AppLovin stock breaks out: App'tizing momentum ahead

From a technical standpoint, identifying a mid-cap stock that has performed as remarkably and consistently over one year as AppLovin (NYSE: APP) might be difficult.

Impressively, over the previous year, shares of the software technology company have shot up more than 260%. More recently, year-to-date, the company’s stock has already increased double-digits, up almost 15%. If that wasn’t enough, as the company approaches its earnings, its stock has formed a bullish consolidation right at its 52-week highs. A pattern that firmly suggests further upside.

With the upward momentum showing no signs of slowing down, even after delivering impressive returns, the question remains: Is this the opportune moment to purchase shares?

AppLovin (NYSE: APP)

AppLovin Corporation, a US-based software company, specializes in developing platforms for mobile app developers. Their solutions include AppDiscovery, linking advertisers and publishers; Adjust, an analytics platform for app marketing; MAX, optimizing ad inventory with in-app bidding software; and Wurl, facilitating streaming video distribution through a connected TV platform.

The company is a growth stock, so its P/E ratio of 155 will be far from attractive for the traditional investor. However, its recent earnings have impressed and reflected the company's growth, with annual sales growth of almost 50% over the previous five years.

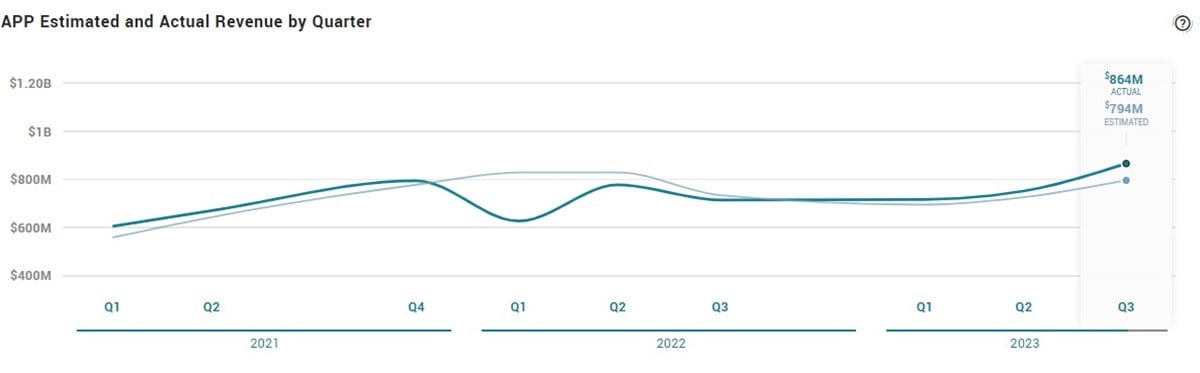

AppLovin released its previous earnings data on November 8th, 2023, reporting $0.30 per share (EPS) for the quarter. This exceeded the consensus estimate of $0.27 by $0.03. The company generated $864.26 million in revenue during the quarter, surpassing analyst estimates of $794.43 million.

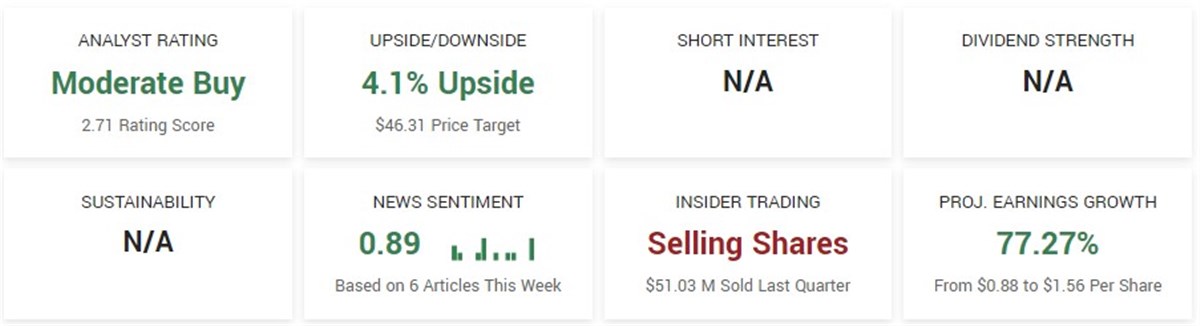

Earnings for the company are projected to increase by 77.27% for the year, rising from $0.88 to $1.56 per share. The company has confirmed that its following quarterly earnings report will be published on Wednesday, February 14th, 2024.

Analysts are bullish, and insiders are selling

Analysts are bullish on APP, with a consensus rating of Moderate Buy based on seventeen analyst ratings. The consensus price target sees a moderate upside of just under 1% based on the $46.31 price target.

Throughout the past year, insiders at APP have consistently unloaded shares without any corresponding purchases. A total of eight insider sales amounting to $1.68 billion in APP stock have been recorded. Considering the remarkable surge in its value during this period, it's hardly surprising that insiders have offloaded substantial amounts of stock.

Bullish consolidation has formed in APP

APP shares have spent over five months consolidating near critical short-term moving averages and above its rising 200-day Simple Moving Average (SMA) in a tight consolidation, with $40 acting as support and $45 as resistance.

More recently, on Monday this week, the stock broke above and notably closed above resistance, marking a potential breakout. Notably, the stock also experienced an uptick in volume as the day's volume was considerably higher than its average daily volume.

Going forward, if the stock can maintain its position above previous resistance, a higher timeframe breakout will be confirmed, and a significant leg higher ahead of its upcoming earnings report might follow suit. In the short term, a move toward the whole number, $50, might be the obvious target and could act as a psychological number and target for the stock, with $55 the next potential target zone if the upward momentum is to continue.

Source MarketBeat