Published August 5th, 2019 by Nick McCullum

On Saturday, Warren Buffett’s conglomerate Berkshire Hathaway (BRK.A) (BRK.B) reported financial results for the second quarter of fiscal 2019.

On the top line, Berkshire Hathaway generated total revenues of $63.6 billion, which represents an increase of 2.2% over the same period in 2018. Through the first six months of the fiscal year, Berkshire Hathaway’s total revenues have increased by 3.0%.

Performance By Operating Segment

Berkshire Hathaway’s revenue growth was stratified by operating segment. The company’s revenue performance for selected major segments is shown below:

- Burlington Northern Santa Fe: 0.2% growth

- GEICO: 5.7% growth (based on premiums written, not premiums earned)

- Berkshire Hathaway Reinsurance: 5.2% decline (based on premiums earned, not premiums written)

- Berkshire Hathaway Energy: 1.6% decline

- Manufacturing, Service, and Retailing: 1.2% growth

How To Measure Berkshire Hathaway’s Performance

Recall that Berkshire Hathaway owns a $201 billion portfolio of common equities, and that recent changes to accounting rules mean that fluctuations in this account must now be run through the company’s income statement. Because of this, measuring Berkshire’s performance using its net income is not the best method for assessing its financial results.

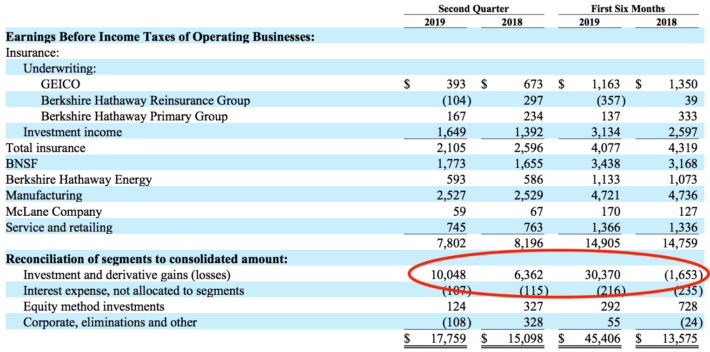

We believe the best way to avoid this problem is by assessing the earnings before income taxes of Berkshire Hathaway’s operating businesses, excluding investment and derivative gains. Fortunately, Berkshire Hathaway makes this comparison in one of the notes to its financial statements, which we have included below. As you can see, the red circle indicates that investment gains and losses have added about $32 billion to Berkshire’s GAAP earnings through the first half of the ongoing fiscal year.

In total, Berkshire Hathaway’s pretax earnings declined by $394 million, or 4.8%, to $7.8 billion in the quarter. Note that more than all of this decline came from its insurance segments, which saw pretax earnings decline by $491 million. Over a longer time period – the first six months of 2019 – the company’s pretax earnings increased from $14,759 million to $14,905 million, representing growth of about 1%.

In total, Berkshire Hathaway’s pretax earnings declined by $394 million, or 4.8%, to $7.8 billion in the quarter. Note that more than all of this decline came from its insurance segments, which saw pretax earnings decline by $491 million. Over a longer time period – the first six months of 2019 – the company’s pretax earnings increased from $14,759 million to $14,905 million, representing growth of about 1%.

On the surface, this is a poor result, but it is important to measure a complicated entity like Berkshire Hathaway using more than one yardstick. We recommend that investors also consider two other metrics when assessing Berkshire’s results, with the first being free cash flow.

Berkshire Hathaway’s statement of cash flows provided in its second quarter earnings release is for the first six months of the year (and not the second quarter alone), but this still provides helpful insight into the company’s results. Through the first half of the year, Berkshire’s free cash flow of $10.0 billion increased by 2.6% over the same period last year.

The third method that we recommend measuring is book value, which Buffett has long used as a measurement tool for his performance managing Berkshire. At the end of the second quarter of fiscal 2019, Berkshire Hathaway had book value per Class B share of $157.56, which increased by 7.5% over the $146.60 of book value reported in 2018’s equivalent reporting period.

On Berkshire Hathaway’s Q2 2019 Performance

By all metrics, Berkshire’s performance through the first half of this year has been disappointing – at least relative to the company’s impressive long-term track record. After examining the company’s filing with the Securities & Exchange Commission, we believe there are two main reasons for this.

The first is the drop in insurance earnings. While the segment’s poor performance was responsible for all of Berkshire’s decline in pretax earnings, this does not concern us over the long term. The insurance industry is somewhat cyclical by nature, and the important aspect of the business is that it is consistently profitable and continues to generate plenty of insurance float for reinvestment.

The second main contributor to Berkshire’s poor performance in the quarter is the lack of any earnings contribution from Kraft-Heinz (KHC). Berkshire noted in its 10-Q that:

“As of August 3, 2019, Kraft Heinz’s financial statements for the first and second quarters of 2019 were not yet available to Berkshire. Accordingly, Berkshire’s Consolidated Financial Statements for the second quarter and first six months of 2019 exclude its share of the earnings and other comprehensive income of Kraft Heinz for those periods. Berkshire intends to record its share of Kraft Heinz’s earnings and other comprehensive income for the first six months of 2019 during the period that such information becomes available. During the six-month period ending June 30, 2018, we recorded equity method earnings of $467 million. Dividends received from Kraft Heinz were $260 million and $407 million in the first six months of 2019 and 2018, respectively, which we recorded as reductions of our investment.”

Given Kraft-Heinz’s recent difficulties, we believe that the equity method investment’s earnings are likely to come in materially lower than the $467 million recorded in last year’s period. If Kraft-Heinz’s earnings are 20% lower this year – which would mean Berkshire’s share of earnings drops to $374 million – then Berkshire’s year-to-date pretax profits increase to $15,279 million, representing year-on-year growth of 3.5%.

Berkshire’s Cash Hoard & Share Repurchases

Because of the company’s tremendous free cash flow, Berkshire Hathaway’s cash hoard continues to build. The company’s cash and short-term investments account totaled $122.4 billion at the end of the second quarter, which represents an increase of 9.4% from the $111.9 billion held at year-end 2018.

Many investors thought that this rising cash pile would be used to repurchase shares in the second quarter given Berkshire’s depressed stock price. However, the pace of the company’s repurchases broadly disappointed the markets.

A summary of Berkshire Hathaway’s buyback activities during the second quarter can be seen below:

In total, these share repurchases amount to $442 million – which compares very poorly to both Berkshire’s $500 billion market capitalization and its $122 billion cash hoard.

Final Thoughts

Overall, Berkshire Hathaway’s second quarter results were slightly disappointing – especially with regard to the company’s slower-than-expected pace of share repurchases. The company seems undervalued, has one of the best management teams of any business, and also has one of the most conservative balance sheets in the public universe. Berkshire seems capable of delivering ~10% total returns with very little risk, which allows it to earn a buy recommendation today.