Bear of the Day: Molson Coors (TAP)

Molson Coors Beverage Overview

Molson Coors Beverage Company (TAP), formerly known as Molson Coors Brewing Company, was formed by the merger of Molson Inc. and Adolph Coors Co. in February 2005. The Zacks Rank #5 (Strong Sell) stock is a global manufacturer and seller of beer and other beverage products boasting an impressive and diverse portfolio of owned and partner brands. These core brands include Blue Moon, Miller Lite, Coors Banquet, Coors Light, Molson Canadian, Carling, and Ozujsko. TAP’s premium brands include Madri Excepcional, Staropramen, Blue Moon, Belgian White, and Leinenkugel’s Summer Shandy. Molson Coors crafts high-quality, innovative products with the aim of delighting the world’s beer drinkers, thus aiming to become the first choice for its consumers. Its largest markets are the United States, Canada, and Europe.

Coors Faces Troubling Drinking Trends

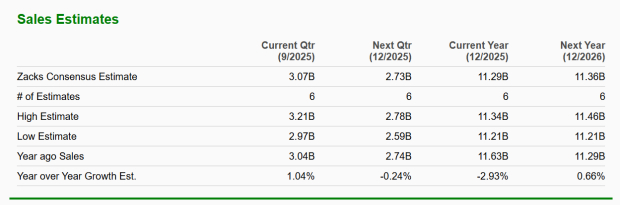

Amid new health-conscious trends, the number of US adults who don’t drink is at modern-day lows. According to a recent Gallup poll, only 54% of US adults drink, down from more than 60% in 2023. In addition, lower-income consumers who have been disproportionately impacted by inflation and weaker consumer confidence have purchased less beer, a shift seen throughout the category. As a result, TAP’s revenues are slated to be stagnant over the next two years, with no obvious light at the end of the tunnel.

Image Source: Zacks Investment Research

Aluminum Cost Shock

On the cost side, Molson Coors is absorbing a sharp spike in aluminum costs. The Midwest Premium, a key component of aluminum pricing, surged by more than 180% since January 2025, reaching levels the company had not anticipated. This increase is expected to add $40-$55 million in incremental costs in 2025 alone. Unlike other commodities, the Midwest Premium is particularly difficult and expensive to hedge, leaving Molson Coors more exposed to volatility.

TAP Exhibits Relative Price Weakness

TAP shares are -8.2% over the past three years, dramatically underperforming the S&P 500’s 73.7% gains.

Image Source: Zacks Investment Research

Bottom Line

Molson Coors faces a complex blend of evolving consumer trends, higher aluminum costs, and macroeconomic headwinds.

Higher. Faster. Sooner. Buy These Stocks Now

A small number of stocks are primed for a breakout, and you have a chance to get in before they take off.

At any given time, there are only 220 Zacks Rank #1 Strong Buys. On average, this list more than doubles the S&P 500. We’ve combed through the latest Strong Buys and selected 7 compelling companies likely to jump sooner and climb higher than any other stock you could buy this month.

You'll learn everything you need to know about these exciting trades in our brand-new Special Report, 7 Best Stocks for the Next 30 Days.

Download the report free now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Molson Coors Beverage Company (TAP): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com