Published on August 15th, 2022 by Bob Ciura

3M Company (MMM) is a storied company with a long history of growing shareholder wealth. 3M has increased its dividend for over 60 consecutive years, a milestone that only a small handful of companies have reached.

As a result, it is on the exclusive Dividend Kings list.

You can download the full list of all 45 Dividend Kings (along with important financial metrics such as dividend yields and price-to-earnings ratios) by clicking on the link below:

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

3M has established itself as a premiere dividend growth stock due to the strength of its business model. Diversity has been a big part of 3M’s success over the years. Operating large businesses across multiple economic industries has allowed 3M to post consistent profits year after year, even during recessions.

In many instances, weakness in one or multiple segments has been offset by strength in other areas, giving the company steady growth over time.

At the same time, companies need to reinvent themselves as time passes, to stay on top of economic trends and continue on a path of long-term growth. Mergers and acquisitions are a part of 3M’s long-term growth plan, as are occasional divestitures and spinoffs.

The company recently announced that it would undergo a major change, and spinoff its healthcare segment into an independent company.

For investors, the question now is how the spinoff will impact the long-term direction of the business. This article will attempt to answer this question.

3M Spinoff Overview

3M is a leading global manufacturer, with operations in more than 70 countries. The company has a product portfolio comprised of over 60,000 items, which are sold to customers in more than 200 countries. These products are used every day in homes, office buildings, schools, hospitals, and others.

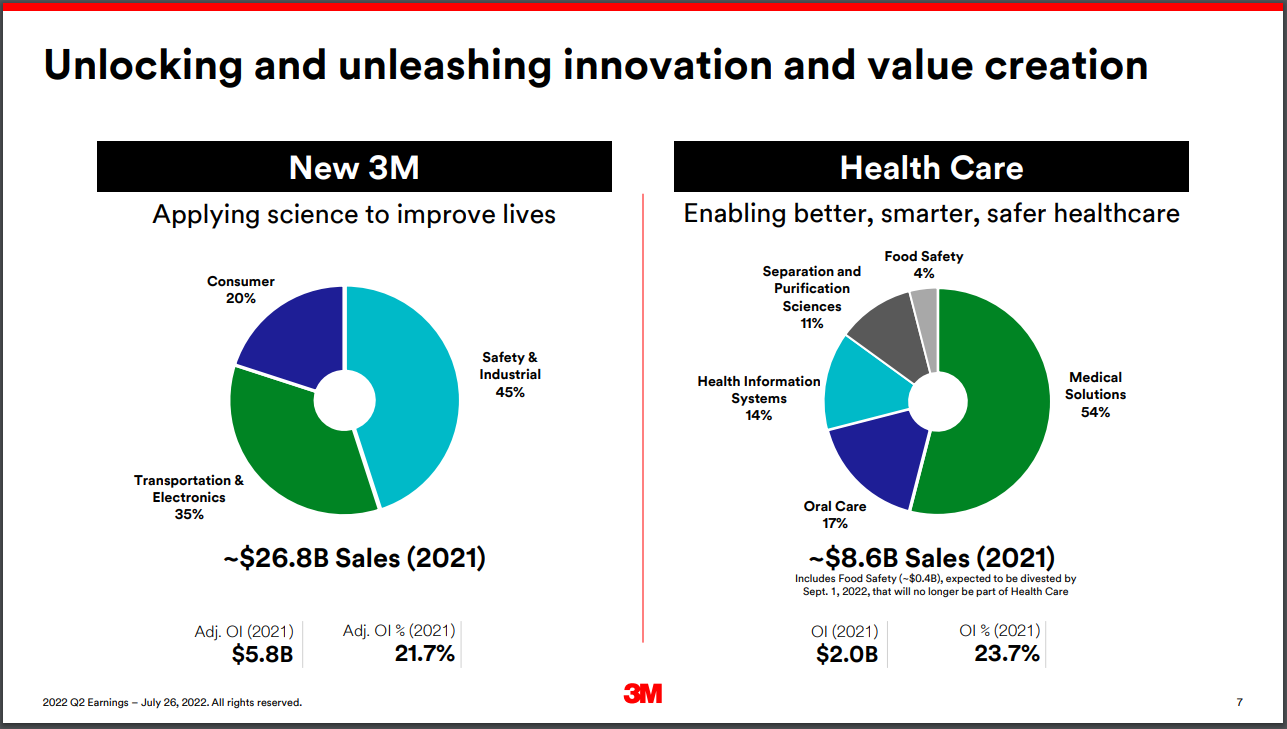

For the time being, 3M operates four separate segments: Safety & Industrial, Transportation & Electronics, Consumer, and Healthcare.

On July 26th, the company reported second-quarter results. For the quarter, revenue fell 3% to $8.7 billion. Adjusted EPS declined 10% year-over-year, from $2.75 in Q2 2021 to $2.48 in Q2 2022.

Along with its quarterly results, the company separately announced that it will spinoff its healthcare segment. This is a major announcement, as the healthcare business itself generates over $8 billion in annual sales.

Source: Investor Presentation

The new 3M will consist of the segments which generated $26.8 billion of sales in 2021, while the healthcare spin-off will retain the product portfolio which generated $8.6 billion of sales in 2021.

3M intends the transaction to be a tax-free spinoff into a standalone publicly-traded company. The “new” 3M is expected to retain a 19.9% stake in the healthcare company, which may be divested over time.

The new healthcare company is also expected to have a net leverage of 3.0x–3.5x adjusted EBITDA. While this is fairly high, 3M expects rapid deleveraging.

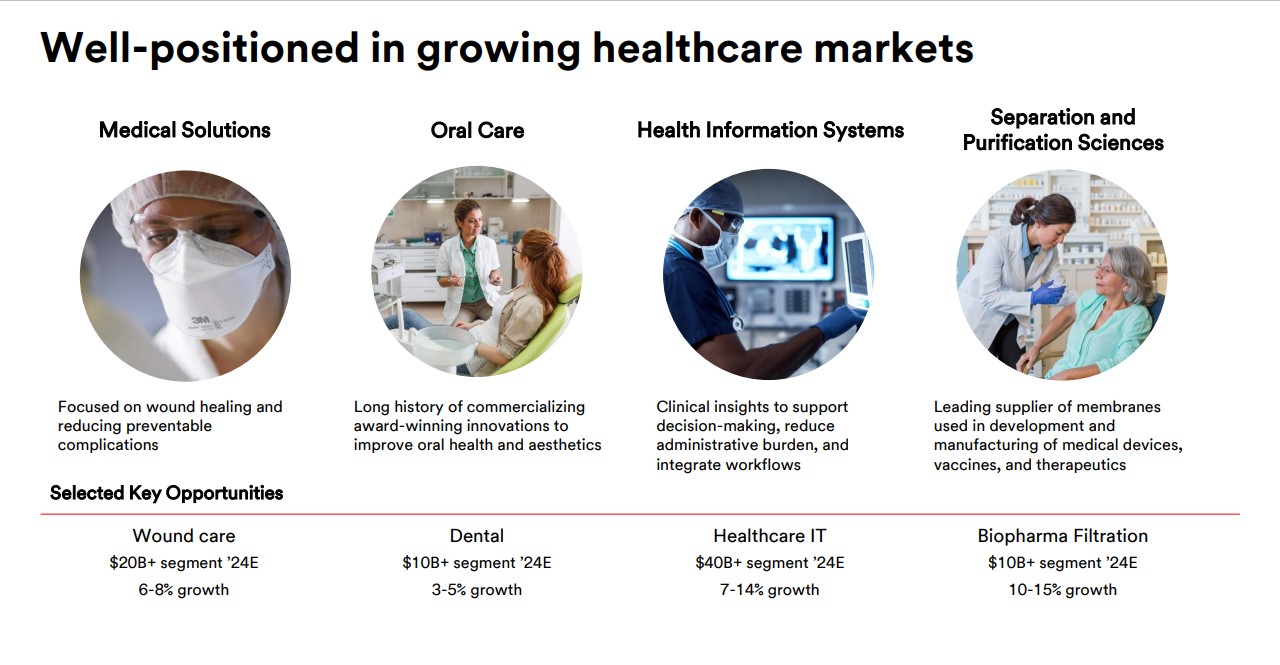

The stand-alone healthcare technology business will focus on wound care, oral care, healthcare IT, and biopharma filtration. The spin-off is expected to be complete by the end of 2023.

How Will the Spinoff Impact Future Growth?

3M has been in business for over a century, which may prompt investors to ask why the company would spinoff one of its largest operating segments.

Generally, companies pursue spinoffs for a few common reasons. Spinning off a segment makes it its own publicly-traded entity, with its own dedicated management team. This provides the new entity greater resources than it had under the umbrella of its former parent company.

In addition, there is usually a view among company management that the post-spinoff entities can earn a higher cumulative valuation than the single entity previously had. This is often done after management performs a sum-of-the-parts valuation analysis of the underlying businesses.

There is also precedent for large companies to pursue spinoffs as a way of generating better long-term growth (and value for shareholders). For example, Pfizer (PFE) separated its consumer segment in 2018 before combining it with GlaxoSmithKline’s (GSK) consumer business just a few months later.

More recently, diversified healthcare giant Johnson & Johnson (JNJ) announced it will spinoff its consumer healthcare business from its pharmaceutical and medical devices businesses.

To summarize, the motivation behind such a shift in strategy is likely due to the goal of unlocking value for shareholders. By focusing on its core industrial businesses while allowing its healthcare business to flourish on its own, the “new” 3M is likely to receive a higher valuation from the market, as these businesses generate higher growth.

How Should 3M Shareholders React?

A sizeable change in direction for one of the country’s oldest companies could be a shock to many shareholders. That said, we feel that investors shouldn’t panic and sell their positions. Instead, we recommend investors receive shares of the new company and hold through the spinoff.

Going forward, the “new” 3M will be able to focus on its own strategic growth priorities, which include automotive/mobility, electronics, sustainability, digitization, robotics and automation, e-commerce, and more.

Meanwhile, the healthcare spinoff will have a strong business of its own, with annual sales of approximately $8.6 billion, earnings before interest, taxes, depreciation, and amortization (EBITDA) of $2.7 billion, and EBITDA margins of 31% last year.

The new healthcare company will have diversification of its own, with leading products and services across multiple areas including medical solutions, oral care, health information systems, and separation and purification sciences. Each of these segments is large, and growing.

Source: Investor Presentation

What many shareholders are probably most concerned with is how this will impact the company’s dividend. After all, 3M has one of the longest dividend growth streaks in the entire stock market, at 64 years. The payout ratio is also reasonable, expected at 56% of adjusted EPS for 2022.

Investors can look back at other similar separations to see what the future of the dividend holds. Other healthcare companies that have split have continued to raise dividends, with Abbott Laboratories (ABT) and AbbVie Inc. (ABBV) being the most prominent example.

The two combined dividends of these companies are greater today than at the time that they were separated in 2013. Both companies have continued to raise their dividends in the years since they separated.

We believe that the eventual separation of the healthcare segment will not result in a lower combined dividend than what shareholders currently receive. For its part, 3M management stated in the spinoff announcement that it does not anticipate any change in its capital allocation priorities through the separation.

Of course, what happens moving forward is what’s important for current shareholders. Much depends on the future growth of the new 3M, and the healthcare company. Both companies should continue to grow their sales and earnings in the years ahead. For this reason, we believe both companies will have the ability to raise their respective dividends each year, as the current 3M has done for over 60 years.

Final Thoughts

3M has a long history of steady growth over the decades. Since its inception, it has routinely utilized acquisitions to supplement its growth, but it has rarely reorganized its business in such a dramatic fashion as the planned spinoff of the healthcare business.

The upcoming spinoff may be a concern for 3M shareholders. After reviewing the details of the spinoff, it appears both companies will be able to continue growing. The new 3M and the healthcare company both possess durable competitive advantages and specific long-term growth catalysts.

We remain confident that 3M will create greater shareholder value with the spinoff, and the dividend looks very safe.

Therefore, we feel 3M will remain a top dividend growth stock to own. It is likely the new company receives a higher valuation and the new healthcare company will attain its own leadership position in the healthcare industry.

Additional Reading

The following Sure Dividend lists contain many more high-quality dividend stocks:

- The Dividend Aristocrats: S&P 500 stocks with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the Dividend Aristocrats with the highest current yields.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks: Monthly dividend stocks with the highest current yields.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Complete List of Russell 2000 Stocks: arguably the world’s best-known benchmark for small-cap U.S. stocks.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The 2022 High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The 2022 High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The 2022 Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta.