Published on August 8th, 2022 by Quinn Mohammed

Berkshire Hathaway (BRK.B) has an equity investment portfolio worth over $360 billion, as of the end of the 2022 first quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can follow Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Free Excel Download: Get a free Excel Spreadsheet of all Warren Buffett stocks, complete with metrics that matter – including P/E ratio and dividend yield. Click here to download Buffett’s holdings now.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31st, 2022, Buffett’s Berkshire Hathaway owned nearly fifteen million shares of STORE Capital Corp. (STOR) for a market value of $431 million. STORE Capital represents about 0.1% of Berkshire Hathaway’s investment portfolio. This marks it as one of the smaller positions in the portfolio.

This article will analyze the diversified real estate investment trust in greater detail.

Business Overview

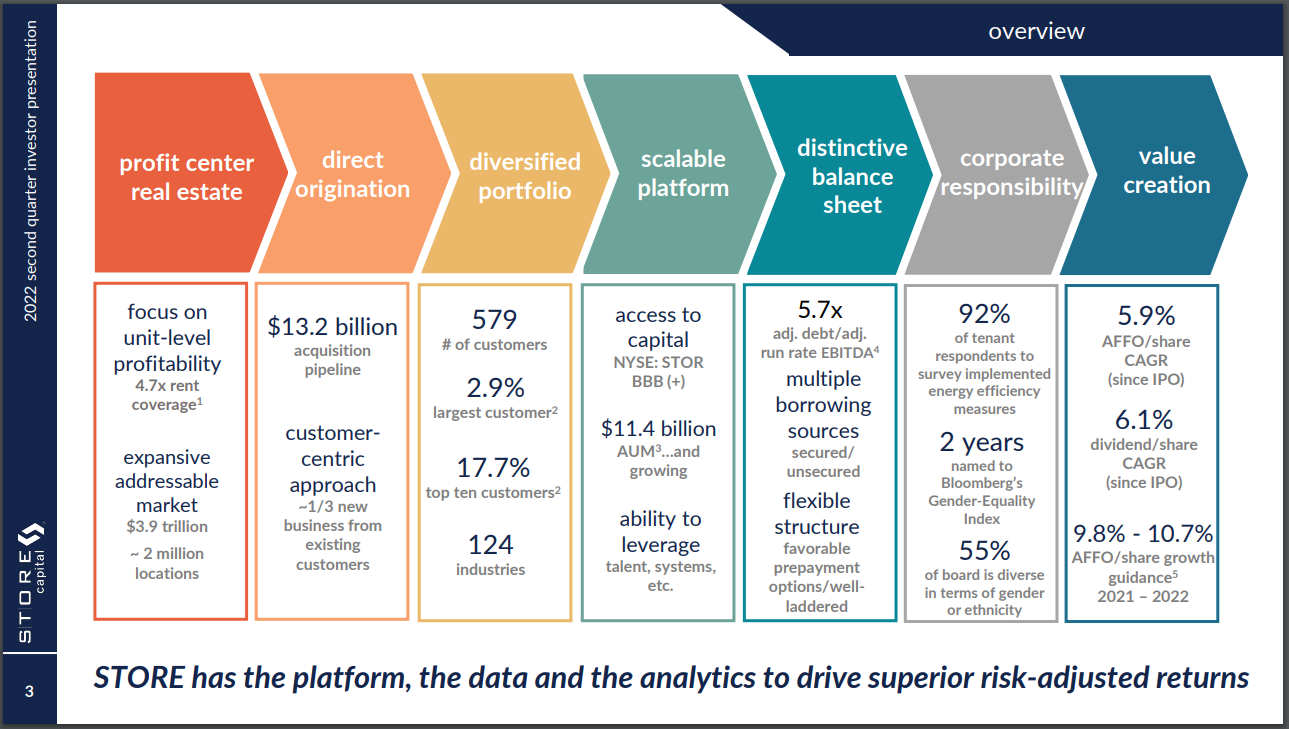

STORE Capital Corp is a real estate investment trust that acquires and manages single tenant operation real estate, or STORE, properties in the US. STORE Capital primarily leases facilities to middle-market and large businesses through long-term, triple-net leases.

STORE Capital had 579 customers at end of Q2 2022 and the ten largest customers made up nearly 18% of base rent. The company operates in 49 states and owned over 3,000 properties at end of Q2 2022.

Source: Investor Presentation

On August 3rd, 2022, STORE Capital reported Q2 2022 results. Total revenues rose 16.5% to $223.8 million and net income grew 45% to $90.5 million. Diluted AFFO per share increased 66% to $0.58 from $0.50.

The REIT invested $391.9 million in 62 properties and added 11 new customers in the quarter. The REIT also sold 13 properties.

The total real estate portfolio was worth $11.4 billion at end of Q2 with about 94% in commercial leases and 6% in mortgage loans and financings. The average lease has approximately 13.2 years remaining with only 4.4% of leases expiring in the next five years.

STORE Capital raised guidance for AFFO per share to $2.25 to $2.27 in 2022.

Growth Prospects

STORE Capital’s AFFO per share growth has been strong since the company went public. AFFO per share has grown from $1.41 in 2014 to $2.05 in 2021. The company grew every year except in 2020, which is understandable. But 2021 results surpassed 2019, and 2022 looks poised to surpass the previous year’s results as well.

After 2021, we are expecting AFFO per share to grow at roughly 4% per year on average out to 2027, which is a bit lower than the trailing average since 2014. In this estimation, we account for the impact of COVID-19 on REITs and their customers and rent collection.

STORE Capital has grown through acquisition and then leasing to medium-to-larger sized customers with rent escalators and senior lease positioning. This has worked well for the company since its IPO in 2014. However, the company is now growing from a higher base of earnings than it was in 2014, which means that growth will slow. Also, the rising share count will likely limit AFFO per share growth.

The dividend has grown rapidly since 2014 but has slowed in the past two years as the payout ratio has risen but it is still reasonably conservative for a REIT. The rising share count has also increased the cash flow requirement for the dividend. We expect the dividend to grow at about 5% annually on average out to 2027.

Competitive Advantages & Recession Performance

As a net lease REIT, STORE Capital is a defensive stock because its leases have a senior position to other obligations, are long-term, and have built in regular rent escalators. Additionally, with triple net leases, the tenant takes care of just about all the operating costs.

Another factor contributing to STORE’s safety is the fact that it has achieved tremendous diversification with over 550 customers, over 3,000 properties in 49 states, and 99.5% occupancy.

STORE announced that it has become among the very few REITs and the only net lease REIT able to issue AAA-rated notes, which showcases the safety of its diverse property portfolio.

While the company was not around during the great financial crisis, it performed very well during the coronavirus pandemic. AFFO per share only dipped 7.6% from 2019 to 2020, and then grew 12% from 2020 to 2021.

The dividend was still well covered during the COVID-19 pandemic, with a 2020 payout ratio of 73%. While some REITs pre-emptively slashed their dividend, STORE Capital continued their dividend increase streak. The company currently has an 8-year consecutive dividend increase streak.

Valuation & Expected Returns

Since the company’s IPO, shares traded with an average valuation of around 16.3 times AFFO. Based on expected earnings-per-share of $2.26 for fiscal 2022, along with a current stock price of ~$28, STORE Capital is presently trading at a price-to-earnings ratio of 12.5. This could indicate that shares are currently undervalued

Our fair value estimate for STORE Capital stock is 15.0 times earnings. If this proves correct, the stock will benefit from a 3.6% annualized gain in its returns through 2027.

Shares of STORE Capital currently yield 5.5%, which is above its ten-year average yield of 3.8%. On a dividend yield basis, STORE shares seem to be trading below fair value.

Putting it all together, the combination of valuation changes, EPS growth, and dividends produces total expected returns of 12.1% per year over the next five years. This makes STORE Capital a buy.

The current dividend payout is well-covered by earnings, with room to grow. Based on expected fiscal 2022 earnings, STORE has a payout ratio of just under 70%. This leaves enough cushion for future dividend increases each year, in the mid single-digit range.

Final Thoughts

STORE Capital is a diversified single tenant operational REIT. The company has hundreds of customers and performed well through the COVID-19 pandemic. It has 8 years of consecutive dividend increases.

The company has performed well since its IPO in 2014, and we still expect further earnings growth. What’s more, the company appears to be undervalued, and offers an above-average dividend yield. As a result, the company earns a buy rating.

Other Dividend Lists

Value investing is a valuable process to combine with dividend investing. The following lists contain many more high-quality dividend stocks:

- The Dividend Aristocrats List is comprised of 65 stocks in the S&P 500 Index with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 44 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.