Bear of the Day: AptarGroup (ATR)

Landing the Bear of the Day, AptarGroup ATR is a stock to avoid in the Zacks Containers-Paper and Packaging Industry, which is currently in the bottom 7% of over 240 Zacks industries.

With the innovative packaging solutions company starting to exemplify some of the industry’s struggles, ATR shares are down more than +20% in 2025 to noticeably underperform the broader indexes.

Unfortunately, there could be more downside risk ahead, even as Aptar has consistently exceeded its quarterly expectations, but has faced various headwinds that have weighed on investor sentiment.

Image Source: Zacks Investment Research

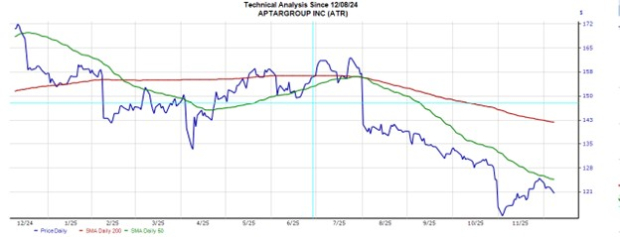

Recent Headwinds & ATR Technical Analysis

Notably, Aptar’s stock has been falling due to a mix of legal costs, inventory challenges, analyst downgrades, and weaker demand in certain healthcare markets. Regarding legal expenses, Aptar is facing intellectual property litigation, raising concerns about short-term profitability.

Furthermore, destocking in its Consumer Healthcare segment has pressured margins and created uncertainty about demand recovery, while challenges in the European cold/cough packaging market have added to investor worries about long-term growth as well.

The technical tape for Aptar stock is indicative of these fears, with ATR trading below its 50-day (green line) and 200-day (red line) simple moving averages, signaling short and long-term weakness and an overall bearish downtrend since July.

Image Source: Zacks Investment Research

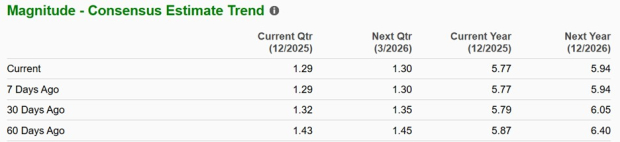

Declining EPS Revisions

Correlating with recent headwinds and taking away from Aptar’s modest growth projections is that over the last 60 days, fiscal 2025 and FY26 EPS estimates have dipped 2% and 7%, respectively.

Image Source: Zacks Investment Research

Aptar’s “F” Value Score

More concerning to the declining EPS revisions is that at 21X forward earnings, Aptar’s stock is still trading at a bit of a stretch to its industry average of 14X, with some noteworthy peers being Avery Dennison AVY, Packaging Corporation of America PKG, and Sonoco SON.

In terms of price to forward sales, ATR is also at an elevated but not as noticeable P/S multiple of 2X compared to the industry average of 1X.

Image Source: Zacks Investment Research

Bottom Line

On the surface, Aptar’s consistent operational performance and pleasant discounts to the benchmark S&P 500’s valuation metrics may be attractive. However, at over $100 a share, investors are understandably concerned about the premium they are paying for ATR relative to its peers, especially given the packaging industry’s challenges at the moment.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AptarGroup, Inc. (ATR): Free Stock Analysis Report

Sonoco Products Company (SON): Free Stock Analysis Report

Avery Dennison Corporation (AVY): Free Stock Analysis Report

Packaging Corporation of America (PKG): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com