Alliant Energy Rides on Renewable Expansion & Strategic Investments

Alliant Energy Corporation LNT continues to benefit from its initiative to further strengthen the infrastructure, retire coal-fired units and add clean assets. Alliant Energy’s long-term investment should further strengthen its infrastructure, and returns from regulated assets should provide earnings visibility.

However, this Zacks Rank #3 (Hold) company faces risks related to its dependence on third-party assets for transmission activities.

Factors That Support LNT

The ongoing economic development in Alliant Energy’s service territories and an increasing customer base are also creating fresh demand for utility services and boosting its performance. The company is currently targeting long-term annual earnings growth in the range of 5-7%.

Alliant Energy plans to invest substantially over the next four years to strengthen the electric and gas distribution network as well as add natural gas and renewable assets to the generation portfolio. The company expects long-term capital expenditure of $11.5 billion during 2025-2028. Its strong and flexible investment plans will support an 11% rate-base CAGR during the same period. More than 40% of Alliant Energy’s 2025-2028 capital expenditure plan includes investments in wind, solar and energy storage.

The company is successfully completing major construction projects on time and at or below budget. A constructive regulatory environment should enable it to recover capital expenditures. Nearly 32% of the 2024 year-end rate base came from regulated owned renewables.

Headwinds for LNT

The company’s utility operations — IPL and WPL — utilize the interstate electric transmission system, which they do not own or control. Alliant Energy's capacity to transport power within its service territories should be restricted by a decline in the third-party electric transmission system's performance, which would also negatively impact its business operations.

Increased competition from self-generation by large industrial customers, customer and third-party-owned generation (e.g., solar panels) and alternative energy sources can lower demand for its services in Iowa and Wisconsin.

LNT Stock’s Price Performance

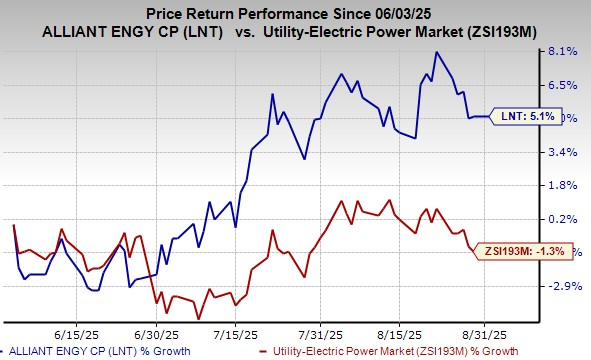

In the past three months, shares of the company have risen 5.1% against the industry’s 1.3% decline.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the same industry are TransAlta TAC, sporting a Zacks Rank #1 (Strong Buy), and NiSource NI and Fortis FTS, both carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TAC’s 2025 earnings per share (EPS) is pinned at 8 cents, indicating a year-over-year decline of 81.4%. The Zacks Consensus Estimate for 2025 sales is pinned at $2 billion, indicating a year-over-year decline of 4%.

NiSource’s long-term (three to five years) earnings growth rate is 7.88%. The Zacks Consensus Estimate for NI’s 2025 EPS implies an improvement of 7.4% from that recorded in 2024.

FTS’ long-term earnings growth rate is 5.13%. The company delivered an average earnings surprise of 4.5% in the last four quarters.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NiSource, Inc (NI): Free Stock Analysis Report

Alliant Energy Corporation (LNT): Free Stock Analysis Report

TransAlta Corporation (TAC): Free Stock Analysis Report

Fortis (FTS): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com