Amazon surges: breaking through a pivotal level

As year-end swiftly approaches, it's time to reflect on the year that was. 2023 will be remembered as the year of not just one standout catalyst but many. Notably the rise of Artificial Intelligence (AI), ongoing geopolitical tensions and conflicts, rising interest rates, and the Federal Reserve's battle against inflation. But 2023 will also be remembered as the year of the 'Magnificent Seven.'

A year in which a significant portion of gains seen in the tech sector and even the overall market are primarily a result of the remarkable performance of the seven global heavyweights and market darlings, making up the 'Magnificent Seven.'

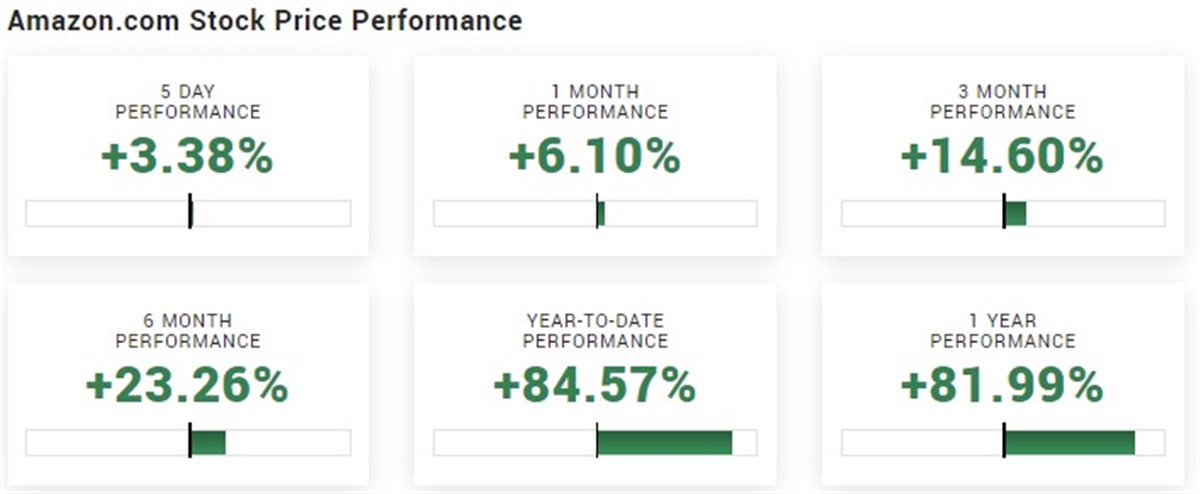

Remarkably, one member of the so-called 'Magnificent Seven,' already up over 80% year-to-date, just broke out and looks set to extend its magnificent performance into the new year.

Amazon's remarkable rebound in 2023

In 2022, Amazon.com (NASDAQ: AMZN) faced a 50% stock drop due to economic challenges impacting consumer spending, causing significant losses in its e-commerce divisions. However, the company rebounded remarkably in 2023, returning its retail business to profitability and recording impressive earnings growth.

With its stock surging by over 80% since the beginning of the year, Amazon's resurgence stems from swift cost-cutting measures and strategic restructuring efforts. This year, it demonstrated resilience, posting robust revenue growth.

In its latest earnings report on October 26, 2023, Amazon.com surpassed analysts' expectations, reporting $0.85 earnings per share for the quarter, higher than the estimated $0.58 by $0.27. The company recorded $143.08 billion in revenue, exceeding analyst forecasts of $141.53 billion. Forecasts predict a 36.02% growth in earnings for Amazon in the next year, expected to increase from $2.61 to $3.55 per share.

The turnaround showcases Amazon's capacity for resilience and strategic adaptation to market challenges. This resurgence also emphasizes the company's long-term reliability as an investment, rewarding those who maintain confidence in the company during market downturns.

Breakout confirmed in AMZN

After several weeks of consolidating at its previous 52-week highs, the world's largest and leading eCommerce giant, Amazon, broke above critical resistance and set new highs for the year.

After the stock successfully found support near its rising 200-day Simple Moving Average (SMA) in late October, it staged a steady recovery and bounced back toward its 52-week highs. As the stock consolidated between $140 and $150, its range contracted, and short-term key moving averages such as the 5-day and 20-day SMA converged. That price action and pattern signaled an expansion in price and volume was likely once either support or resistance gave way.

Going forward, now that the stock is trading above that critical level of resistance and breakout level, the bulls will want to see it firm up as newfound support. If the stock can build a base above that area, energy may build again, resulting in a sustainable move higher into the new year.

Source MarketBeat