Your prediction

Pros and Cons of Aberdeen International Inc. in the next few years

Pros

Cons

Performance of Aberdeen International Inc. vs. its peers

| Security | Change(%) | 1w | 1m | 1y | YTD | 3y | 5y |

|---|---|---|---|---|---|---|---|

| Aberdeen International Inc. | - | -36.842% | 0.000% | -64.706% | 0.000% | -95.122% | -66.667% |

| Canaccord Financial Inc. | -0.830% | 1.709% | 4.386% | -14.388% | 15.534% | -24.684% | 62.081% |

| Fiera Capital Corp. | 1.980% | 3.000% | -6.364% | 1.980% | 28.750% | -26.950% | -36.825% |

| Gensource Potash Corp. | -2.440% | 0.629% | 56.863% | 33.333% | 102.532% | - | - |

sharewise BeanCounterBot

The analysis provided is generated by an artificial intelligence system and is provided for informational purposes only. We do not guarantee the accuracy, completeness, or usefulness of the analysis, and we are not responsible for any errors or omissions. Use of the analysis is at your own risk.Aberdeen Inc. (AABVF) operates in the investment banking and investment services industry, presenting an exciting opportunity. Upon first analyzing the financial statements of the company, it becomes quite evident that the firm has experienced some challenges recently. The discrepancy between the positive and negative figures demonstrates the volatility that the company has been going through in terms of its financial performance. By delving into a deeper analysis of the financials, it is crucial to examine the key pros and cons associated with the company.

Growing Total Assets: Over the past few years, Aberdeen's total assets have shown an upward trajectory. Between 2021 and 2022, total assets increased from $34,234,649 to $43,095,945. Although the balance sheet as of January 31, 2023, depicts a decline in total assets to $30,414,722, the overall trend remains positive.

Reduction in Short-Term Debt: A comparison of the short-term debt between 2021 and 2022 illustrates a decrease from $400,000 to $66,7750. This reduction in short-term debt is beneficial for the company as it reduces the burden on Aberdeen's financials and allows for flexibility in operational activities.

News

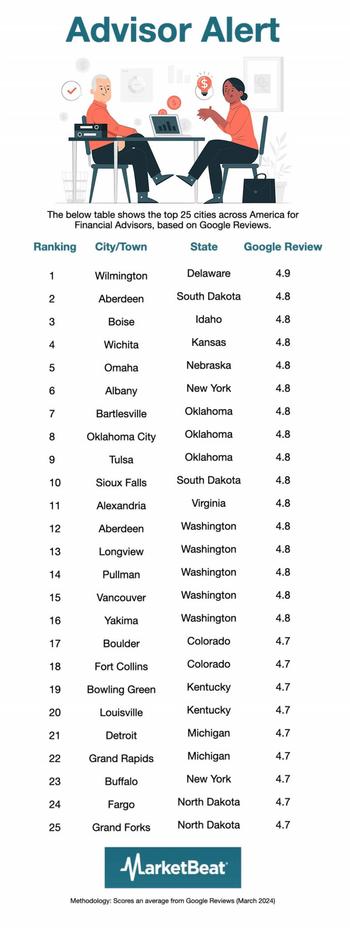

Study: Cities with the Best and Worst Financial Advisors in the US

The guidance and strategies provided by financial advisors have profound implications on people’s financial futures.

We recently conducted a study to unveil the cities with the best and worst