Updated on September 23rd, 2021 by Bob Ciura

The U.S. housing industry is one of the most important sectors of the economy, because of its impact on many other industries, and also because the health of the housing market is often seen as an indicator for the broader economy.

One sub-sector of the very large home industry that investors should pay attention to is the furniture industry, which offers some promising companies that investors can put their money into.

These companies are less cyclical compared to home builders, as furnishings and fixtures are not only needed for newly built houses, but also in already existing homes.

New furniture is purchased as replacements when buildings are sold to new owners. Even when there is no sale of the property, owners and renters regularly upgrade their furniture.

This results in strong profits and cash flow for the top furniture stocks, which return cash to shareholders in the form of dividends.

You can see the entire list of consumer-cyclical dividend stocks here. The full list is available for download below, along with important financial metrics like dividend yields and price-to-earnings ratios:

The furniture industry is not a high-growth industry, but the following three companies could offer attractive total returns through earnings growth, dividends, and low valuations.

Table of Contents

In this article we will take a look at the top 3 furniture stocks, two of which are analyzed in greater detail in the Sure Analysis Research Database.

Our top 3 furniture stocks are ranked below, according to their 5-year expected total annual returns, in order of lowest to highest.

You can jump to any specific section of the article by clicking on the links below:

- Furniture Stock #3: Ethan Allen Interiors (ETD)

- Furniture Stock #2: HNI Corporation (HNI)

- Furniture Stock #1: Leggett & Platt (LEG)

Furniture Stock #3: Ethan Allen Interiors (ETD)

- 5-year expected annual returns: 6.0%

Ethan Allen Interiors is an interior design and home furnishings company that was founded in 1932. Ethan Allen is the smallest company of the three furnishing companies in this article, as it has a market cap just above $600 million.

Ethan Allen generates the majority of its revenues in the U.S., but the company is growing its international business continuously. Growth prospects in countries such as China, the UAE, as well as several other Asian countries are promising over the long term, as rising disposable incomes and a growing middle class allow for growing consumer spending on higher-priced goods such as furniture.

Ethan Allen has been one of the biggest beneficiaries of the economic recovery, as sales in its most recent fiscal quarter nearly doubled from the same quarter last year. The company also returned to profitability with adjusted EPS of $0.74 for the quarter, reversing a loss of $0.15 per share in the year-ago period.

Analysts are currently forecasting earnings-per-share of $2.67 for the upcoming fiscal year, which ends at the end of June 2022. Based on this, Ethan Allen stock trades at a forward P/E of 9.2. If the stock trades up to a P/E of 10, it would incur a small gain from an expanding P/E multiple.

The stock also has a 4.1% dividend yield. With an earnings-per-share growth rate of ~2% annually as the company’s outsized growth rate normalizes in future years, total returns are expected at ~6% annually going forward.

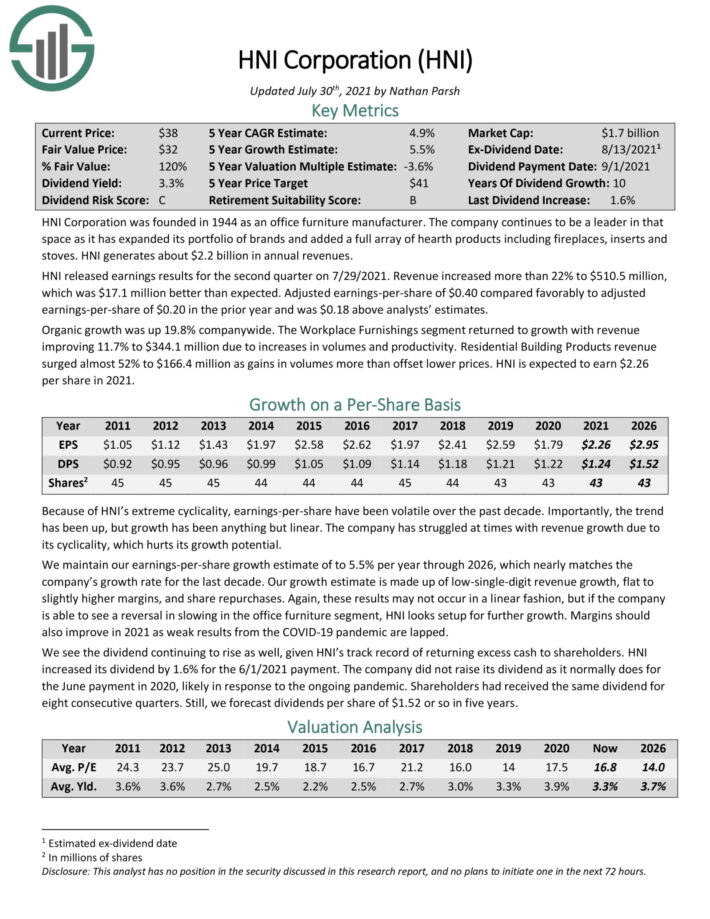

Furniture Stock #2: HNI Corporation (HNI)

- 5-year expected annual returns: 6.0%

HNI Corporation was founded in 1944 as an office furniture manufacturer. The company continues to be a leader in that space as it has expanded its portfolio of brands. HNI added a full array of hearth products including fireplaces, inserts and stoves to its portfolio. The company generates about $2.2 billion in annual revenues.

Source: Investor Presentation

HNI released earnings results for the second quarter on 7/29/2021. Revenue increased more than 22% to $510.5 million, which was $17.1 million better than expected. Adjusted earnings–per–share of $0.40 compared favorably to adjusted earnings–per–share of $0.20 in the prior year and was $0.18 above analysts’ estimates.

Organic growth was up 19.8% company-wide. The Workplace Furnishings segment returned to growth with revenue improving 11.7% to $344.1 million due to increases in volumes and productivity. Residential Building Products revenue surged almost 52% to $166.4 million as gains in volumes more than offset lower prices.

Shares trade for a 2021 P/E ratio of 16.4, which is above our fair value estimate of 14. This means the stock could generate a negative return from a declining P/E multiple. EPS growth and dividends will help offset this impact.

Together with a 3.4% dividend yield and our earnings-per-share growth rate estimate of 5.5% annually, we get to a total return estimate of 6% annually going forward.

Click here to download our most recent Sure Analysis report on HNI (preview of page 1 of 3 shown below):

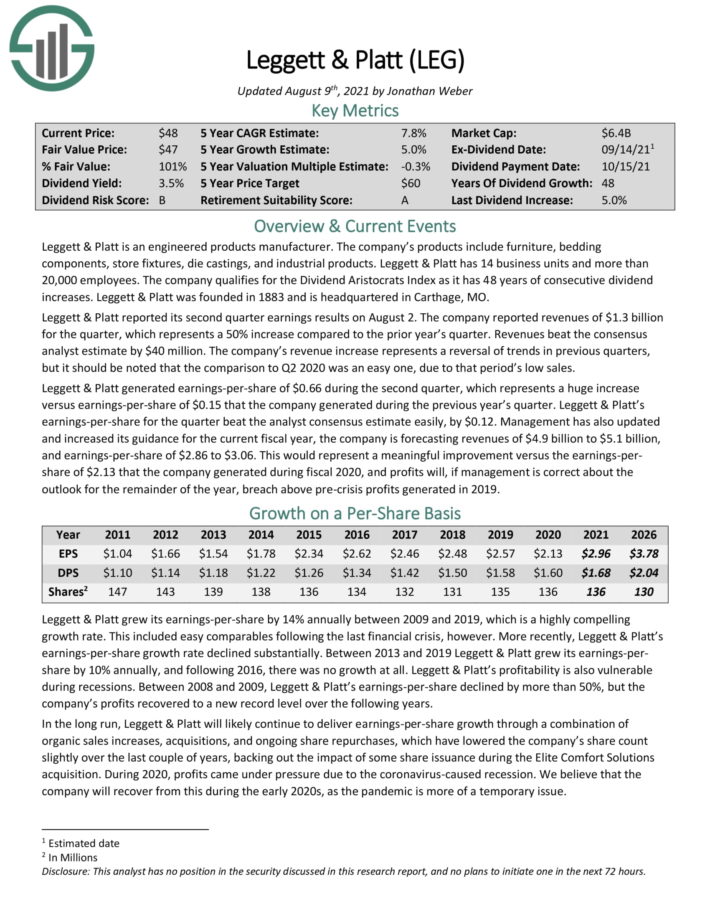

Furniture Stock #1: Leggett & Platt (LEG)

- 5-year expected annual returns: 8.8%

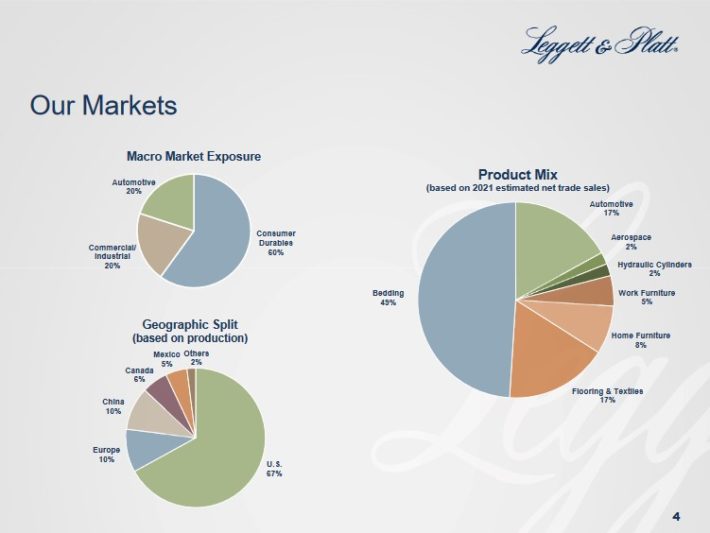

Leggett & Platt is an engineered products manufacturer. The company’s products include furniture, bedding components, store fixtures, die castings, and industrial products. Leggett & Platt has 14 business units and more than 20,000 employees. The company qualifies for the Dividend Aristocrats list as it has 48 years of consecutive dividend increases.

Source: Investor Presentation

Leggett & Platt reported its second quarter earnings results on August 2. The company reported revenues of $1.3 billion for the quarter, which represents a 50% increase compared to the prior year’s quarter. Revenues beat the consensus analyst estimate by $40 million. The company’s revenue increase represents a reversal of trends in previous quarters, but it should be noted that the comparison to Q2 2020 was an easy one, due to that period’s low sales.

From the combination of modest multiple expansion, expected earnings growth of 5% annually, and the 3.6% dividend yield, total expected returns could reach nearly 9% per year over the next five years.

Click here to download our most recent Sure Analysis report on LEG (preview of page 1 of 3 shown below):

Final Thoughts

Furniture stocks are cyclical, as they depend on a healthy economy and U.S. housing market. Of course, this presents an elevated level of risk during recessions, as furniture stocks are likely to struggle during an economic downturn. But over the long-term, quality furniture stocks have generated steady growth over the years, while paying consistent dividends. Leggett & Platt is our top-ranked furniture stock today, due to its high level of expected returns, and its impressive dividend history.