This is a guest contribution by Dividend Power

Monthly dividend stocks pay a dividend every month. Most companies in the US pay a dividend quarterly, a few pay one semi-annually or annually. In the rest of the world, companies usually pay a dividend semi-annually. Even bonds pay interest semi-annually or annually. If you plan to live off dividends as a retiree, this fact requires more planning to pay monthly expenses using investment income.

However, approximately 50 companies in the US pay a monthly dividend.

An investor owning monthly dividend stocks can smooth out the passive income stream. Aligning cash flows between income and expenses may make managing your budget easier. However, investors should keep in mind buying a stock just because it pays a monthly dividend is not reason enough to do so.

Monthly dividend stocks are generally grouped in three sectors: Real Estate, Financial Services, and Energy. Hence, a portfolio comprised of only monthly dividend payers would not be diversified. In addition, many of these companies struggled in 2020 during the peak of the COVID-19 pandemic, and some faced challenges during the Great Recession.

We pick three monthly dividend stocks using three criteria: at least five years of dividend growth, a dividend yield of more than the S&P 500 Index’s average of ~1.35%, and a market capitalization greater than $1 billion. The first criterion filters out many monthly dividend payers that struggled during the pandemic. Next, we pick two different REITs and a financial company for diversification. Our top three choices are:

- Realty Income (O)

- Main Street Capital Corporation (MAIN)

- Gladstone Land (LAND)

Realty Income

Realty Income (O) is a well-known REIT. Realty Income is a Dividend Champion and one of only three Dividend Aristocrat REITs. The company is also a monthly dividend payer.

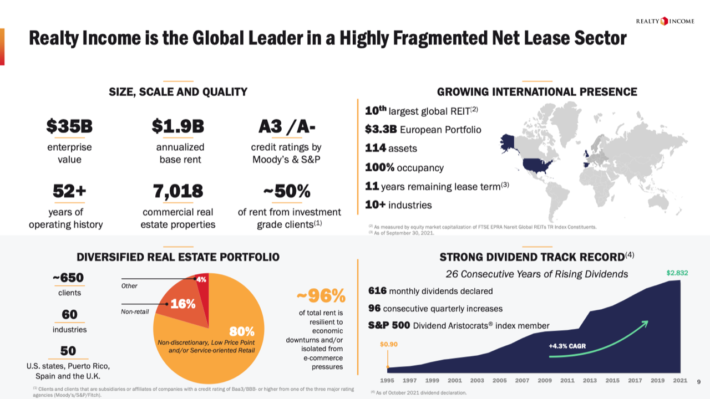

The REIT was founded in 1969 and is headquartered in San Diego. Today, it is the fifth-largest REIT in the US and the 10th largest REIT globally, with around 11,000 properties and approximately 650 clients. Realty Income’s clients are in all 50 states plus Puerto Rico, the UK, and Spain. No single client represents more than 6% of revenue. The five largest clients by revenue are 7-Eleven (5.7%), Walgreens (5.0%), Dollar General (4.2%), FedEx (3.4%) and Dollar Tree / Family Dollar (3.3%).

Notably, at the end of Q3 2021, Realty Income had a 98%+ occupancy rate demonstrating the strength of its property portfolio and client base. In addition, Realty Income operates under a triple-net lease structure, which means that besides rent, the tenant is responsible for taxes, maintenance, and insurance. This structure makes Realty Income less risky since they are not responsible for rising operating expenses.

Realty Income has several desirable characteristics as monthly dividend stocks go, including consistency and safety. The company is in the S&P 500 Index and the Dividend Aristocrats. The REIT has paid an increasing dividend for 26 consecutive years, and further, it has increased the dividend for 96 quarters and 616 months. As a result, the dividend has grown at a 4.3% compound annual growth rate (CAGR) since 1994. No other monthly dividend stock has this type of record.

Source: Realty Income Investor Presentation

From the perspective of dividend safety, Realty Income has a low beta of roughly 0.46 versus the S&P 500 Index. Earnings per share have grown in 24 of the past 25 years, and adjusted funds from operations (AFFO) have risen 5.1% CAGR since 1996. The company grows organically through fixed rent increases and variable rent increases as a percentage of tenant sales. In addition, Realty Income recently acquired Vereit, adding to its property portfolio.

The forward dividend yield is 4.26%, supported by a solid balance sheet. Realty Income has an A3 / A- credit rating from Moody’s and S&P Global.

Main Street Capital

Main Street Capital is a financial company that traces its history to the mid-1990s. The firm conducted an IPO in 2007. Main Street Capital is a private equity firm providing equity capital to lower middle-market companies and debt capital to middle-market companies. The firm offers financing to mostly privately held businesses with annual revenues ranging from $10 to $150 million.

The company has 177 portfolio companies with 70 lower middle markets, 69 private loans, and 38 middle markets. Main Street Capital has ~$5.1 billion of capital under management with an average investment of $14.2 million. These investments are diversified across industries, with no single industry representing more than 7% of the cost. Furthermore, the investments are diversified across geography in the US.

Source: Main Street Capital Investor Presentation

Main Street Capital has paid a monthly dividend continuously since August 2008. Significantly, the monthly dividend has never been decreased, even during the Great Recession or the COVID-19 pandemic. In addition, Main Street Capital has paid $4.14 in special dividends since the IPO, adding to the attraction.

The dividend has grown at a ~3.9% CAGR in the past decade and about 2.6% CAGR in the trailing 5-years. The annual total dividend was lower in 2020 than in 2019 since a special dividend was not paid in 2020. However, based upon only the cumulative monthly dividends, the annual dividend has been increased for 11 years.

The forward dividend yield is 6.0%, and the stock is trading at a forward price-to-earnings (P/E) ratio of ~16.8X. Main Street Capital is an attractive high dividend stock.

Gladstone Land

Gladstone Land was founded in 1997 and conducted an IPO in 2013. The firm is structured as REIT and is one of the four publicly traded Gladstone companies. Gladstone Land acquires and leases farmland to third-party farmers through a triple-net leasing structure. This structure is suitable for Gladstone Land since it reduces exposure to rising operating expenses.

Gladstone owns around 159 farms totaling ~108,000 acres in 14 states and worth about $1.4 billion. The REIT mainly buys farmland suitable for fruits, vegetables, and nuts. Importantly, Gladstone’s farmland is 100% leased. The REITs farmland is located across the US, but ~78% is located in Colorado, California, and Florida.

The REIT primarily seeks to buy family farmland with a $2 to $50+ million purchase price. Then, Gladstone leases the land for a period of five to ten years for a fixed rent or fixed rent plus a percentage of the tenant’s gross revenue. The average weighted lease duration is seven years.

Gladstone has paid its dividend monthly since the IPO. On an annual basis, the dividend has been raised for seven years. However, the growth rate is slow. The 5-year growth rate is ~1.8%, and it has been only about 0.54% in the past 3-years. Gladstone’s dividend is supported by rising lease revenue and AFFO.

The forward dividend yield is approximately 1.84%. However, the relatively low dividend yield is balanced by excellent dividend safety. Farmland prices and leasing rates are rising. In addition, occupancy has never been below 99.5% and was 100% through the third quarter of 2021.

Source: Gladstone Investor Relations

Author Bio: Dividend Power is a self-taught investor and blogger on dividend growth stocks and financial independence. Some of his writings can be found on Seeking Alpha, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, Entrepreneur, FXMag, and leading financial blogs. He also works as a part-time freelance equity analyst with a leading newsletter on dividend stocks. He was recently in the top 1.5% (126 out of over 8,212) of financial bloggers as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.

Disclaimer: Dividend Power is not a licensed or registered investment adviser or broker/dealer. He is not providing you with individual investment advice. Please consult with a licensed investment professional before you invest your money.