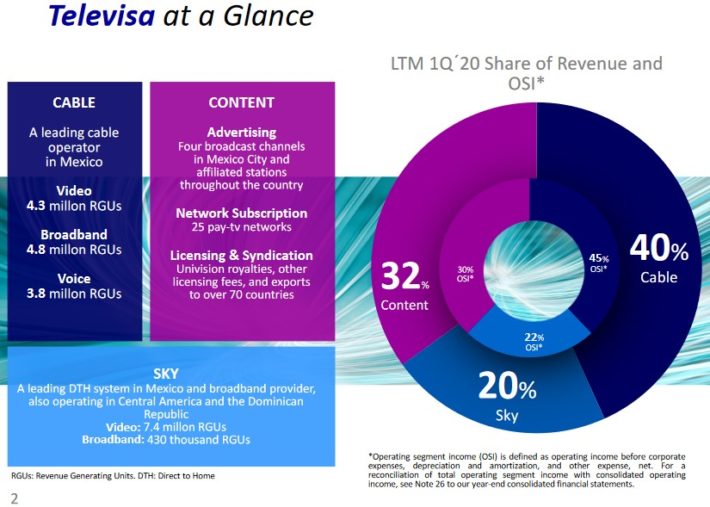

#15—Grupo Televisa SAB

Dividend Yield: 1.7%

Percentage of Bill Gates’ Portfolio: 0.6%

Televisa is a diversified media conglomerate. In all, Televisa operates 25 pay-tv brands, and television networks, cable operators and over-the-top services in over 50 countries.

In the U.S., it operates Univision. In addition, Televisa owns a majority interest in Sky, a satellite television provider in Mexico, the Dominican Republic, and Central America.

Source: Investor Presentation

The company is enjoying strong growth, thanks largely to high economic growth in Mexico and several Latin American markets. The company’s strongest businesses are Sky and cable.

Televisa is a strong brand and has a fundamental advantage, thanks to its geographic focus. As a result, it is a compelling growth stock, for investors interested in international diversification.

While it does not pay much of a dividend to shareholders, Televisa’s return potential is still significant, thanks to its rapid growth.

#16—Liberty Global (LBTYK)

Dividend Yield: N/A

Percentage of Bill Gates’ Portfolio: 0.33%

Liberty Global is the largest international television and Internet provider. Its core brand in Europe is Virgin Media. It also has the Ziggo, Unitymedia, Telenet, and UPC brands.

Liberty Global is split up into two businesses, which are Liberty Global Group and Liberty Latin America, or LiLAC. Liberty Global includes its European operations, and LiLAC houses its Latin America and Caribbean business.

Each segment—Liberty Global Group and LiLAC—have three share classes each. This share class corresponds to the Liberty Global Group.

The European economy is on shaky ground broadly speaking, with weak economic growth due to coronavirus and the uncertainty presented by Brexit. This has led to challenging results to start 2020.

Source: Investor Presentation

But television and Internet is a growth industry, because of the low levels of market penetration. There are still many parts of Europe with untapped growth potential.

As far as future growth is concerned, there is plenty of runway left. Liberty expects to add more new households in the years ahead. This aggressive expansion required significant capital investment, but the payoff is growth.

The company is investing large amounts of capital. There will be little cash flow to spare over the next two years, which is why the stock does not pay a dividend.

Investors looking for income may want to select a different telecom stock that pays dividends, and there are many to choose from. But Liberty Global could conceivably start paying a dividend at some point in the not-too-distant future, once its aggressive expansion period ends.

In the meantime, the stock is reasonably valued and could generate double-digit earnings growth. This earnings growth means investors can earn satisfactory returns moving forward, even without the benefit of a dividend.

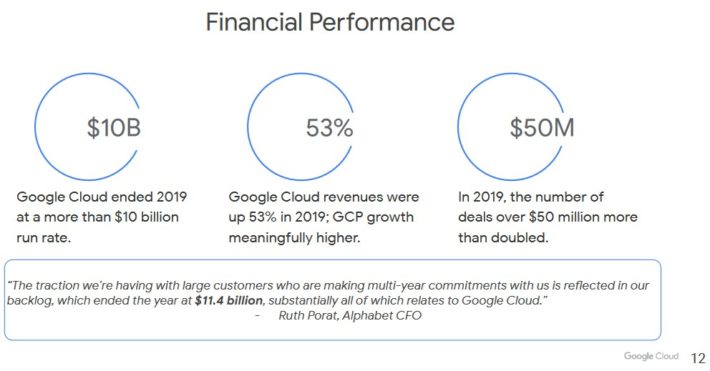

#17—Alphabet Inc. (GOOGL)

Dividend Yield: N/A

Percentage of Bill Gates’ Portfolio: 0.3%

Investors most likely know Alphabet by of its former name – and largest business – Google. Since going public in 2004, Google has grown into a technology giant, which now exists as a conglomerate known as Alphabet. The stock trades under two share classes, an ‘A’ class and a ‘C’ class. The ‘A’ class, GOOGL, has voting rights, while the ‘C’ class, GOOG, does not.

Alphabet, a $900+ billion market capitalization company employing nearly over 123,000 people, holds all the various businesses—the Google search platform, Android, Chrome, YouTube, Nest, Gmail, Maps and more – under one umbrella. Google Cloud is an emerging growth platform for the company.

Source: Investor Presentation

On April 28th, 2020 Alphabet released Q1 2020 results for the period ending March 31st, 2020. For the quarter the company reported $41.2 billion In revenue, which was up 13.3% compared to Q1 2019, driven by a 10.4% increase in Google advertising revenue (by far Alphabet’s largest source of revenue).

Operating Income equaled $7.98 billion compared to $6.61 billion previously, which includes -$1.12 billion in “Other Bets” operating loss. Net income equaled $6.84 billion or $9.87 per share compared to $6.66 billion or $9.50 per share previously. However, Q1 2019 included a European Commission fine.

On an adjusted basis, earnings compared unfavorably to $11.90 in Q1 2019. Alphabet said performance was strong in the first two months of the quarter, but March saw a significant slowdown in ad revenue.

From 2009 through 2019, Alphabet grew earnings-per-share by an average compound rate of 17% annually. The ongoing coronavirus crisis brings attention to Alphabet’s services, but advertising demand will be impacted in the short-term. Still, Alphabet has positive long-term growth potential from three major sources.

First, Alphabet has the world’s dominant search engine, which generates a remarkable amount of cash. Growth may slow at some point, but we see plenty of opportunity as the network effect continues to take hold around the world (making Google more and more valuable to advertisers).

Next, the company makes significant investments in new technologies, known as its Other Bets segment. Other Bets investments are devoted to high-risk, high-reward ventures. Alphabet’s Other Bets include life sciences brand Verily and Google Fiber. These bets still represent a very small part of the company but have the opportunity to propel Alphabet to its next level. Finally, the company’s immense cash hoard allows Google to retire shares and “buy its way” to growth via acquisitions.

#18—Alphabet Inc. (GOOG)

Dividend Yield: N/A

Percentage of Bill Gates’ Portfolio: 0.3%

In addition to the GOOGL shares, the Gates Foundation also owns the GOOG shares. Although this corresponds to a different share class, it refers to the same company. You can see the analysis of Alphabet in the above section of this article.

#19—Liberty Global (LBTYA)

Dividend Yield: N/A

Percentage of Bill Gates’ Portfolio: 0.2%

In addition to the LBTYK shares, the Gates Foundation also owns the LBTYA shares. Although this corresponds to a different share class, it refers to the same company. You can see the analysis of Liberty Global in the above section of this article.

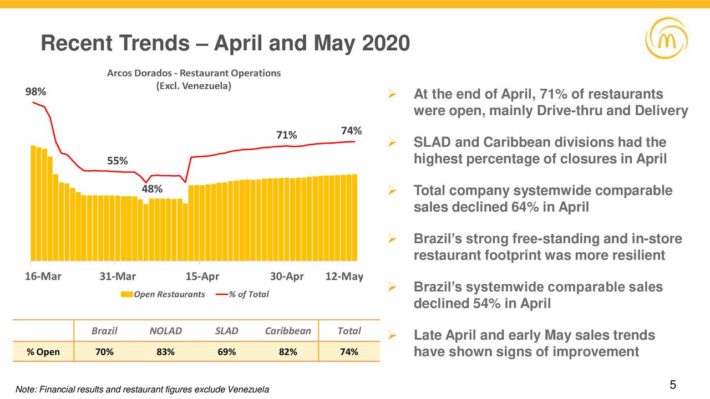

#20—Arcos Dorados Holdings

Dividend Yield: 3.6%

Percentage of Bill Gates’ Portfolio: 0.06%

Investors might not immediately recognize Arcos Dorados by its name, but they will certainly understand its business. Arcos Dorados is a holding company. Collectively, it is the largest McDonald’s (MCD) franchisee in the world, in terms of number of restaurants.

It has the exclusive right to own and operate McDonald’s restaurants in ~20 Latin American and Caribbean countries and territories. In all, it operates or franchises over 2,000 McDonald’s restaurants. The biggest geographic region for the company is Brazil.

The company struggled with stay-at-home orders due to coronavirus to start 2020, but trends have improved in recent weeks.

Source: Investor Presentation

The coronavirus crisis is likely to make 2020 a difficult year for Arcos Dorados, but the long-term potential remains intact for the company.

Many of the countries Arcos Dorados operates in are emerging markets, which presents attractive long-term growth due to their rapidly-expanding economies and growing middle classes. With a dividend yield above 3%, Arcos Dorados is a compelling dividend stock for investors looking for exposure to emerging markets.

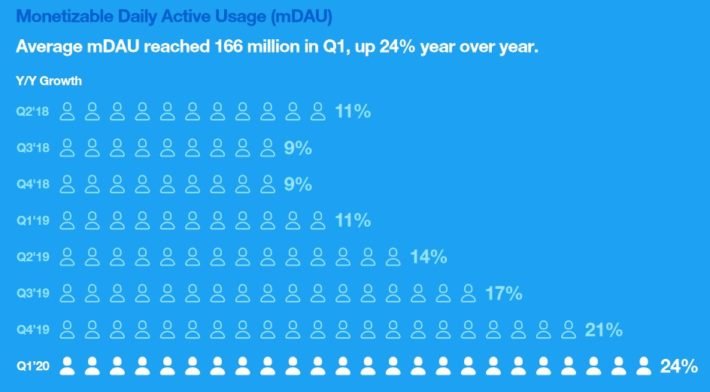

#21—Twitter, Inc.

Dividend Yield: N/A

Percentage of Bill Gates’ Portfolio: 0.04%

Twitter is a social networking giant, which provides a platform to millions people to discuss about everything that happens in the world, including breaking news, politics, sports and everyday interests.

Despite its popularity, the company is still in its early phases of expansion, which are typically characterized by high growth.

Source: Investor Presentation

Twitter generated 24% year-over-year growth in average monetizable daily users, in the most recent quarter. Twitter does not rest on its laurels–it is continuously trying to make it easier for people to find content relevant to the topics of their interest and follow new conversations. To this end, the company is trying to improve its machine-learning models in order to provide more relevant content in everyone’s timelines and notifications.

Twitter is also trying to make progress in the “health” of its conversations by removing automatically abusive content and enabling authors to hide some of the responses, which derail the trajectory of the conversation. As there is ample room for improvement and expansion of the platform, Twitter has promising growth potential ahead.

Growth investors may be attracted to Twitter, but income investors should look elsewhere. Twitter does not pay a dividend, and is not likely to join the ranks of a dividend payer any time soon.

#22—Liberty Latin America Ltd. (LILAK)

Dividend Yield: N/A

Percentage of Bill Gates’ Portfolio: 0.04%

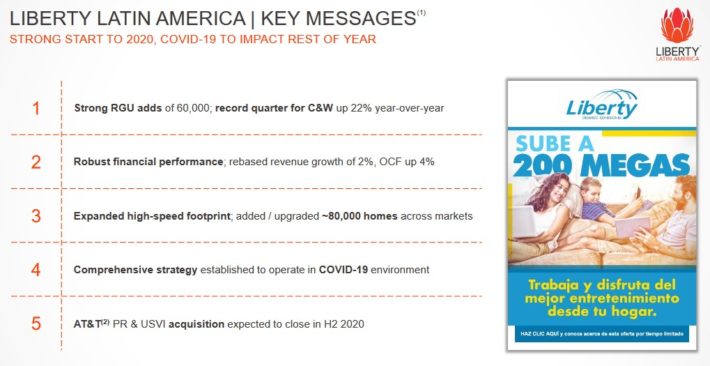

This share class corresponds to Liberty Global’s LiLAC operating segment. LiLAC includes Liberty Global’s Latin America and Caribbean businesses, under the brands VTR, Flow, Liberty, Mas Movil, and BTC.

These are currently a small part of the overall business. But there is lots of growth potential up ahead. LiLAC is poised to become a much bigger part of the company going forward, as a result of the 2016 acquisition of Cable & Wireless Communications.

The $7.4 billion deal added more than 10 million new customers in Latin America and the Caribbean. Plus, the CWC acquisition presents cost synergy opportunities.

The company’s results were negatively impacted by the coronavirus to start 2020.

Source: Investor Presentation

However, LiLAC has positive long-term growth potential, not just because of the CWC acquisition. Another growth catalyst for LiLAC is to increase bundling of services. The company will seek to expand on this moving forward. Bundling services is lucrative for telecommunications providers, which is why the practice is so common in the U.S.

Liberty Global has a much higher percentage of triple-play customers in Europe, and it has served the company well. Like Liberty Global, LiLAC uses its cash flow to reinvest in the business and support its balance sheet. It does not pay a dividend. That being said, LiLAC also offers investors attractive return potential, from its future revenue and earnings growth.

#23—Liberty Latin America Ltd. (LILA)

Dividend Yield: N/A

Percentage of Bill Gates’ Portfolio: 0.02%

In addition to the LILAK shares, the Gates Foundation also owns the LILA shares. Although this corresponds to a different share class, it refers to the same company. You can see the analysis of Liberty Latin America Ltd. in the above section of this article.