Bear of the Day: Diageo (DEO)

One of the most surprising consumer trends in recent years has been the sharp decline in alcohol consumption, particularly among younger generations. Alcohol usage in America has dropped from 60% in 2023 to just 54% today, the lowest level recorded since tracking began in 1939. Not surprisingly, spirits sales volumes in the US have stagnated, with surveys showing a growing share of consumers cutting back on or eliminating alcohol altogether. This shift has created a difficult operating environment for legacy alcohol companies like Diageo (DEO).

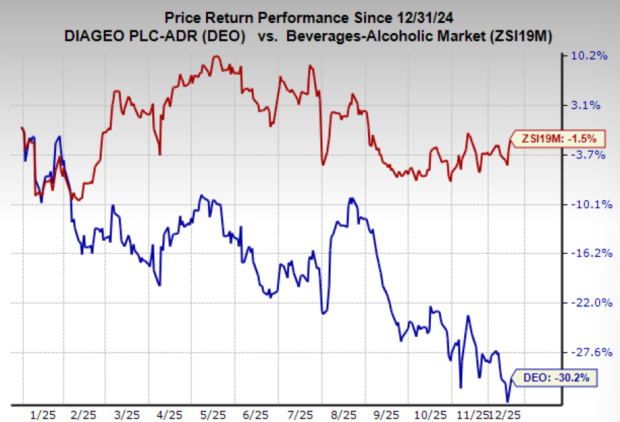

Diageo shares have reflected those challenges, severely underperforming the already underperforming industry and the market year-to-date as both earnings and sales growth expectations trend lower. Even after such a decline, DEO still doesn’t trade an especially discounted valuation as earnings shrink. Until Diageo can reinvent its portfolio to align with shifting consumer preferences, or the alcohol consumption trend reverses, investors may be better off avoiding the name.

Image Source: Zacks Investment Research

Diageo Shares Fall on Continuous Earnings Downgrades

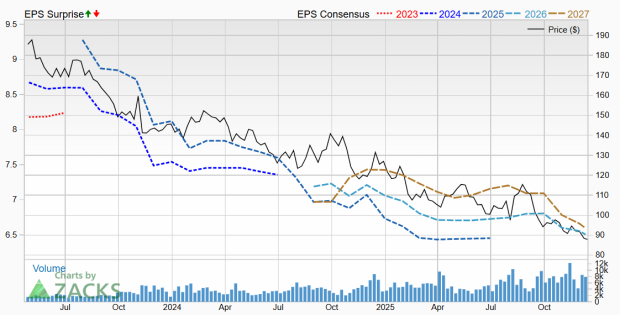

Diageo currently holds a Zacks Rank #5 (Strong Sell), reflecting a steady stream of downward earnings revisions over the past two months. The weakness is not new. As the chart below shows, analysts have been cutting earnings estimates consistently since mid-2022, and the company has struggled to regain momentum.

This decline in estimates mirrors the company’s fundamental performance. Both sales and earnings have followed the same downward trend over the last two years, which has naturally weighed on the stock price. Since 2022, revenue has been essentially flat, with no meaningful growth expected this year or next. Earnings have fared even worse, falling roughly 20% over the same period, and forecasts show little sign of improvement going forward.

With deteriorating fundamentals, stagnant demand trends, and persistent estimate cuts, Diageo’s near-term outlook remains challenged conditions that continue to justify the stock’s current Zacks Rank and the ongoing pressure on its share price.

Image Source: Zacks Investment Research

Should Investors Avoid DEO Stock?

Given the persistent decline in alcohol consumption, stagnant sales trends, and steady stream of earnings downgrades, Diageo’s challenges appear far from temporary. The company is facing both structural headwinds in consumer behavior and company-specific pressure on growth and margins. With no meaningful recovery in revenue or earnings expected in the near term, and valuations still not compelling relative to the risk, Diageo offers little justification for new investment.

Until the company can reposition its portfolio to match shifting consumer preferences or demonstrate a credible path back to growth, DEO is likely to remain under pressure. For now, investors may be better served focusing on areas of the market where fundamentals are improving rather than deteriorating.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Diageo plc (DEO): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com