Published on February 1st, 2022 by Bob Ciura

Lumber prices have been on a tear, recently hovering at just over $1,000 per 1,000 board feet. Even after a drop from its 52-week high above $1,600, lumber prices are still up significantly in the past year.

Inflation has picked up in the U.S., while demand for housing and construction remains robust. As a result, investors might want to know more about lumber stocks.

With this in mind, we created a list of over 20 lumber stocks. You can download the list (complete with important financial metrics such as price-to-earnings ratios and dividend yields) by clicking on the link below:

The lumber stocks list was derived from the following exchange-traded funds:

- iShares Global Timber & Forestry ETF (WOOD)

- Invesco MSCI Global Timber ETF (CUT)

This article will give an overview of the lumber industry, and the top 4 lumber stocks right now.

Table of Contents

You can instantly jump to a specific section of the article by clicking on the links below:

- Lumber Industry Overview

- Lumber Stock #4: Weyerhaeuser (WY)

- Lumber Stock #3: WestRock Co. (WRK)

- Lumber Stock #2: International Paper (IP)

- Lumber Stock #1: Amcor plc (AMCR)

- Final Thoughts

Lumber Industry Overview

Broadly, the lumber industry is involved in forestry, logging, and the timber trade. It is also engaged in the production of wood products, as well as secondary products such as pulp that is used in the packaging and paper industry.

Fundamentals of the lumber industry remain healthy. According to IBIS World, the lumber wholesaling market in the U.S. grew at a 6.2% compound annual rate from 2017-2021. This exceeded the comparable growth rate of the broader U.S. economy.

There are many reasons for this.

First, the U.S. economy in general remains in good condition, with the unemployment rate falling below 4% in December 2021. Employment continued to rise in multiple industries, including construction.

Growth in employment and wages has coincided with rising home prices. In turn, this has boosted demand for construction projects and home building.

At the same time, 2022 could be a step backwards for the lumber industry. IBIS World expects the lumber market to decline by 2.2% this year, as the industry cools off a bit from pent-up demand seen in 2021.

Moreover, the Federal Reserve has signaled it will begin raising interest rates in 2022, perhaps as soon as March. Rising interest rates, designed to combat inflation, could be a headwind for the lumber industry.

That said, there are still a number of high-quality lumber stocks for investors looking to enter the lumber industry. The top 4 lumber stocks below are ranked in order of expected returns in the Sure Analysis Research Database, from lowest to highest.

Lumber Stock #4: Weyerhaeuser (WY)

- 5-year expected annual returns: 3.4%

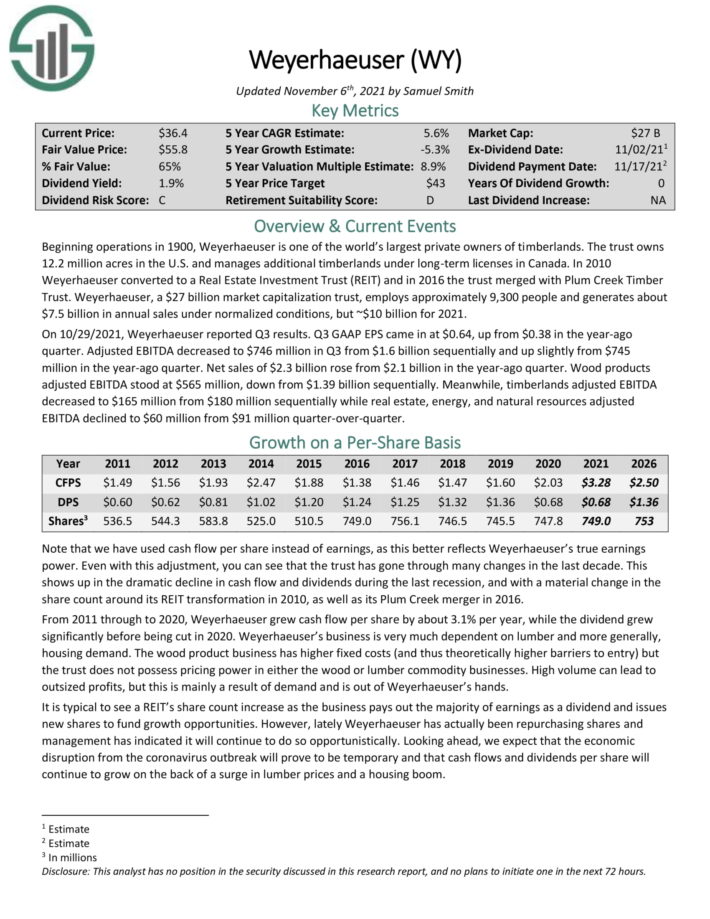

Weyerhauser began its operations in 1900. Today, it is one of the world’s largest private owners of timberlands. The company is structured as a Real Estate Investment Trust, or REIT.

Related: 2022 REITs List

The trust owns 12.2 million acres in the U.S. and manages additional timberlands under long–term licenses in Canada. Weyerhaeuser stock has a $30 billion market capitalization.

The company performed well in 2021. In the third quarter, EPS came in at $0.64, up from $0.38 in the year–ago quarter. Net sales of $2.3 billion rose from $2.1 billion in the year–ago quarter.

Click here to download our most recent Sure Analysis report on Weyerhaeuser (preview of page 1 of 3 shown below):

Lumber Stock #3: WestRock Co. (WRK)

- 5-year expected annual returns: 6.7%

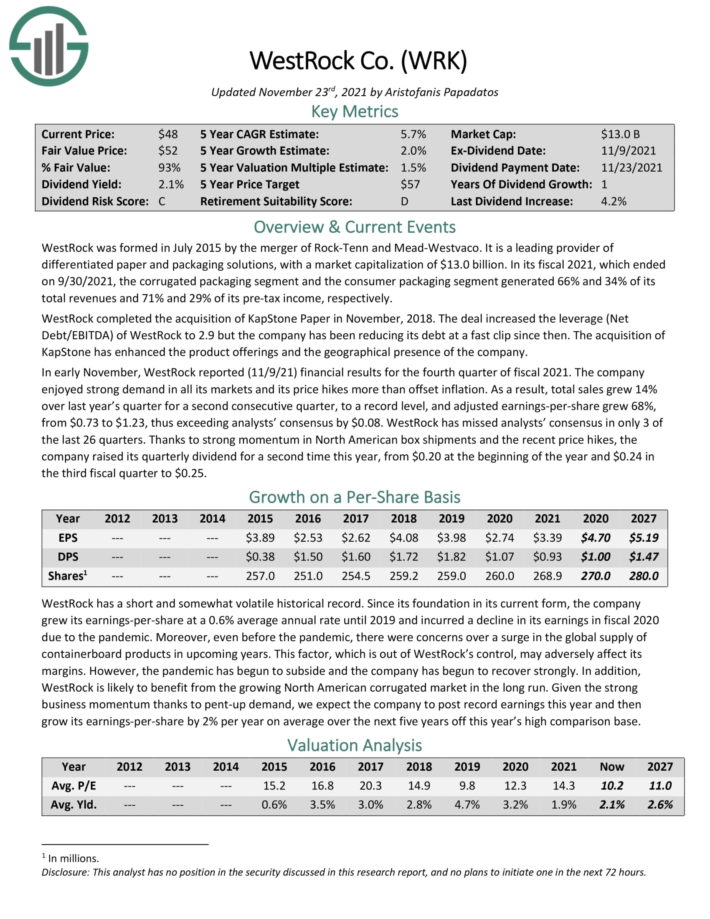

WestRock Company was formed in July 2015 by the merger of Rock–Tenn and Mead–Westvaco. It is a leading provider of differentiated paper and packaging solutions, with a market capitalization of $11 billion.

The company has two operating segments, corrugated packaging and consumer packaging. In fiscal 2021, the corrugated packaging segment and the consumer packaging segment generated 66% and 34% of its total revenues, respectively.

In early November, WestRock reported (11/9/21) financial results for the fourth quarter of fiscal 2021. The company enjoyed strong demand in all its markets and its price hikes more than offset inflation.

As a result, total sales grew 14% for a second consecutive quarter, and reached a record level. Adjusted earnings–per–share grew 68%, exceeding analysts’ consensus.

Click here to download our most recent Sure Analysis report on WestRock (preview of page 1 of 3 shown below):

Lumber Stock #2: International Paper (IP)

- 5-year expected annual returns: 6.7%

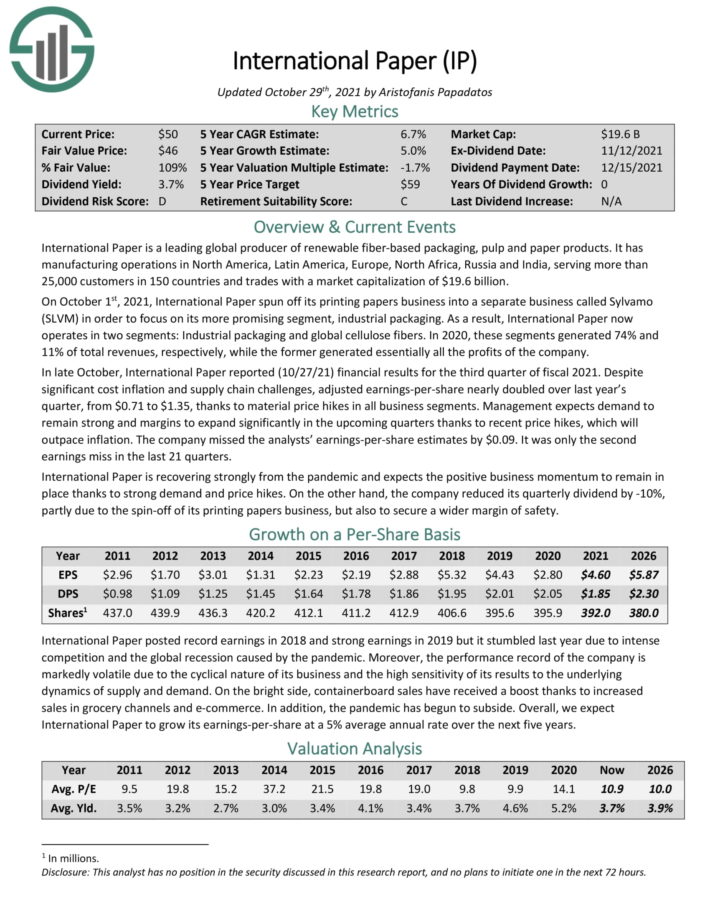

International Paper is a leading global producer of renewable fiber–based packaging, pulp and paper products. It has manufacturing operations in North America, Latin America, Europe, North Africa, Russia and India, serving more than 25,000 customers in 150 countries and trades with a market capitalization of $18 billion.

On October 1st, 2021, International Paper spun off its printing papers business into a separate business called Sylvamo (SLVM) in order to focus on its more promising segment, industrial packaging.

As a result, International Paper now operates in two segments, Industrial Packaging and Global Cellulose Fibers. The Industrial Packaging segment is by far the larger of the two.

Click here to download our most recent Sure Analysis report on International Paper (preview of page 1 of 3 shown below):

Lumber Stock #1: Amcor plc (AMCR)

- 5-year expected annual returns: 8.2%

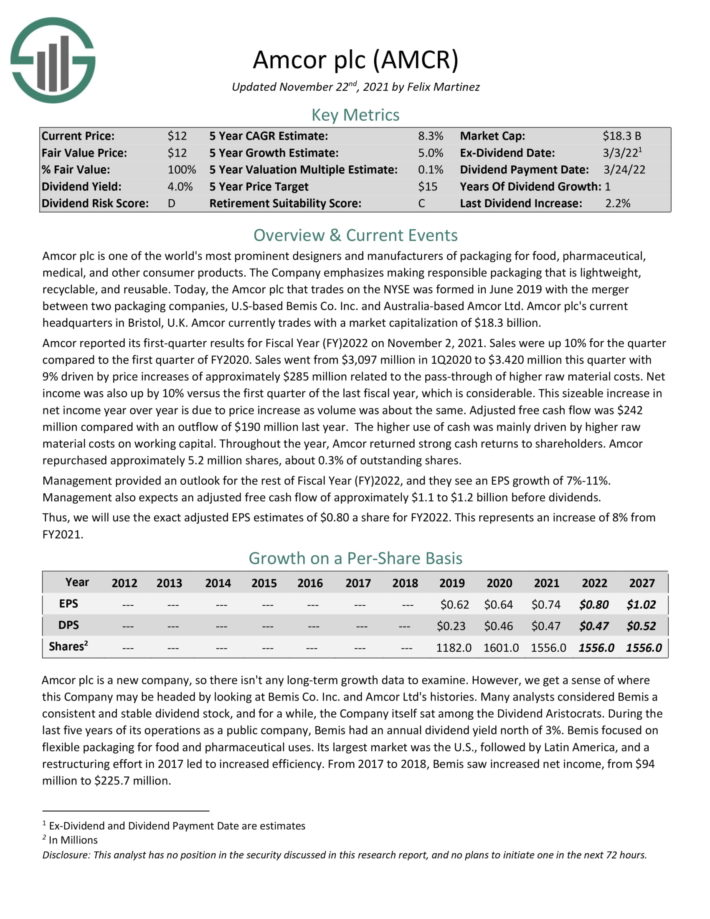

Amcor is our top-ranked lumber stock, not just because of its high expected returns, but also because of its impressive dividend history.

Amcor has increased its dividend for over 25 consecutive years, placing it on the Dividend Aristocrats list. There are only 66 Dividend Aristocrats, including Amcor.

You can see the entire Dividend Aristocrats list here.

Amcor is one of the world’s most prominent designers and manufacturers of packaging for food, pharmaceutical, medical, and other consumer products. The company is headquartered in the U.K.

The company reported its first–quarter results for fiscal 2022 on November 2, 2021. Sales were up 10% for the quarter, with the vast majority of growth in the form of price increases. Net income was also up by 10% versus the first quarter of the previous fiscal year.

Management also provided an outlook for the rest of fiscal 2022, which calls for 7%-11% earnings-per-share growth for the full year. Management also expects an adjusted free cash flow of approximately $1.1 to $1.2 billion before dividends.

Click here to download our most recent Sure Analysis report on Amcor (preview of page 1 of 3 shown below):

Final Thoughts

Lumber prices have risen sharply in the past year. Whether the recent rise in lumber prices continues depends on many factors, including interest rates, housing activity, and the health of the broader U.S. economy.

In turn, lumber stocks could perform well going forward, if the positive industry trends continue. As a result, these lumber stocks may be attractive to investors looking for exposure to the lumber industry.

Of the top 4 lumber stocks mentioned above, we believe Amcor is the top lumber stock due to its strong business model, high expected returns, and attractive dividend.