Apple Inc. buy Subdi

Summary

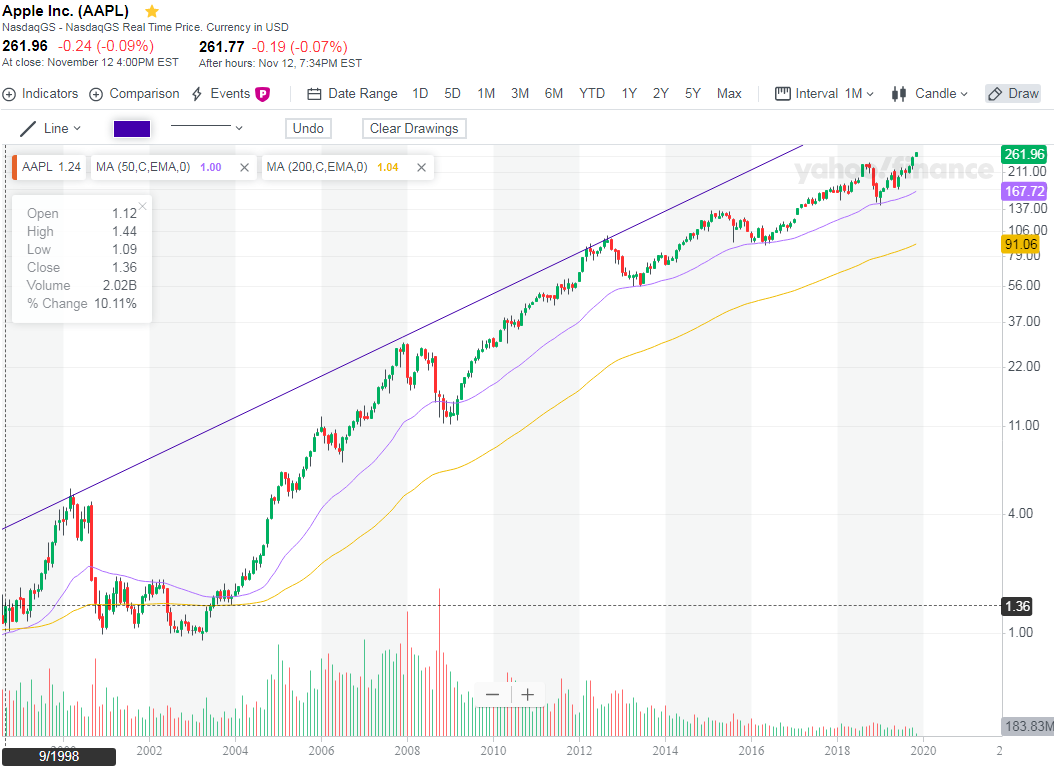

This prediction ended on 16.07.22 with a price of €149.90. With a performance of 363.56% the BUY prediction by Subdi was a big success. A total of €3.53 was paid as dividends for this prediction. Subdi has 50% into this predictionApple Inc. (AAPL) is a multinational technology company known for designing and developing high-quality consumer electronics, software services, and personal computers. It is best known for its flagship product, the iPhone, which accounts for a majority of its revenue. The company also generates revenue from its other products like the iPad, MacBook, AirPods, and Apple Watch. Apart from hardware, Apple provides software services like iCloud, Apple Music, and Apple TV+. With a market capitalization of over $2 trillion, Apple is one of the most valuable companies globally and consistently ranks among the world's top brands.

Performance without dividends (%)

| Name | 1w | 1m | 1y | 3y |

|---|---|---|---|---|

| Apple Inc. | 2.153% | 2.153% | -6.090% | 60.736% |

| iShares Core DAX® | -1.410% | 0.471% | 12.651% | 58.522% |

| iShares Nasdaq 100 | -0.450% | -0.305% | 5.495% | 95.184% |

| iShares Nikkei 225® | -0.224% | 5.529% | 18.894% | 49.093% |

| iShares S&P 500 | -1.095% | -0.774% | 1.350% | 60.886% |

Comments by Subdi for this prediction

In the thread Ist Apple kein Wachstumsunternehmen mehr?

Apple hat einige Wachstumstreiber in Segmenten wo es keine Konkurrenz gibt. Z.B. die Watch ist konkurrenzlos. Mark Hibben erklärt: Why Apple Is Still A Growth Company

"...

..."

Langfristig ist mit Apple tausendmal lieber als der DAX :-)

News