Updated on February 25th, 2021 by Samuel Smith

Investors looking to generate higher levels of income from their investment portfolios should take a look at Real Estate Investment Trusts, or REITs. These are companies that own real estate properties and lease them to tenants or invest in real estate backed loans, both of which generate a steady stream of income.

The bulk of their income is then passed on to shareholders, through dividends. You can see all ~170 REITs here.

You can download our full list of REITs, along with important metrics such as dividend yields and market capitalizations, by clicking on the link below:

Click here to download your Complete REIT Excel Spreadsheet List now. Keep reading this article to learn more.

The beauty of REITs, for income investors, is that they are required to distribute 90% of their taxable income to shareholders annually, in the form of dividends. In return, REITs typically do not pay corporate taxes. As a result, many of the 171 dividend-paying REITs we track offer high dividend yields of 5%+.

Bonus: Listen to our interview with Brad Thomas on The Sure Investing Podcast about intelligent REIT investing in the below video.

But not all high-yielding stocks are automatic buys. Investors should carefully assess the fundamentals to ensure the high yields are sustainable. This article will discuss 10 of the highest-yielding REITs around with market capitalizations above $1 billion.

Note that while the securities in this article have very high yields, a high yield alone does not make for a solid investment. Dividend safety, valuation, management, balance sheet health, and growth are all very important factors as well.

We urge investors to use the above article as informative, but to do significant due diligence before buying into any security – and especially high yield securities. Many (but not all) high yield securities have significant risk of a dividend reduction and/or deteriorating business results.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

- High-Yield REIT No. 10: Two Harbors Investment Corp. (TWO)

- High-Yield REIT No. 9: New Residential (NRZ)

- High-Yield REIT No. 8: Office Properties Income Trust (OPI)

- High-Yield REIT No. 7: Global Net Lease (GNL)

- High-Yield REIT No. 6: Ladder Credit Corp. (LADR)

- High-Yield REIT No. 5: Blackstone Mortgage Trust (BXMT)

- High-Yield REIT No. 4: Starwood Property Trust (STWD)

- High-Yield REIT No. 3: AGNC Investment Corp. (AGNC)

- High-Yield REIT No. 2: Annaly Capital Management (NLY)

- High-Yield REIT No. 1: Apollo Commercial Real Estate Finance (ARI)

High-Yield REIT No. 10: Two Harbors Investment Corp. (TWO)

- Dividend Yield: 8.0%

Two Harbors Investment Corp. focuses on investing in, financing, and managing residential mortgage-backed securities (RMBS), non-agency securities, mortgage servicing rights, and other financial assets in the United States.

Its target assets include agency RMBS collateralized by fixed rate mortgage loans, adjustable rate mortgage loans, and hybrid adjustable-rate mortgage (ARMs); non-agency securities collateralized by prime mortgage loans, Alt-A mortgage loans, pay-option ARM loans, and subprime mortgage loans; and other assets, such as financial and mortgage-related assets, as well as residential mortgage loans and non-hedging transactions.

Two Harbors Investment Corp. was incorporated in 2009 and is headquartered in New York, New York.

Source: Earnings Presentation, page 21

On February 9th, TWO reported fourth quarter results. Core earnings-per-share came in at $0.30, up from $0.28 in Q3. Book value per share also increased sequentially to $7.63 from $7.37 in Q3. 60+ day delinquencies declined from 4.1% in Q3 to just 3.2% in Q4.

That said, the total portfolio size declined from $24.4 billion to $21.8 billion, quarter-over-quarter, and the annualized net yield for the aggregate portfolio declined from 1.78% to 1.76%, quarter-over-quarter.

Looking ahead, the company is combining Agency RMBS and MSR which it believes will generate mid-double digits at a lower risk. Meanwhile, their discounted legacy non-Agencies continue to benefit from residential tailwinds that support strong total returns. Baseline returns to lower priced bonds will come in the high single digits and upside price appreciation can drive total returns in low-to-mid double digits.

As deeply discounted legacy non-Agency securities realize their upside potential, management expects to recycle capital into the best market opportunities available at the time.

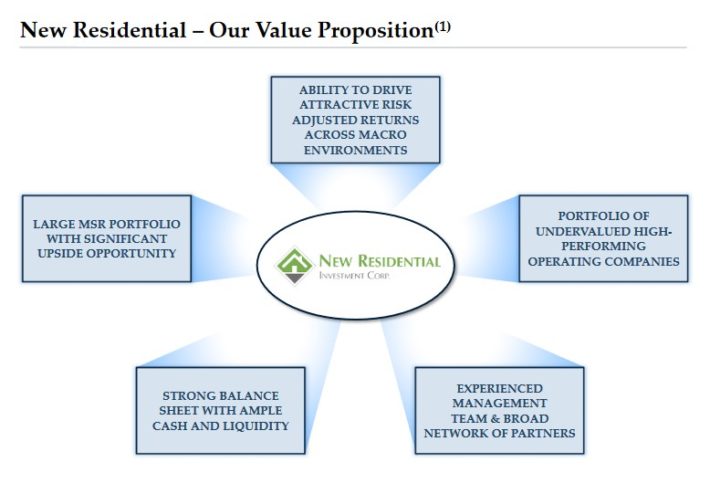

High-Yield REIT No. 9: New Residential (NRZ)

- Dividend Yield: 8.1%

New Residential Investment Corporation is a real estate investment trust that invests in Excess Mortgage Servicing Rights (MSRs), real estate securities, residential mortgage loans, consumer loans, and other real estate-related securities. The REIT is focused on the residential real estate market. New Residential was founded in 2013 as a spin-off of Newcastle Investment Corporation, and is headquartered in New York, NY.

Source: Earnings Presentation, page 30

New Residential reported its fourth quarter and full year earnings results on February 9th. Fourth-quarter funded origination volume came in at $23.9 billion while forbearances on the full MSR portfolio fell to 5.3%, from 6.8% sequentially. Core earnings-per-share in Q4 came in at 32 cents, up slightly from 31 cents sequentially. They achieved record quarterly originated funded production in Q4 of $23.9 billion in unpaid principal balance, up a whopping 32% quarter-over-quarter and 125% year-over-year.

New Residential is not a typical mortgage REIT, as it is primarily active in the mortgage servicing rights (MSR) field. Mortgage servicing rights are paid by financial institutions that do not want to handle the mortgage loan, and that outsource the back office work in exchange for a certain amount of the unpaid principal balance of such loans. These MSRs are partially paid to the licensed mortgage service that gets the basic servicing fees, but a part of the MSR can be sold to other parties such as New Residential.

These so-called excess MSRs allow New Residential to acquire a small part of the cash flows a mortgage generates for a very low price, which is why New Residential is able to generate relatively strong cash flows and earnings relative to its asset holdings. This business model requires New Residential’s management to find attractively priced MSRs, mortgage-backed securities and other assets that the company invest in to grow the portfolio, especially as existing debt securities that New Residential owns will, at one point, get paid off.

This approach has worked out very well for New Residential and its shareholders recently, as management has been able to grow the mREIT’s asset base fast and very profitably. However, it will likely get harder for the company to find the assets it seeks as less housing starts, and lower mortgage originations will limit the size of the asset base New Residential can invest in. This will likely make it harder to make accretive asset purchases during the coming years, which is why our growth estimate is relatively low.

New Residential does not have a long history as a standalone company, but during the years of its existence its dividend payout ratio has been quite high. The company pays out more than 80% of its earnings right now, which is why we do not rate New Residential’s dividend as overly safe.

Since New Residential was only spun off in 2013, we do not have data on how it performs during a major recession. Due to the nature of the assets New Residential invests in, which includes risky items such as credit-card debt and unsecured mortgages, it is appropriate to assume that New Residential’s profitability would be hit relatively hard during a steep economic downturn.

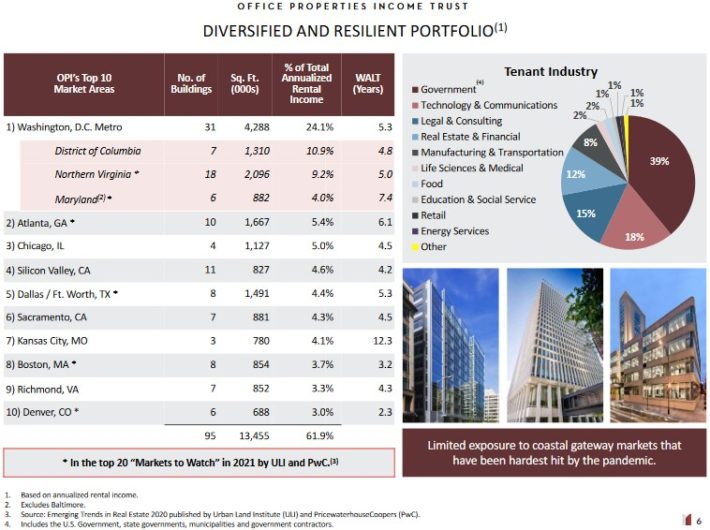

High-Yield REIT No. 8: Office Properties Income Trust (OPI)

- Dividend Yield: 8.6%

Office Properties Income Trust (OPI) is a REIT that currently owns 184 buildings, which are primarily leased to single tenants with high credit quality. The REIT’s portfolio currently has a 91.2% occupancy rate and an average building age of 17 years.

On 12/31/2018, the predecessor company – Government Properties Income Trust – merged with Select Income REIT (SIR) and the combined company was renamed Office Properties Income Trust. The aggregate transaction value was $2.4 billion, including the assumption of $1.7 billion of debt from SIR. The combined company has enhanced geographic diversification and one of the highest percentages of rent paid by investment-grade rated tenants in the REIT universe.

The U.S. Government is the largest tenant of OPI, as it represents 39% of the annual rental income of the REIT. After acquiring First Potomac Realty Trust (FPO) in 2017 and merging with SIR, OPI is now in the process of selling assets to reduce its leverage to a healthy level.

Source: Earnings Slides, page 6

On February 18th, OPI reported its Q4 results. Cash available for distribution came in at $0.88 per share, up 6.5% year-over-year. Same property cash basis NOI was also very healthy with 5.1% year-over-year growth and they completed 2 million square feet of leasing during FY 2020 with a 6.9% roll-up in rents.

OPI generates 65% of its annual rental income from investment-grade tenants. This is one of the highest percentages of rent paid by investment-grade tenants in the REIT sector. Moreover, U.S. Government tenants generate about 39% of total rental income and no other tenant accounts for more than 3% of annual income. This exceptional credit profile constitutes a meaningful competitive advantage.

On the other hand, OPI has greatly increased its debt load after its latest acquisition. Its net debt is excessive, as it stands at $2.2 billion, which is about 8 times the annual funds from operations and twice as much as the current market capitalization of the REIT. However, OPI is in the process of selling more than $1.0 billion of its assets and hence it is likely to drive its leverage to healthier levels in the near future.

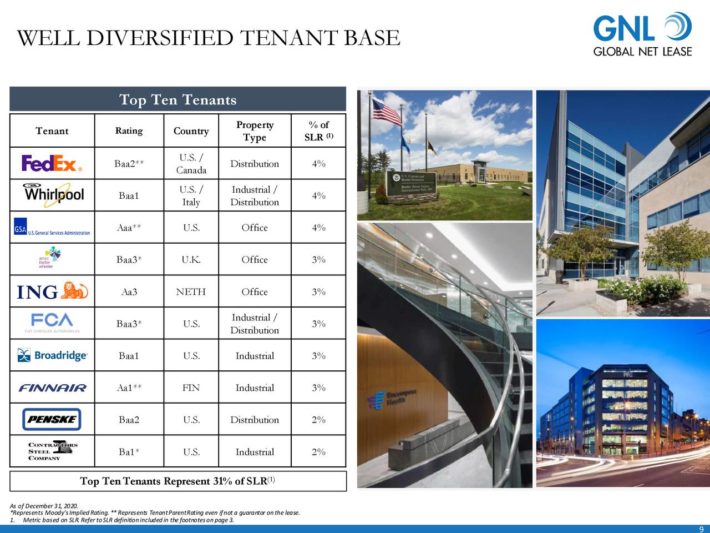

High-Yield REIT No. 7: Global Net Lease (GNL)

- Dividend Yield: 8.6%

Global Net Lease is a Real Estate Investment Trust (REIT) investing in commercial properties in the U.S (56% of locations) and Europe (44% of locations) with an emphasis on sale-leaseback transactions. The company owns over 350 properties. Office properties are the largest sector, with industrial / distribution making up a very large portion of the portfolio as well, while retail rounds out the remainder.

Source: Earnings Slides

On February 24th, Global Net Lease reported Q4 and full year 2020 results for the period ending December 31st, 2020. For the quarter, revenue increased 13.4% year-over-year to $87 million, while FFO-per-share came in at $0.45. Management impressively collected 99% of Q4 cash rents including 100% from their top 20 tenants through February 22,2021.

Note that Global Net Lease was not publicly listed until 2015, which results in a very short observation history. In addition, the company does not directly report AFFO per share, a measure we find to be more accurate for REIT valuation, but does calculate total AFFO for each year.

At first glance, Global Net Lease appears to be a reasonable REIT with a broadly diversified pool of tenants, including well-established names like FedEx, U.S. Customs, ING Bank, and Family Dollar, diversified across countries and continents. However, there are a variety of underlying concerns, especially as it relates to potential growth.

General concerns include potential conflicts of interest due to being externally managed by AR Global Investments (which invests for other entities), the office space industry requiring increased capex, and categorizing some of its tenants as investment grade using an “implied” credit model.

Global Net Lease pays out effectively all of its AFFO in the form of cash dividends. As such, future growth cannot be fueled by internal funds and instead require additional debt or share dilution. Even if the company continues to increase total AFFO, the real test will be whether or not AFFO-per-share can increase.

Global Net Lease maintains a reasonable capital structure, though it carries a sizable amount of preferred equity in addition to debt. Global Net Lease is adhering to a near 100% payout ratio and thus has to issue shares in good times, which makes us skeptical of the company’s performance during industry downturns.

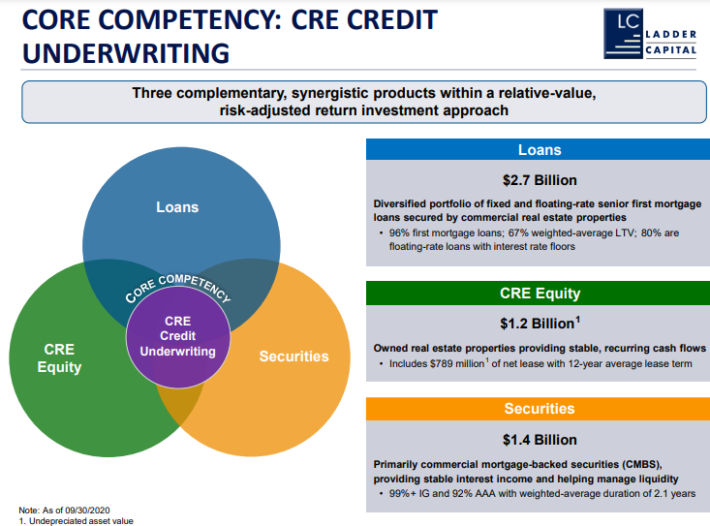

High-Yield REIT No. 6: Ladder Capital Corp. (LADR)

- Dividend Yield: 8.6%

Ladder Capital Corp. is a commercial real estate finance company structured as an internally managed REIT. LADR originates and invests in a portfolio of commercial real estate and real estate-related assets, diversified by region and property type. LADR capitalizes on CRE-related loans, securities and real estate and other investments.

LADR was founded in October 2008 and completed their IPO in February 2014. They received REIT status at the beginning of 2015, nearly one year after the IPO. LADR has a fully integrated, highly experienced management team and employs a large team of full-time industry professionals.

The company has over $6 billion worth of assets on its balance sheet, including $2.7 billion of loans, $1.4 billion of securities and $1.2 billion of real estate. The $2.7 billion loan portfolio is predominantly senior secured first mortgage loans. The securities portfolio is a source of stable recurring net interest income and is compromised mostly of CMBS bonds. The real estate portfolio is comprised of roughly 7.7 million square feet and is a source of stable recurring cash flows with potential NAV upside. It is financed with long-term, non-recourse, fixed-rate financing.

Source: Investor Presentation, page 6

Ladder Capital’s most recent earnings release was Q3 earnings on October 29th. They announced core earnings of $19.7 million, or $0.16 of core earnings-per-share. After-tax core returns on average equity was 5.1%, down from 10.9% in the same quarter last year.

Compared to the third quarter of last year, core EPS fell 58% from $0.38. Year-to-date, core EPS fell 54% from $1.20 to $0.55. The company reduced debt by $967 million and increased unrestricted cash by $517 million. As of the end of the third quarter, the company had $876 million on cash on the balance sheet.

The payout ratio for LADR is calculated as dividends per share divided by core EPS. The payout ratio was very high in 2015, however that was the first year that LADR became an REIT and began paying out virtually all its taxable income as distributions to qualify for its status as REIT. Barring the 2015 outlier, the payout ratio has averaged 82%.

The competitive advantage LADR has is its experienced management team with over 145 years of cumulative experience. Management and director interests are aligned with shareholders as they own a significant portion of LADR stock.

High-Yield REIT No. 5: Blackstone Mortgage Trust (BXMT)

- Dividend Yield: 8.6%

Blackstone Mortgage Trust is a real estate finance company primarily involved in the origination and purchase of senior loans collateralized by commercial properties in North America and Europe.

The vast majority of the company’s asset portfolio is comprised of floating rate loans secured by first priority mortgages primarily derived from office, hotel, and manufactured housing properties. A significant percentage of the collateralized real estate properties are located in New York, California, and the United Kingdom. Blackstone Mortgage Trust is managed by a subsidiary of The Blackstone Group and benefits from the market data provided by its parent company.

Source: Earnings Slides, page 4

The trust reported Q4 earnings on February 10th. Distributable earnings-per-share came in at $0.60, down from $0.63 sequentially. Net income from loans and other investments fell year-over-year to $109.5 million compared to $109.7 million in Q4 2019. That said, the company still collected 100% of interest payments in Q4 and 99.7% for the year while improving its debt-to-equity ratio by 0.1x sequentially. Considering that interest rates declined year-over-year and the COVID-19 disruptions, these results are not bad.

Blackstone Mortgage Trust’s competitive advantages clearly stem from its scale as one of the largest commercial mortgage REITs, as well as its age (founded in 1966), which have enabled it to build up a long track record.

Additionally, the network it shares with its parent Blackstone – a global asset management giant – and the name brand and relationships that come with it give it access to deal flows that many of its peers do not have. Not to mention, the cross-industry expertise, global macro insight, and scale of capital that can lead to outperforming risk-adjusted returns over time.

As the last recession illustrated, Blackstone Mortgage Trust’s business is not recession-resistant. Though the company and the mortgage industry have taken steps to improve their underwriting practices to make such an occurrence unlikely to occur again, this is not the best stock to hold when a downturn hits the commercial real estate markets in which it operates.

At the same time, however, we do believe that Blackstone’s conservatively financed portfolio (average loan to value ratio is in the low-60% area currently and the portfolio is 100% performing) will prevent it from experiencing deep losses in the event of a slowdown, and the long-term trend will remain upward.

High-Yield REIT No. 4: Starwood Property Trust (STWD)

- Dividend Yield: 8.6%

Starwood Property Trust, Inc. is a real estate investment trust that operates in the commercial mortgage space. Starwood originates, acquires, finances, and manages commercial mortgage loans and other debt and equity investments. It has multiple operating segments which include Real Estate Lending, Real Estate Property, and Real Estate Investing and Servicing.

Real Estate Lending investments include commercial first and subordinated mortgages, mezzanine loans, preferred equity, and residential mortgage loans. The Real Estate Property segment consists of acquiring equity interests in commercial real estate properties. The Real Estate Investing and Servicing segment mostly invests in unrated, investment grade, and non-investment grade commercial real estate assets.

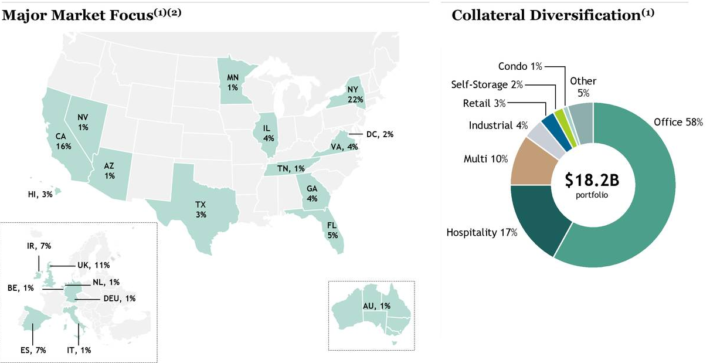

A snapshot of the company’s commercial portfolio can be seen in the image below:

Source: Investor Supplemental

Starwood generated fourth-quarter distributable earnings-per-share of $0.50, and full-year DEPS of $1.98. The company continues to invest in growth, even in the face of the coronavirus pandemic. Starwood originated or acquired $4.6 billion of assets in 2020.

Starwood does not have many competitive advantages in our view. Starwood’s primary benefit is its talent, and its ability to make successful investments, both of which can be finicky. In addition, Starwood is not a recession-resistant trust. A tightening credit cycle, flattening yield curve, or downturn in the commercial real estate industry would all have a significant negative impact.

The mortgage REIT business model calls for very high leverage. This makes stocks in the industry inherently risky. The low interest rate environment during the years after the Great Recession allowed Starwood to increase its debt and earn strong returns for shareholders. Given where things are headed in the wake of the coronavirus outbreak, we expect growth to remain weak and view the dividend as being at risk if conditions should worsen.

High-Yield REIT No. 3: AGNC Investment Corp. (AGNC)

- Dividend Yield: 8.8%

American Capital Agency Corp was founded in 2008, and is a mortgage real estate investment trust that invests primarily in agency mortgage-backed securities (or MBS) on a leveraged basis. The firm’s asset portfolio is comprised of residential mortgage pass-through securities, collateralized mortgage obligations (or CMO), and non-agency MBS. Many of these are guaranteed by government-sponsored enterprises.

The majority of American Capital’s investments are fixed-rate agency MBS. Most of these are MBS with a 30-year maturity period. The counter-parties to most of American Capital’s assets are located in North America. Counter-parties in Europe also represent a significant percentage of the trust’s total portfolio. American Capital derives nearly all its revenue in the form of interest income.

AGNC reported its Q4 2020 results on January 25th, 2021. Q4 net spread and dollar roll income per share stood at 75 cents compared with consensus estimates of 65 cents and 81 cents in Q3 2020. Partially responsible for this success was AGNC’s forward purchase and sales of agency MBS in the TBA market that brought the average net long position to $33.8 billion.

The company’s net book value per common share also showed an increase from $15.88 on September 30, 2020 to $16.71 as of December 31, 2020. 36 cents in dividends per common share and the 83-cent increase in TNBV per common share generated an 7.5% economic return on tangible common equity for Q4.

The lower coupon, new production pools, and higher coupon specified pools are the reasons AGNC’s portfolio outperformed their hedge portfolio this quarter.

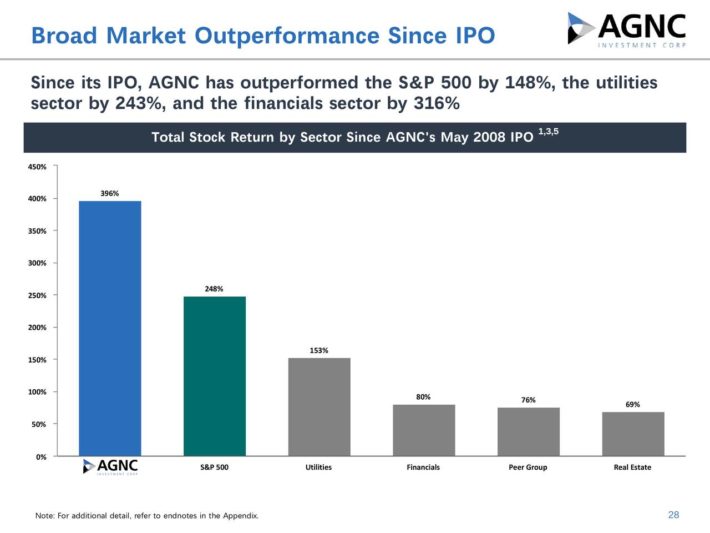

Source: Investor Presentation

Given that it had its IPO in 2008 – in the midst of the financial crisis – it is hard to get an accurate picture of exactly how it can be expected to perform during this recession. However, the mortgage backed security industry – given its leverage and interest rate sensitivity – is very prone to underperform when the housing market experiences a downturn and mortgage foreclosures rise. As a result, it should not be viewed as a safe, defensive stock.

That said, its record thus far has been fairly strong, with industry-leading total economic return (NAV-based) and total stock return (share price based). This outperformance has been driven by its highly efficient operating cost structure of approximately 0.8% of total equity capital, and the competitive advantage that it enjoys through economies of scale as one of only a few residential mortgage REITs with a market capitalization of above $5 billion.

The trust also strives to guard against downside and enhance shareholder total returns by utilizing a comprehensive risk management framework that is predicated on careful asset selection, disciplined hedging, and diversified funding.

High-Yield REIT No. 2: Annaly Capital Management (NLY)

- Dividend Yield: 10.6%

Annaly Capital Management, Inc., a diversified capital manager, invests in and finances residential and commercial assets. The company invests in various types of agency mortgage-backed securities, non-agency residential mortgage assets, and residential mortgage loans. It also originates and invests in commercial mortgage loans, securities, and other commercial real estate investments. Annaly provides financing to private equity-backed middle market businesses, and operates as a broker-dealer.

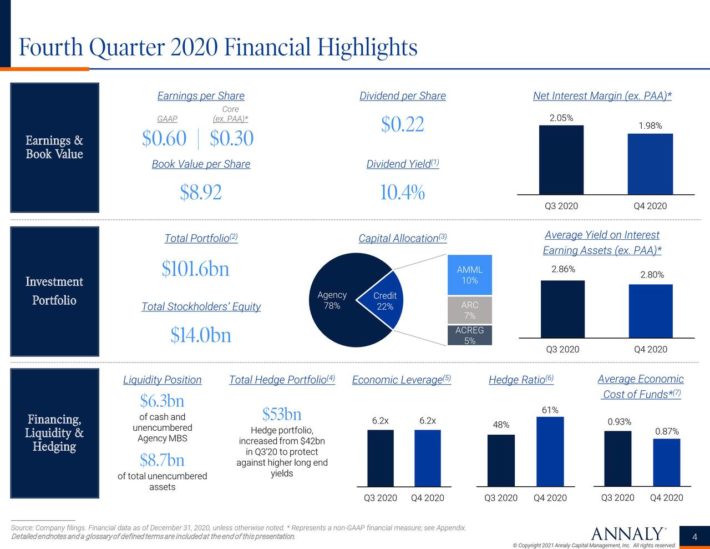

Source: Earnings Presentation, page 4

Q4 results were reported on February 10th. Core earnings-per-share came in at 30 cents, down from 32 cents sequentially. Economic leverage stood at 6.2x and the trust generated an economic return of 5.1% during Q4. Book value per common share increased by 2.5% to $8.92 while net interest margin shrank by 7 basis points to 1.98%, though net interest spread remained flat sequentially.

The advantage Annaly has over some of its mortgage REIT competitors is diversification of income streams, providing it the opportunity to pivot depending on the circumstance. That said, Annaly is very interest rate sensitive and just as it was able benefit from the drop in interest rates through larger spreads during the last recession, it is now being challenged by increasing interest rates and compression of spreads.

Although it is less leveraged than others in the sector, we have concerns that Annaly is using more leverage to generate results and issuing additional shares to drive capital expansion, rather than growing based on increased profitability.

High-Yield REIT No. 1: Apollo Commercial Real Estate Finance (ARI)

- Dividend Yield: 10.7%

Apollo Commercial Real Estate Finance, Inc. was founded in 2009. It is a real estate investment trust (REIT) that invests in debt securities including senior mortgages, mezzanine loans, and other commercial real estate-related debt. Apollo’s investments, placed in the U.S. and Europe, are collateralized by the underlying estate properties. Apollo is externally managed by ACREFI Management, LLC, an indirect subsidiary of Apollo Global Management, LLC.

Apollo Commercial Real Estate Finance holds a multi-billion dollar commercial real estate portfolio consisting of Hotels, Office Properties, Urban Predevelopment, Residential-for-sale inventory, and Residential-for-sale construction. The company’s portfolio is split up between Manhattan, New York, the United Kingdom, and the remainder of the U.S.

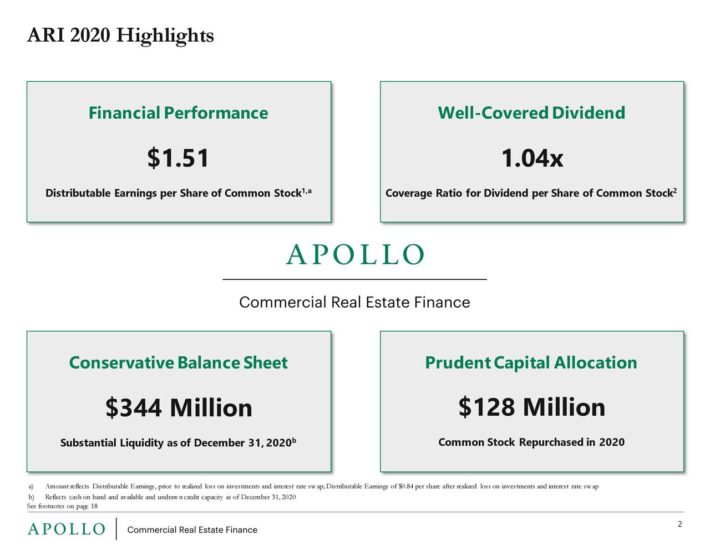

Source: Earnings Slides, page 2

On February 20th, 2020, Apollo announced fourth-quarter results. For the quarter, net income available to common stockholders came in at $0.23 per share. Meanwhile, distributable earnings was $0.36 per diluted common share. The trust repurchased 4 million shares during Q4 alone and 14.8 million across the fiscal 2020 year. The business remains highly liquid with $325 million in cash and $18 million in approved and undrawn credit capacity. They also hold $1.1 billion in unencumbered loans.

Apollo’s two main growth catalysts are growth of its overall loan portfolio, and higher investment returns from existing loans. Apollo has an exceptionally high dividend yield, but it also has a high dividend payout ratio that investors should closely monitor going forward.

The company has frequently distributed over 100% of annual earnings. While payout ratios greater than 100% are possible when cash flows exceed earnings – as is the case with Apollo – this significantly limits the company’s safety in lesser times. This is often the case with extreme high-yielders and will make it hard for them to grow accretively through issuing more common shares. As a result, their earnings-per-share trajectory will largely be subject to interest rate levels.

During the Great Recession, Apollo posted a net loss in 2009, reflecting its sensitivity to recessions and downturns in commercial real estate activity. As a result, investors should only hold it in a broadly-diversified portfolio.