Updated on September 22nd, 2021 by Bob Ciura

Income investors have to look at a multitude of factors that determine whether a stock is a good investment, with one of these factors being the safety of the dividend payments – during good times as well as during bad times.

During times of economic expansion most companies benefit from growing profits, but during economic downturns some companies are hit harder than others. Recession resilience therefore is an important data point long term focused investors should look at.

The consumer staples industry is among the most resilient sectors of the economy when it comes to dealing with the impact of recessions, which is not surprising, as their products are bought by customers whether the economy is doing well or not.

You can see the entire list of 350 consumer staples stocks here.

You can also download a free Excel list of all 350 consumer staples stocks (along with important financial metrics like price-to-earnings ratios and dividend yields) by clicking on the link below:

One sub-category of the consumer staples sector is the food industry, and specifically packaged foods, which we will look at more closely in this article. Food stocks are not high-growth stocks in most cases, as demand for their products is not growing at an extraordinarily high pace.

However, quality food stocks can still generate satisfactory returns for shareholders, due to their steady growth, modest valuations, and solid dividend yields.

Through a combination of relatively high and secure dividends and some growth, which is achieved through rising prices, international expansion, or margin growth, they nevertheless have the potential to deliver attractive total returns in the years ahead.

Table of Contents

In this article we will take a look at the 7 dividend stocks from the food sector in the Sure Analysis Research Database that promise the highest total returns over the coming five years and that have a Dividend Risk score of C or better.

Our top 7 food stocks are ranked below, according to their 5-year expected total annual returns, in order of lowest to highest.

You can jump to any specific section of the article by clicking on the links below:

- Food Stock #7: Kellogg Company (K)

- Food Stock #6: Campbell Soup Company (CPB)

- Food Stock #5: General Mills (GIS)

- Food Stock #4: Tyson Foods (TSN)

- Food Stock #3: Unilever plc (UL)

- Food Stock #2: Mondelez International (MDLZ)

- Food Stock #1: Flowers Foods (FLO)

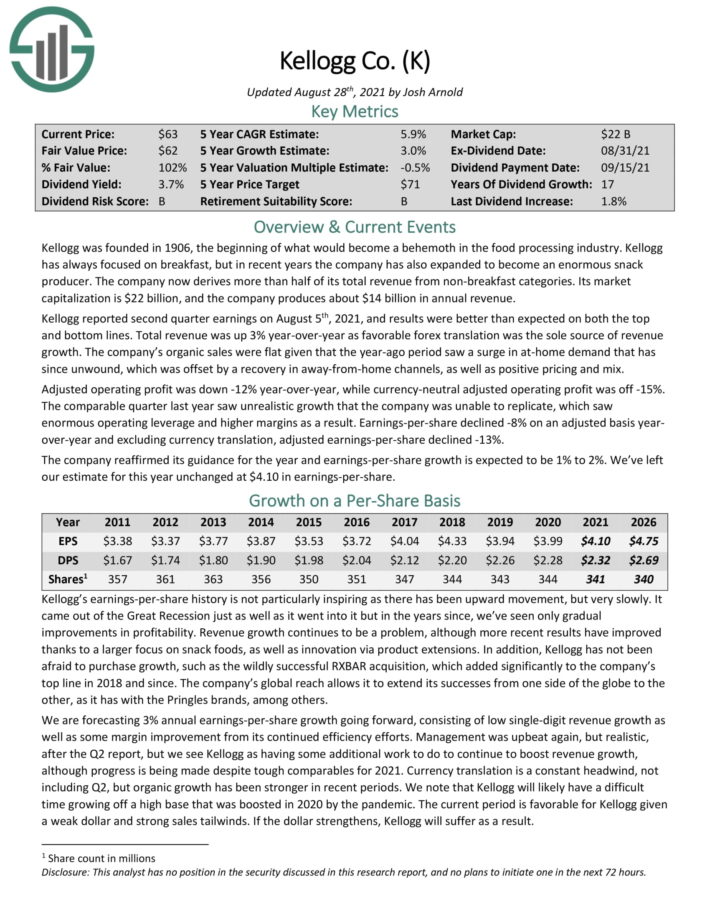

Food Stock #7: Kellogg Co. (K)

- 5-year expected annual returns: 5.9%

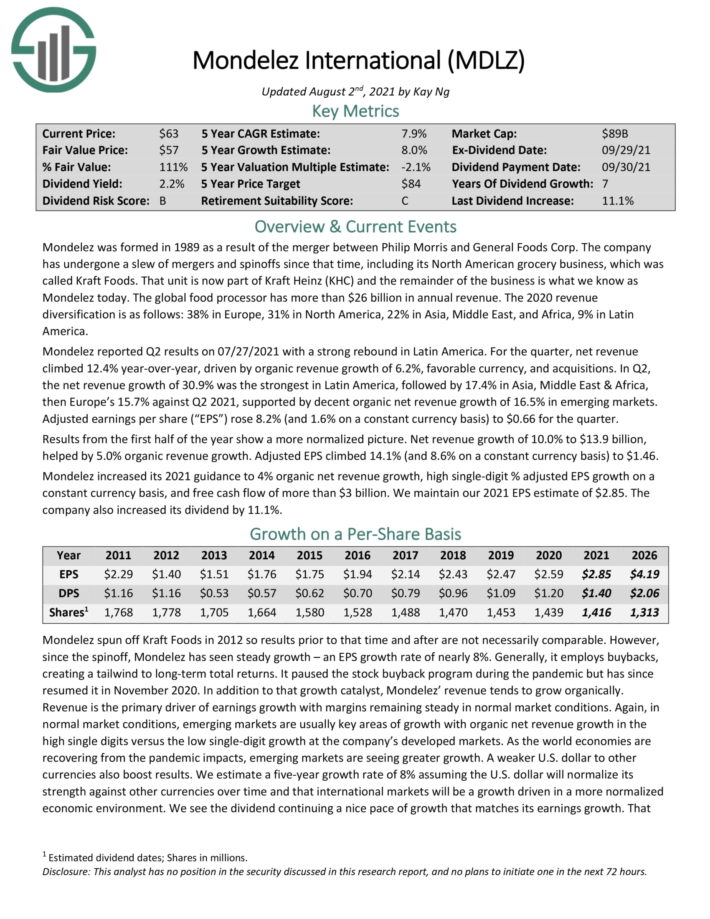

Kellogg was founded in 1906. Kellogg has always focused on breakfast, but in recent years the company has also expanded to become an enormous snack producer. The company now derives more than half of its total revenue from non–breakfast categories. The company produces about $14 billion in annual revenue.

Kellogg has focused on its premier snacks brands in recent years.

Source: Investor Presentation

Through a combination of low-single digit earnings-per-share growth (~3%), and its 3.7% dividend yield, partially offset by a slight decline in the P/E multiple, Kellogg should be able to deliver total returns of nearly 6% a year going forward.

Click here to download our most recent Sure Analysis report on Kellogg (preview of page 1 of 3 shown below):

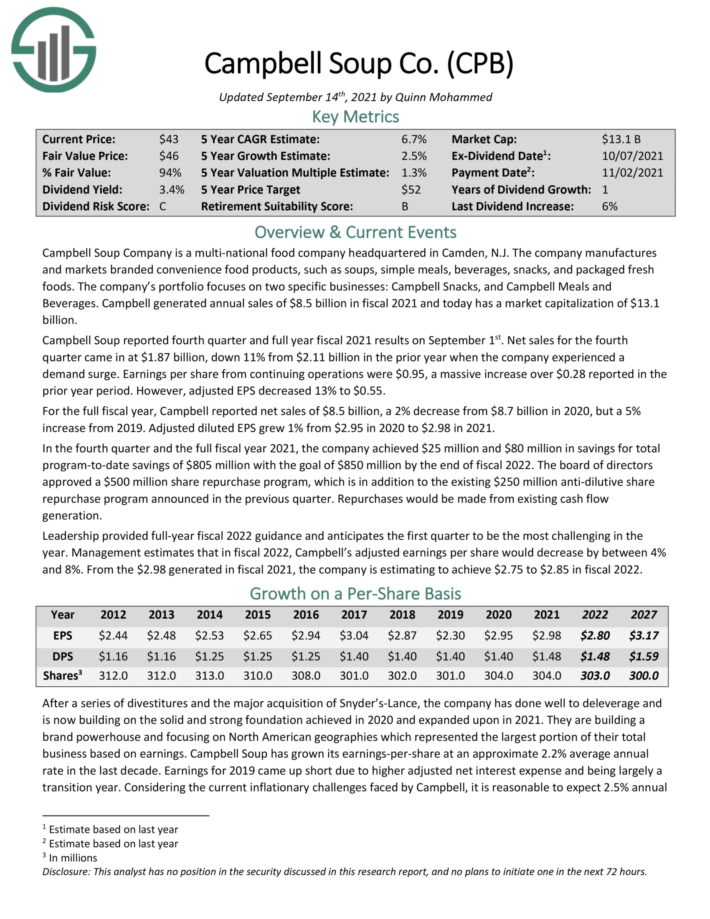

Food Stock #6: Campbell Soup Company (CPB)

- 5-year expected annual returns: 7.0%

The Campbell Soup Company is a manufacturer of branded foods and beverages products. Its product portfolio includes condensed and ready-to-serve soups, broth, pasta sauces, gravies, beans, dinner sauces, cookies and crackers, as well as salad dressings, refrigerated beverages, and more.

Like Kellogg, Campbell Soup has focused intently on building its portfolio of snacks brands, due to the broad growth of the snacking category.

Source: Investor Presentation

Campbell Soup shares trade for a 2021 P/E of 15.1, compared with our fair value estimate of 16.5. Therefore, we expect valuation expansion to be a modest tailwind for shareholder returns. In addition, the stock has a 3.5% dividend yield, while we also expect 2.5% EPS growth per year. This results in total expected returns of 7% per year.

Click here to download our most recent Sure Analysis report on Campbell Soup (preview of page 1 of 3 shown below):

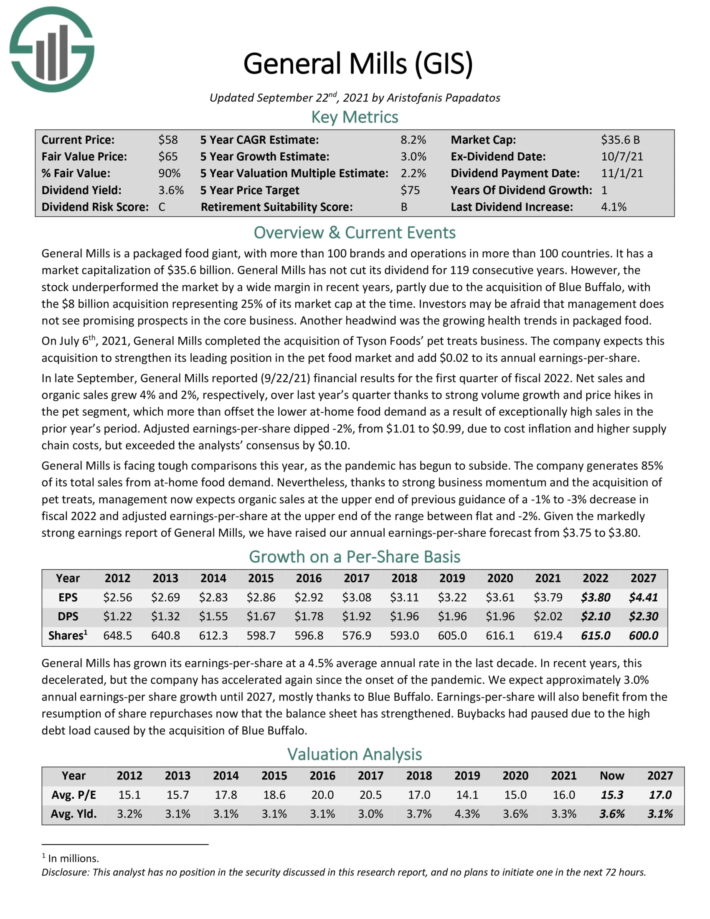

Food Stock #5: General Mills (GIS)

- 5-year expected annual returns: 7.7%

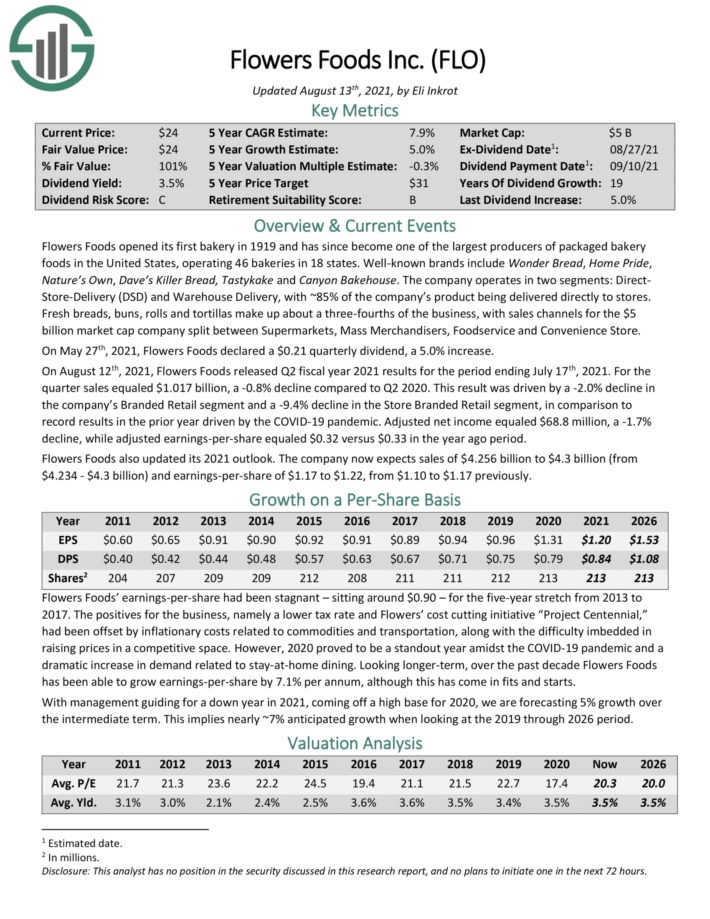

General Mills is a packaged food giant, with more than 100 brands and operations in more than 100 countries. Its various brands include its major cereal products like Cheerios, but the company has built an expansive portfolio. Other notable brands include Pillsbury, Haagen-Dazs, Betty Crocker, Green Giant, Annie’s, and also the Blue Buffalo pet food brand.

The company’s acquisition of Blue Buffalo, in addition to its turnaround efforts, have led to a return to growth in North America in the past two years.

Source: Investor Presentation

We estimate total returns at 7.7% per year for GIS stock, comprised of 3% EPS growth, the 3.4% dividend yield, and a small boost from a rising P/E multiple.

Click here to download our most recent Sure Analysis report on General Mills (preview of page 1 of 3 shown below):

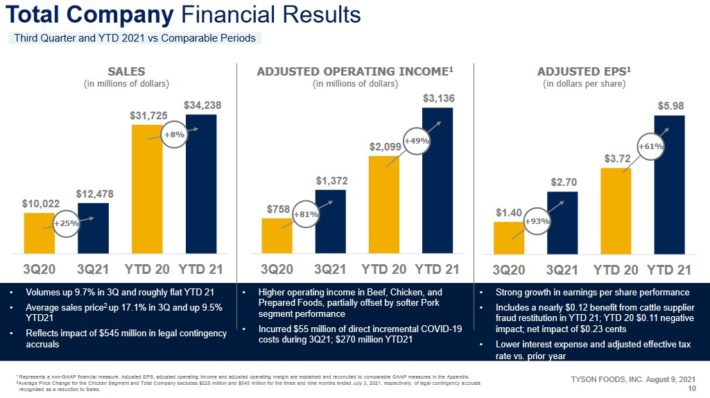

Food Stock #4: Tyson Foods (TSN)

- 5-year expected annual returns: 7.8%

Tyson Foods, founded in 1935, is one the world’s largest processors and marketers of chicken, beef and pork products. Today, Tyson Foods sells products to leading grocery chains, food franchises, and military commissaries in over 100 countries. Well–known brands include Tyson, Jimmy Dean, Hillshire Farm, Ball Park and State Fair. The company generated $43 billion in revenue last year.

Tyson has exhibited strong financial performance over the past year.

Source: Investor Presentation

Shares of TSY trade for a P/E of 10.5, below our fair value P/E of 12. This means an expanding P/E could lift shareholder returns. Combined with 3% earnings-per-share growth and the 2.4% dividend yield, Tyson stock has expected annual returns of slightly below 8%.

Click here to download our most recent Sure Analysis report on Tyson Foods (preview of page 1 of 3 shown below):

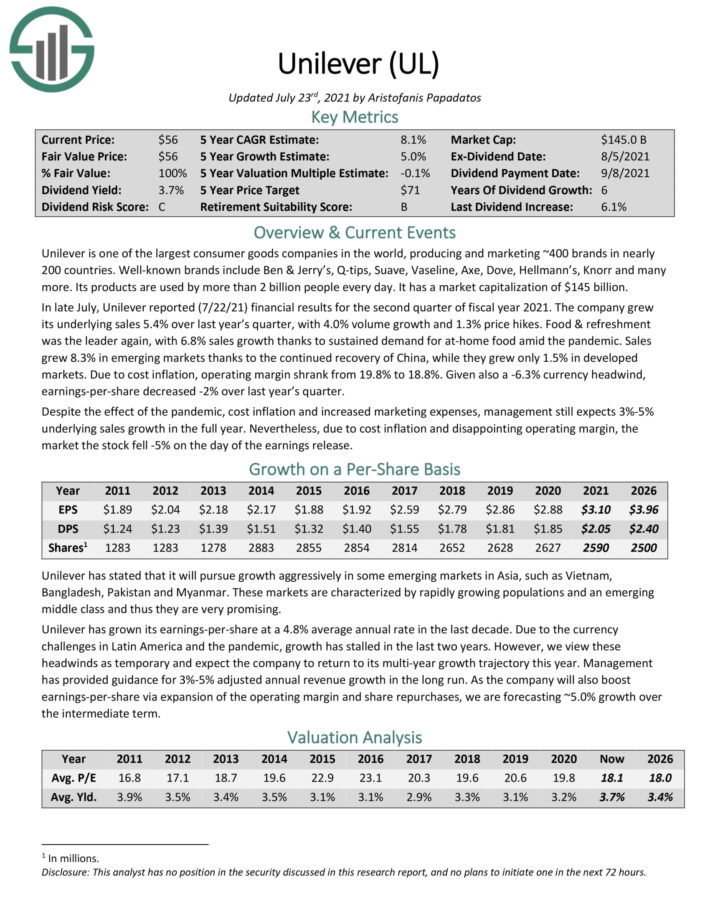

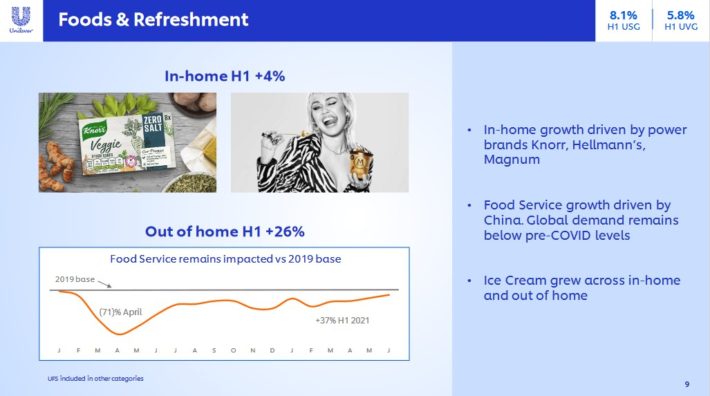

Food Stock #3: Unilever plc (UL)

- 5-year expected annual returns: 8.8%

Unilever is one of the largest consumer goods companies in the world, producing and marketing ~400 brands in nearly 200 countries. The company is a large producer of personal care and home products, but it also generates roughly 40% of its revenue from its food brands.

Well–known food brands include Ben & Jerry’s, Hellmann’s, Knorr, Lipton, and more. Unilever’s food brands have generated solid growth over the start of 2021.

Source: Investor Presentation

Annual returns are expected to reach 8.8% per year for Unilever, due to 5% EPS growth, the ~3.7% dividend yield, and a fractional boost from an expanding P/E multiple.

Click here to download our most recent Sure Analysis report on Unilever (preview of page 1 of 3 shown below):

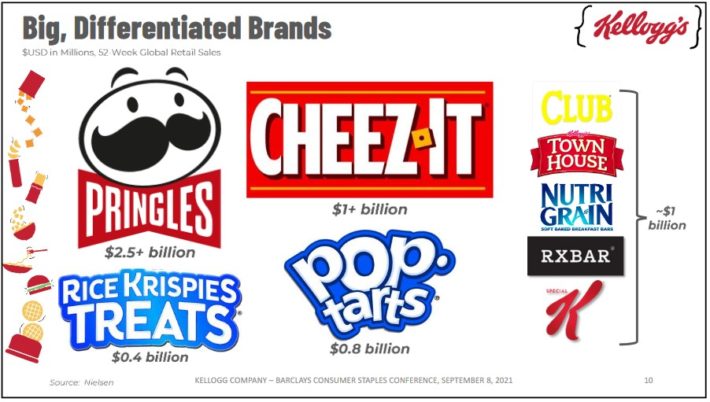

Food Stock #2: Mondelez International (MDLZ)

- 5-year expected annual returns: 8.9%

Mondelez was formed in 1989 as a result of the merger between Philip Morris and General Foods Corp. The company has undergone a slew of mergers and spinoffs since that time, including its North American grocery business, which was called Kraft Foods. That unit is now part of Kraft Heinz (KHC) and the remainder of the business is what we know as Mondelez today.

The global food processor has more than $26 billion in annual revenue.

Source: Investor Presentation

We expect Mondelez to grow its EPS by 8% per year over the next five years. Shares are presently overvalued, meaning a declining P/E multiple is expected to slightly reduce annual returns. With a 2.3% dividend yield, total expected returns are estimated at 8.9% per year.

Click here to download our most recent Sure Analysis report on Mondelez International (preview of page 1 of 3 shown below):

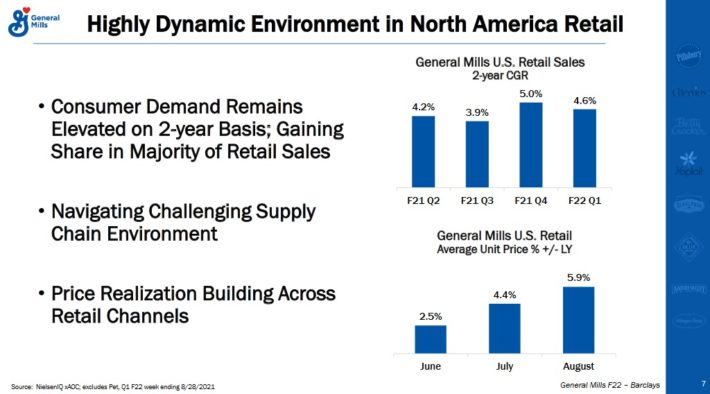

Food Stock #1: Flowers Foods (FLO)

- 5-year expected annual returns: 9.1%

Flowers Foods opened its first bakery in 1919 and has since become one of the largest producers of packaged bakery foods in the United States, operating 46 bakeries in 18 states. Well–known brands include Wonder Bread, Home Pride, Nature’s Own, Dave’s Killer Bread, Tastykake and Canyon Bakehouse.

Source: Investor Presentation

Flowers Foods stock trades for a P/E of 19.3, slightly below our fair value estimate of 20. A slight boost from an expanding P/E multiple will increase returns, as will the 3.6% dividend yield and 5% expected EPS growth. Total returns are expected to slightly exceed 9% per year over the next five years.

Click here to download our most recent Sure Analysis report on Flowers Foods (preview of page 1 of 3 shown below):

Final Thoughts

Food stocks can be appealing for income investors, due to their consistent earnings growth over the long term, their ability to withstand recessions, and their steady dividends. All 7 food stocks on this list are expected to generate positive total returns over the next five years, led by Flowers Foods which is our top-ranked food stock right now.