Aflac was formed in 1955, when three brothers — John, Paul, and Bill Amos — came up with the idea to sell insurance products that paid cash if a policyholder got sick or injured. In the mid-20th century, workplace injuries were common, with no insurance product at the time to cover this risk.

Today, Aflac has a wide range of product offerings, some of which include accident, short-term disability, critical illness, hospital indemnity, dental, vision, and life insurance.

Source: Aflac Debt Investors Update

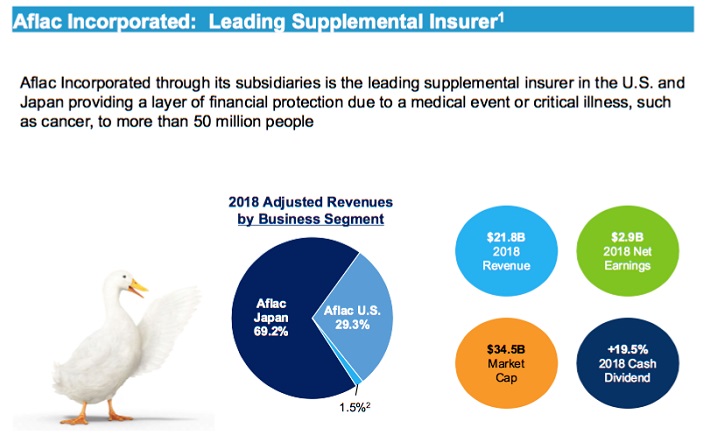

The company specializes in supplemental insurance, which pays out to policy holders if they are sick or injured, and cannot work. Aflac operates in the U.S. and Japan, with Japan accounting for approximately 70% of the company’s premium income. Because of this, investors are exposed to currency risk.

Aflac’s strategy is to increase premium growth through new customers, as well as increase sales to existing customers. It is also investing to expand its distribution channels, including its digital footprint, in the U.S. and Japan.

Aflac continues to perform well. Last quarter, Aflac generated $5.54 billion in revenue and $1.16 in adjusted earnings-per-share, representing a 12.6% year-over-year improvement. For the first three quarters of 2019 the company has generated $16.7 billion in revenue, a 0.4% increase, and $2.6 billion in earnings ($3.41 per share) compared to $2.4 billion ($3.15 per share) in the first three quarters of 2018.

In addition, Aflac has guided investors to anticipate $4.35 to $4.45 in adjusted earnings-per-share for 2019, compared to the $4.17 posted in 2018. At the midpoint, the company is likely to grow adjusted EPS by 5.5% from 2018.

Aflac has laid out clear growth avenues in its respective markets. In Japan, Aflac wants to defend its strong core position, while further expanding and evolving to customer needs. To this point, Aflac Japan is expanding its offerings of “third-sector” products. These include non-traditional products such as cancer insurance, as well as medical and income support.

Aflac has enjoyed strong demand in Japan for third-sector products, due to the country’s aging population, and declining birthrate.

Source: Aflac 2019 Financial Analysis Briefing

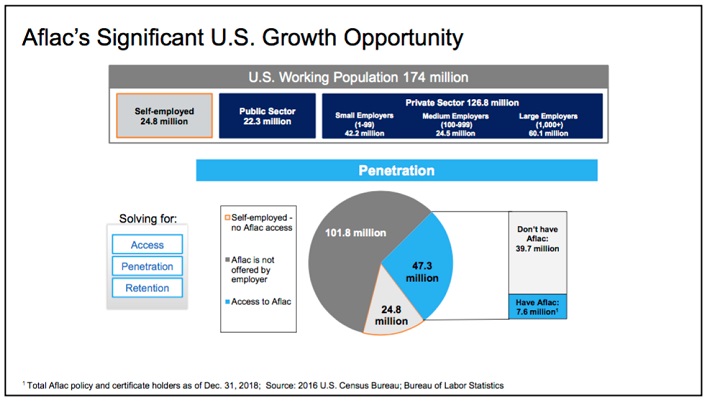

Meanwhile, in the U.S., Aflac believes it has a long way to go to penetrate the market. While the brand name is well-known, only a small fraction of the U.S. working population has access to Aflac and an even smaller fraction actually purchases Aflac – under 5% of the working population.

In general terms, Aflac has two sources of income: income from premiums and income from investments. Taking the items collectively, in addition to an active share repurchase program, reasonable expectations would be for 6% annual earnings-per-share growth over the next five years, in-line with the company’s guidance for 4.3% to 6.7% growth for 2019.

During the last decade shares of Aflac traded at an average P/E ratio of about 10 times earnings. Based on 2019 expected earnings-per-share of $4.40, at the midpoint of guidance, shares are presently trading hands at 12.1 times earnings. As such, this could imply a moderate valuation headwind (~4%) over the next five years, should shares revert to their historical average.

On the other hand, the 6% expected growth rate and 2.0% current dividend yield (which ought to grow over the years) should aid in shareholder returns. Still, combined this would only imply ~4% annual returns over the next five years. That said, Aflac should have little trouble continuing to increase its dividend each year.