News und Analysen

'Surgutneftegas' PJSC: Statement of a significant fact on the meeting of the issuer's Board of Directors and its agenda

'Surgutneftegas' PJSC: Information statement on the list of affiliates disclosure by the joint stock company

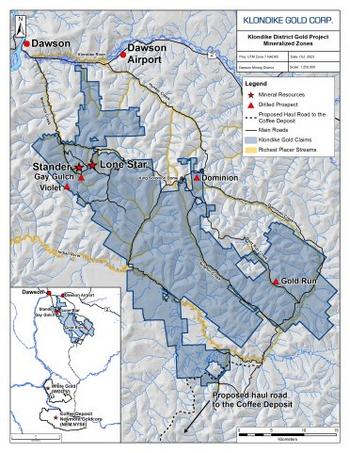

Klondike Gold Closes Oversubscribed Private Placement Raising $970,736

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED STATES

May 21, 2024, Vancouver, BC - Klondike Gold Corp. (TSX.V: KG; FRA: LBDP; OTC: KDKGF) (“Klondike Gold”

Chesapeake Energy Stock is The Energy Play, Earnings Confirm

Professional traders often say that the first move is always wrong; how much traction that saying has over shares of Chesapeake Energy Co. (NASDAQ: CHK) is up for debate. After reporting its first

3 Trend-Following Entries for Income Investors

The oilfield services industry is in a supercycle that has yet to play out. However, the Q1 results aligned with expectations and failed to spur individual names to new highs. The takeaway is that

3 Stocks Mega Investors Are Buying

When the biggest names on Wall Street make an investment decision, the world listens. As the first quarter of 2024 comes to a close, SEC 13-F filings are coming in hot, showing investors where

3 Energy Plays for Cash Flow: Buy 1 or Buy Them All

Cash and capital returns are flowing in the energy sector. Volatility in oil prices aside, oil prices range above long-term averages, driving revenue, margin, and cash flow for energy companies

5 Trends You Need to Know This Quarter

The global financial markets are like a machine, and each asset class acts as a cog that twists and turns each cycle. Today, there are a few key trends that investors should be aware of before

3 Energy Stocks to Consider as the Sector Breaks Out

The energy market has been ablaze with activity this year, particularly in crude oil. Witnessing a remarkable ascent, the WTI crude oil futures, America's primary oil price benchmark, have soared

Energy Sector Nears Multi-Year Resistance: Breakout Ahead?

As the U.S. market hovers near all-time highs, one sector has quietly surged higher and now stands at a critical juncture - the energy sector. While the broader market has experienced a

Oil Prices Up Again, Should You Buy This Time?

Oil is – and has always been – the primary driver in energy stocks. When prices swing as aggressively as they are about to, investors tend to position themselves with more than clear expectations

Marathon Oil stock is the place to be if you need value

Not all stocks are created equal, and this year energy stocks could quickly become the market's favorite. A once-in-a-cycle opportunity to line up your portfolio with all the macro forces at play

Occidental Petroleum stock price is ready to gush higher

The Occidental Petroleum (NYSE: OXY) investment thesis has been getting more bullish over the last two years, setting the stock up for a substantial rally. Q4 results aside, the market appears

Energy sector: assessing breakout potential and key players

As the overall market continues to ramp up and trade near all-time highs, one sector has quietly consolidated. The energy sector remains close to flat this year despite the recent melt-up

Exxon and Chevron ready to rally: The floor is in for big oil

As sketchy as the outlook for oil prices, a floor has been in place for over a year and is unlikely to be broken. Persistent demand and OPEC help to support the price, while rising production

Chesapeake to buy Southwestern Energy as natural gas prices rise

As the U.S. Energy Information Agency forecasts natural gas prices to rise in 2024 and 2025, the $7.4 billion all-stock merger of Chesapeake Energy Corp. (NASDAQ: CHK) and Southwestern Energy Co.

Hess stock to see 96% growth in EPS

The markets may have just ended their super cycle for the past four years (2020-2024), sponsored by low-interest rate environments pushed by the FED to counteract the effects of the COVID-19

Higher prices at the pump? Make up for it in Baker Hughes stock

You are about to witness a pivoting moment in the stock market, driven by similar changes in the underlying economy today. People tend to fall into a sort of continuation fallacy, where what has

Energy sector's risk-off stance, underperformance so far in 2024

In the early days of 2024, the SPDR S&P 500 ETF Trust (NYSE: SPY) is soaring near its all-time high, primarily driven by the impressive rally in the technology sector. Over the past month, it has

3 Russell 2000 stocks for your January watchlist

As investors face another uncertain year in the market, it could be time to look at small- and mid-cap stocks. That means looking at stocks that are listed on the Russell 2000 index. The Russell

Chevron stock made it to Barron's top 2024 picks

Barron's helped thousands beat the market by roughly 6.5% with their top stock picks for 2023. Could history repeat itself? If you are at the desk wondering which stocks deserve to get a taste of

Buffett keeps buying Occidental Petroleum, should you?

The price action in Occidental Petroleum (NYSE: OXY) has been range-bound for the last two years and may not break out of the range soon. However, the stock retreated to the low end of the range

MarketBeat ‘Stock of the Week’: Viper winds up as oil prices sink

Despite a weakened commodity price environment, Viper Energy, Inc. (NASDAQ: VNOM) is showing some real bite.

Shares of the Midland, Texas oil & gas company closed at $30.54 on Friday, up 25% from

Don't hesitate to trade Hess well below Chevron's buyout price

The iconic Hess Corporation (NYSE:HES) toy truck isn’t the only thing on sale this holiday shopping season.

Shares of the U.S. oil and gas producer fell nearly 5% to $134.50 last week even as the