Published on July 4th, 2022 by Felix Martinez

Berkshire Hathaway (BRK.B) has an equity investment portfolio worth more than $360 billion as of the end of the 2022 first quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can ‘cheat’ from Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Free Excel Download: Get a free Excel Spreadsheet of all Warren Buffett stocks, complete with metrics that matter – including P/E ratio and dividend yield. Click here to download Buffett’s holdings now.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31, 2022, Buffett’s Berkshire Hathaway owned just over 420 thousand shares of Markel Corp (MKL) for a total market value exceeding $555.57 million. Markel Corp currently constitutes over 0.18% of Berkshire Hathaway’s investment portfolio.

This article will thoroughly examine Markel Corp’s prospects as an investment today.

Business Overview

Markel Corporation is a diverse financial holding company for insurance, reinsurance, and investment operations worldwide. Headquartered in Richmond, Virginia, and founded in 1930, Markel reports its ongoing underwriting operations in three segments, and products originate from three insurance divisions and one reinsurance division. Through Markel Ventures, they allocate capital to invest in opportunities outside of insurance.

Over the last years, Markel has grown its revenues at a rate of 12% per year, and its book value has increased in the same proportion as the previous years. The three segments that the company depends on, which they call ‘engines’ are Insurance, Markel Ventures, and Investments.

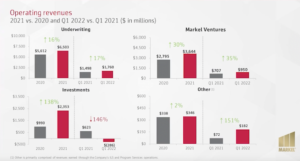

On April 26, 2022, the company reported first-quarter results for the Fiscal year 2022. Earned premiums were $1.76 billion compared to $1.5 billion in the first quarter of 2021. This represents an increase in earned premiums of 17% year-over-year. This was due to continued growth in gross premium volume from new business and more favorable rates.

However, net investment was a loss for the quarter of $358 million compared to a gain of $526 million last year in the same period. This was mainly due to the overall market being down over 23% thus far.

Book value per common share also decreased because of the net investment loss. Book value per share was $995.53 compared to $1,036.20 per common share in the first quarter of 2021. This is a decrease of 3.9% year-over-year.

The company ventures businesses grew revenues by an impressive 35% through strong organic growth and contributions from the company’s 2021 acquisitions.

Source: Investor Presentation

Growth Prospects

The most significant growth prospect is the company’s insurance engine. This is the primary business of Markel. The continuation of growing this segment will benefit the company’s growth prospects for years to come.

Also, Markel’s four priorities for capital allocation are first to support its existing businesses, second to acquire new companies, third to acquire publicly traded stocks and fourth to repurchase shares.

These are all great growth drivers for the company. As you can see in the chart below, the company has returned a great return to its shareholders.

Source: Investor Presentation

Competitive Advantages & Recession Performance

As an insurer, they do not benefit from favorable competitive positions. Industry competition is fierce, and the products are essentially commodities. Furthermore, most participants do not know the cost of goods sold for several years, allowing them to underprice policies without knowing it.

The main reason investors invest in this company is that the company has a remarkable ability to generate good returns for investors.

The company did not fair well doing the Great Recession and during the COVID-19 pandemic. For example, during the great recession, earnings fell 13% in 2008 and deeper with a 42% decrease in 2009.

Durning the COVID-19 pandemic, the company’s earnings dropped 21% in 2020 but came back strong in 2021 with an increase of 543%. This was driven because of the strong bull market we saw in 2021.

Thus, if there were another recession, it would bring the company’s earnings down.

Valuation & Expected Returns

In 2021, the company earned $179.91 per share. This was an outlier to recent years. Because of this, we expect an earning decrease of 58% for 2022. Thus, we expect the company to earn $75.00 per share in 2022.

The current price of $1321 gives us a PE ratio of 10.4x earnings. Based on peer companies in the same industries, having 10x earnings, PE is fair for an insurer.

The company does not pay dividends to its shareholders, so this will not be included in our expected total return calculation over the next five years.

We expect the company to grow earnings at about 6% over the next five years. Thus, putting all this together, we expect the company to provide an 8% return over the next five years.

Final Thoughts

Markel is a fundamentally dependable insurance and investment company. Its holdings are attractive, and a solid management group with a good track record and 20-year returns of over 700%, beating the market average.

However, We view the stock to be slightly higher than reasonably valued. Thus, we rate this stock as a hold at the current price. It will be a respectable buying opportunity if the stock price can get under $1,100.

Other Dividend Lists

Value investing is a valuable process to combine with dividend investing. The following lists contain many more high-quality dividend stocks:

- The Dividend Aristocrats List is comprised of 65 stocks in the S&P 500 Index with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 38 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.