News

3 just-upgraded energy stocks to put on your radar

Last night saw the S&P 500 index close at a fresh all-time high. It's a remarkable achievement that didn't look as likely as recently as October. But since the prospect of a rate cut became quite

Is 2024 the year of the dividend increase?

If you’ve been around while, you might remember the old commercial slogan for Almond Joy and Mounds candy bars: “Sometimes you feel like a nut, sometimes you don’t.”

You could spin an admittedly

Rio Tinto and BHP stock: Can mining giants unearth profit growth?

The mining industry as a whole didn’t get the memo that the early 2024 selloff has been toned down, despite analysts seeing hope on the horizon.

Mining giants Rio Tinto Group (NYSE: RIO) and BHP

HSBC stock: Your safest bet to play China's new stimulus?

If you're looking for a way to bet against the consensus, where many underground investors seem to go today. The deal on the table, which can potentially become the next addition to your

Solo Brands cooked on 2023 guidance cut. Is it a bargain or trap?

Outdoor and lifestyle products maker Solo Brands Inc. (NASDAQ: DTC) has grown a cultlike following under its many brands. The consumer discretionary sector company initially started by offering an

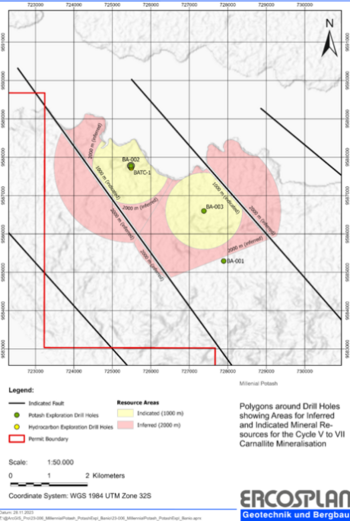

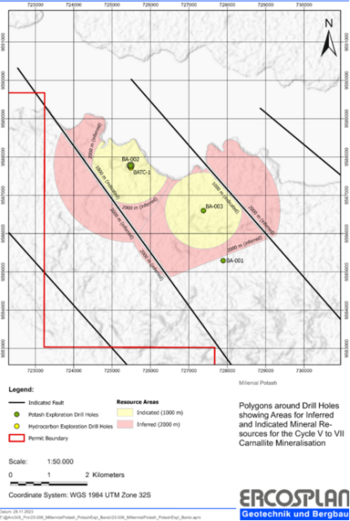

Millennial Potash Announces Maiden Mineral Resource Estimate in the Northern Part of the Banio Potash Project: Indicated Mineral Resources of 657 Million Tonnes of 15.9% KCl

Millennial Potash Announces Maiden Mineral Resource Estimate in the Northern Part of the Banio Potash Project: Indicated Mineral Resources of 657 Million Tonnes of 15.9% KCl and Inferred

Millennial Potash gibt erste Mineralressourcenschätzung für den nördlichen Teil des Kaliprojekts Banio bekannt: Angezeigte Mineralressourcen von 657 Millionen Tonnen mit 15,9% KCl

Millennial Potash gibt erste Mineralressourcenschätzung für den nördlichen Teil des Kaliprojekts Banio bekannt: Angezeigte Mineralressourcen von 657 Millionen Tonnen mit 15,9% KCl und

Bitcoin ETFs: A two-day ranking of top performers

The recent approval and launch of eleven Bitcoin spot ETFs have added a thrilling chapter. Building up to the much-anticipated approval, the market was brimming with anticipation.

As the U.S.

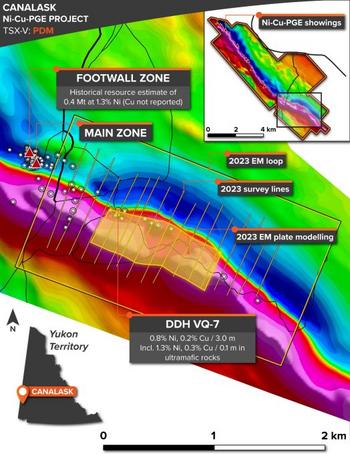

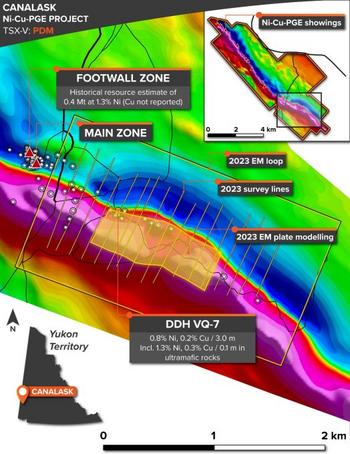

Palladium One Announces Electromagnetic (“EM”) Survey Results for Canalask Nickel – Copper Project, Yukon, Canada

January 16, 2024 – Toronto, Ontario – Palladium One Mining Inc. (TSX-V: PDM, OTCQB: NKORF, FRA: 7N11) (the “Company” or “Palladium One”) is pleased to announce Electromagnetic (“EM”) survey

Palladium One meldet die Ergebnisse der elektromagnetischen („EM“) Vermessung des Nickel-Kupfer-Projekts Canalask im kanadischen Yukon

16. Januar 2024 – Toronto, Ontario / IRW-Press / - Palladium One Mining Inc. (TSX-V: PDM, OTCQB: NKORF, FWB: 7N11) (das „Unternehmen“ oder „Palladium One“) freut sich bekannt zu geben, dass

3 retailers to compound your wealth this cycle

Today's market is the epitome of opportunity for those who know where to look. Considering that most market analysts suggest the stock market is overvalued today, by measures such as the Buffett

Rising credit card delinquencies make these stocks your safer bet

The credit cycle, as well as the business cycle in the United States economy, is getting underway for a major pivot coming into 2024. Whether you are a long-term investor or enjoy dabbling in and

20% upside for JPMorgan Chase stock? Here’s how

Shares of JPMorgan Chase & Co. (NYSE: JPM) surged more than 5% immediately following the Q4 earnings release. The release aside, the move higher has extremely bullish implications for this market

Bitcoin Breakthrough: SEC approves Bitcoin ETFs

The U.S. Securities and Exchange Commission (SEC) has given the go-ahead to the first-ever U.S.-listed exchange-traded funds (ETFs) tracking Bitcoin. This watershed moment marks a significant leap

Here is what BlackRock wants out of 2024`

The new year is here, and all the major investment banks and asset managers have been excitingly putting out their macroeconomic projections for 2024. Whatever they advise their clients will

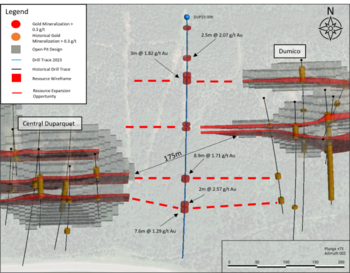

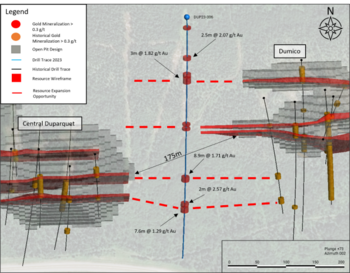

First Mining Confirms New Area of Mineralization at Central Duparquet and Announces Management Changes

- Exploration Between Central Duparquet and Dumico Resource Areas Returns 1.71 g/t Au over 8.9 m, Confirming Strike Continuity

- Central Duparquet High Grade Zone Returns

First Mining bestätigt neues Mineralisierungsgebiet bei Central Duparquet und gibt Änderungen im Management bekannt

- Explorationen zwischen Ressourcengebieten Central Duparquet und Dumico ergeben 1,71 g/t Au auf 8,9 m und bestätigen die Beständigkeit von Streichen

- Hochgradige Zone

Bank of America and Citigroup are banking stocks that could soar

Who likes to invest in financial stocks? Only people with a solid financial or accounting background, since they can reasonably understand the balance sheets and valuations of these stocks well

Citi and Lazard just got bullish upgrades

While the final weeks of 2023 saw almost non-stop rallying across equity markets, the first week of 2024 has been a little softer. The benchmark S&P 500 index has fallen for the past five

This biotech stock has surged over 300% this week

As the market continues to witness a resurgence in small-cap investments, led by a jump in investor optimism and speculation, there’s been a seemingly steady flow of capital back into

The 5 top-rated dividend stocks by analysts

Marketbeat.com provides many tools for investors, including analyst-tracking algorithms. A single upgrade is worthless, but a trend of upgrades can repeatedly drive a stock to new highs. Today

Analysts expect Bank of America stock to rally 55%

A 35% rally since October meant that Bank of America (NYSE: BAC) shares finished the year on a high after what was, at best, turning into a mediocre year before that. Shares of the Wall Street

3 dividend stocks that insiders are buying

Insider buying is a viable means of finding stocks trading at a value. Insiders rarely have reason to buy once they’ve established skin in the game, so new purchases are telling. Today, we’re

3 mid-cap stocks that analysts love heading into earnings season

The beginning of a new year also means that a new earnings season is right around the corner. Every earnings season seems "the most important earnings season" for investors. But when every stock

CAVA Group looks tasty following buy call, high-volume breakout

Like one of its colorful salad bowls, fast-casual restaurant chain CAVA Group Inc. (NYSE: CAVA) has been a mix of green and red since its June 2023 IPO.

The Mediterranean-themed Chipotle