News

3 Quality Stocks On Track for Significant Dividend Increases

Income investors aren't known for their risk-on attitude or speculative natures, but that doesn't mean there aren't speculations in the income-investment universe. A simple speculation is on

Will the Energy Sector Continue to Outshine the Market?

The market has been swept by a sea of red month-do-date (MTD), with the overall market, the SPDR S&P 500 ETF (NYSE: SPY) down over 3% MTD. Apart from one sector, most sectors and industries have

3 Compelling Reasons to Start Buying Undervalued Amazon

Amazon (NASDAQ: AMZN) is not a cheap stock, but there are indications it is undervalued. The company's transition to CEO Andy Jassy resulted in significant traction and, more importantly, an

Shell's 4.12% Dividend Yield: An Attractive Feature for Investors

Shell plc (NYSE: SHEL) recently cleared price resistance above $63.69, trending higher in heavier-than-normal volume as the broader energy sector moves higher.

While the recent price move is

Baker Hughes, Pioneer, Diamondback: Energy Stocks on the Rise

The energy sector has rotated back into leadership, with big S&P 500 components such as Exxon Mobil Corp. (NYSE: XOM), Chevron Corp. (NYSE: CVX) and Schlumberger Ltd. (NYSE: SLB) trading to the

This is a Golden Time to Buy Beaten Down Oil Stocks

A combination of factors, including the supply/demand imbalance, OPEC+ production cuts, and the oil charts, suggest this is a golden time to buy oil and oil stocks. Regarding the oil price

3 Health Companies with Healthy Insider Buying and Market Support

Insider buying is a good sign that a company is heading for better times, but it is often unreliable. The signal is more robust if institutions and analysts are as supportive as they are with the

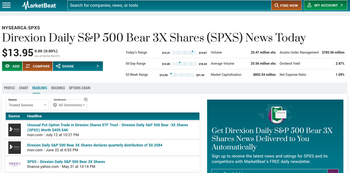

7 Best Bear Market ETFs to Battle a Market Decline

During unprecedented times in financial markets, the term "bear market" can strike fear into even the most seasoned investor's heart. As economic tides come and go, the need for strategic planning

Energy Sector's Resurgence: 3 Stocks To Buy

An interesting shift in allocation and performance has occurred over the last month, with the energy sector catching up to the overall market. Over the last month, the Energy Select Sector SPDR

Three Ways To Play The Rise In Oil Prices

Oil prices (NYSEARCA: USO) are on the rise and likely heading higher. The Saudis and Russia are working together with voluntary production cuts to keep the supply/demand balance tilted firmly in

Should a Lack of Windfall Profits Keep You Out on Chevron Stock?

You won’t be hearing any complaints about “windfall profits” after the latest earnings report from Chevron Corporation (NYSE: CVX). The company delivered a mixed earnings report with the headline

Why Markets Are Loving Exxon Mobil, Despite The Earnings Dip

Shares of Exxon Mobil (NYSE: XOM) fell by as much as 1.8% during the early hours of Friday's trading session; the decline is happening on a day when the broader markets (namely the S&P 500) are up

Energy Stocks Bullish, But Futures Market Signals Trouble Ahead

The Energy Select Sector SPDR Fund (NYSEARCA: XLE) was trading higher for the fifth session in a row on July 24, extending that streak with a gap up at the open.

However, some analysts are

Winners And Losers In The Oilfield Supercycle

There are no losers in the oil field super cycle, only winners, but winning is relative. While the signs are good that the spending in upstream, natural gas, and efficiency will continue, 1

U.S. Bancorp Shares Rally As Analysts Get Bullish After Q2 Report

Analysts have been vocal lately about U.S. Bancorp’s (NYSE: USB) potential, emphasizing that shares have been undervalued as investors focused on requirements for capital holdings.

U.S. Bancorp

3 Oil Stocks to Buy Before the Price of Crude Takes Off

As is often the case with equity markets, stocks that perform well one year lag the market the following year. That’s been the case with energy stocks, and in particular oil stocks, which are

Shell's Production Outlook: Not as Bad as Expected?

VanEck Oil Services ETF (NYSEARCA: OIH) has delivered investors a nearly 43.4% performance over the past 12 months, outperforming the broader market by as much as 21.2% during the same period.

Is The XLE Primed For A Potential Breakout?

The Energy Select Sector SPDR Fund (NYSE: XLE) is setting up on a higher time frame for a potential breakout. YTD, the sector ETF is down almost 7%. However, as the uptrend remains intact and the

Oilfield Services Growing Faster Than Wider Energy Sector

It’s sometimes said that markets can turn on a dime. That seemed to have happened with the energy sector, which was the huge 2022 winner, but the Energy Select Sector SPDR Fund (NYSEARCA: XLE) is

Shell's New Dividend And Buyback Program, New Targets?

Shares of Shell (NYSE: SHEL) are rallying by as much as 2.6% in the pre-market hours of Wednesday morning as investors and traders pile in to anticipate further price reactions stemming from the

A 7% Yield and 50% Upside? Wall Street Digs Rio Tinto

This month, London-based Rio Tinto Group (NYSE: RIO) became the first mining company to operate an open pit mine solely with renewable diesel fuel. A shift from using fossil diesel to renewable

Cactus Opens The Cash Flow Wellhead With Flexsteel Acquisition

Cactus (NYSE: WHD) expected the acquisition of Flexsteel to be accretive in the first year, and the execs were more than right. The Q1 results were good enough but came with solid guidance for Q2

2 Dow Stocks Trading Less Than 10x Earnings are Blue Chip Values

The price-to-earnings ratio, or P/E ratio, is one of the most commonly used metrics in fundamental stock analysis. The division of share price by earnings per share (typically over the last 12

Equitrans Midstream Surges 40% On Debt Ceiling Deal

Equitrans Midstream Corp. (NYSE: ETRN) got some fuel from D.C. politicians, climbing 40% for the week as its Mountain Valley Pipeline project looks set for completion as part of the debt ceiling

Meet the Nasdaq's 3 Biggest Dividend Payers

The words ‘Nasdaq’ and ‘dividend’ don’t typically go hand in hand.

It makes sense. The tech-heavy Nasdaq-100 consists largely of cyclical companies that prefer to reinvest profits in growth