BASFY Opens PolyTHF Technology Licensing to Clients & Partners

BASF SE BASFY recently announced that it will offer licensing of its state-of-the-art polytetrahydrofuran (PolyTHF) 1800 production technology to clients and partners. BASF, being one of the leaders in the development of this technology, has three PolyTHF production assets globally. They are located in Caojing, China; Ludwigshafen, Germany; and Geismar, the United States.

The licensing aims to create significant value, not just for the company, but for its clients and partners too. The attractive proposition gives them access to innovation and R&D at lower costs and shortens delivery time.

BASFY’s proprietary PolyTHF technology is widely used in a range of textiles, including swimwear, sportswear, underwear, shirts and stretch jeans for its elastic spandex and elastane fibers.

The licensing will strengthen the company’s ties with its long-standing partners by unlocking value for them. Given the usefulness of the proprietary technology, the partners and BASFY will be able to nurture innovation and reshape the textile market.

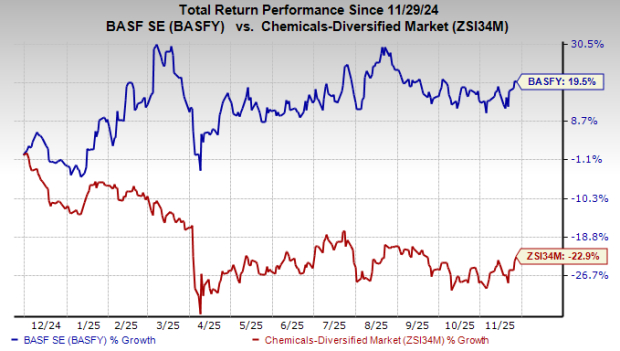

The company’s shares have gained 19.5% over the past year against the industry’s 22.9% decline.

Image Source: Zacks Investment Research

BASFY’s Zacks Rank & Key Picks

BASFY currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Kinross Gold Corporation KGC, Fortuna Mining Corp. FSM and Harmony Gold Mining Company Limited HMY. At present, KGC sports a Zacks Rank #1 (Strong Buy), while FSM and HMY carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for KGC’s current-year earnings is pegged at $1.63 per share, indicating a rise of 139.71%. Its earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, with an average surprise of 17.37%. KGC’s shares have risen 184.8% in the past year.

The Zacks Consensus Estimate for FSM’s current fiscal-year earnings stands at 83 cents per share.Its shares have surged 104.2% in the past year.

The Zacks Consensus Estimate for HMY’s 2026 earnings is pegged at $2.66 per share, indicating a rise of 112% from year-ago levels. HMY’s shares have gained 109.9% in the past year.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kinross Gold Corporation (KGC): Free Stock Analysis Report

BASF SE (BASFY): Free Stock Analysis Report

Harmony Gold Mining Company Limited (HMY): Free Stock Analysis Report

Fortuna Mining Corp. (FSM): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com