Originally by Bob Ciura

Updated by Nate Parsh on August 15th, 2019

When it comes to the telecommunications sector, one of the things that never changes is the ongoing price war between the major wireless carriers AT&T (T) and Verizon (VZ).

Virtually everyone in the U.S. who wants wireless, TV, and Internet services provably has it by this point in time.

As a result, in order to generate growth in the U.S., the major carriers often resort to taking customers from one another.

This is typically done through price wars, which have heated up again recently when Verizon announced it will offer unlimited data plans.

Both Verizon and AT&T are Dividend Achievers, a group of 260 stocks with 10+ years of consecutive dividend increases.

You can see the full Dividend Achievers List here.

AT&T is also a Dividend Aristocrat, since it has raised its dividend for 35 years in a row.

You can see the entire list of all 57 Dividend Aristocrats here.

Importantly for dividend investors, both AT&T and Verizon are high dividend stocks with 4%+ yields. While Verizon’s current yield of 4.3% is well above that of the average yield of the S&P 500, it is much lower than AT&T’s 5.9% dividend yield.

However, a continuing price war stands to hurt Verizon more than AT&T. This article will discuss the latest turn in the never-ending wireless war.

Business Overview

Going forward, Verizon Wireless customers will be able to purchase an unlimited talk, text, and data plan for $70 per month for a single line. The cost per line declines as more lines are added to a customer’s plan, culminating in $30 per month per line, for five lines.

Verizon had previously resisted the idea of offering unlimited data, because of the potential margin erosion.

For many years, Verizon generated industry-leading margins on the wireless side of the business. This was the result of the massive investments Verizon placed to build the strongest nationwide network.

However, Verizon’s advantage has been undone in recent periods.

That changed in the second quarter, when Verizon edged out AT&T, with a EBITDA margin of 37.7%.

Source: Q2 Earnings Presentation, page 6.

Meanwhile, AT&T’s communication segment generated EBIDTA margins of 37.6% in the second quarter.

It should be noted that both companies have seen margins decline from the low ~40% range to where they are now over the past few years.

Verizon’s margins are declining because its customers are gradually accepting slower data speed, in exchange for unlimited data and lower monthly bills offered by Verizon’s competitors.

Lowering prices on unlimited data plans will likely pressure Verizon’s margins going forward. That is because Verizon has nearly gone all-in on wireless after the $130 billion acquisition of Vodafone’s (VOD) 45% stake in Verizon Wireless.

Wireless service now represents the vast majority of Verizon’s total revenue:

- Verizon Wireless (74% of total revenue)

- Verizon Wireline (26% of total revenue)

As a result, its growth is largely dependent on wireless growth.

By contrast, AT&T is more diversified. It has made significant investments in TV, with internal investment in U-Verse as well as its $49 billion acquisition of satellite TV provider DirecTV.

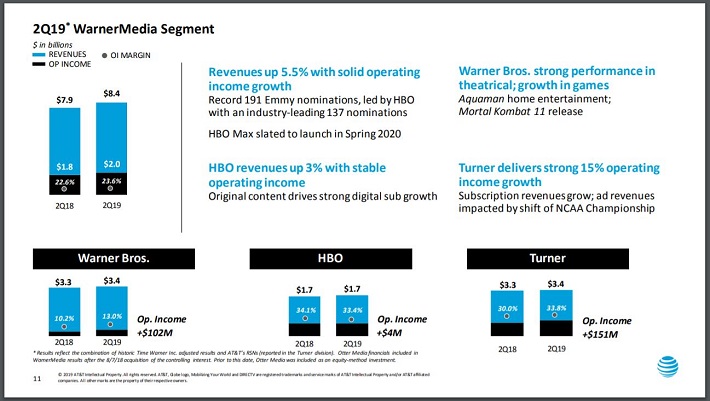

AT&T operates four main segments:

- AT&T Communications (79% of revenue)

- Warner Media (18% of revenue)

- AT&T Latin America (~3% of revenue)

- Xandr (~0.1% of revenue)

Included in the AT&T Communications segment is its mobility, entertainment and business wireline businesses. AT&T’s $109 billion deal for content giant Time Warner (TWX) significantly enhanced diversification.

Source: Q2 Earnings Presentation, slide 11.

Time Warner offers cable networks like TNT, TBS, and CNN, as well as premium networks HBO and Cinemax. Time Warner also operates the Warner Bros. movie studio.

Verizon’s strategy worked wonders during the early stages of 4G rollout. It staked itself out to a big lead in 4G, thanks to its network quality, which fueled its high margins and pricing power.

However, most carriers have caught up.

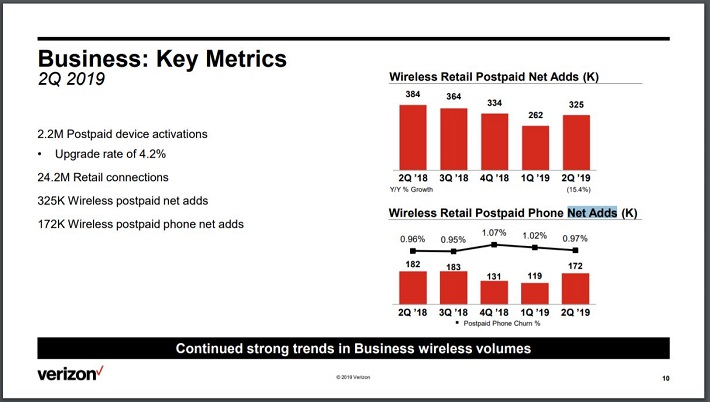

Verizon’s retail postpaid net customer additions fell 15.4% in the second quarter.

Source: Q2 Earnings Presentation, slide 10.

As a result, Verizon may not reclaim its top-tier margins until its 5G rollout accelerates.

Growth Prospects

Verizon conducted initial trials of its 5G service in 2016, but has begun rolling out 5G service in the U.S this year.

The company expects at least 30 cities will be able to offer 5G service by the end of 2019. Verizon activated its Ultra Widebrand 5G service in St. Paul, Denver, and Providence earlier this year. More recently, 5G service was turned on in parts of Atlanta, Detroit, Indianapolis and Washington, D.C.

In Verizon’s 2015 annual report, the company alludes to this with the following excerpt:

“We expect future growth opportunities will be dependent on expanding the penetration of our network services, offering innovative wireless devices for both consumer and business customers and increasing the number of ways that our customers can connect with our network and services.”

Essentially, in order for Verizon’s customers to see the true value of the company’s high-end services, it relies on the most powerful network infrastructure possible.

With the maturity of 4G, even lower-tier carriers have had time to catch up, and their marketing has emphasized that most customers will not notice a difference.

For example, Sprint (S) has advertised using Verizon’s old “can you hear me now” spokesman, who states that Sprint’s network quality is now within 1% of Verizon’s.

This will likely change once Verizon’s major growth drivers—namely 5G and the Internet of Things—reach nation-wide rollout across the U.S. When that happens, differences in network quality will once again become noticeable.

However, Verizon is still likely to be more adversely affected by a wireless price war than AT&T in the short term, given the relative importance of wireless to Verizon’s bottom line.

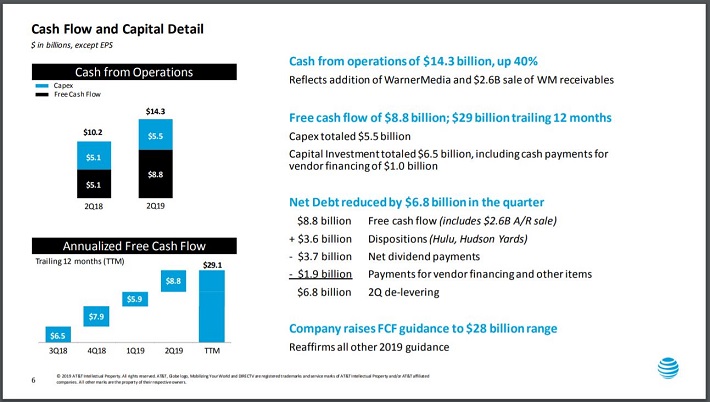

AT&T’s diversity helped the company turn in excellent cash from operations and free cash flow in the most recent quarter.

Source: Q2 Earnings Presentation, slide 6.

Verizon has compelling long-term growth catalysts, but its decision to offer unlimited data could have a more severe impact margins—and consequently dividend growth—in 2019.

Dividend Analysis

The biggest impact of a price war is that it is generally a win for consumers, at a cost to a company’s bottom line.

Verizon’s decision to lower the price on its unlimited data plans is likely to keep pressure on margins.

Falling margins could also weigh on Verizon’s ability to raise its dividend. This is a concern for investors, since Verizon’s dividend growth rate was already slowing in recent years.

For example, the company’s dividend increases over the past few years are as follows:

- 2014 dividend raise: 3.8%

- 2015 dividend raise: 2.7%

- 2016 dividend raise: 2.3%

- 2017 dividend raise: 2.2%

- 2018 dividend raise: 2.1%

As a result, Verizon investors should expect a 2019 dividend increase in the 1%-2% range, while AT&T should be able to maintain its 2%-3% dividend growth rate due to higher cash flows.

The dividend safety of each company is examined in the videos below.

Final Thoughts

Verizon topped AT&T in terms of EBITDA margin in the most recent quarter and is likely to see a benefit to its business with the rollout of its 5G service. That being said, AT&T offers a superior yield to Verizon and operates a more diversified business model.

And if the lowered price points for unlimited plans pressures Verizon’s margins then shareholders could see an even lower dividend growth rate going forward. For these reasons, a price war likely harms Verizon more than it does AT&T.

For investors who desire current income, such as retirees, AT&T and Verizon remain both attractive stocks for risk-averse income investors.