Bear of the Day: Molson Coors (TAP)

One of the most surprising consumer trends in recent years has been the sharp decline in alcohol consumption, particularly among younger generations. Alcohol usage in America has dropped from 60% in 2023 to just 54% today, the lowest level recorded since tracking began in 1939. Not surprisingly, beer volumes in the US have fallen steadily, with surveys showing a growing share of consumers cutting back on or eliminating alcohol altogether. This shift has created a difficult operating environment for legacy brewers like Molson Coors (TAP).

TAP shares have reflected those challenges, underperforming the market year-to-date as both earnings and sales growth expectations trend lower. While the stock now trades at a depressed valuation, the fundamental outlook remains negative. Until Molson Coors can reinvent its portfolio to align with shifting consumer preferences, or the alcohol consumption trend reverses, investors may be better off avoiding the name.

Image Source: Zacks Investment Research

Earnings Downgrades Weigh on Molson Coors Stock

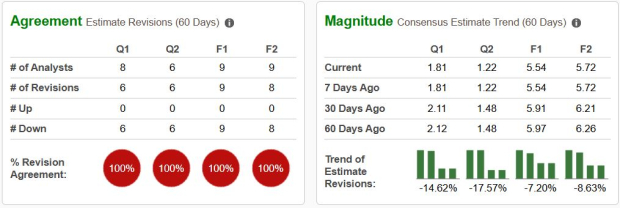

Wall Street sentiment on Molson Coors has turned decidedly negative, with analysts unanimously lowering earnings estimates across every timeframe. Over the past 60 days, current-quarter EPS estimates have been cut by 14.6%, while FY25 estimates are down 7.2%. This steady trend of downward revisions reflects growing concerns and gives the stock a Zacks Rank #5 (Strong Sell) rating.

The topline outlook isn’t much better. Sales are expected to decline 3% this year, followed by a modest rebound of only 0.7% in 2026.

From a valuation standpoint, shares trade at just 9.1x forward earnings, which on the surface looks inexpensive. However, with earnings projected to grow only 5% annually over the next three to five years, TAP carries a PEG ratio of 1.82, signaling that the stock is not particularly cheap when adjusted for its sluggish growth profile. In other words, the “value” case for Molson Coors may be a mirage without a clear catalyst for revenue or earnings acceleration.

Image Source: Zacks Investment Research

Should Investors Avoid Molson Coors Stock?

Despite its long legacy and dividend appeal, Molson Coors is struggling to navigate structural headwinds in beverage consumption. The recent analyst downgrades, poor consumer trends, and tepid growth forecasts suggest the company is in a prolonged transition, the kind that may take years to resolve.

Absent a meaningful strategy shift or reversal in consumer behavior, Molson Coors remains a name to avoid for the time being. There are stronger plays today with better growth trajectories and less structural risk.

Quantum Computing Stocks Set To Soar

Artificial intelligence has already reshaped the investment landscape, and its convergence with quantum computing could lead to the most significant wealth-building opportunities of our time.

Today, you have a chance to position your portfolio at the forefront of this technological revolution. In our urgent special report, Beyond AI: The Quantum Leap in Computing Power, you'll discover the little-known stocks we believe will win the quantum computing race and deliver massive gains to early investors.

Access the Report Free Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Molson Coors Beverage Company (TAP): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com