2 Microcap Value Plays

Previously we had commented on how to value microcaps with lumpy revenue. See https://www.zacks.com/stock/news/2279978/how-to-invest-in-microcaps-with-lumpy-revenue.

Here we highlight 2 new names in this vein.

Image Source: Zacks Investment Research

AMREP Corporation (AXR), operates substantially from Rio Rancho, NM, primarily engaging in land development and homebuilding. AMREP (AXR) owns approximately 17,000 acres in Sandoval County, NM, and markets land for sale or lease to homebuilders and developers.

What makes the financial performance lumpy is the periodic sale of land. So “transactional timing” creates uneven performance. There is a constant trade-off between selling land or developing it and/or building on it.

The balance sheet reflects a tangible book value of about $25/share, suggesting a 16% discount at the current

price of $21. The majority of the $68.5 m real estate inventory is land inventory ($56.4 m) with the remainder completed or in progress homebuilding.

The company is debt-free with $44.6 m in cash. Most importantly, Sandoval County, NM consistently gets high ratings for housing affordability and has positive population growth and income characteristics.

At this point, in our opinion, we don’t foresee land values cratering in this area. So we believe the stock appears undervalued here. But as the chart above reflects, the stock price has shown sensitivity to interest rates.

The stock responded favorably to rates falling from 5% to 4% but appears to have responded less favorably to more static rates.

Bear in mind that AMREP (AXR) is still profitable with positive cash flow despite the significant reduction in land sales.

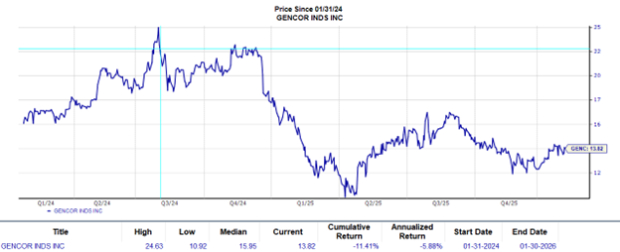

The other microcap, Gencor Industries, Inc. (GENC), also appears undervalued, in our opinion. Gencor Industries, Inc. (GENC) is a manufacturer of heavy machinery used in the production of highway construction equipment, materials and environmental control systems. It designs, manufactures and sells asphalt plants, asphalt pavers, combustion systems and fluid heat transfer systems.

While the company reported a slight operating loss ($.2 m) in the September quarter, net income was positive due to interest, dividend, and security gain income. So the company is profitable with positive FCF yet trades near tangible book value of $14.40/share.

The company has no long-term debt and cash and marketable securities of $136.3 m.

Importantly, the company is poised to benefit from future outlays of the Infrastructure Investment and Jobs Act (IIJA). According to the Department of Transportation, as of September 30, 2025, nearly 60% of the authorized funds have yet to be disbursed, although the cadence and timing of the release of funds remains unknown.

Image Source: Zacks Investment Research

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

See Our Newest 5 Stocks Set to Double Picks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gencor Industries Inc. (GENC): Free Stock Analysis Report

AMREP Corporation (AXR): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com