News und Analysen

SKYX Files for a Mandatory Safety Standardization with the National Electrical Code (NEC) for Its Outlet Receptacle for Ceilings in Homes and Buildings

As Part of Its Application the Company Has Provided Significant Data Related to Hazardous Incidents with Electrical Wire Installations. SKYX's Ceiling Outlet Receptacle Platform Enables a

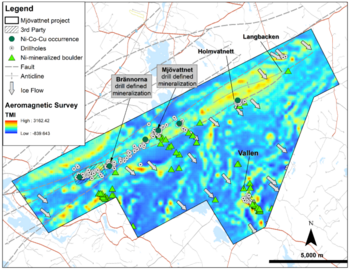

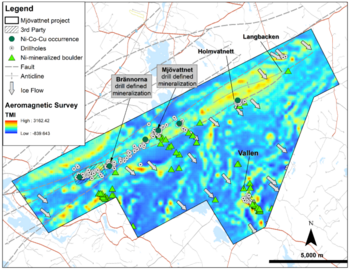

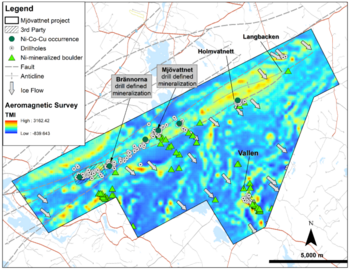

EMX Royalty Sells Two Additional Battery Metal Projects to Kendrick Resources PLC

Vancouver, British Columbia, August 8, 2023 (TSX Venture: EMX; NYSE American: EMX) – EMX Royalty Corporation (the “Company” or “EMX”) is pleased to announce the execution of an agreement

EMX Royalty Sells Two Additional Battery Metal Projects to Kendrick Resources PLC

Vancouver, British Columbia, August 8, 2023 (TSX Venture: EMX; NYSE American: EMX) – EMX Royalty Corporation (the “Company” or “EMX”) is pleased to announce the execution of an agreement

EMX Royalty Sells Two Additional Battery Metal Projects to Kendrick Resources PLC

Vancouver, British Columbia, August 8, 2023 (TSX Venture: EMX; NYSE American: EMX) – EMX Royalty Corporation (the “Company” or “EMX”) is pleased to announce the execution of an agreement

Contrarian Play: Beyond Meat Is At An Inflection Point

Beyond Meat (NASDAQ: BYND) deserves its spot among the most shorted stocks on Wall Street, but the story is played. The company’s attempt to enter the mainstream market via fast food was a flop

Contrarian Play: Beyond Meat Is At An Inflection Point

Beyond Meat (NASDAQ: BYND) deserves its spot among the most shorted stocks on Wall Street, but the story is played. The company’s attempt to enter the mainstream market via fast food was a flop

Contrarian Play: Beyond Meat Is At An Inflection Point

Beyond Meat (NASDAQ: BYND) deserves its spot among the most shorted stocks on Wall Street, but the story is played. The company’s attempt to enter the mainstream market via fast food was a flop

Analyst Upgrades Drive Old Dominion Freight Line 13.49% Higher

Shares of Old Dominion Freight Line inc. (NASDAQ: ODFL) just keep on truckin’ higher. As of June 28, stock of the less-than-truckload (LTL) specialist is up 13.49% for the week,

A catalyst for

Analyst Upgrades Drive Old Dominion Freight Line 13.49% Higher

Shares of Old Dominion Freight Line inc. (NASDAQ: ODFL) just keep on truckin’ higher. As of June 28, stock of the less-than-truckload (LTL) specialist is up 13.49% for the week,

A catalyst for

Analyst Upgrades Drive Old Dominion Freight Line 13.49% Higher

Shares of Old Dominion Freight Line inc. (NASDAQ: ODFL) just keep on truckin’ higher. As of June 28, stock of the less-than-truckload (LTL) specialist is up 13.49% for the week,

A catalyst for

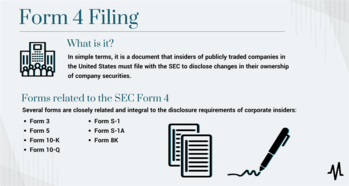

Insider Trading Activity (Form 4 Filings): What is Form 4?

When it comes to gaining an edge in the market, few tactics are as controversial and captivating as buying or selling securities based on privileged information. However, the Securities and

Insider Trading Activity (Form 4 Filings): What is Form 4?

When it comes to gaining an edge in the market, few tactics are as controversial and captivating as buying or selling securities based on privileged information. However, the Securities and

Insider Trading Activity (Form 4 Filings): What is Form 4?

When it comes to gaining an edge in the market, few tactics are as controversial and captivating as buying or selling securities based on privileged information. However, the Securities and

OPEC Meeting: Is Saudi Arabia Trying to Squeeze the Oil Market?

In a surprising move, Saudi Arabia pledged to reduce its oil output by 1 million barrels per day for July at the June 4 OPEC meeting. This adjustment, which may continue monthly, places Saudi oil

OPEC Meeting: Is Saudi Arabia Trying to Squeeze the Oil Market?

In a surprising move, Saudi Arabia pledged to reduce its oil output by 1 million barrels per day for July at the June 4 OPEC meeting. This adjustment, which may continue monthly, places Saudi oil

OPEC Meeting: Is Saudi Arabia Trying to Squeeze the Oil Market?

In a surprising move, Saudi Arabia pledged to reduce its oil output by 1 million barrels per day for July at the June 4 OPEC meeting. This adjustment, which may continue monthly, places Saudi oil

Did SOFI Technologies Deserve a Price Target Cut to $2.50?

Despite robust results, Fintech personal finance company SoFi Technologies Inc. (NASDAQ: SOFI) stock has been losing credibility with investors. The company reported strong Q1 2023 earnings and

Did SOFI Technologies Deserve a Price Target Cut to $2.50?

Despite robust results, Fintech personal finance company SoFi Technologies Inc. (NASDAQ: SOFI) stock has been losing credibility with investors. The company reported strong Q1 2023 earnings and

Did SOFI Technologies Deserve a Price Target Cut to $2.50?

Despite robust results, Fintech personal finance company SoFi Technologies Inc. (NASDAQ: SOFI) stock has been losing credibility with investors. The company reported strong Q1 2023 earnings and

Did SOFI Technologies Deserve a Price Target Cut to $2.50?

Despite robust results, Fintech personal finance company SoFi Technologies Inc. (NASDAQ: SOFI) stock has been losing credibility with investors. The company reported strong Q1 2023 earnings and

Did SOFI Technologies Deserve a Price Target Cut to $2.50?

Despite robust results, Fintech personal finance company SoFi Technologies Inc. (NASDAQ: SOFI) stock has been losing credibility with investors. The company reported strong Q1 2023 earnings and

Did SOFI Technologies Deserve a Price Target Cut to $2.50?

Despite robust results, Fintech personal finance company SoFi Technologies Inc. (NASDAQ: SOFI) stock has been losing credibility with investors. The company reported strong Q1 2023 earnings and

Texas Instruments: Another Reason To Take Profits In Chip Stocks?

Reasons to take profits in chip stocks are growing, and Texas Instruments (NASDAQ: TXN) is 1 of them. The company’s Q1 results and outlook weren’t horrible, but they didn’t inspire a rally, and

Texas Instruments: Another Reason To Take Profits In Chip Stocks?

Reasons to take profits in chip stocks are growing, and Texas Instruments (NASDAQ: TXN) is 1 of them. The company’s Q1 results and outlook weren’t horrible, but they didn’t inspire a rally, and

Texas Instruments: Another Reason To Take Profits In Chip Stocks?

Reasons to take profits in chip stocks are growing, and Texas Instruments (NASDAQ: TXN) is 1 of them. The company’s Q1 results and outlook weren’t horrible, but they didn’t inspire a rally, and