Updated on October 17th, 2019 by Bob Ciura

Spreadsheet data updated daily

Utility stocks can make excellent investments for long-term dividend growth investors.

Strong, regulatory-based competitive advantages allow these companies to consistently raise their dividend payments year in and year out. Even better, many utility stocks have above-average dividend yields, providing a compelling combination of income now and growth later for long-term investors.

Because of these favorable industry characteristics, we’ve compiled a list of utility stocks. The list is derived from the major utility sector exchange-traded funds JXI, VPU and XLU. You can download the list below:

You can view a preview of our utility stocks list below:

| ETR | Entergy Corp. | 116.04 | 3.1 | 23,072.2 | 22.4 | 70.0 |

| ATO | Atmos Energy Corp. | 111.11 | 1.9 | 13,133.3 | 26.2 | 48.6 |

| WEC | WEC Energy Group, Inc. | 92.76 | 2.5 | 29,259.8 | 26.7 | 65.9 |

| WTR | Aqua America, Inc. | 45.42 | 1.9 | 9,800.6 | 59.4 | 114.6 |

| ED | Consolidated Edison, Inc. | 90.84 | 3.2 | 30,172.0 | 21.5 | 68.8 |

| NEE | NextEra Energy, Inc. | 229.91 | 2.1 | 112,368.7 | 32.8 | 67.3 |

| XEL | Xcel Energy, Inc. | 63.49 | 2.5 | 32,698.0 | 25.9 | 64.1 |

| SO | The Southern Co. | 61.09 | 4.0 | 63,853.1 | 14.3 | 56.5 |

| EIX | Edison International | 69.84 | 3.5 | 25,009.0 | -91.7 | -320.8 |

| PPL | PPL Corp. | 32.41 | 5.1 | 23,408.0 | 13.1 | 66.7 |

| BKH | Black Hills Corp. | 77.39 | 2.6 | 4,725.7 | 20.4 | 52.4 |

| DTE | DTE Energy Co. | 129.26 | 2.9 | 23,693.6 | 21.3 | 61.2 |

| AEP | American Electric Power Co., Inc. | 92.60 | 2.8 | 45,725.4 | 23.1 | 65.7 |

| SRE | Sempra Energy | 144.85 | 2.6 | 39,768.7 | 20.6 | 52.9 |

| DUK | Duke Energy Corp. | 95.13 | 3.9 | 69,311.8 | 21.0 | 81.9 |

| UGI | UGI Corp. | 47.88 | 2.3 | 8,347.3 | 25.2 | 56.7 |

| MDU | MDU Resources Group, Inc. | 27.57 | 2.9 | 5,488.1 | 18.8 | 54.8 |

| D | Dominion Energy, Inc. | 81.80 | 4.3 | 67,232.6 | 54.9 | 235.2 |

| CNP | CenterPoint Energy, Inc. | 28.62 | 3.9 | 14,373.5 | 25.1 | 98.9 |

| NFG | National Fuel Gas Co. | 44.91 | 3.8 | 3,876.4 | 13.1 | 49.9 |

| EXC | Exelon Corp. | 44.91 | 3.2 | 43,633.8 | 19.1 | 60.3 |

| PEG | Public Service Enterprise Group, Inc. | 61.78 | 3.0 | 31,238.2 | 21.3 | 63.4 |

| ES | Eversource Energy | 84.58 | 2.5 | 27,370.3 | 31.2 | 76.7 |

| FE | FirstEnergy Corp. | 47.80 | 3.1 | 25,811.4 | 23.0 | 71.2 |

| AWK | American Water Works Co., Inc. | 121.63 | 1.6 | 21,972.8 | 37.9 | 59.4 |

| AEE | Ameren Corp. | 75.72 | 2.5 | 18,612.2 | 23.3 | 58.0 |

| CMS | CMS Energy Corp. | 63.54 | 2.3 | 18,031.8 | 30.8 | 71.8 |

| EVRG | Evergy, Inc. | 63.58 | 3.0 | 14,971.0 | 27.0 | 79.9 |

| LNT | Alliant Energy Corp. | 52.29 | 2.6 | 12,420.0 | 24.2 | 63.8 |

| NI | NiSource, Inc. | 27.97 | 2.8 | 10,442.5 | 91.7 | 259.0 |

| PNW | Pinnacle West Capital Corp. | 93.83 | 3.1 | 10,537.5 | 20.9 | 64.8 |

| AES | The AES Corp. | 16.13 | 3.3 | 10,707.9 | 27.0 | 90.3 |

| NRG | NRG Energy, Inc. | 39.52 | 0.3 | 9,998.1 | 21.7 | 6.6 |

| VST | Vistra Energy Corp. | 26.73 | 0.9 | 13,108.2 | 19.0 | 17.8 |

| IDA | IDACORP, Inc. | 108.49 | 2.3 | 5,461.0 | 24.4 | 55.9 |

| POR | Portland General Electric Co. | 56.23 | 2.6 | 5,025.4 | 25.1 | 65.8 |

| SWX | Southwest Gas Holdings, Inc. | 88.69 | 2.4 | 4,818.0 | 23.4 | 56.1 |

| HE | Hawaiian Electric Industries, Inc. | 44.51 | 2.8 | 4,850.4 | 23.8 | 67.4 |

| OGS | ONE Gas, Inc. | 93.32 | 2.1 | 4,921.2 | 27.5 | 56.6 |

| ALE | ALLETE, Inc. | 85.60 | 2.7 | 4,421.8 | 22.5 | 60.2 |

| SR | Spire, Inc. (Missouri) | 83.72 | 2.8 | 4,253.7 | 22.2 | 62.0 |

| PNM | PNM Resources, Inc. | 51.18 | 2.2 | 4,063.9 | -164.3 | -365.5 |

| NJR | New Jersey Resources Corp. | 43.12 | 2.7 | 3,879.9 | 28.3 | 76.8 |

| NWE | NorthWestern Corp. | 73.46 | 3.1 | 3,705.5 | 17.2 | 52.7 |

| AVA | Avista Corp. | 47.68 | 3.2 | 3,131.7 | 15.9 | 51.0 |

| SJI | South Jersey Industries, Inc. | 31.55 | 3.6 | 2,914.9 | 39.7 | 143.6 |

| AGR | Avangrid, Inc. | 49.36 | 3.5 | 15,335.9 | 26.8 | 94.9 |

| EE | El Paso Electric Co. | 67.43 | 2.2 | 2,744.4 | 30.4 | 66.3 |

| NG | NovaGold Resources, Inc. | 6.32 | 0.0 | 2,020.4 | -78.5 | 0.0 |

| FTS | Fortis, Inc. | 41.48 | 3.2 | 18,101.4 | 15.1 | 48.9 |

| SSE | 3022 | 0.00 | 0.0 | 0.0 | ||

| SRG | Seritage Growth Properties | 43.74 | 0.0 | 1,665.4 | -14.4 | 0.0 |

| EDP | 27498 | 0.00 | 0.0 | 0.0 | ||

| NTGY | 0.00 | 0.0 | 0.0 | |||

| APA | Apache Corp. | 21.76 | 4.6 | 8,180.9 | -11.6 | -53.5 |

| TRN | Trinity Industries, Inc. | 18.06 | 3.3 | 2,309.4 | 20.1 | 66.8 |

| REE | 0.00 | 0.0 | 0.0 | |||

| ENIA | Enel Américas SA | 9.51 | 0.0 | 14,471.6 | 8.3 | 0.0 |

| SEV | 0.00 | 0.0 | 0.0 | |||

| SVT | Servotronics, Inc. | 10.34 | 1.5 | 25.7 | 7.4 | 11.4 |

| EDF | Stone Harbor Emerging Markets Income Fund | 13.40 | 16.1 | 219.7 | ||

| CNA | CNA Financial Corp. | 46.88 | 3.0 | 12,728.2 | 14.6 | 43.6 |

| CIG | Companhia Energética de Minas Gerais SA | 3.34 | 0.0 | 3,174.1 | 4.5 | 0.0 |

| ENIC | Enel Chile SA | 4.84 | 0.0 | 6,789.0 | 15.5 | 0.0 |

| AWR | American States Water Co. | 93.09 | 1.2 | 3,428.7 | 45.0 | 53.2 |

| CTWS | Connecticut Water Service, Inc. | 69.98 | 1.8 | 844.6 | 39.4 | 71.3 |

| CWT | California Water Service Group | 54.64 | 1.4 | 2,630.4 | 44.4 | 62.6 |

| SJW | SJW Group | 72.34 | 1.6 | 2,057.5 | 39.4 | 63.2 |

| YORW | York Water Co. | 42.83 | 1.6 | 555.8 | 39.6 | 63.4 |

| Ticker | Name | Price | Dividend Yield | Market Cap ($M) | P/E Ratio | Payout Ratio |

Keep reading this article to learn more about the benefits of investing in utility stocks.

Table Of Contents

The following table of contents provides for easy navigation:

- How To Use The Utility Stock List

- Why Utility Dividend Stocks Make Attractive Investments

-

The Top 10 Utility Stocks Today

#10: Black Hills Corp (BKH)

#9: DTE Energy (DTE)

#8: American Electric Power (AEP)

#7: Sempra Energy (SRE)

#6: Duke Energy (DUK)

#5: UGI Corporation (UGI)

#4: MDU Resources (MDU)

#3: Dominion Energy (D)

#2: CenterPoint Energy (CNP)

#1: Nation Fuel Gas Company (NFG)

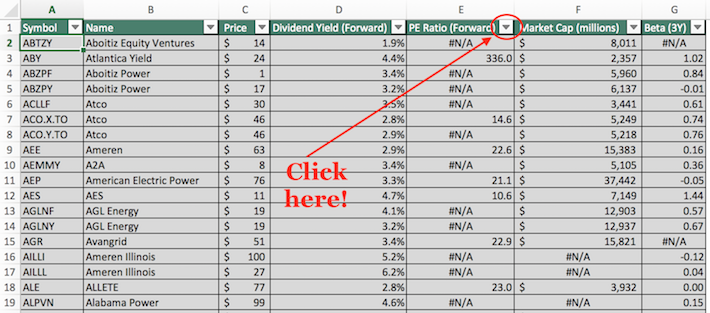

How To Use The Utility Dividend Stocks List To Find Investment Ideas

Having an Excel database of all the dividend-paying utility stocks combined with important investing metrics and ratios is very useful.

This tool becomes even more powerful when combined with knowledge of how to use Microsoft Excel to find the best investment opportunities.

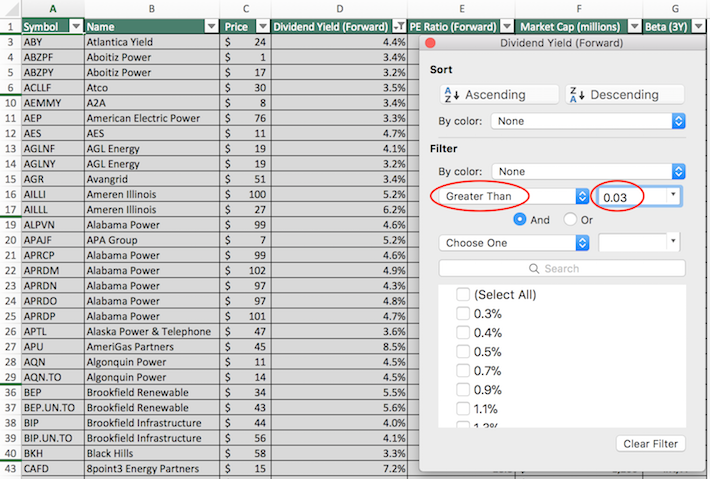

With that in mind, this section will provide a quick explanation of how you can instantly search for utility stocks with particular characteristics, using two screens as an example.

The first screen that we will implement is for utility stocks with price-to-earnings ratios below 15.

Screen 1: Low P/E Ratios

Step 1: Download the Utility Dividend Stocks Excel Spreadsheet List at the link above.

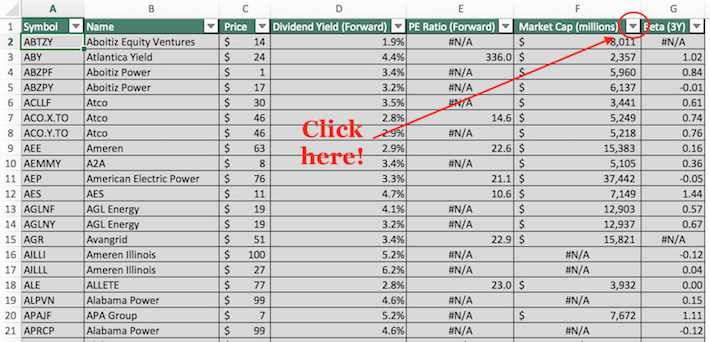

Step 2: Click the filter icon at the top of the price-to-earnings ratio column, as shown below.

Step 3: Change the filter field to ‘Less Than’, and input ’15’ into the field beside it.

The remaining list of stocks contains dividend-paying utility stocks with price-to-earnings ratios less than 15. As you can see, there are relatively few securities (at the time of this writing) that meet this strict valuation cutoff.

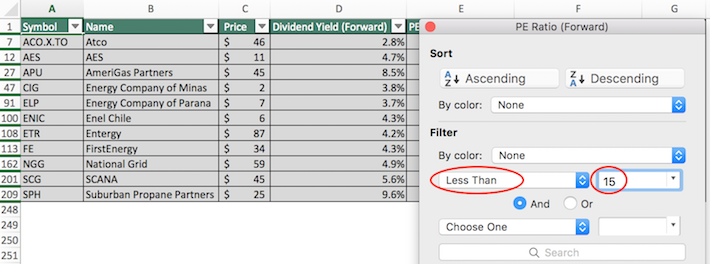

The next section demonstrates how to screen for large-cap stocks with high dividend yields.

Screen 2: Large Cap Stocks With High Dividend Yields

Businesses are often categorized based on their market capitalization. Market capitalization is calculated as stock price multiplied by the number of shares outstanding and gives a marked-to-market perception of what people think a business is worth on average.

Large-cap stocks are loosely defined as businesses with a market capitalization above $10 billion and are perceived as lower risk than their smaller counterparts. Accordingly, screening for large-cap stocks with high dividend yields could provide interesting investment opportunities for conservative, income-oriented investors.

Here’s how to use the Utility Dividend Stocks Excel Spreadsheet List to find such investment opportunities.

Step 1: Download the Utility Dividend Stocks Excel Spreadsheet List at the link above.

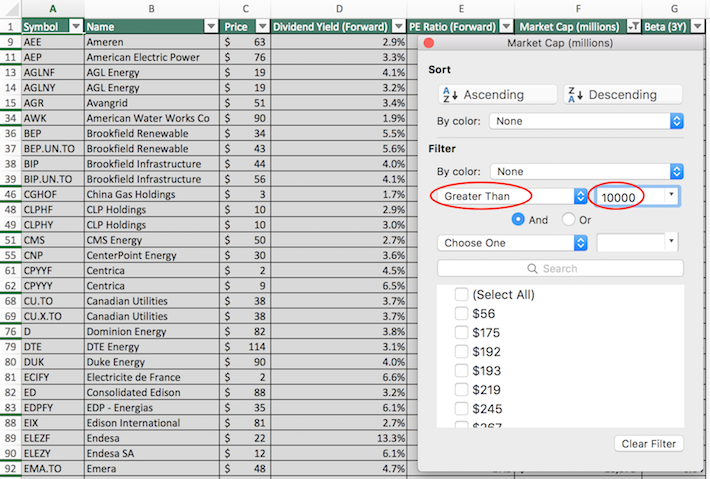

Step 2: Click the filter icon at the top of the Market Cap column, as shown below.

Step 3: Change the filter setting to ‘Greater Than’, and input 10000 into the field beside it. Note that since market capitalization is measured in millions of dollars in this Excel sheet, filtering for stocks with market capitalizations greater than ‘$10,000 millions’ is equivalent for screening for those with market capitalizations exceeding $10 billion.

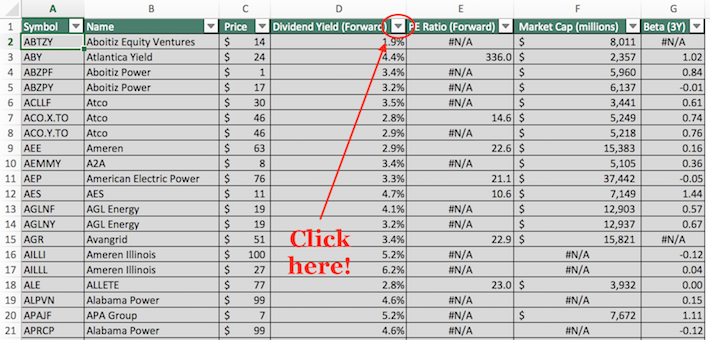

Step 4: Close that filter window (by exiting it, not by clicking ‘clear filter’) and click on the filter icon for the ‘dividend yield’ column, as shown below.

Step 5: Change the filter setting to ‘Greater Than’ and input 0.03 into the column beside it. Note that 0.03 is equivalent to 3%.

The remaining stocks in this list are those with market capitalizations above $10 billion and dividend yields above 3%. This narrowed investment universe is suitable for investors looking for low-risk, high-yield securities.

You now have a solid fundamental understanding of how to use the Utility Dividend Stocks Excel Spreadsheet List to its fullest potential. The remainder of this article will discuss the characteristics that make the utility sector attractive for dividend growth investors.

Why Utility Dividend Stocks Make Attractive Investments

The word ‘utility’ describes a wide variety of business models but is usually used as a reference to electric utilities – companies that engage in the generation, transmission, and distribution of electricity. Other types of utilities include propane utilities and water utilities.

So why do these businesses make for attractive investments?

Utilities usually conduct business in highly regulated markets, complying with rules set by federal, state, and municipal governments.

While this sounds highly unattractive on the surface, what it means in practice is that utilities are basically legal monopolies. The strict regulatory environment that utility businesses operate in creates a strong and durable competitive advantage for existing industry participants. For this reason, electric utilities are among the most popular stocks for long-term dividend growth investors – especially because they tend to offer above-average dividend yields.

Indeed, the regulatory-based competitive advantages available to utility stocks allow them to raise their dividends very consistently. Simply put, utility stocks are some of the most dependable dividend growth stocks around.

To provide a few examples, the following utility stocks have exceptionally long streaks of consecutive dividend increases:

- Consolidated Edison (ED) – more than 25 years of consecutive dividend increases

- American States Water (AWR) – a water utility – more than 50 years of consecutive dividend increases

- SJW Group (SJW) – another water utility – more than 50 years of consecutive dividend increases

The long streak of consecutive dividend increases is possible only because of their unique industry-specific competitive advantages.

Clearly, the utility sector is very stable. People are going to need electricity in ever-increasing amounts for the foreseeable future.

One characteristic that does not describe utility stocks is fast-growing. One of the regulatory constraints imposed upon utility companies is the pace at which they can increase the rate fees paid by their customers. These rate increases are usually in the low-single-digits, which provides a cap on the revenue growth experienced by these companies. Utility stocks typically don’t offer strong total returns, but there are exceptions.

Accordingly, utility investors must be willing to accept sluggish growth in exchange for the stability that comes from doing business as a regulated utility.

The Top 10 Utility Stocks Now

Taking all of the above into consideration, the following section discusses our top 10 list of utility stocks today, based on their expected annual returns over the next five years. The rankings in this article are derived from our expected total return estimates from the Sure Analysis Research Database.

The 10 utility stocks with the highest projected five-year total returns are ranked in this article, from lowest to highest.

Related: Watch the video below to learn how to calculate expected total return for any stock.

Rankings are compiled based upon the combination of current dividend yield, expected change in valuation, as well as forecasted annual earnings-per-share growth to determine which stocks offer the best total return potential for shareholders.

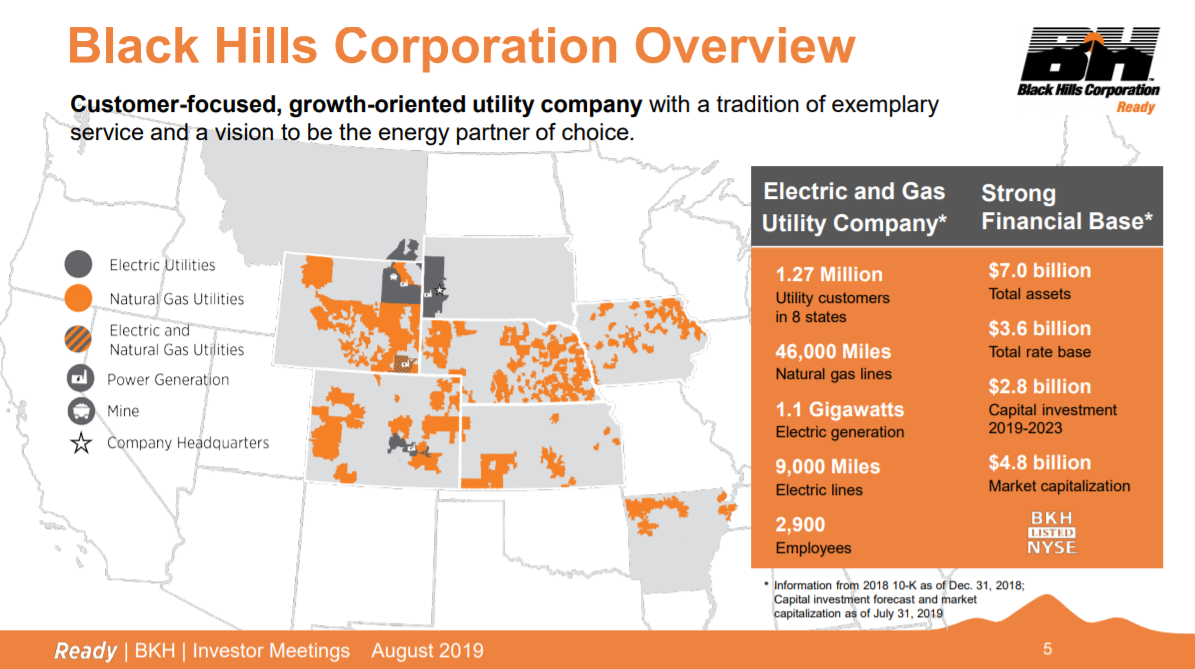

Top Utility Stock #10: Black Hills Corporation (BKH)

Black Hills Corporation (BKH) is a regional electric utility that provides natural gas and electricity to customers in the Midwestern US, including Colorado, Iowa, Kansas, Montana, Nebraska, Wyoming, and South Dakota. The company was founded in 1941 and has a current market capitalization of $4.7 billion.

Source: Investor presentation, page 5

Black Hills is extraordinary in terms of dividend history, having boosted its payout for 49 consecutive years. Assuming Black Hills increases its payout in 2020, it will achieve the coveted status of Dividend King with its 50th consecutive annual dividend increase.

Black Hills’ profitability has seen fairly sizable swings in both directions in the past decade, but earnings have trended upwards. In fact, EPS has grown at a rate of nearly 5% annually since 2009. For a utility, this is a decent growth rate given that the group is generally limited to regulator-enforced pricing increases and modest user base growth.

Black Hills, like any other utility, is beholden to weather conditions in its service areas, which drives demand for electricity and natural gas. Rate reviews continue to drive results for the company, but Black Hills is also expanding its offerings by investing in new pipelines and other infrastructure. Its current capex allowance is $2.8 billion through 2023, which is more than half of its market capitalization.

We see this contributing to 4.5% annual earnings-per-share growth in the coming years, combining with the current 2.6% yield to overcome a ~4% headwind from what we view as an overvaluation of the stock. In total, we believe Black Hills will produce just over 3% in total annual returns in the coming years.

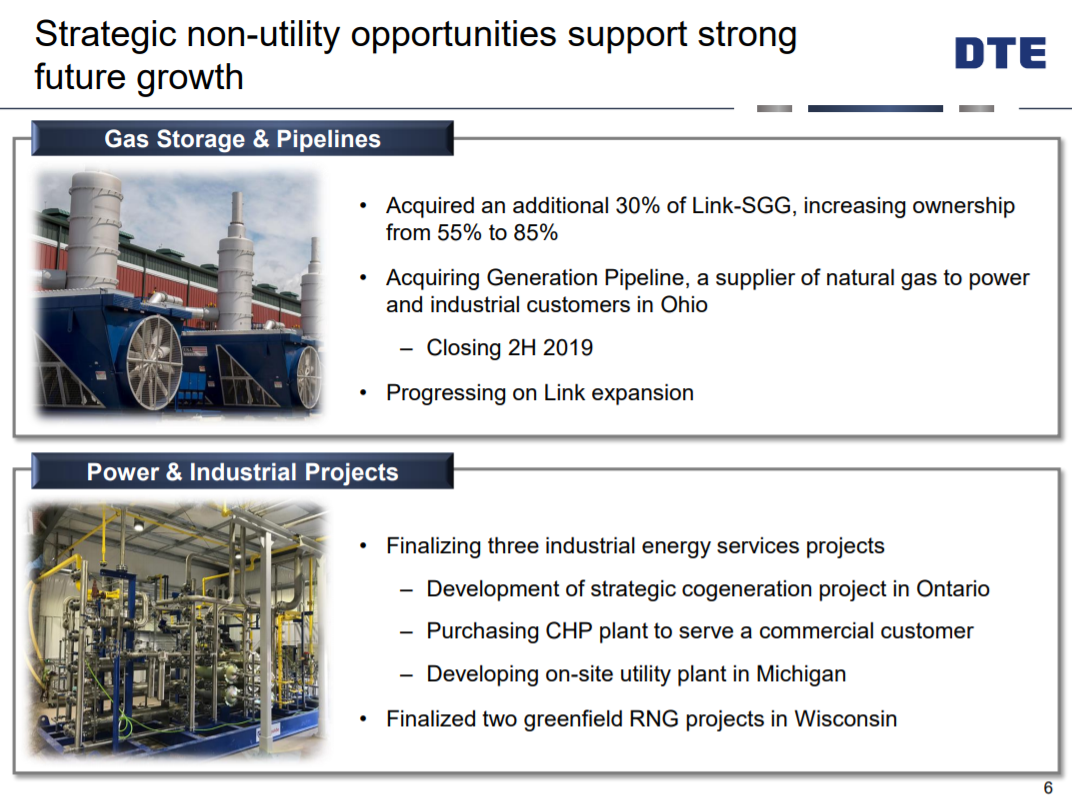

Top Utility Stock #9: DTE Energy (DTE)

DTE Energy is an energy provider that was founded in Detroit in 1849. However, what started as a small gas provider in the northern U.S. city has grown into a nationwide provider of utility services.

Most of DTE’s business is still in Michigan as it provides electricity and natural gas, gas pipelines and storage, energy trading, and power and industrial projects. DTE is primarily a utility, with ~80% of its earnings derived from traditional electricity and natural gas revenue. DTE has a nearly $24 billion market capitalization.

DTE has shown very strong growth for a utility, boosting earnings-per-share by an average rate of nearly 7% in the past decade. The company continues to show growth from its gas storage and pipelines segment.

Source: Investor presentation, page 6

DTE has outlined above how it continues to invest in the areas, where it can grow revenue and earnings without having to work through rate reviews. In addition, these projects support DTE’s initiative to reduce its reliance upon coal, and replace it with cleaner energy projects. We see DTE producing ~6% earnings-per-share growth in the coming years due to rate reviews, customer base growth, and new projects.

Considering the 6% projected earnings-per-share growth, the ~3% yield, and a ~4% headwind from the valuation declining over time, we see DTE producing between 4% and 5% in total annual returns in the coming years.

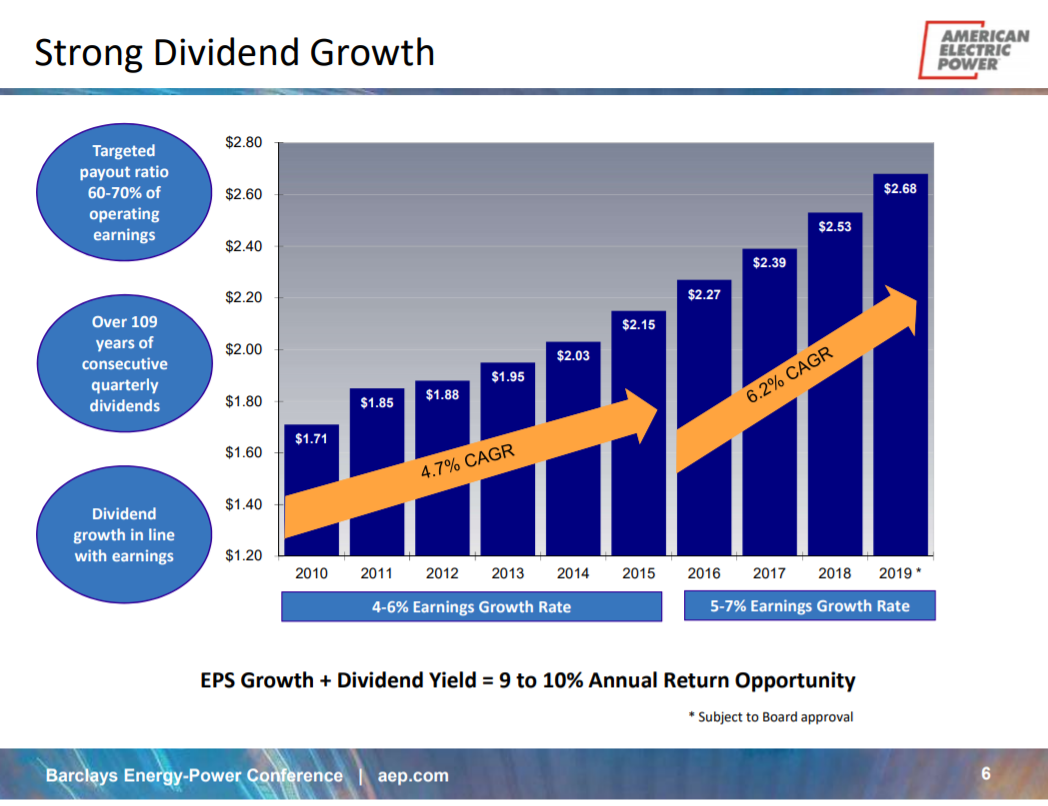

Top 10 Utility Stock #8: American Electric Power (AEP)

American Electric Power was founded in 1906 and in the 113 years since, has grown into a diversified regulated utility in the U.S. The company offers electricity generation, transmission, and distribution services in 11 different states. AEP uses coal, natural gas, renewable energy, and nuclear power.

AEP also derives revenue from transmission and distribution services, transmission, and unregulated generation. The stock trades with a $46 billion market capitalization.

Source: Investor presentation, page 6

AEP has managed to pay a quarterly dividend for an astounding 109 consecutive years. While certainly not all of those years has seen a dividend increase, that sort of track record on shareholder returns is difficult to come by.

To its credit, AEP has boosted its payout for 16 consecutive years, and as seen above, those increases have been sizable. AEP has grown the payout by an average of more than 6% annually in the past four years. AEP is on the list of Dividend Achievers, which have increased their dividends for at least 10 consecutive years.

We see AEP producing ~5% annual earnings-per-share growth in the coming years, fueled by its plans to transform itself into a major player in renewable energy. The company is building out its wind power business, and will help achieve the company’s goal of expanding its renewable portfolio exponentially by 2030. Importantly, AEP has grown earnings at a rate of under 4% in the past decade, but we believe its focus and investments on non-traditional utility revenue will help it improve results moving forward.

Our estimate of 5% earnings growth, the sub-3% yield, and a low-single-digit headwind from the valuation ticking lower over time has our forecast for total annual returns at ~6% in the coming years for AEP.

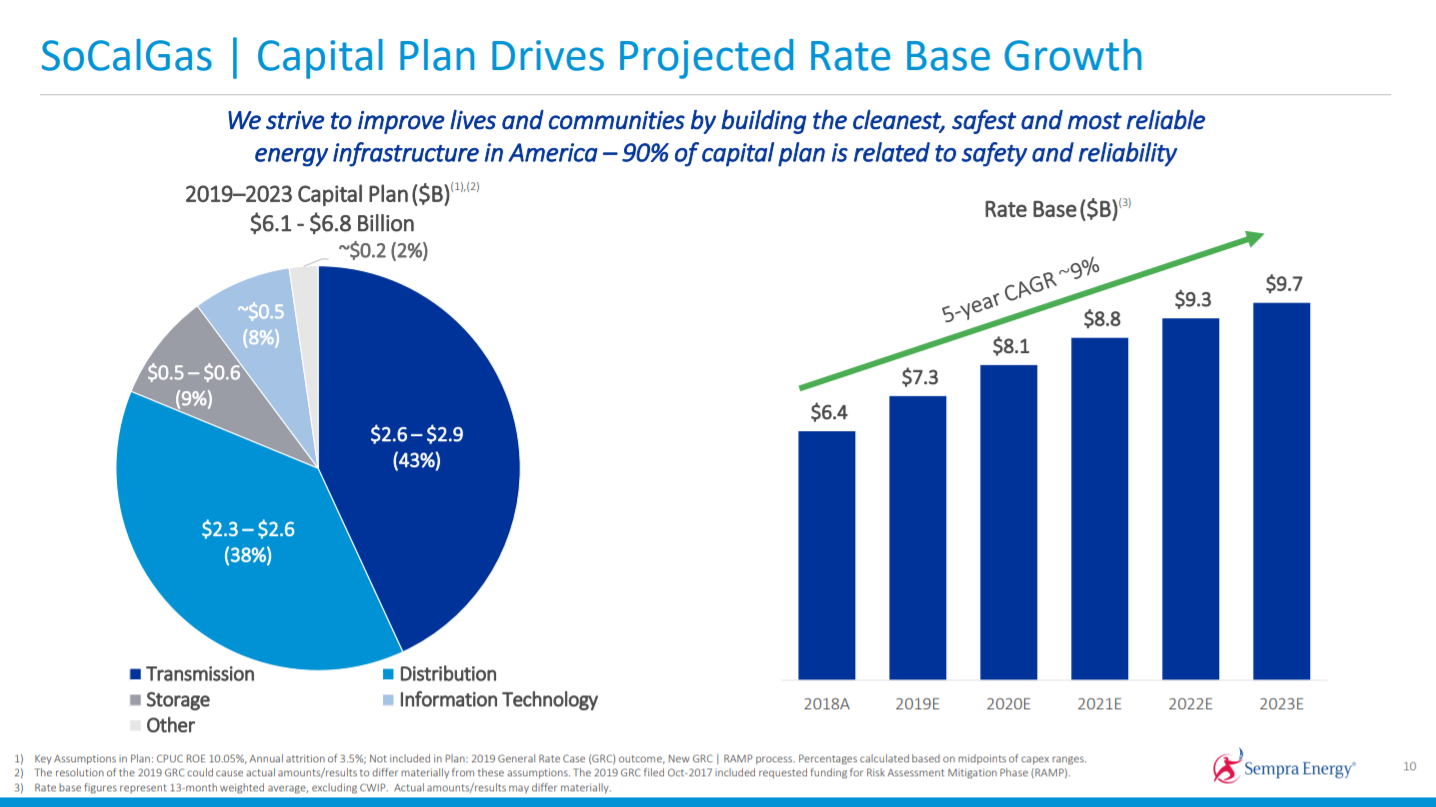

Top Utility Stock #7: Sempra Energy (SRE)

Sempra Energy was founded just 20 years ago, but has grown into a $40 billion market capitalization utility. The company has a sizable utility customer base in the US, focused in Southern California.

Sempra distributes natural gas and electricity to its 20+ million customers, and owns a majority stake in Texas-based Oncor, which is a transmission and distribution business.

Sempra also owns renewable energy projects, liquefied natural gas facilities, and gas pipelines and storage in the U.S. and Latin America.

Source: Investor presentation, page 10

We see Sempra benefiting from the macro move towards cleaner energy, as well as continued population growth in Southern California. Sempra has remade its portfolio recently via acquisitions and divestitures, and we now expect robust 8% annual earnings-per-share growth.

As seen above, Sempra expects to produce 9% annual growth in its rate base in Southern California, which will drive earnings growth, but also funding renewable energy capex, in addition to other growth initiatives.

Sempra’s exposure and dominance in the Southern California market is a huge competitive advantage, and should remain the company’s cash cow for years to come. In addition, its assets in Mexico should drive growth as that country continues to try and develop its utility infrastructure.

Sempra’s growth forecast will help drive ~6% total annual returns in the coming years, as the valuation will drive a mid-single-digit headwind to total returns, while the sub-3% dividend yield will help offset some of the valuation headwind.

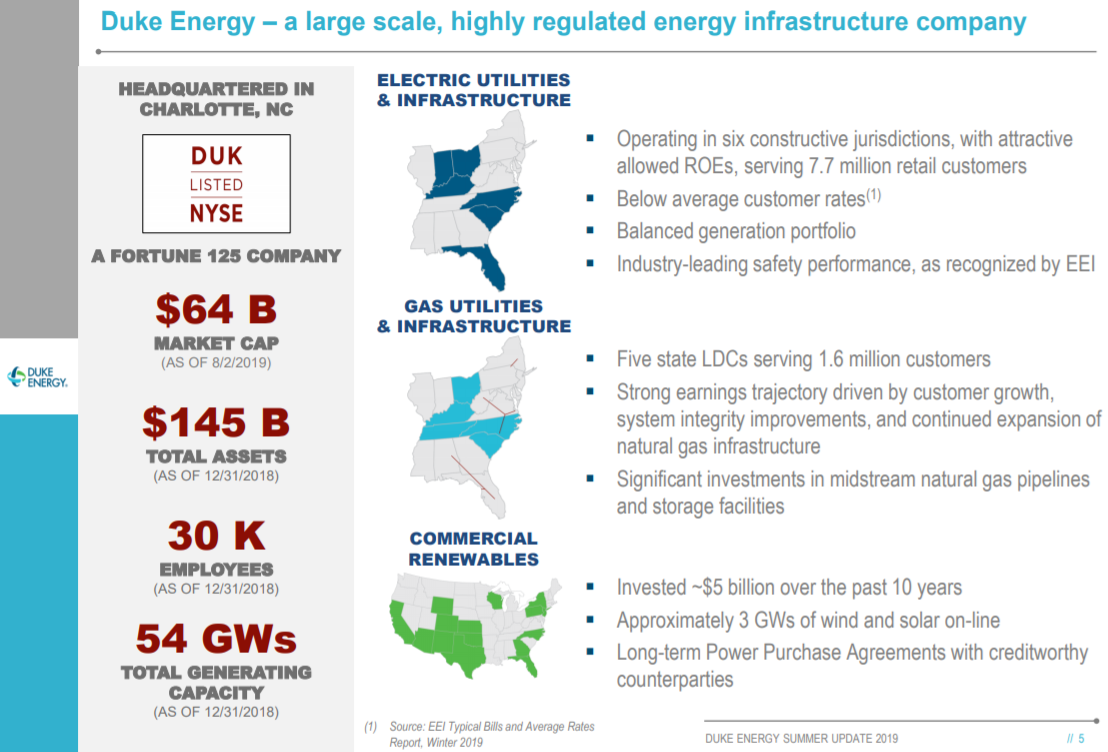

Top Utility Stock #6: Duke Energy (DUK)

Duke Energy was founded in 1904 and in the time since, it has grown from powering a single cotton mill in South Carolina to one of the largest energy providers in the U.S.

Duke Energy has a market capitalization near $70 billion.

Source: Investor presentation, page 5

Duke’s core electric utilities segment serves nearly 8 million retail customers in six different states. In addition, it serves 1.6 million customers in five states with its gas utility and infrastructure segment, which is helping to drive earnings growth. Duke is also a big player in the natural gas pipeline and storage business. Finally, Duke has spent billions of dollars in recent years to grow its renewables portfolio, but it is still just ~5% of total power production at this point.

Duke has grown earnings-per-share at a rate of about 4% annually in the past decade, and that is what we expect moving forward. Management has guided for earnings-per-share growth of 4% to 6% annually over the next five years, but we are slightly more cautious. Duke has a massive $37 billion capital expenditure plan it is attempting to execute, and is also subject to the same regulatory rate cases that any other utility is subject to.

The company’s Atlantic Coast Pipeline project is running behind and costing more than expected, which we see as crimping earnings growth. Finally, Duke’s share count continues to rise as it issues shares to fund acquisitions from time to time. This introduces another headwind to earnings-per-share growth.

In total, we see Duke’s 4% earnings growth, the ~4% dividend yield, and a low-single-digit headwind from the valuation combining to produce ~6% total annual returns in the coming years.

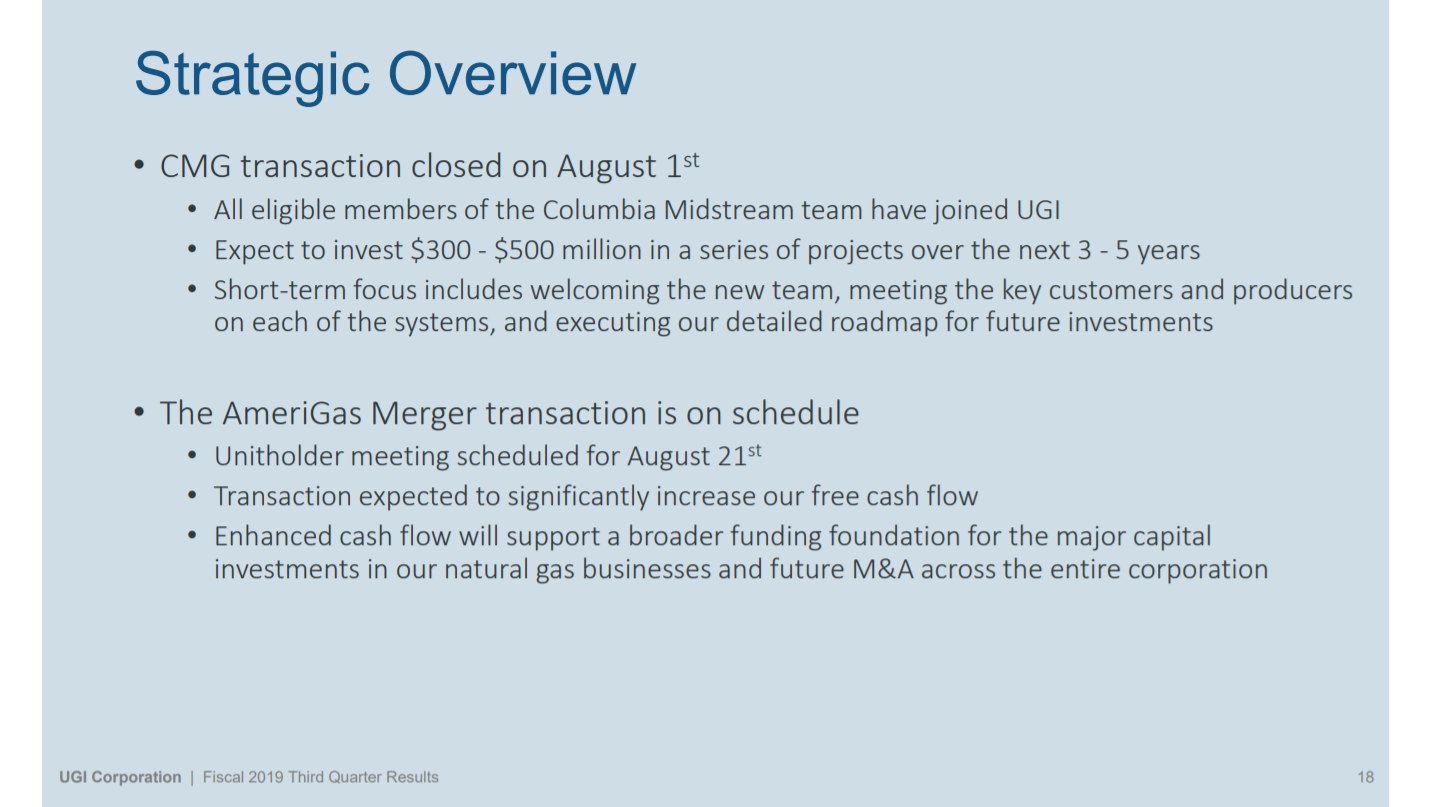

Top Utility Stock #5: UGI Corporation (UGI)

UGI Corporation is a gas and electric utility that operates in Pennsylvania. UGI also has a large energy distribution business that operates nationwide, and other parts of the world. UGI was founded in 1882 and has paid consecutive dividends since 1885. The company has increased its annual dividend for 32 consecutive years.

UGI is a conglomerate that operates in four segments: AmeriGas, International, Midstream & Marketing, and Utilities. The company trades with a $10 billion market capitalization.

UGI has been busy on the acquisition front, with the company’s two most recent mergers listed below.

Source: Investor presentation, page 18

UGI recently closed on its Columbia Midstream Group purchase, while its merger with AmeriGas is scheduled to be completed in the near future. UGI already owns about one-quarter of AmeriGas, and is purchasing the remainder it doesn’t already own. The company expects the transaction to significantly increase its free cash flow as the partnership has performed well in recent years.

These acquisitions are examples of why management believes UGI can produce 6% to 10% annual earnings-per-share growth. UGI has grown at a rate of 7% annually historically, and we see 8% in the coming years. Acquisitions are the biggest catalyst for UGI, but investors would do well to remember UGI is beholden to the weather just like any other utility.

This robust earnings growth will be partially offset by a mid-single-digit headwind from the valuation, but mid-2% yield will help UGI produce between 6% and 7% total annual returns in the coming years.

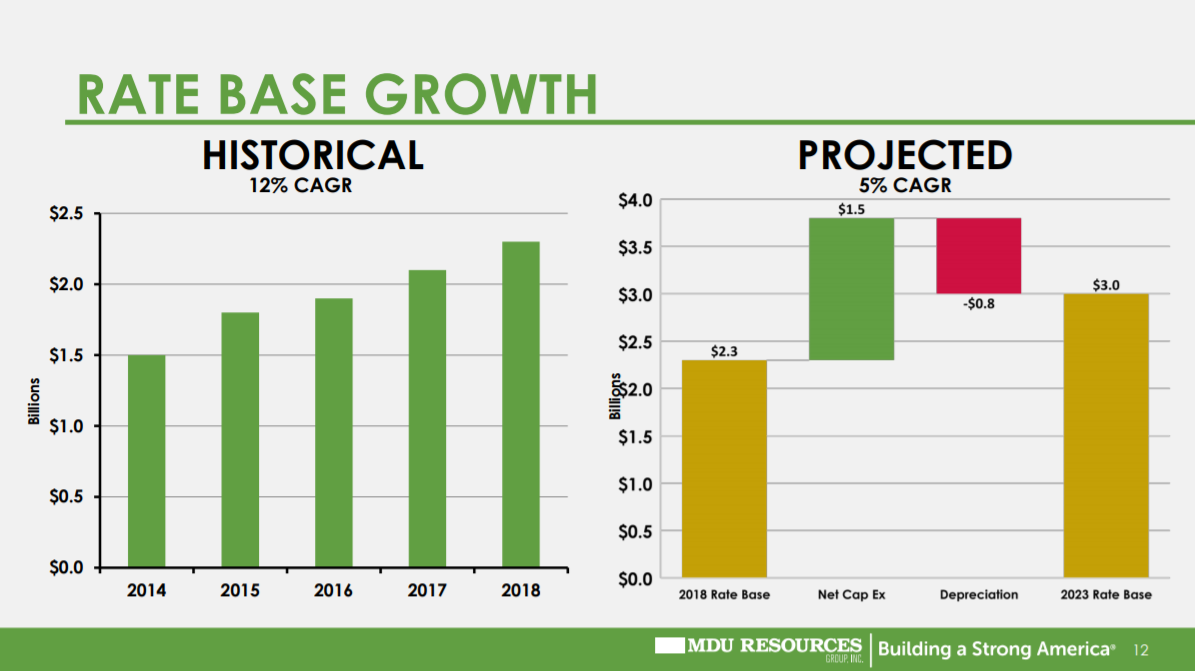

Top Utility Stock #4: MDU Resources (MDU)

MDU Resources is a regulated energy delivery utility that also competes in a variety of other industries. Unlike most utilities that are pure-plays on electricity or natural gas, MDU also has a transportation business, and a construction materials business. The company was founded in North Dakota in 1924 and since then, has paid 80 consecutive years of dividends.

Source: Investor presentation, page 12

Above we can see the company’s core utility segment’s growth over the past five years, and its future growth outlook. Like any regulated utility, MDU must request rate increases, and it has done so with great success in recent years. Part of the rate base growth seen above is from rising customer bases, but MDU has also achieved better pricing outcomes. The continued success of this combination should see MDU’s rate base continue to grow at ~5% annually through 2023.

MDU is also seeing record volumes in its transportation business, and its construction business has a $2+ billion backlog of work. Every segment is performing well and we see this combination producing, conservatively, 5% annual growth moving forward. Construction businesses tend to perform poorly during weak economic times, which increases MDU’s cyclicality.

Mid-single-digit earnings growth, virtually no impact from the valuation, and the ~3% dividend yield should produce ~7% annual total returns for shareholders moving forward.

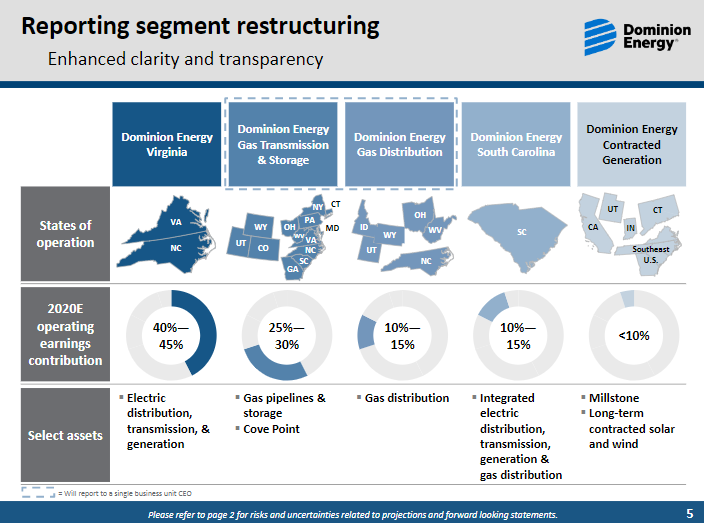

Top Utility Stock #3: Dominion Energy (D)

Dominion Energy is a large electric utility valued at $63 billion, with more than 6 million customers in eight states. Dominion’s core business is its electric utility that provides power to customers in Virginia and North Carolina, but it has significant other business lines as well.

Source: Investor presentation, page 5

Nearly half of the consolidated company’s operating earnings come from the core electric energy segment. However, significant earnings are derived from gas pipelines and storage in roughly a dozen states across the US. The remaining segments produce around one-third of operating earnings, so Dominion is well-diversified, but still certainly focused on utility activities.

Dominion has grown earnings-per-share at just 3% annually in the past decade, but we see mid-single-digit growth in the years ahead. This is consistent with Dominion’s recent performance, boosting earnings by nearly 6% annually in the past five years.

Growth should accrue from the company’s Cove Point LNG project, as well as its SCANA acquisition from early 2019. In addition, Dominion continues to benefit from rate cases in its utility service areas. Finally, cost synergies from staff reductions should help with margins.

In total, we see total returns of nearly 9% annually accruing from mid-single-digit earnings-per-share growth, the nearly-5% yield, and low-single-digit headwind from the valuation. Dominion’s total return profile is attractive, earning it the number three spot on this list.

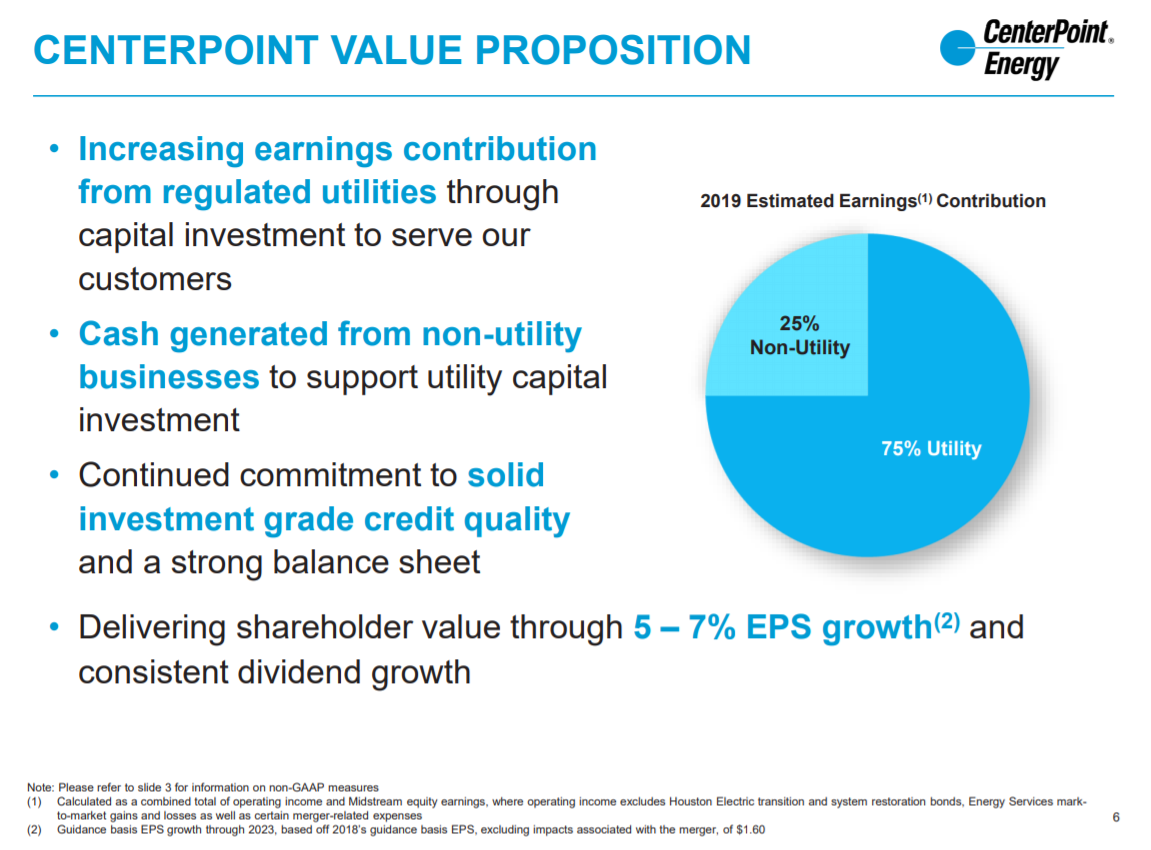

Top Utility Stock #2: CenterPoint Energy (CNP)

CenterPoint Energy is a utility holding company. It owns and operates facilities that transmit and distribute electricity and natural gas. CenterPoint serves commercial, industrial, and natural gas utilities, and was founded in 2003.

CenterPoint was formed after Houston Lighting and Power split into three separate companies. Today, shares trade with a $15 billion market capitalization.

Source: Investor presentation, page 6

CenterPoint derives about three-quarters of its earnings from its utility segment. However, it also has diversified into non-utility areas, similar to other companies on this list. The utility business is steady and produces reliable cash flows, and CenterPoint is using its non-utility businesses to support the core utility segment.

We see ~6% earnings-per-share growth annually in the years to come, the midpoint of the company’s stated guidance. We think CenterPoint’s recent merger with Vectren will boost results in the near-term, while other acquisitions will help it grow longer-term. In addition, the constant investments the company is making in its utilities business should afford it the ability to go to regulators with rate cases, as it has in the past.

In total, we see ~9% total annual returns for CenterPoint, consisting of ~6% earnings growth, a nearly 4% yield, and a modest headwind from the valuation drifting slightly lower over time.

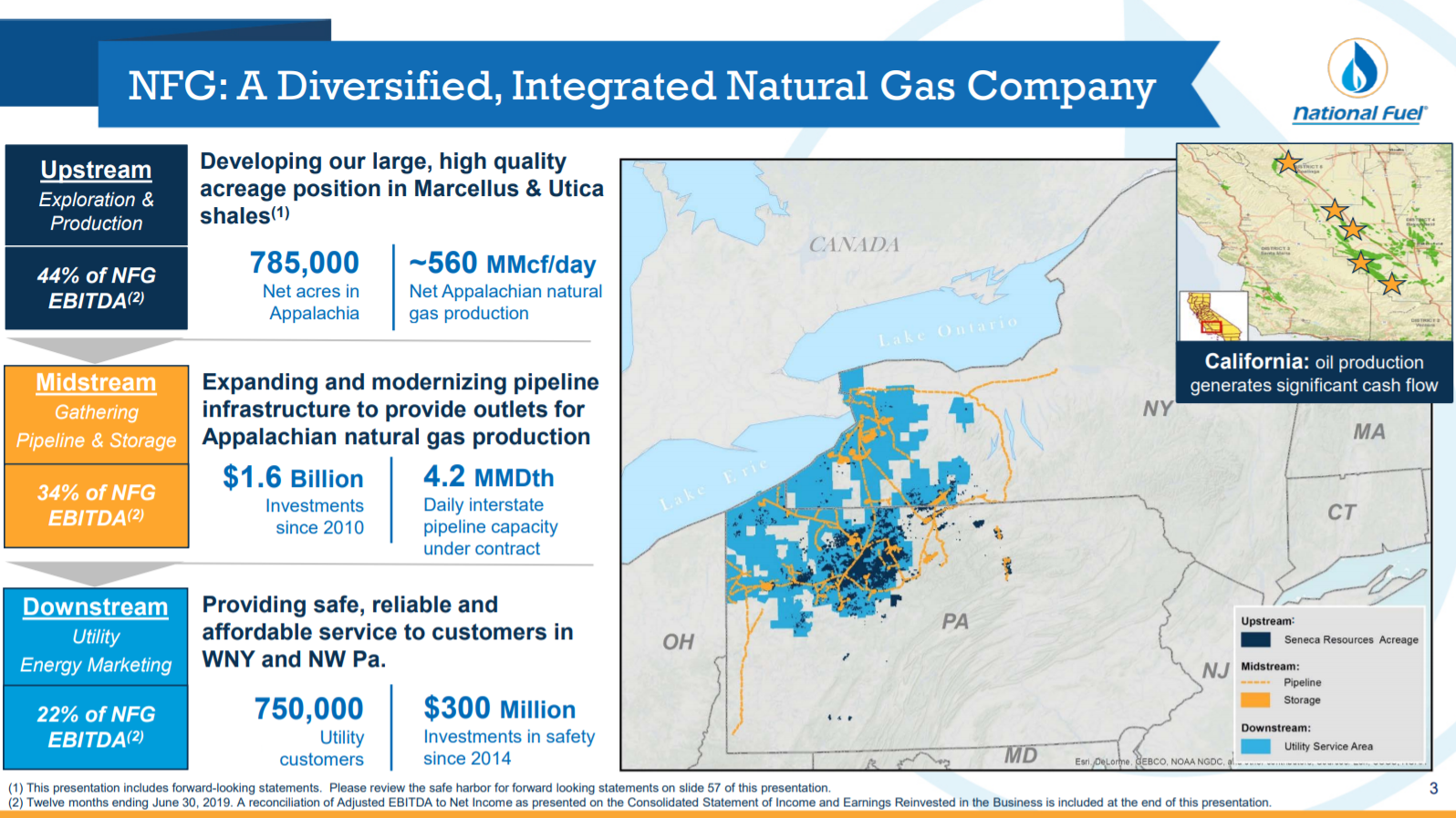

Top Utility Stock #1: National Fuel Gas Company (NFG)

The best utility stock on our list is National Fuel Gas Company. National is a diversified energy company that operates in a variety of areas, including exploration and production, pipeline and storage, gathering, utility, and energy marketing. Exploration and production is the company’s largest source of revenue.

National was founded in 1902 and now sports a $4.3 billion market capitalization. It concentrates in the Northeast U.S., while oil production is based in California. In addition, it has raised its dividend for a staggering 49 consecutive years, making it one annual dividend increase away from being a Dividend King.

Source: Investor presentation, page 3

National operates upstream, midstream, and downstream segments, the largest of which is the upstream segment. Unlike the other companies in our list, traditional utility operations are the smallest portion of National’s business.

National’s earnings have been very volatile in the past decade, with 2015 and 2016 posting significant losses. However, we see 2% annual earnings-per-share growth moving forward as natural gas prices have stabilized at a profitable level. That said, National’s earning potential is greatly dependent upon natural gas pricing, so volatility should be expected.

We forecast total returns at nearly 11% accruing from modest earnings growth, a mid-3% dividend yield, and a mid-single-digit tailwind from a rising valuation. Unlike other stocks in our list, National is actually cheaply priced today, and it leads the pack because of this valuation advantage.

Final Thoughts

The utility sector is a great place to find high-quality dividend stocks suitable for long-term investment.

It is not, however, the only place to find attractive investments.

If you’re willing to venture outside of the utility industry while searching for investment opportunities, the following Sure Dividend databases are very useful:

- The Dividend Aristocrats: dividend growth stocks with 25+ years of consecutive dividend increases

- The Dividend Kings: dividend growth stocks with 50+ years of consecutive dividend increases

- The Dividend Achievers: dividend growth stocks with 10+ years of consecutive dividend increases

- The Blue Chip Stocks List: stocks with 100+ year operating histories and 3%+ dividend yields