Heliostar Metals Ltd. Stock

Your prediction

Heliostar Metals Ltd. Stock

Pros and Cons of Heliostar Metals Ltd. in the next few years

Pros

Cons

Performance of Heliostar Metals Ltd. vs. its peers

| Security | Change(%) | 1w | 1m | 1y | YTD | 3y | 5y |

|---|---|---|---|---|---|---|---|

| Heliostar Metals Ltd. | 3.610% | 5.397% | 38.333% | 312.935% | 321.320% | 882.249% | 185.223% |

| Golconda Gold Ltd. | 1.540% | -2.273% | 13.158% | - | - | - | - |

| Orla Mining Ltd | 4.300% | 4.892% | 6.903% | 108.411% | 110.179% | 208.864% | 170.631% |

| Trailbreaker Resources Ltd. | -8.700% | -16.556% | -19.231% | -30.769% | -25.882% | 154.545% | -14.865% |

News

Heliostar Presents Stronger Economics at the La Colorada Mine in Updated Technical Report

Technical Report Highlights:

- Base Case shows US$66.2M post tax NPV5, 24.4% IRR, with a payback multiple of 1.9 at a US$2,300/oz gold price

- Upside Case shows US$243.3M

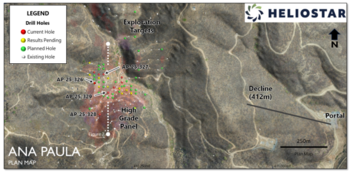

Heliostar Drills 88 m Grading 8.82 g/t Gold in Resource Conversion Drilling and Adds Third Drill Rig at Ana Paula

HIGHLIGHTS:

- 88.05 m grading 8.82 g/t gold from 88.2 m including

- 35.5 m grading 13.03 g/t gold from 88.2 m

- 6.4 m grading 5.16 g/t gold from 39.8 m

- 14.3 m

Heliostar Presents Second Quarter 2025 Financial Results

Q2 2025 Quarter Highlights

- Q2 2025 production of 7,396 Gold Equivalent Ounces (GEOs).

- Q2 2025 sales of 8,556 GEOs.

- Consolidated cash costs of $1,413