What‘s Not To Love About These Great Bull Runs?

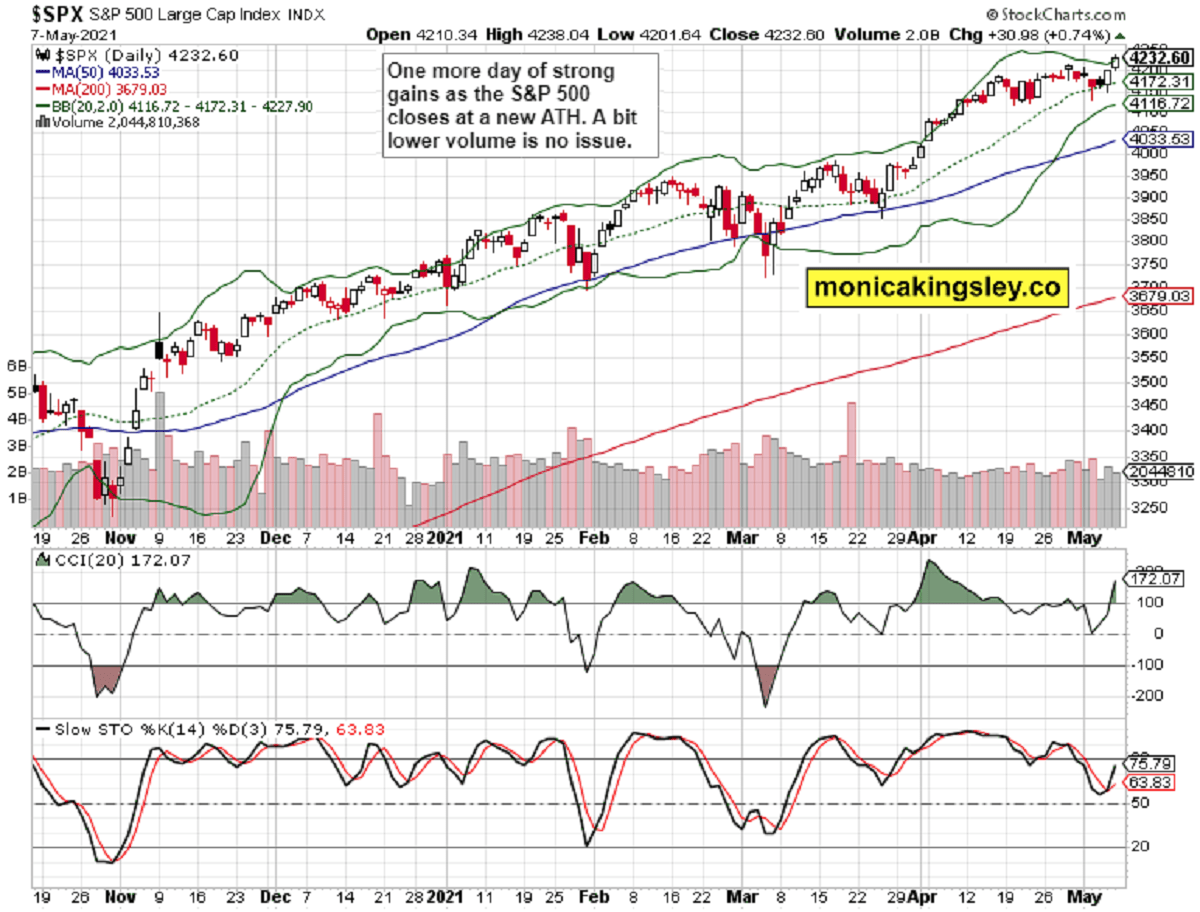

A bit of selling at the open, and off to new highs – the S&P 500 bulls are taking no prisoners. The long recent consolidation has been broken, and it was again to the upside. Option traders are still having a hard time agreeing with the declining VIX, which is pointing to them serving as still some more cannon fodder next in the bullish advance. In fairness though, it can‘t be denied that the average put/call ratio has been rising over the last 3 months.

Q1 2021 hedge fund letters, conferences and more

Still, that doesn‘t change the reality that my reasonably and justifiably aggressive long positions in both S&P 500 and gold, are going even more profitable. No problem that the Russell 2000 didn‘t climb as much – emerging markets stepped into the void on account of predictably cratering USD.

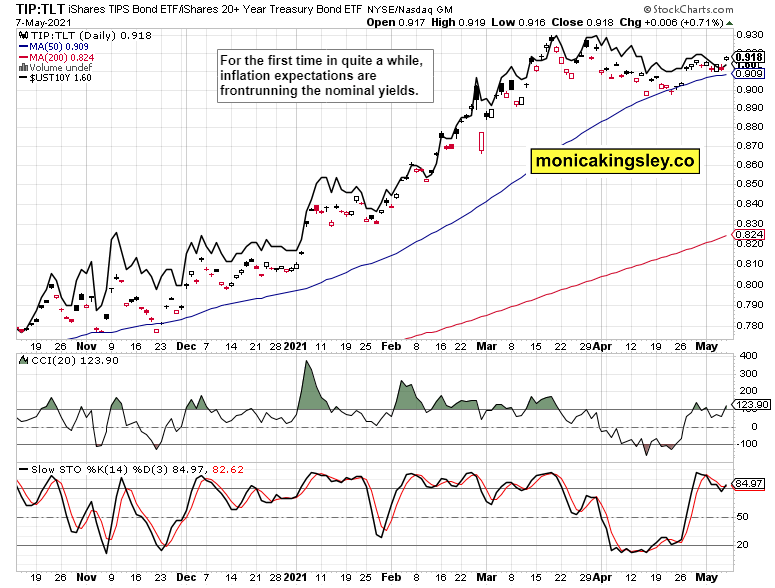

Friday didn‘t bring any changes to the narratives – the very weak non-farm payrolls weren‘t a selling catalyst in the least. All eyes remain on reopening trades to the effect that value stocks are rising effortlessly whatever the nominal rates direction. In spite of inflation and inflation expectations not being negligible, we‘re in still in the reflationary period where economic growth is higher than either of these two.

Not only is the S&P 500 advance a very broad one as evidenced by the number of stocks trading above their 50-day moving average (with tech playing a positive role once again), commodities continue being on fire. Especially the base metals such as copper welcomed the uptick in inflation expectations. With the recent two trial baloons (Kaplan and Yellen), the Fed might be exploring market reactions if it had moved to counter inflation at least to some degree. Hold not your breath though, that would tank the risk-on assets – they won‘t do that any time soon.

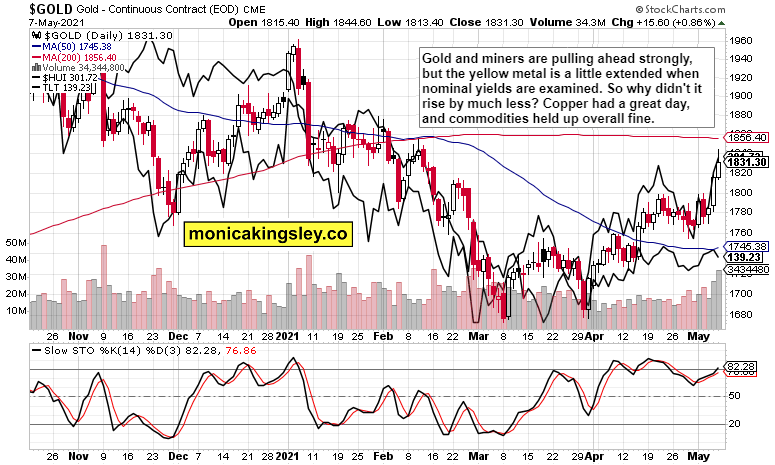

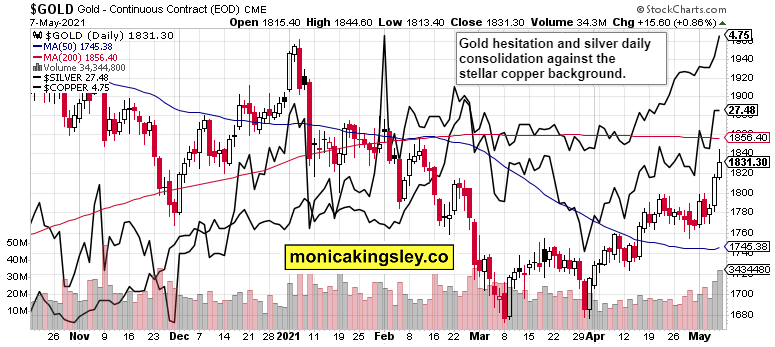

Gold is making its run, unhampered by nominal yields rising on the day. Miners have continued their advance, and the precious metals upleg offers a sight of health. Note also that the silver miners have been doing overall better than the gold ones throughout the long soft patch starting in Aug 2020, just as silver did. That‘s precisely what to expect in an environment of inflation running hot:

(…) Gold and silver fireworks arrived, and more is to come! What a better proof than a broad based advance across the sector, starting with both metals, and extending to gold and silver miners left and right. Not to mention the copper fires burning brightly – if you were listening to my incessant red metal bullish calls, you‘re very happy now. And just as in the precious metals, there is more to come here too.

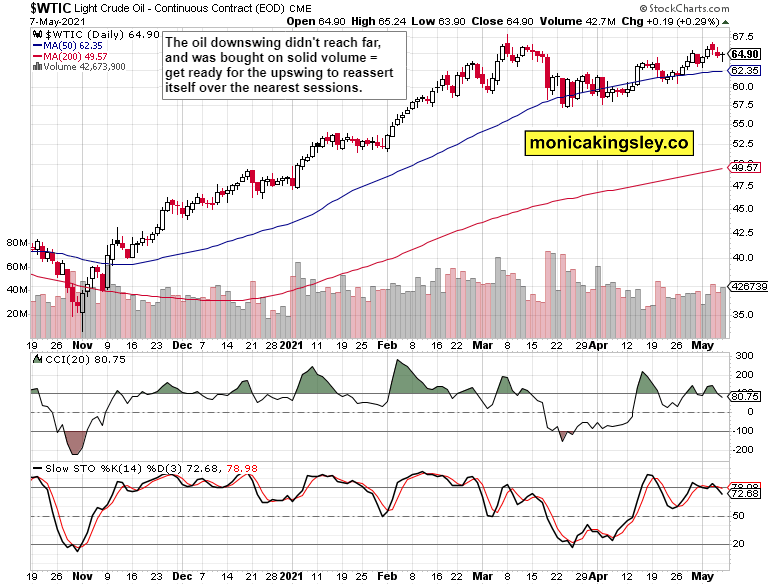

And as the Fed continues playing ostrich when it comes action, commodities including oil continue doing great. While black gold consolidated over the last few sessions, it remains primed to go higher.

Bitcoin is also enjoying upside momentum as it aims to clear the 50-day moving average vicinity. Its uptrend is gradually reasserting itself – patience required still. But it‘s the steep gains in other cryptos such as Ethereum making new highs practically on a daily basis, that is catching much attention. ETH/USD looks short-term extended though, and I would prefer waiting for a pullback, especially given the last two candles‘ shape (both having significant knots – today is shaping up to be a day of more upside rejection).

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 Outlook

We‘re again at the upper border of the Bollinger Bands, and the daily indicators are constructive with more room to grow. We‘re staring at a positive week ahead.

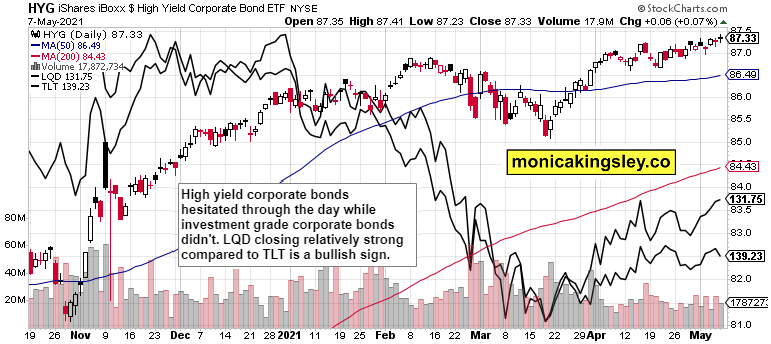

Credit Markets

The corporate credit markets did waver a little on the day, investment grade bonds more so than the high yield ones, which is understandable given the long-dated Treasuries setback.

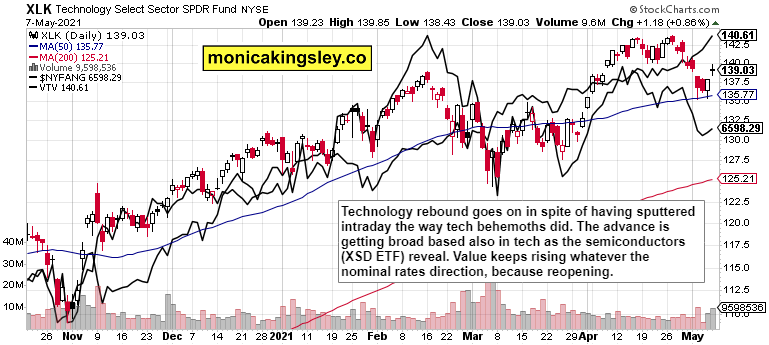

Technology and Value

Technology rebound continues, and should so aided by the recent earnings announced. I am not looking for a meaningful dip in $NDX or whichever part of the tech sector over the nearest days as $NYFANG did its job quite well on Friday. Yet again, value stocks continued their steep ascent come hell or high water.

Inflation Expectations

A rare sight indeed – Treasury yields have run behind inflation expectations on Friday.

Gold, Silver and Miners

Gold and miners continue running higher together, and neither gold‘s upper knot nor miners reaching visually escape velocity compared to the yellow metal, is an issue, because copper had a great day.

Silver consolidated daily gains, lagging behind both gold and copper. No issues, the white metal has great days ahead still, and Friday‘s session proves that the precious metals upswing is nowhere near overheated.

Crude Oil

Crude oil bulls defended Thursday‘s lows, and the bullish consolidation continues. Look for an upside breakout next as this isn‘t a double top. I‘m standing by my calls for at least $80 West Texas Intermediate before 2022 is over. Seasonality is still good for black gold, so enjoy the ride!

Summary

S&P 500 is at new highs, and its ascent is far from over – no signs of a major or even local top to be made. The index will have an easier time now that the short term tech / Nasdaq outlook has flipped bullish as well.

Gold, silver and miners continue to be well positioned to reap further gains as the well balanced rally continues. The copper and nominal yields combo balances each other out, so the factors speak for a bullish consolidation in the short term as a minimum.

Crude oil is getting ready to resume its upswing in a modest fashion, and I look for its early Mar top to be challenged this or next week.

Bitcoin upswing is very gradually reasserting itself, and the bulls would be well advised to pay attention as the 50-day moving average is likely to start sloping upwards perhaps as early as this Friday, thus supporting the prices above the late Apr base.

Thank you for having read today‘s free analysis, which is available in full here at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the four publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

The post What‘s Not To Love About These Great Bull Runs? appeared first on ValueWalk.

Source valuewalk